Last week, the crypto market experienced a massive sell-off that saw the price of Bitcoin drop to just $25,000. The sharp market movement ended several months of unprecedented calm in the crypto market.

Previous analysis by CryptoSlate pointed to the derivatives market as the main catalyst for the aggressive sell-off. Significant deleveraging took place in the futures market, resulting in the closing of more than $2.5 billion in perpetual futures contracts closed in a single day.

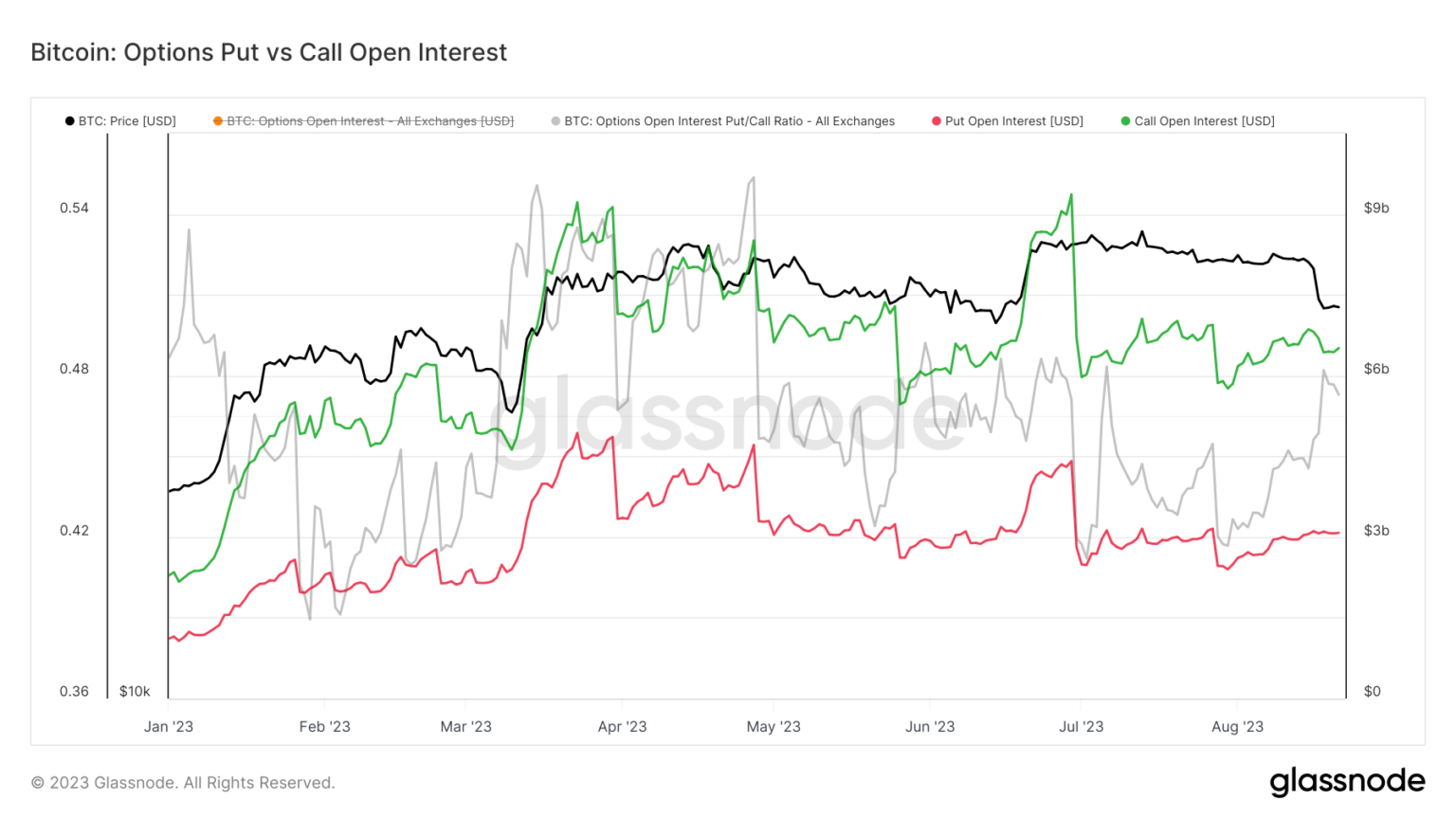

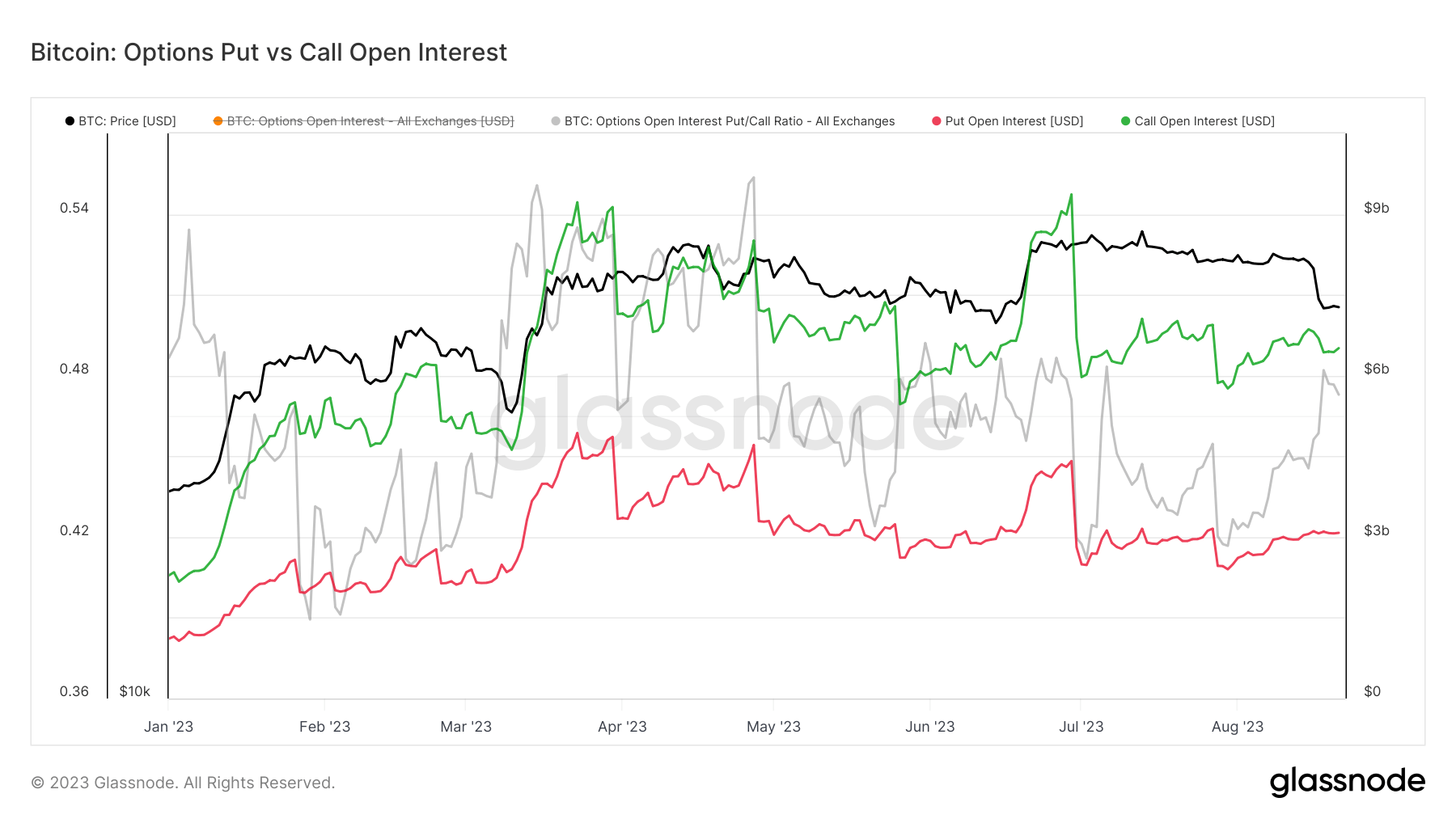

On the other hand, the options market remained remarkably resilient during Bitcoin’s price decline. Glassnode data showed consistent open interest for both call and put options, indicating that these instruments were largely unaffected by market volatility.

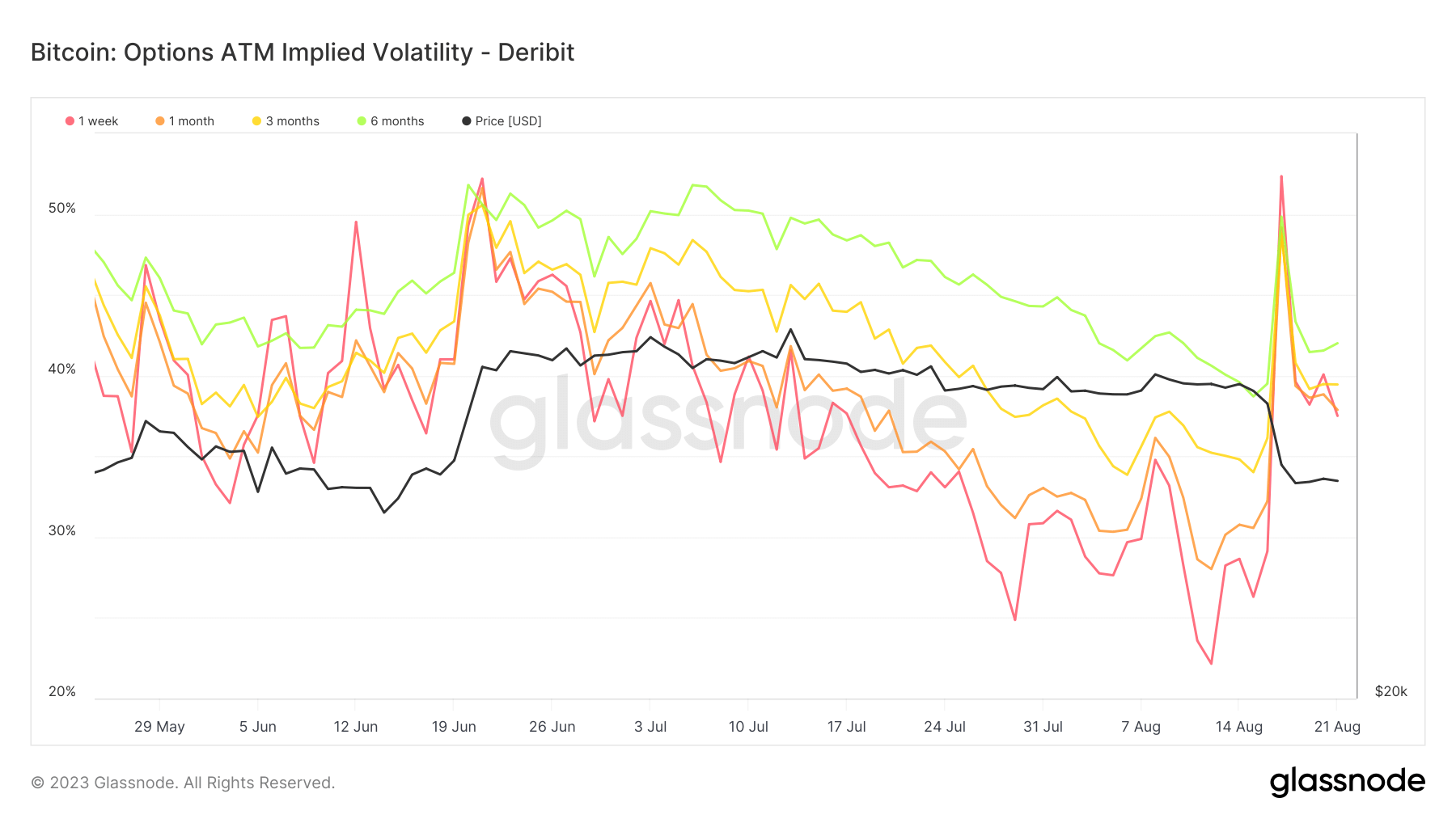

It wasn’t all a breeze for options, though. One notable shift the market saw was the aggressive price revision of volatility.

Implied volatility, a market measure that predicts the potential magnitude of asset price swings based on option prices, was at all-time lows all summer. Implied volatility is an important metric to monitor, as it provides insight into future price movements and influences trading strategies.

The calm in implied volatility was swept away last week during Bitcoin’s price drop. Bitcoin’s drop to $25,000 almost doubled the implied volatility for options due to expire in a week. Specifically, it rose from 22.15% on August 12 to 52.35% on August 18.

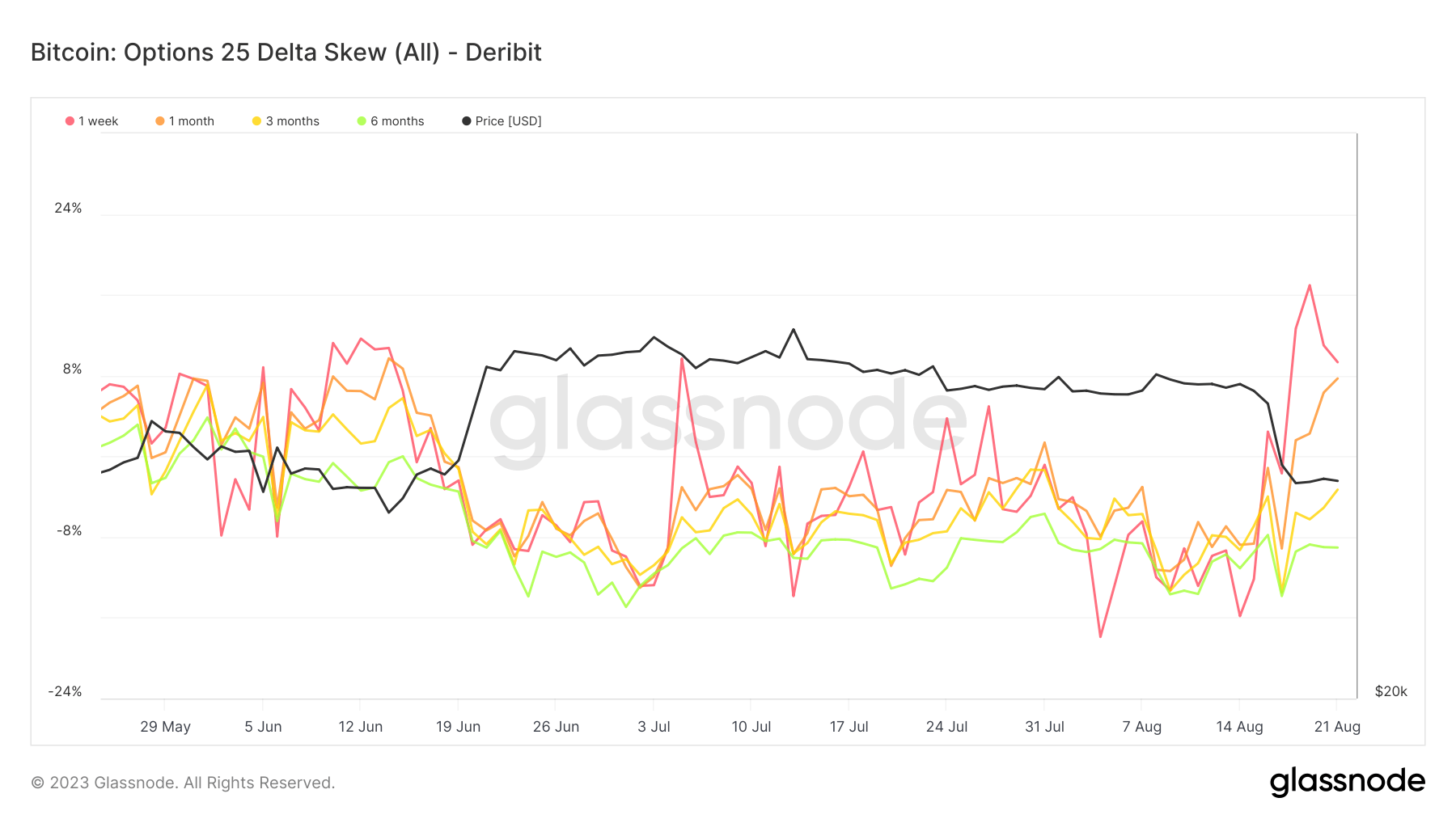

Another metric that saw a significant shift was the 25 delta skew for options. This skewness, which measures the difference in implied volatility between out-of-the-money puts and calls, jumped from -15.8% to 16.9% for options that expire within a week. A positive skew indicates that puts are more expensive than calls, suggesting greater demand for downside protection and bearish sentiment.

While the recent turbulence in the crypto market has rocked many sectors, the options market has remained a beacon of stability, at least in terms of overt interest. However, the sharp adjustments in implied volatility and 25 delta skewness underscore the market’s heightened sense of uncertainty and caution.

The post Bitcoin Dives, But Options Market Remains Stable appeared first on CryptoSlate.