Este Artículo También Está Disponible and Español.

Bitcoin, the world’s best digital active, rose with more than 20% Monday from last week’s lows, with large altcoins that follow the example. The rally of the crypto came immediately after the announcement of US President Donald Trump that the administration is considering a strategic reserve for Bitcoin, Solana, Cardano, Ethereum and XRP. Bitcoin’s answer was immediately – from a $ 85k low on March 2, the Alpha Coin bounced on Monday past $ 90k.

Related lecture

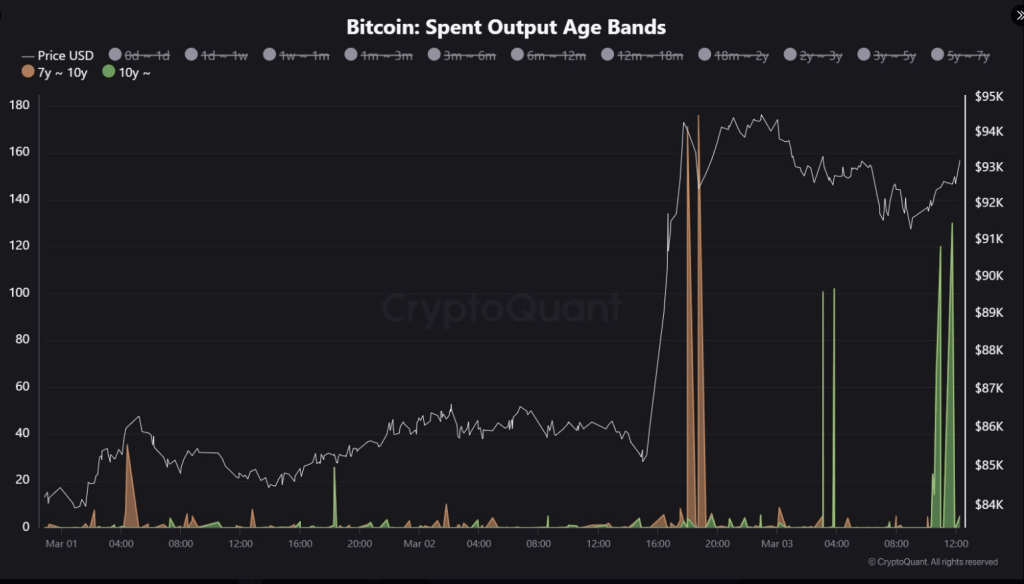

The price action of the day also came up with a massive fund movement, in particular under old Bitcoin portfolios. According to Cryptoquant, old BTC -Walvisportfeuilles between seven and 10 years old around 180 BTC immediately after the price of the active came back from its low points and flirted with $ 96k.

Whale on alert when Bitcoin rose short to $ 90k

The Bitcoin price campaign from Monday created a wrinkle effect in the wider crypto market. As the price was briefly strengthened, other large altcoins such as XRP and Ada followed the example. XRP, for example, even rose by more than 30% on Monday and became one of the best performing assets for the day.

Other interesting developments, however, happened on the chain, according to an analyst. Marchunn, cryptoquant on-chain analyst, shared an interesting screenshot with commercial activities among Bitcoin long-term holders.

🚨 Old bitcoin alert

Serious movement of 7+ year old BTC as the price rises beyond $ 95k! 📈 pic.twitter.com/ti3ejakfcp

– Marchunn (@ja_maartun) March 3, 2025

In a Twitter/X tweet, Marchunn shared an image with a peak in activity for seven to 10-year portfolios. Data about the chain showed that these portfolios moved more than 180 bitcoins as the price $ 96k reached. In addition, portfolios that hold BTC for at least 10 years have also moved 120 tokens.

Huge whale movements due to impatience with BTC price?

The Bitcoin price rally was short -lived because it has withdrawn into less than $ 85k. In the last 24 hours it has been active Wild traded Between $ 83k and $ 93k. The price of the active falls by 8.8% compared to last week’s level and 16.4% compared to that of last month.

Bitcoin’s data and trading patterns suggest that some whale And long -term holders are impatient with his price performance. An analytical exhibition also indicates that fund transfers have increased with investors who have arrived before the last two half -rings.

Heavy movements noted on crypto portfolios between 5 and 7 years old

Marchunn also noticed the shift in funds between portfolios between five and seven years old. While the price of Bitcoin floated around $ 93k, these addresses transferred 1,453.40 units. These movements suggest sales, which indicates a possible loss of enthusiasm.

Related lecture

Interestingly, these portfolios have bought Bitcoin on around $ 25,000, which means that these holders have achieved a stunning profit given the current price of the $ 83k active price. While these whales have fired some of their companies, some crypto analysts bullish remain on Bitcoin. For example, Ali Martinez suggested that the price of Bitcoin is in a bargain. In a recent tweet, Martinez shared that it is now the best time to invest in Bitcoin.

Featured image of Pexels, Graph of TradingView