Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Distitible and Español.

Bitcoin has an important zone introduced In the last few days, with the $ 94,500 price surface that stands out as an increasingly important battlefield for its short -term process. Although the leading cryptocurrency has made different attempts to erase this region During the last rally, It has confronted with repeated rejections and emphasizes the presence of strong resistance.

Despite these setbacks, data on chains on significant whale accumulation indicate Noted on crypto -fairsshow that the bullish undercurrent is still strong, because Bitcoin seems to end up on April 2025 on a postive -close.

Heavy resistance cluster between $ 94,125 and $ 99,150

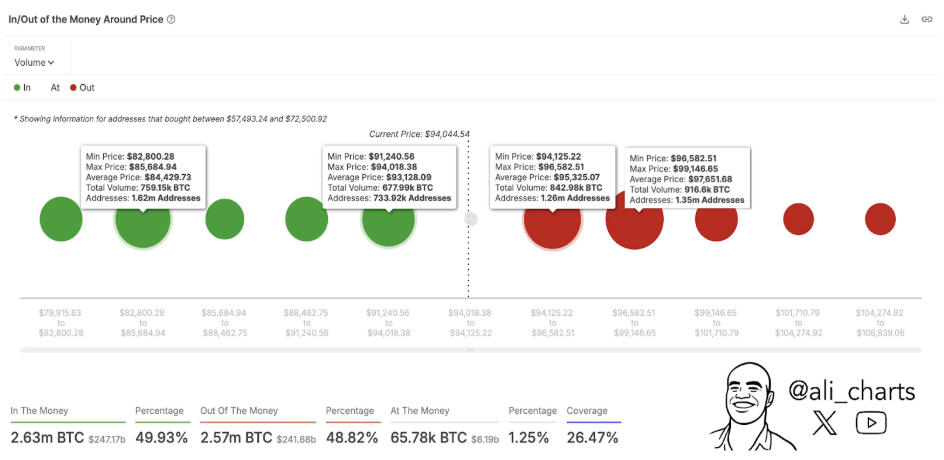

According to Crypto analyst Ali Martinez, who Shared insights Bitcoin is from on-chain Analytics Platform Intothlock is Weigh up Between the price range of $ 94,125 and $ 99,150.

Related lecture

It is remarkable that his function on social media platform X shows that around 2.61 million wallet addresses have collected around 1.76 million BTC in this zone, making it one of the closest supply barriers that Bitcoin has confronted in its current market cycle.

As shown in the graph below, around 1.26 million addresses keep nearly 843,000 BTC between $ 94.125 and $ 96,582, while another 1.35 million addresses are clustered between $ 96,582 and $ 99.146, with around 917,000 BTC. This concentration of holders creates a formidable wall that Bitcoin has to break through decisively if it wants to continue its upward march to the following month.

A strong and decisive daily or weekly close to $ 96,600 can make the overhead resistance invalid here, so that the next target zone is placed at $ 99,150. Ultimately, the buying momentum would free the path here for the Bitcoin price for finally Target $ 100,000 and beyond again.

Conversely, repeated failures in this zone can cause a retest of lower support levels around $ 93,000 and $ 84,000, which also have considerable volumes of 678,000 BTC and 759.150 BTC respectively.

Image From X: Ali_charts

Bitcoin’s Bullish structure still intact

Even because the resistance zone is a challenge of $ 94,000 to $ 99,000 in the short term, technical patterns suggest that the Bitcoin rally just starts. Another prominent crypto analyst, known as Titan van Crypto, that confirmed that Bitcoin’s long -term price objective of around $ 125,000 is still valid.

This target is derived from a hugely reverse head and shoulders (H&S) pattern that has been identified on the Bitcoin monthly candlestick diagram.

Image From X: Titan Crypto

The graph shows a clear outbreak Above the neckline of the inverted H&S formation earlier this year when Bitcoin pushed high at around $ 108,790 to his current of all time. Since then, the price action has been followed by a retest that is above a supporting trend line on the monthly period.

Related lecture

According to the analyst, this technical structure shows that Bitcoin is well positioned to recover and to reach a new highest point of $ 125,000 very soon. Of course, this timeline will also depend on whether the current support zone is stable from around $ 85,000 to $ 87,000.

At the time of writing, Bitcoin acts at $ 94,147

Featured image of Unsplash, graph of TradingView