- The price of Bitcoin focuses on $ 90,000 as a triangular pattern meant a potential outbreak.

- Whale activity and mining flows stimulate market speculation and influence price trends.

Bitcoin [BTC] has experienced remarkable price movements last week and fluctuates between $ 80,380 and $ 84,000. Despite the volatility, BTC retained an upward trend, acting on $ 83,100At the time of the press.

BTC won 3.5% in the past week, although it saw a small dip of 0.29% in the last 24 hours. With a market capitalization of $ 1.64 trillion, Bitcoin continued to show strong market activity while testing important resistance levels.

Bitcoin’s triangle pattern points to …

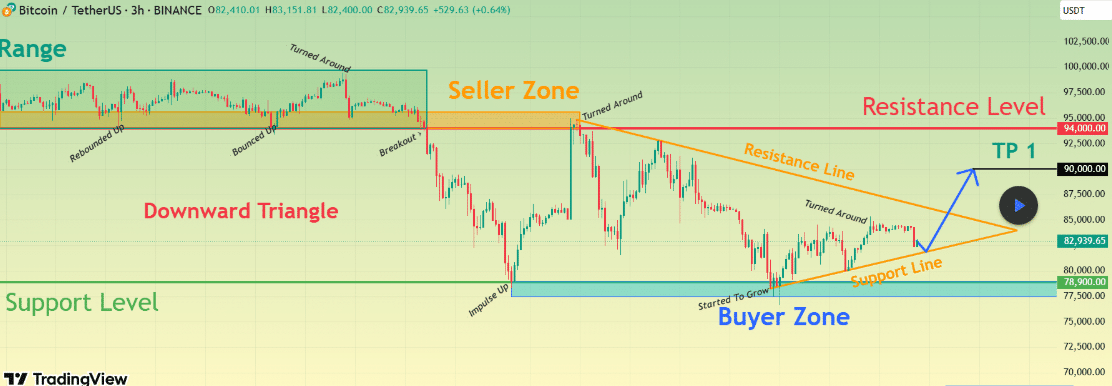

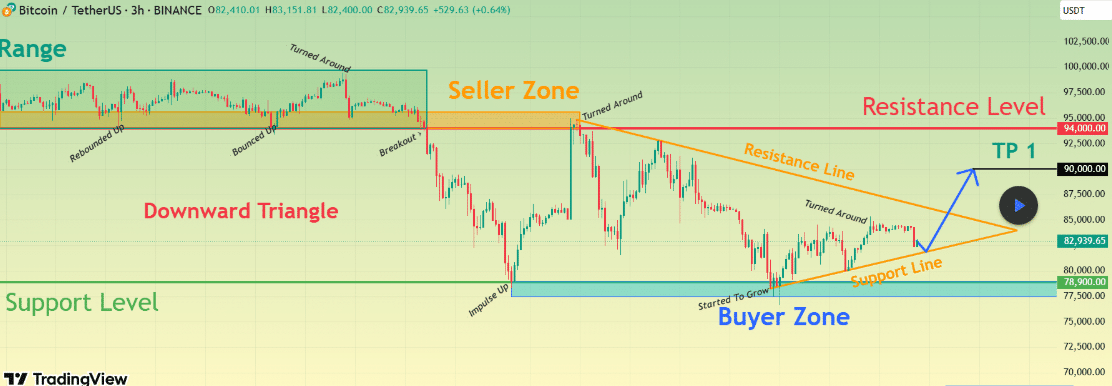

Bitcoin’s 3-hour graph reveals a downward triangular pattern with support at $ 82,939.65 and resistance near $ 94,000.

At the time of writing, BTC acted in a copper zone, where previous price promotion showed upward movement, characterized by “Impuls Up” and “started to grow” points.

Source: TradingView

That is why the price of Bitcoin is approaching a crucial resistance level. A breakout could bring BTC to a target of $ 90,000, indicating a long -term bullish momentum.

If this happens, Bitcoin can achieve further profits and possibly set new all time.

Impact of large transactions and mining flows

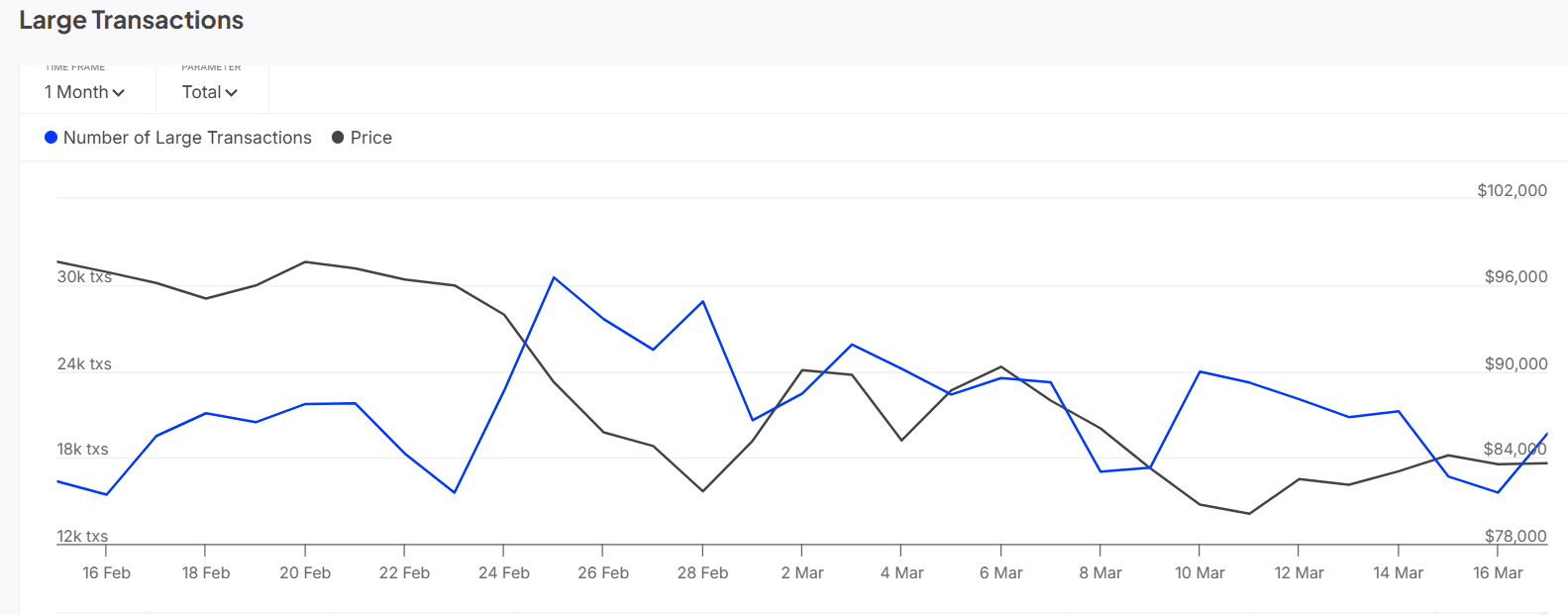

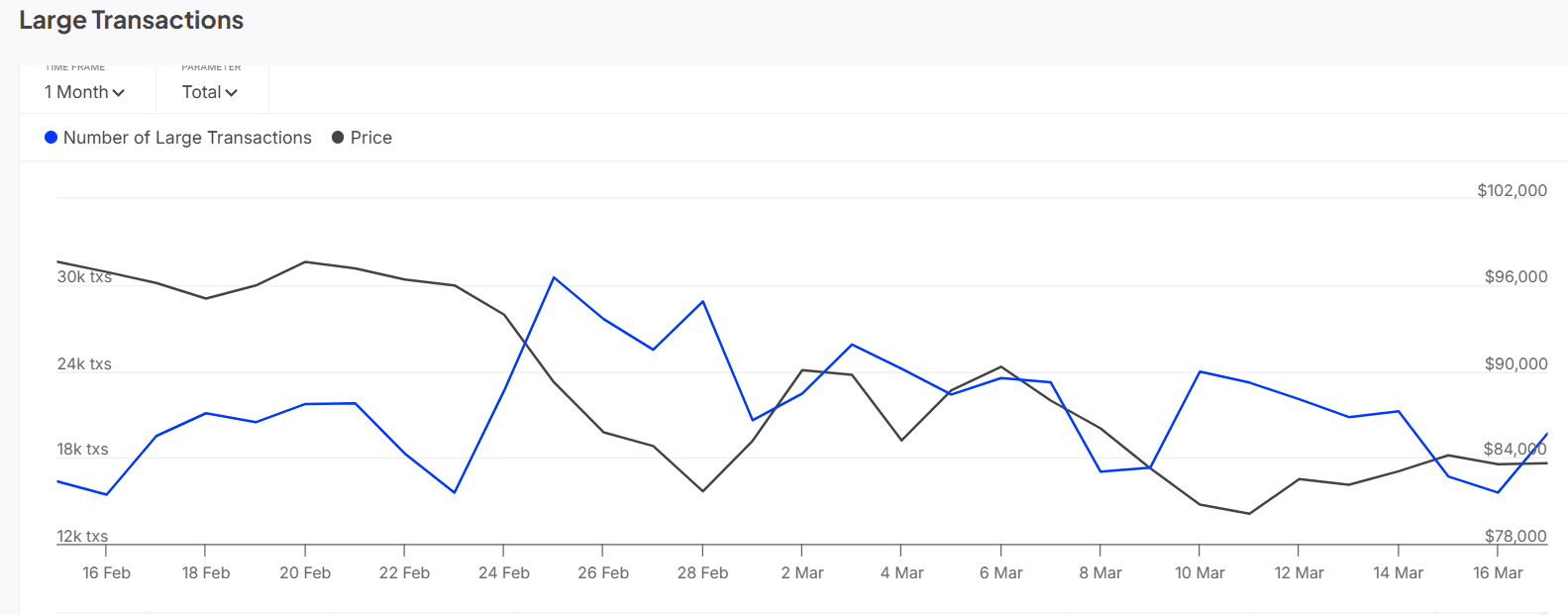

Between 15 February and 17 March 2025 the price of Bitcoin varied from $ 78,000 to $ 84,000. Large transactions increased during price increases, but fell during dips, especially on February 22 and March 6.

When Bitcoin struck $ 84,000 on March 16, large transactions, as a result of the growing trust of investors.

Source: Intotheblock

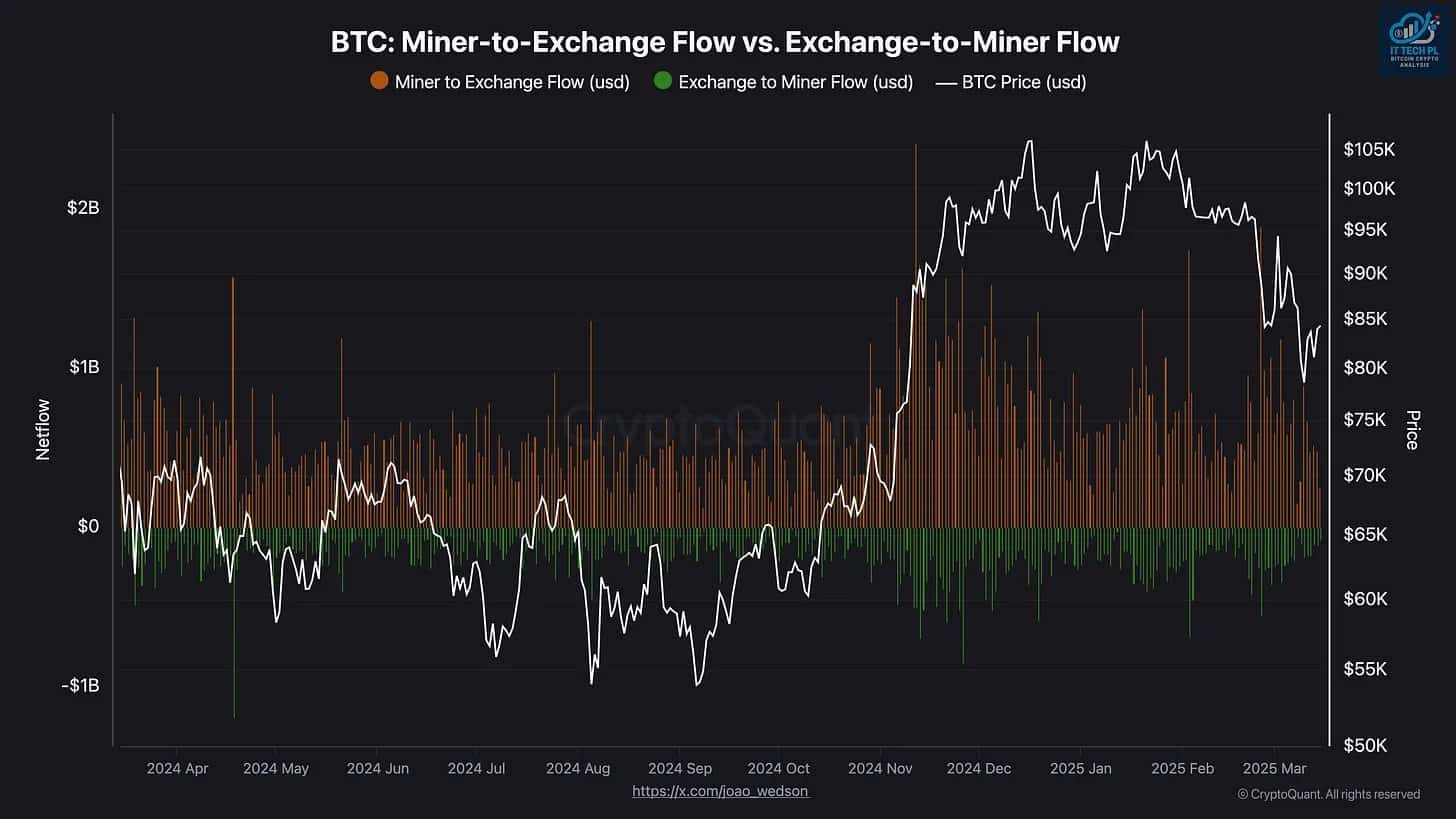

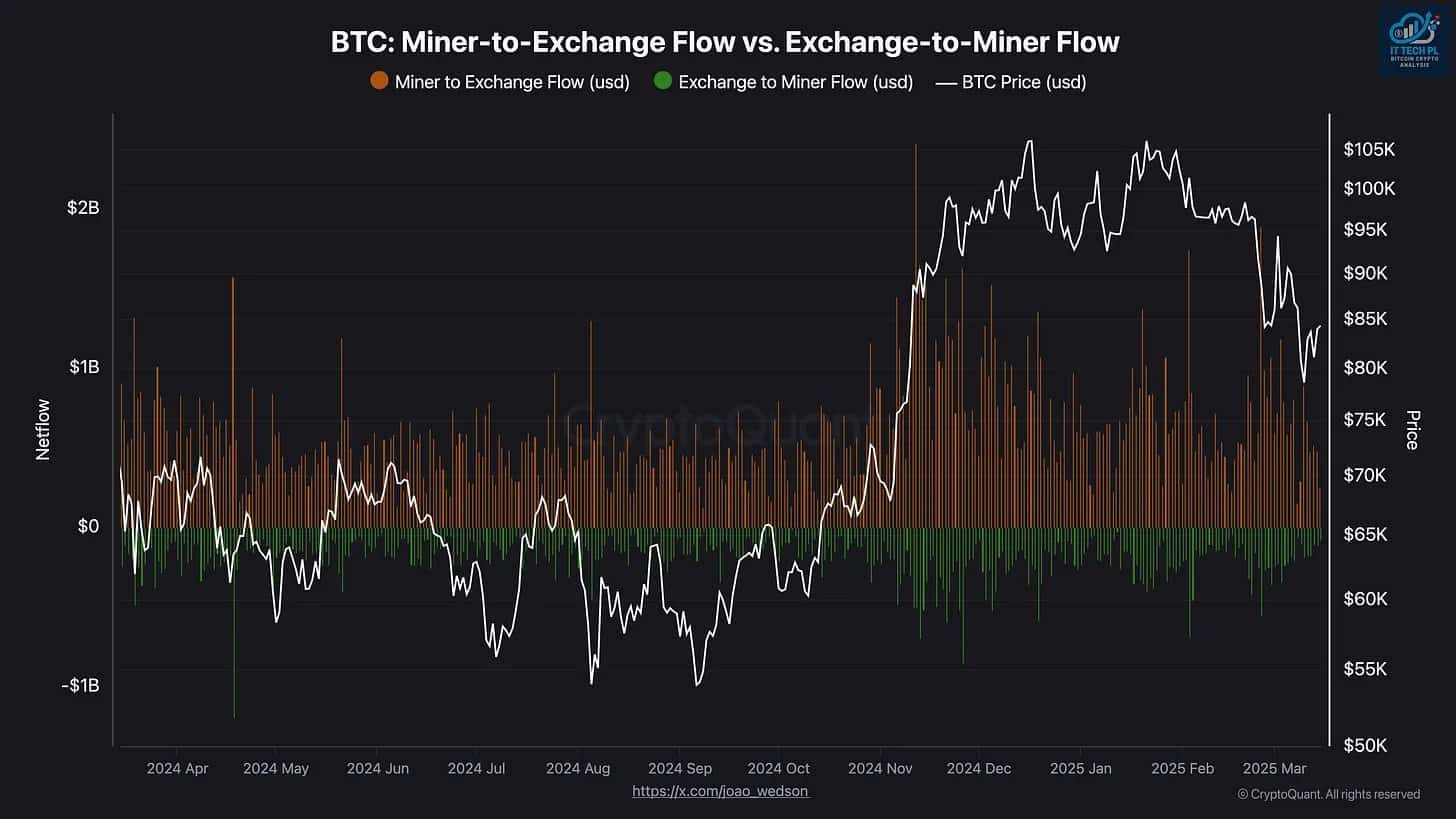

Cryptoquant author it tech pointed From April 2024 to March 2025 miner-to-Exchange and Exchange-to-miner flows have a direct influence on Bitcoin’s price movements.

Between the end of February and March 2025, when Bitcoin rose from $ 80,000 to more than $ 90,000, the transfers of miner-to-Exchange increased.

This indicates that miners sold Bitcoin, which probably expected higher prices, which influenced market sentiment and potential price movements.

Source: Cryptuquant

Whale activity increases market speculation

A Bitcoin -Walvis recently transferred $ 25.1 million in BTC to Falconx after being destroyed for 1.5 years. The transaction followed 300 Bitcoin movements and led to discussions about the potential market impact.

The whale originally acquired 1500 BTC for $ 39.5 million in August 2023, at an average price of $ 26,353 per bitcoin.

After the recent increase in Bitcoin, the whale has achieved an estimated profit of $ 85.7 million, which reflects a return of 219%. A total of 1,050 BTC, with a value of $ 87.2 million, was transferred to two new portfolios, while 150 BTC, worth $ 12.5 million, remains untouched.

This significant activity has led to concern about its potential impact on Bitcoin’s price trends and market movements.

The price of Bitcoin remains strongly influenced by large transactions, mine rider activity and market sentiment, making the next step a crucial area of focus for traders and investors.