- Despite the recent price drop, the number of long-term holders of BTC has increased.

- In the event of a bullish takeover, BTC could first recover $68k.

Bitcoin [BTC] registered a big drop in the past 24 hours as it failed to retest its all-time high, which some had expected. However, in the past few hours, BTC has consolidated slightly near $66.

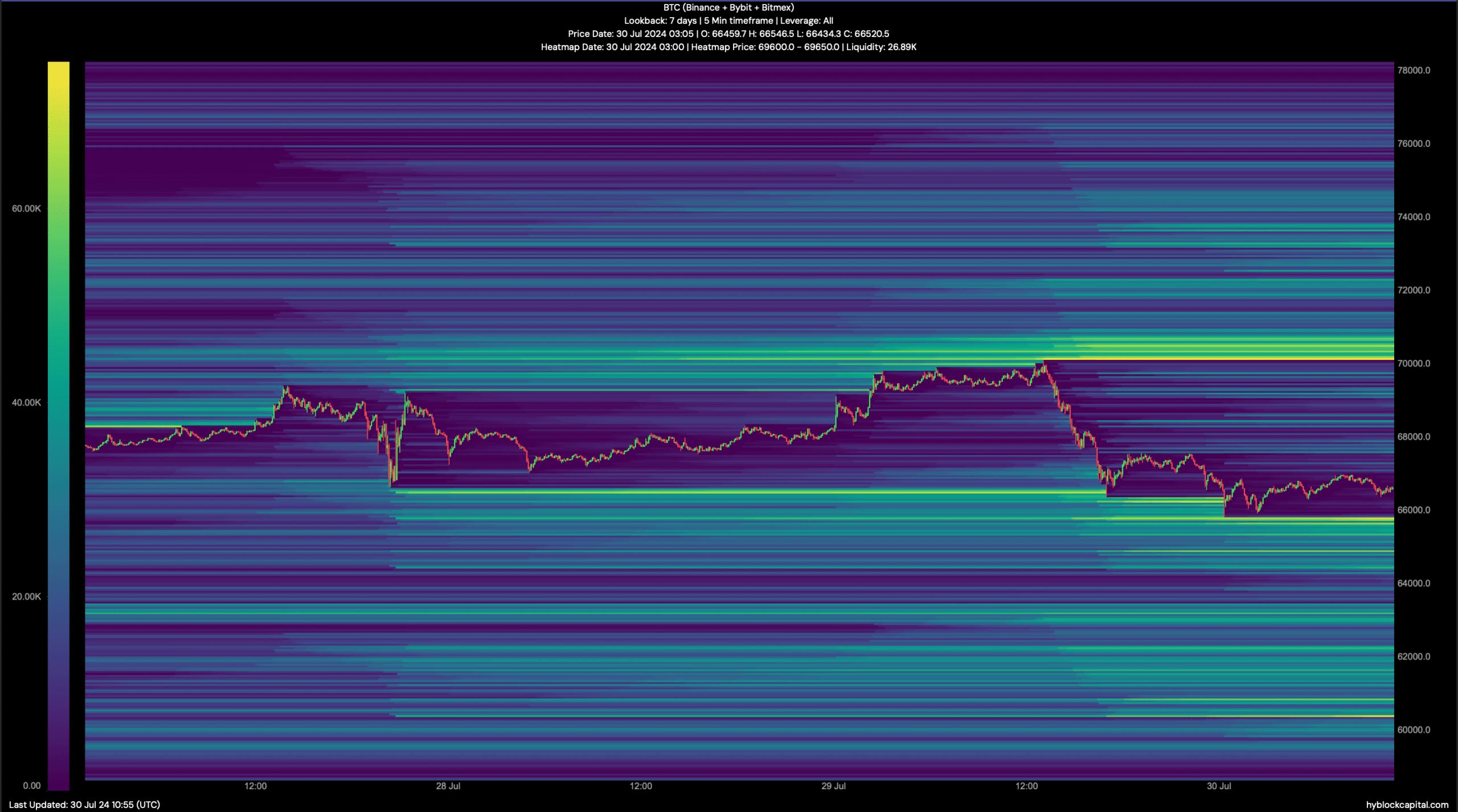

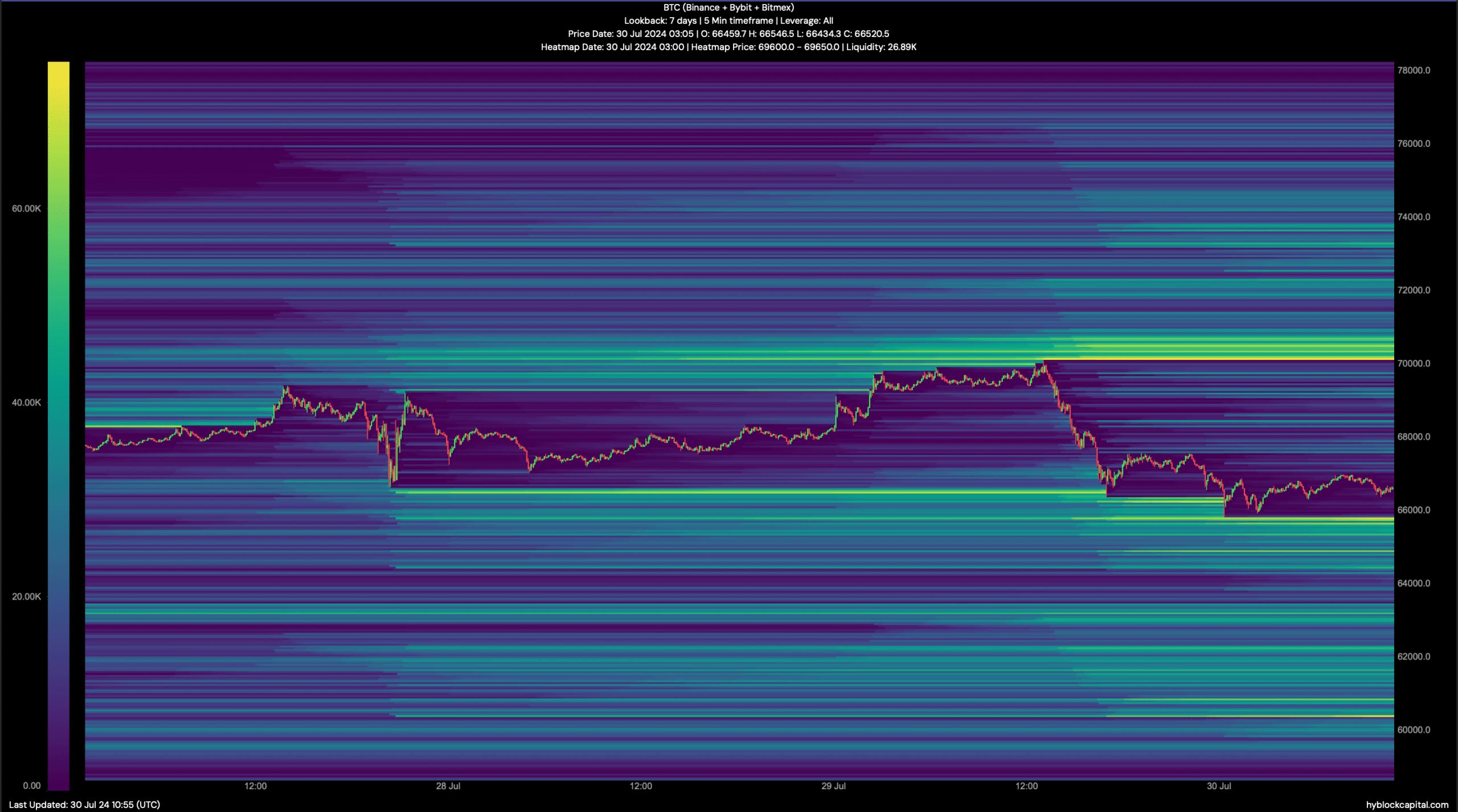

Let’s take a look at the Bitcoin liquidation heatmap to find out the upcoming targets.

The Recent Demise of Bitcoin

CoinMarketCaps facts revealed that the price of BTC has fallen by more than 4% in the past 24 hours. At the time of writing, the king coin was sitting comfortably around $66,000, with a market cap of over $1.31 trillion.

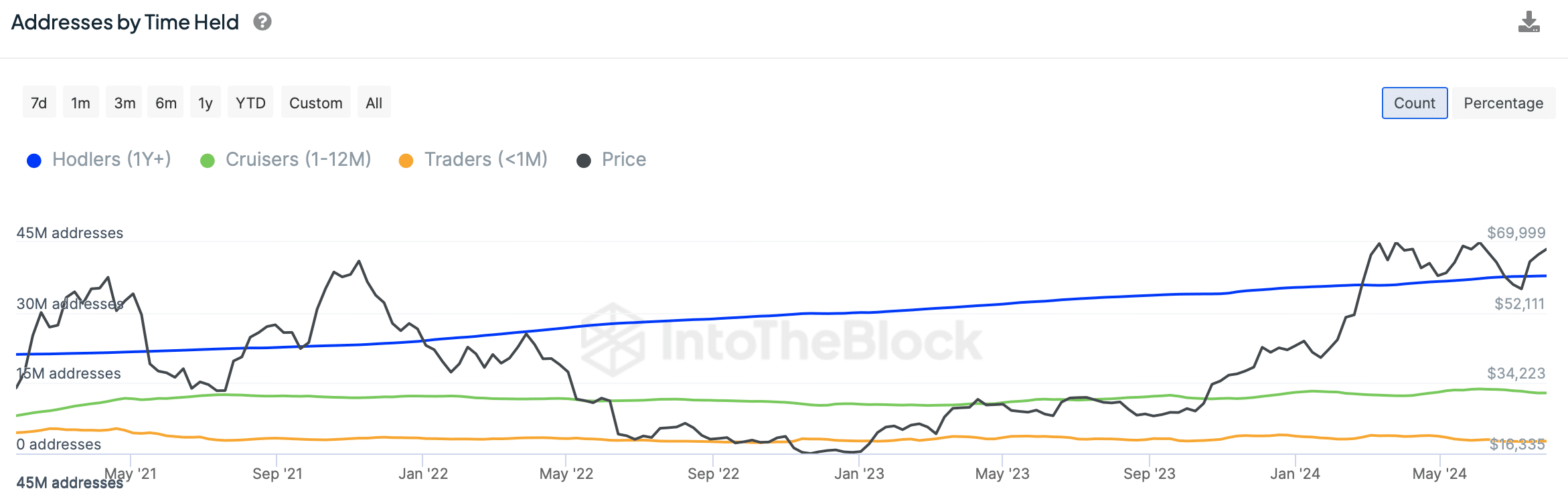

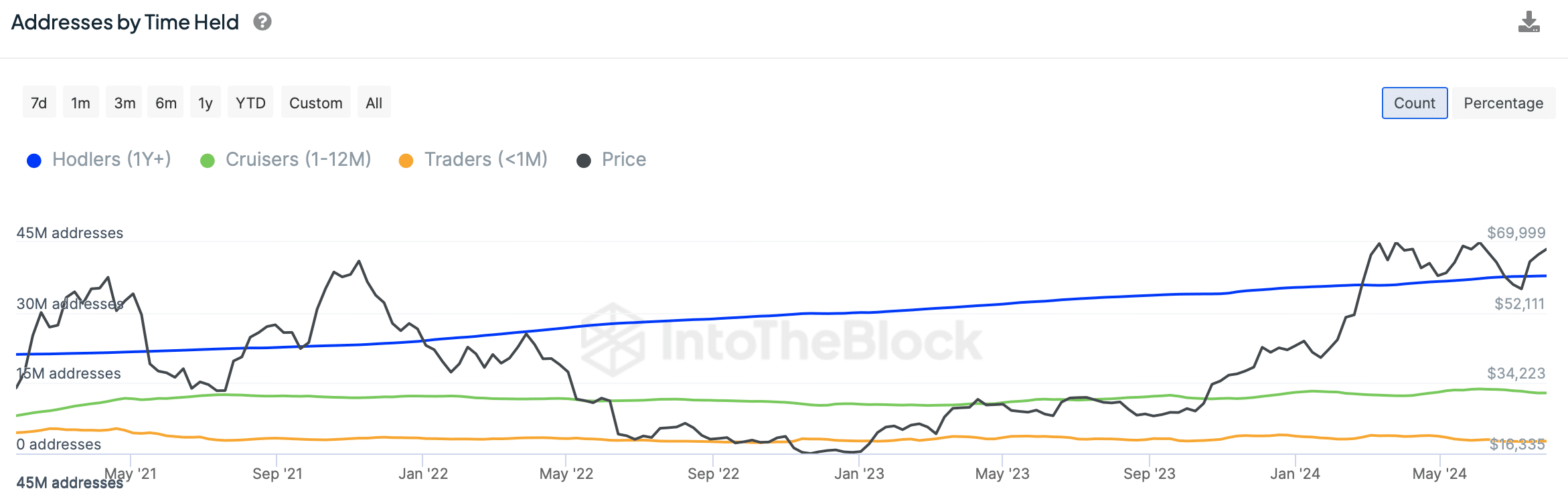

AMBCrypto’s look at IntoTheBlock’s data revealed that despite the recent setback, the number of long-term holders of BTC (addresses that have held BTC for more than 1 year) increased.

Source: IntoTheBlock

AMBCrypto’s look at CryptoQuant’s facts revealed that its binary CDD was green. This meant that the movement of long-term bonds over the past seven days was lower than the average. They have a motive to hold on to their coins.

Another bullish measure was the funding rate, which increased. However, not everything was in BTC’s favor.

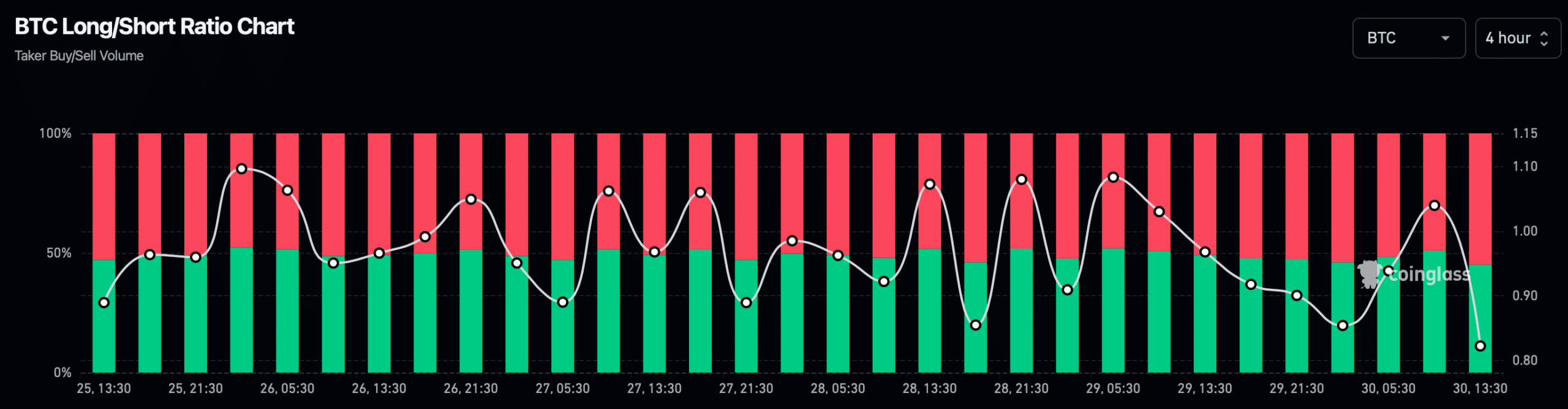

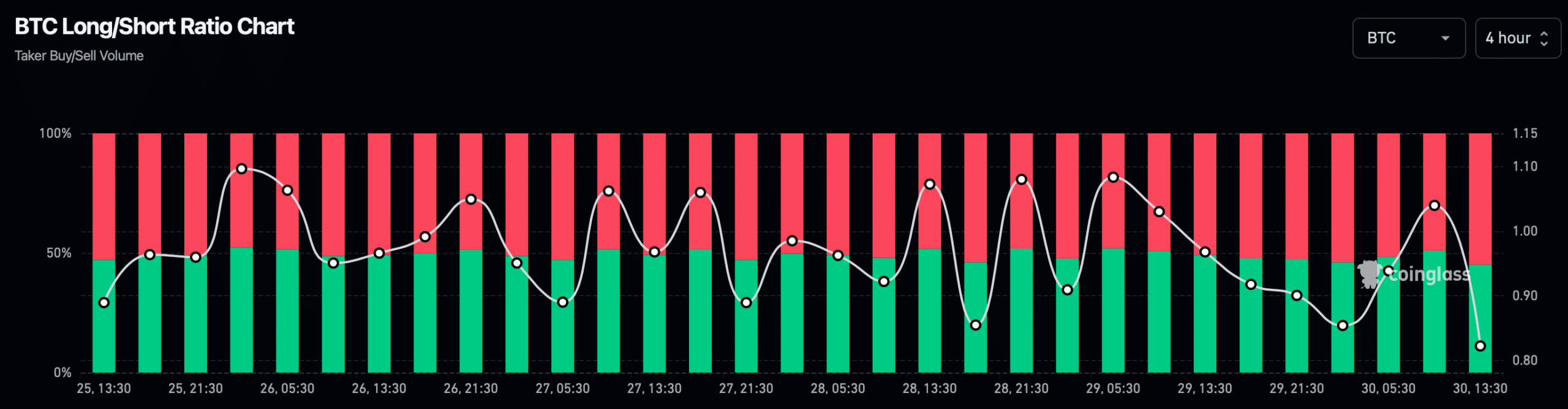

For example, according to Coinglass data, BTC’s long/short ratio recorded a huge dip. A decline in the market suggested that there are more short positions in the market than long positions.

This indicated that bearish sentiment around the king of cryptos has increased.

Source: Coinglass

Upcoming goals for BTC

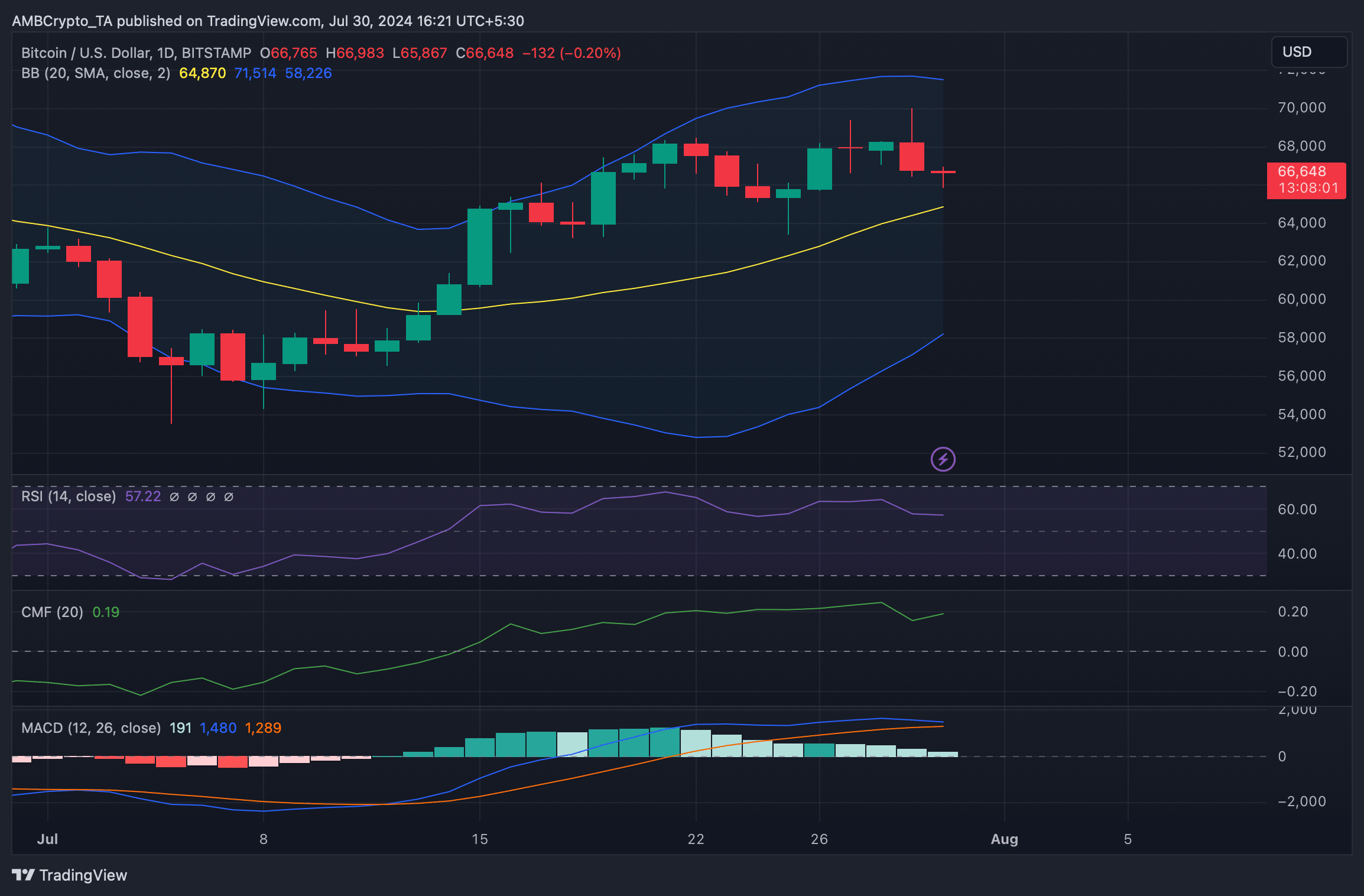

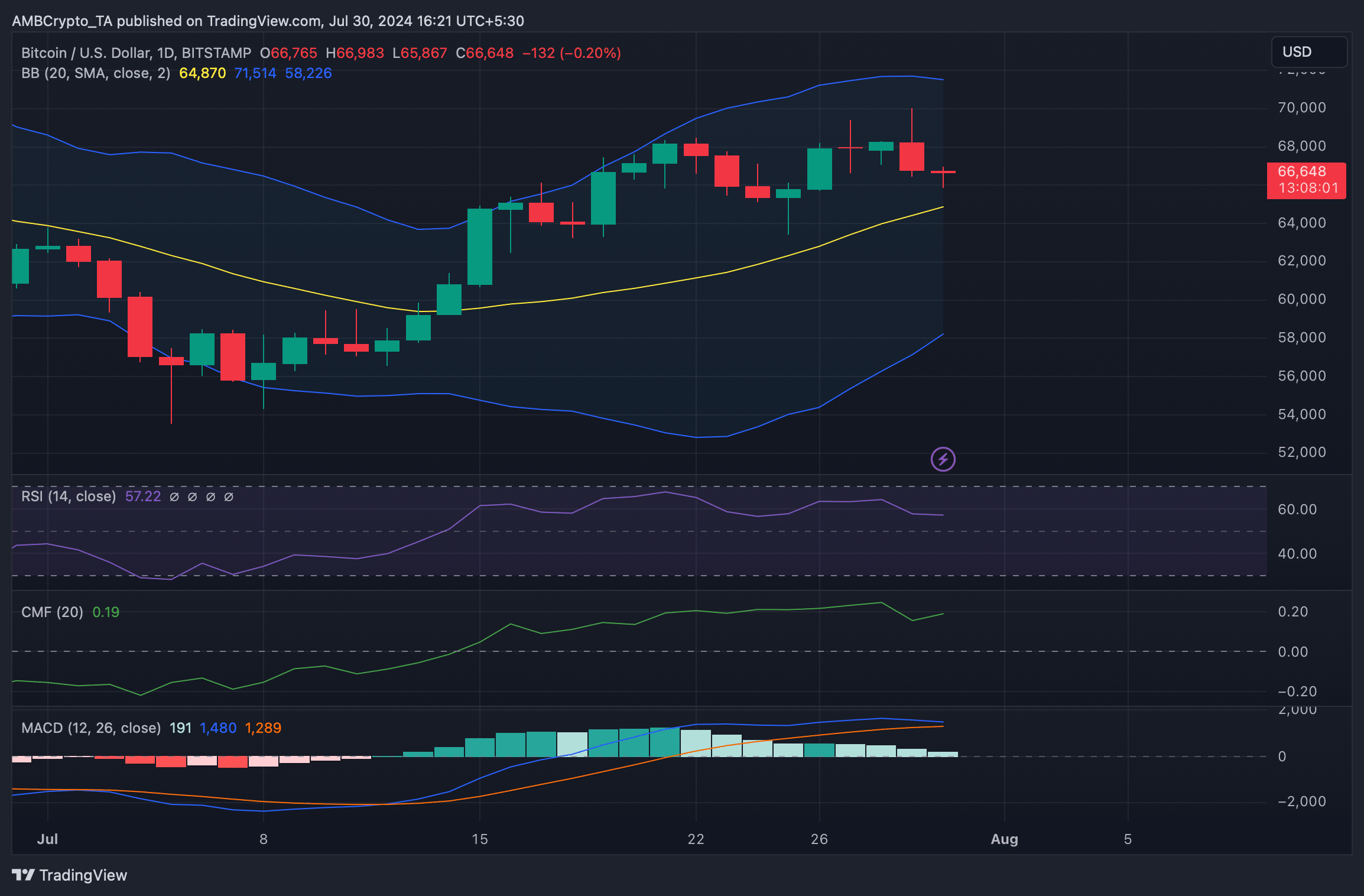

AMBCrypto then checked BTC’s daily chart to see which way BTC was heading in the coming days. The Relative Strength Index (RSI) followed a sideways path, indicating a few more days of consolidation.

The technical indicator MACD also had a similar reading as it showed the possibility of a bearish crossover.

Nevertheless, the Bollinger Bands revealed that BTC was about to test its 20-day Simple Moving Average (SMA). Bitcoin might as well test the support successfully as the Chaikin Money Flow (CMF) registered an upswing.

Source: TradingView

We then looked at the Bitcoin liquidation heatmap to figure out the upcoming targets. If the bear rally continues, it won’t be surprising to see BTC fall to $65,000 first as liquidation would rise.

A further decline below that could send BTC down to almost $60,000.

Read Bitcoins [BTC] Price prediction 2024-25

However, in the event of a trend reversal, BTC could reclaim $68,000 before retesting its ATH.

If BTC manages to retest its ATH, it would be interesting to see if it can go above that.

Source: Hyblock Capital