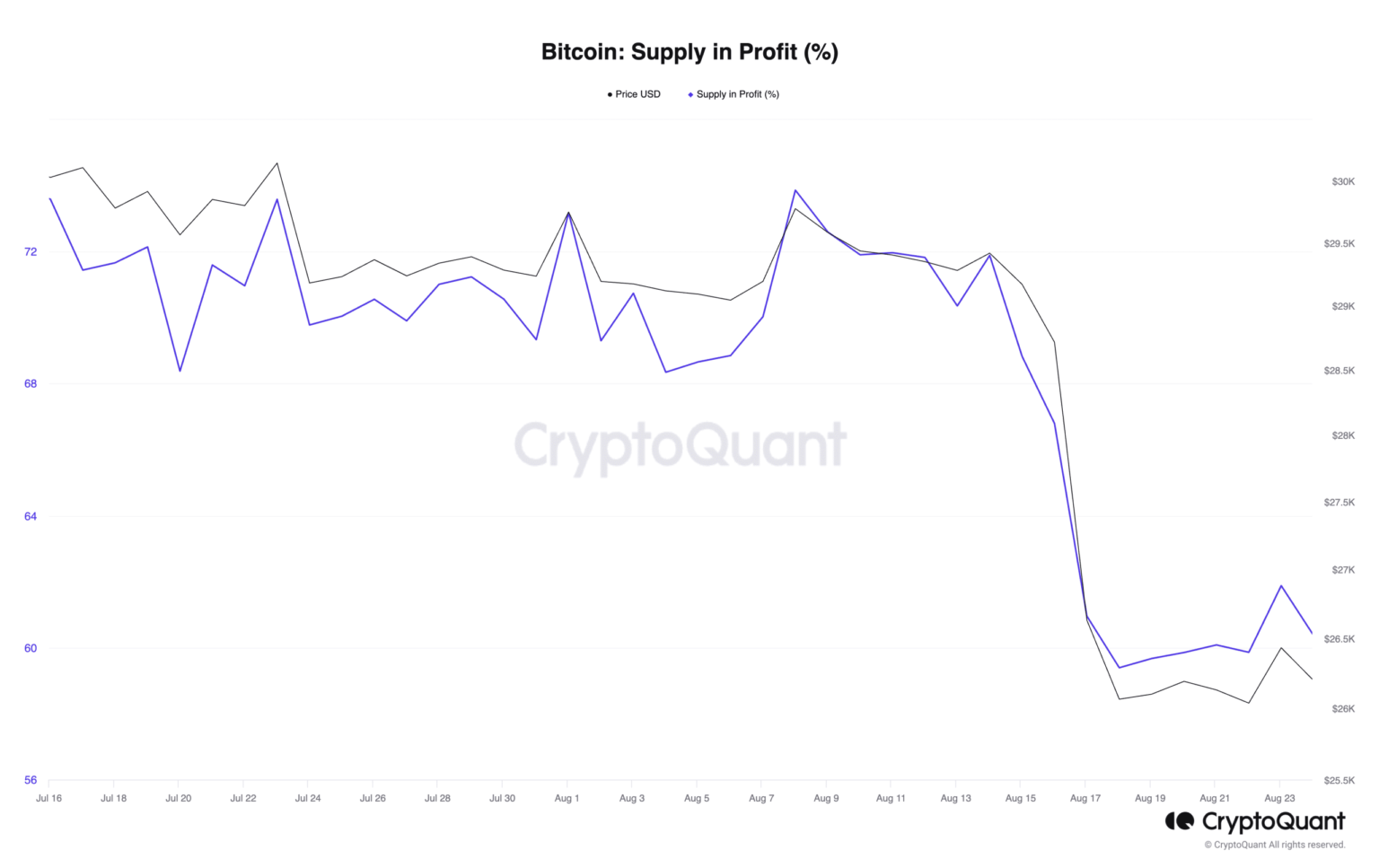

- The supply of BTC in profit has decreased, while the supply in loss has increased.

- As the price hangs at $26,000, a good buying opportunity may have been taken advantage of.

Like Bitcoin’s [BTC] the price stalled at $26,000 after the recent capital exodus, falling to a low last seen in June. The coin’s supply of profits has decreased while its supply of losses has increased, according to pseudonymous CryptoQuant analyst On the chain revealed in a new report.

Read Bitcoin’s [BTC] Price Forecast 2023-24

The analyst reviewed BTC’s Supply in Profit and Supply in Loss metrics. These stats measure the percentage of BTC currently held in the profit and loss account.

Typically, a high percentage of BTC’s supply in profit suggests that most coin holders are making a profit and have refused to sell their holdings in anticipation of more profit. Onchain commented:

“This often indicates market optimism and is usually observed during bullish trends.”

Conversely, when the percentage of BTC’s supply is high, many coin holders hold a loss and are willing to divide their holdings among their cost base. The analyst further pointed out:

“This can act as a harbinger of a bearish phase or an extended period of consolidation, especially when combined with other bearish indicators.”

At the time of writing, BTC’s profit offering stood at 62%, after falling 15% since the beginning of the month. According to Onchained, this is:

“Indicates that a significant portion of holders who previously made profits are now in a state of diminished returns or potential losses.”

Source: CryptoQuant

On the other hand, the percentage of BTC’s supply that is losing is up 46% since the start of the month, according to data from CryptoQuant.

Source: CryptoQuant

The analyst noted that the combination of these two numbers indicated a significantly bearish market and concluded:

“This… reinforces the idea of bearish sentiment. Such a sharp turn in the numbers could represent a crucial turn in market dynamics.”

A good buying opportunity?

At the time of writing, BTC was trading at USD 26,008.79, according to data from CurrencyMarketCap. While the price appears to have stagnated at $26,000 after deleveraging on August 17, the Bollinger Bands (BB) on a daily chart showed that the price remained severely volatile and prone to swinging in either direction.

On a D1 chart, there was a large gap between the upper and lower bands that make up the BB indicator, indicating that market volatility remained high.

Source: BTCUSD, TradingView

The CryptoQuant analyst too meant that a good buying opportunity could have presented itself despite the current market conditions. Onchained has assessed BTC’s NVT Golden Cross – an indicator that uses the Network Value to Transactions (NVT) ratio to identify potential price reversals.

According to Onchained, the indicator generates a long signal when it returns a value less than 1.6, which indicates that:

“Traders may want to consider opening long positions.”

Is your wallet green? Check out the Bitcoin Profit Calculator

When the indicator returns values above 2.2, a short signal is generated, “indicating that traders may want to consider opening short positions.”

Taking into account BTC’s current NVT Golden Cross, the analyst concluded:

“Recently, the (NVT Golden Cross) indicator has moved below the -1.6 threshold, indicating a long signal. This suggests that the long-term trend of the NVT ratio was significantly higher than the short-term trend. According to the logic of the indicator, this would imply that the cryptocurrency network (Bitcoin) could be underpriced and ready for a potential price increase.”

Source: CryptoQuant