- Wallets holding between 1 and 100 BTCs have started selling their assets.

- While sentiment remains negative, accumulation in the overall market continues.

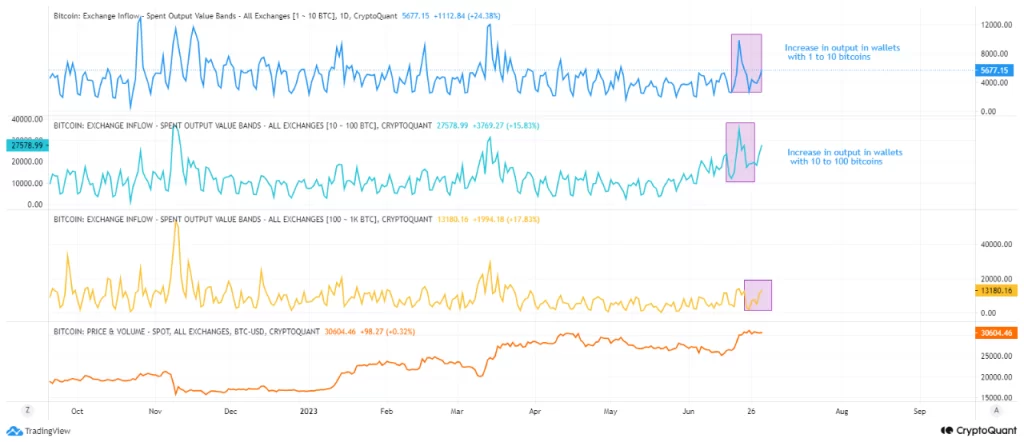

Holders with 1-100 Bitcoins (BTC) in custody have been doling out more coins in recent days as general sentiments remain sour, pseudonymous CryptoQuant analyst CryptoOnchainfound in a new one report.

Read Bitcoin [BTC] Price forecast 2023-2024

After reviewing BTC’s spent output indicator for wallets holding between 1 and 100 BTCs, CryptoOnchain found that a large percentage of leading coins have been moved or spent from these wallets in recent days.

Source: CryptoQuant

Overall, an increase in spent output from this cohort of BTC holders typically suggests a potential increase in sales activity by these investors. This can be caused by a variety of factors such as profit taking, market sentiment or the belief that the price may fall further.

However, it could also mean that these investors have transferred their BTC holdings to other entities in recent days.

Analyst CryptoOnchain further found that the biggest increase in issued output in recent days was seen in wallets holding between 10 and 100 BTCs. The analyst noted:

“The biggest increase can be seen in wallets with 10 to 100 bitcoins, which after the increase in recent days to around 36,170 bitcoins are now around 28,000.”

The decision to shrink their BTC holdings may be due to a continued drop in positive sentiment. Per Sanitation, BTC’s weighted sentiment has been negative since June 9. It hovered below the centerline at the time of writing, returning a negative -1.048.

Hold your horses

While weighted sentiment remained in negative territory, an assessment of BTC’s exchange activity revealed a drop in the leading currency’s exchange reserve. This statistic tracks the total number of BTCs held within exchanges. When the value of this metric increases, it indicates an increase in selling pressure, while a decrease indicates greater accumulation.

Is your wallet green? Check out the Bitcoin Profit Calculator

According to data from CryptoQuantBTC exchange reserves fell between June 2 and June 25, after which they rose until the end of the second quarter. Price movements during that period showed severe volatility. This could have prompted many to exit their trading positions and send their BTC to exchanges for sale.

However, things have normalized over the past two days as the statistic has been falling since the beginning of July.

Source: CryptoQuant

Further, while a certain cohort of BTC holders may have turned to selling, buying activity, among others, continued unabated. A look at BTC’s movements on the price chart confirmed this.

At the time of writing, the main momentum indicators RSI and MFI were above their neutral positions at 65.57 and 71.16 respectively. In these places the king’s coin was almost overbought.

While the coin was moving closer to overbought highs at the time of writing, the price was close to the upper band of its Bollinger Bands indicator. At this level, it may encounter resistance, which may lead to a setback or a period of consolidation.

Source: BTC/USDT on TradingView