- The change in Bitcoin’s illiquid supply remains high as the accumulation trend continues.

- Bitcoin forms new support and resistance as it remains in the $30,000 price range.

Despite Bitcoin’s [BTC] price staying in the $30,000 range, the trend of accumulating this digital currency has continued. According to recent data from Glassnode, the level of Bitcoin’s illiquid supply indicates that the hodling race is on.

Read Bitcoin Price Prediction (BTC) 2023-24

Bitcoin HODLing continues

While hodling continued to dominate, Bitcoin Illiquid Supply Change remained remarkably high, reaching levels near the peak of its cycle. Per Glasnodeled a significant influx of coins into wallets with minimal or no spending history, with an impressive monthly rate of over 194,500 BTC.

This wave of Bitcoin (BTC) coming into the possession of illiquid entities, such as network participants who rarely spend their holdings, is happening at its fastest pace in half a year.

In addition, this trend strongly indicated a preference for accumulation among long-term investors. The steady and gradual flow of funds into illiquid portfolios is further evidence of this ongoing process of accumulation.

The market is quietly accumulating Bitcoin, indicating underlying demand despite recent regulatory challenges. In addition, this accelerated accumulation meant a decrease in the available supply. This could potentially pave the way for a price hike.

Micro strategy joins the BTC accumulation trend

In a recent development, institutional investors have made remarkable strides in their BTC accumulation efforts. For example, Microstrategy successfully acquired over $300 million in BTC, further contributing to the ongoing accumulation trend. This important move reflects the continued accumulation by institutional players and individual investors and underlines the continued interest of institutions.

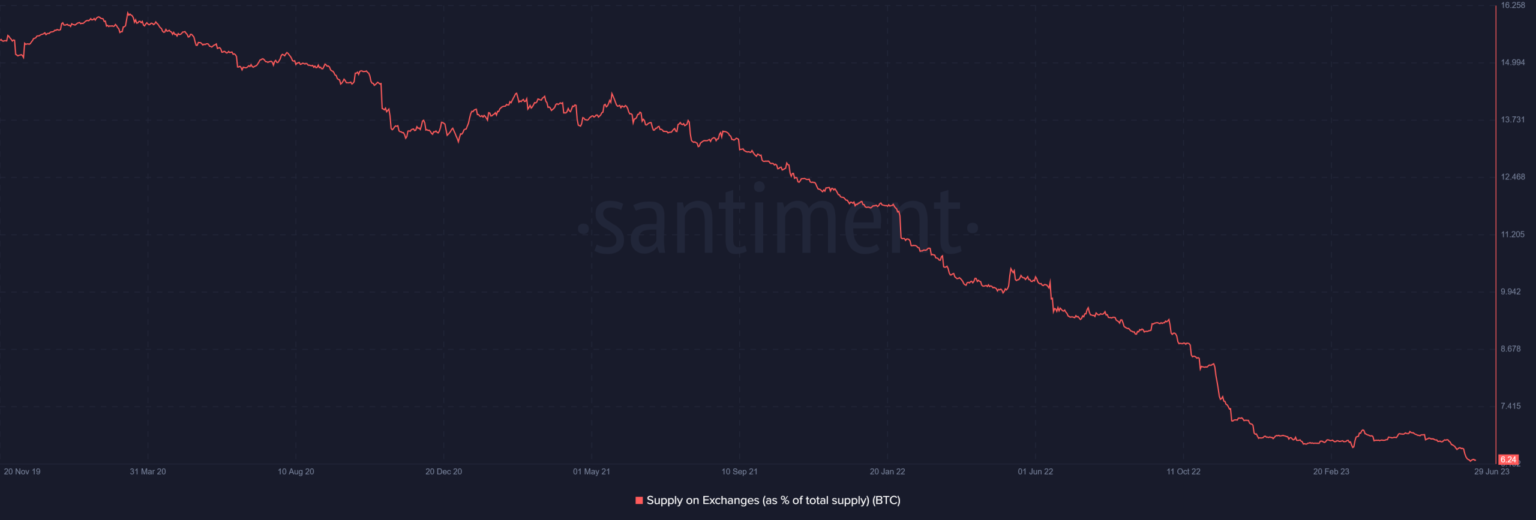

In addition, Bitcoin’s dwindling supply on exchanges serves as further proof of the illiquid nature of this asset. According to the Santiment chart, the available supply was about 6.24 at the time of writing. This measure indicates that despite continued accumulation by individuals and institutions, there are no signs of a sell-off or significant supply in the market.

Source: Sentiment

This collective behavior suggests a strong belief in Bitcoin’s long-term value, as investors hold onto their assets rather than engage in profit-taking. The continued accumulation of various market participants underscores confidence in Bitcoin’s prospects and its potential for continued growth.

How much are 1,10,100 BTC worth today

Bitcoin price movement

At the moment, Bitcoin has experienced a modest increase in value. On the daily time chart, BTC had remained within the $30,000 price range, with a trading price of around $30,500 representing an increase of almost 1%. Notably, a new resistance level appeared to be emerging around $31,600, while support held steady near $29,000.

Source: TradingView

Moreover, according to its Relative Strength Index (RSI), BTC had moved out of the overbought zone. Although the RSI line had been falling, indicating a decline in momentum, Bitcoin continued to show a strong bullish trend.