- Bitcoin hashrate has dropped significantly in recent days, which could lead to miner capitulation.

- Activity on the Bitcoin network also dropped significantly

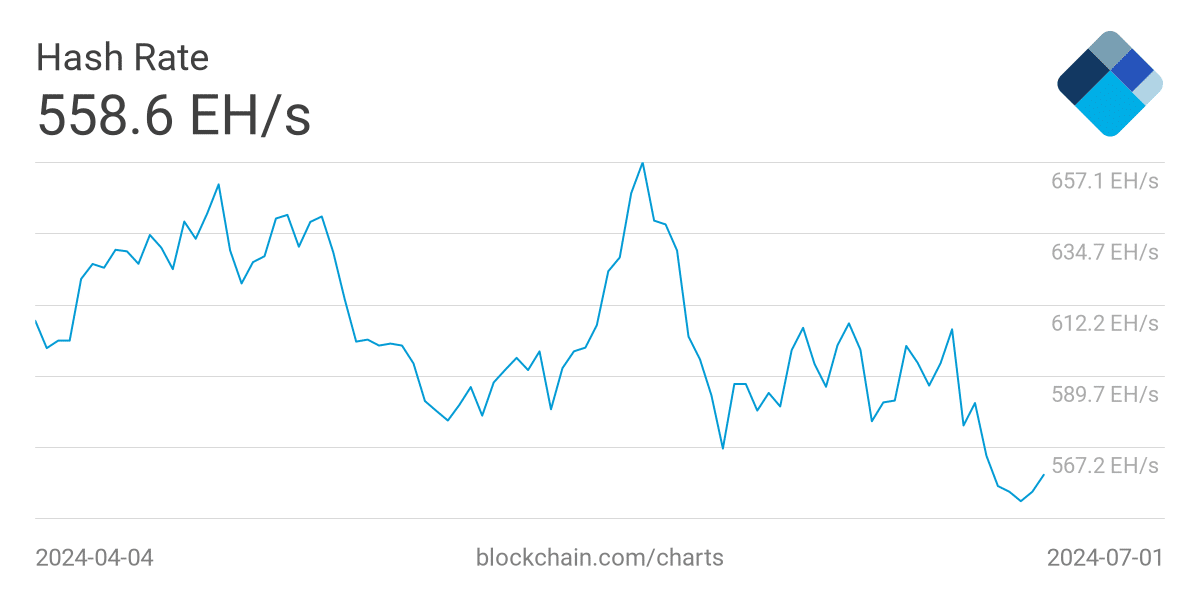

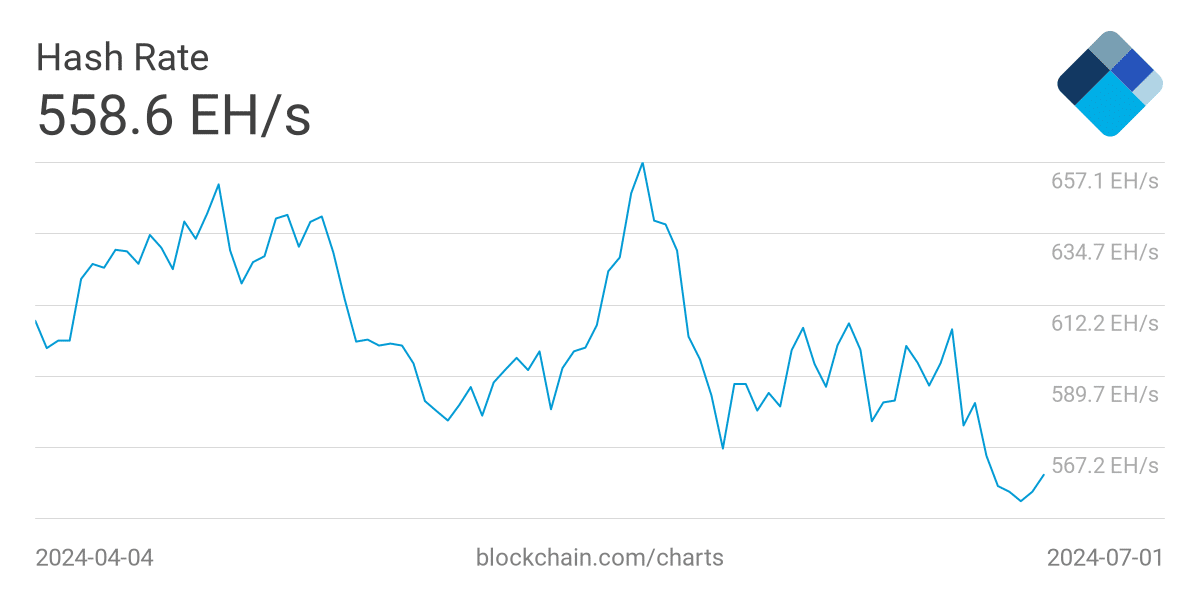

An important indicator of Bitcoin [BTC] The network’s processing power, the hashrate capture, has fallen to its lowest point since December 2022.

Bitcoin hashrate drops

According to Blockchain.com, there was a significant drop in Bitcoin’s hashrate this month, dropping it to levels reminiscent of the tumultuous period surrounding the collapse of the FTX exchange in late 2022.

However, there is a crucial distinction between the two scenarios. The current drop in hashrate follows Bitcoin’s recent halving, which saw miner rewards halved to 3,125 BTC per block mined.

Source: Blockchain.com

This decline in hashrate suggests that some miners are struggling to stay afloat. Capitulation of Bitcoin miners occurs when miners are forced to cease operations due to unsustainable costs.

This usually happens when the cost of mining Bitcoin, including electricity, hardware and maintenance costs, exceeds the income from mining rewards.

The recent halving has undoubtedly exacerbated this challenge for miners, as they now earn less Bitcoin for the same amount of work.

The current drop in hashrate could be a sign that some miners are capitulating and leaving the network.

If costs continue to rise and miners are forced to sell their assets, there could be downward pressure on BTC, causing a significant correction.

Bitcoin ecosystem in trouble

Miners are also struggling with reduced revenue from alternative sources as network activity declines. Initially, they benefited from high fees during the post-halving Bitcoin-based Runes Protocol frenzy.

However, profits have fallen sharply as network activity has declined.

Daily Rune transactions have plummeted, marking a drastic 90% drop. As a result, miners’ overall revenue from Rune transactions has also dropped significantly.

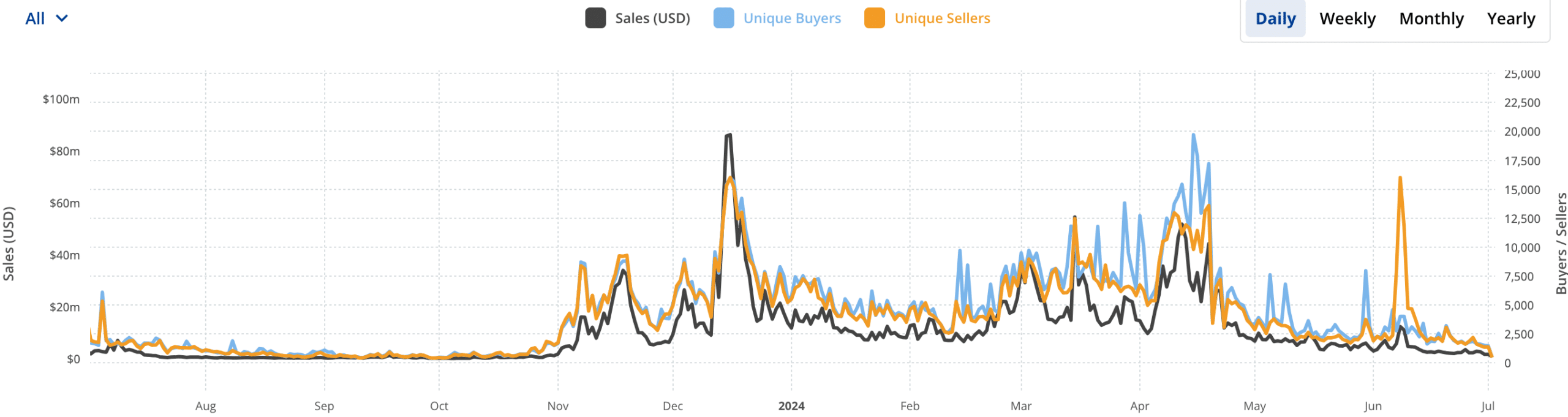

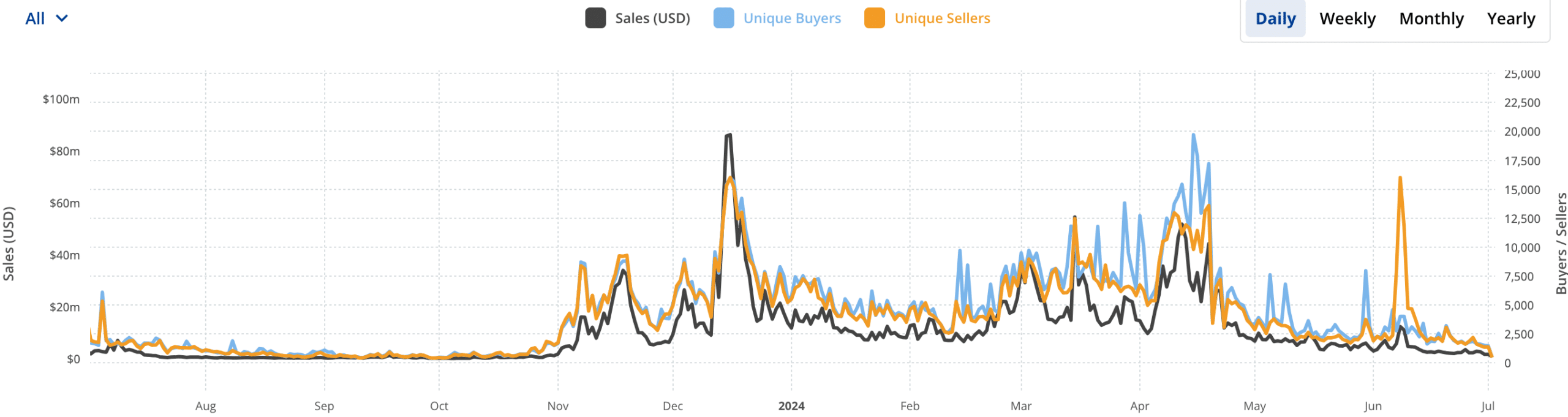

In addition, the total NFT transactions taking place on the network have also dropped significantly in recent days. CryptoSlam’s data showed that sales volume for these NFTs fell to 68.32% over the past month.

Source: Crypto Slam

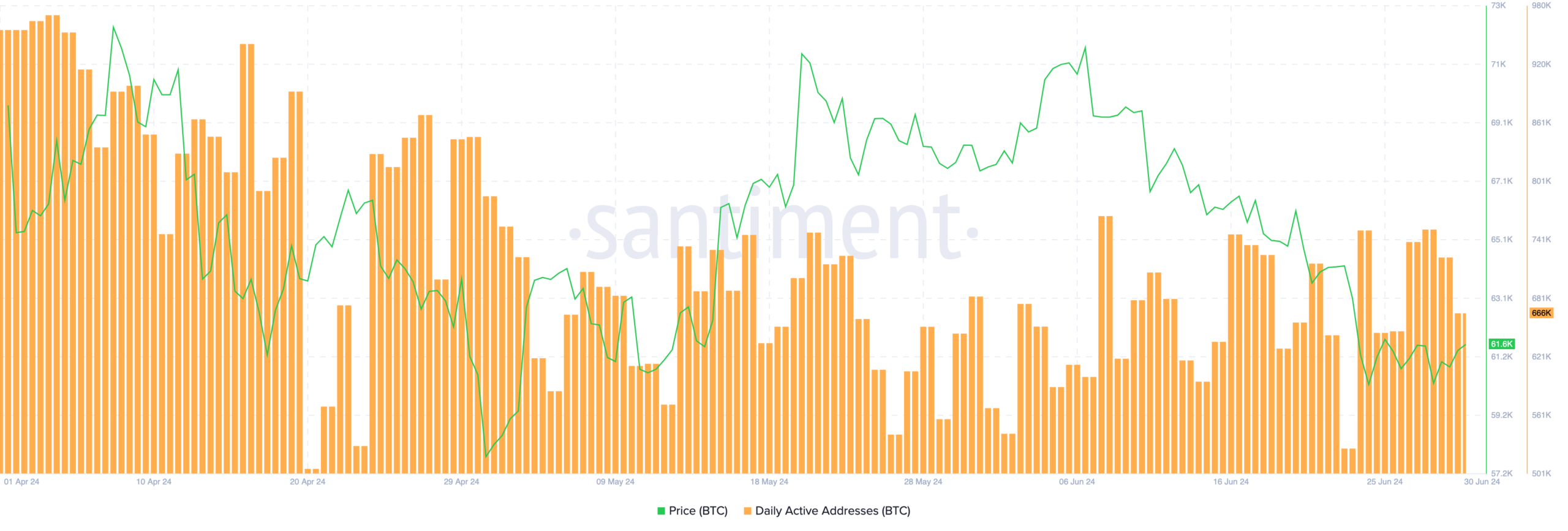

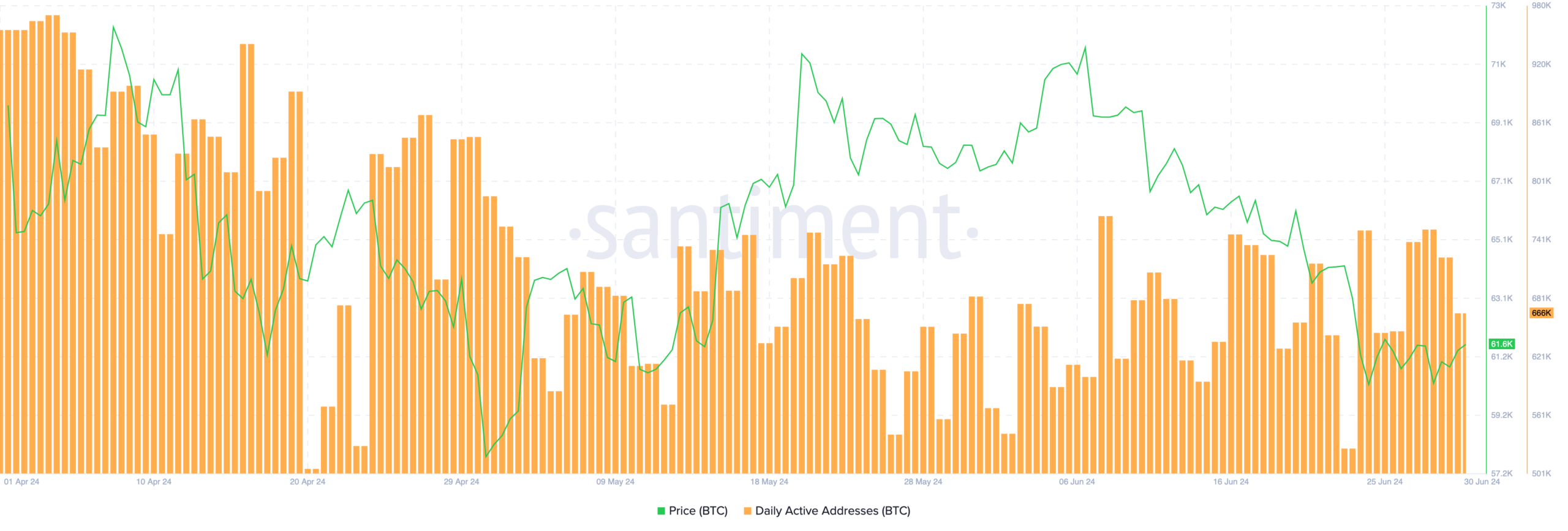

Moreover, activity on the network had also decreased.

Read Bitcoin’s [BTC] Price forecast 2024-25

AMBCrypto’s analysis of Santiment’s data indicated that the number of daily active addresses on the network had decreased significantly over the past 30 days, from 955,000 per day to 666,000 per day.

This decline in activity could further impact miners’ ability to generate significant amounts of revenue.

Source: Santiment