Former Goldman Sachs CEO Raoul Pal says he is looking at a signal that has preceded a massive Bitcoin (BTC) rally five times in the past.

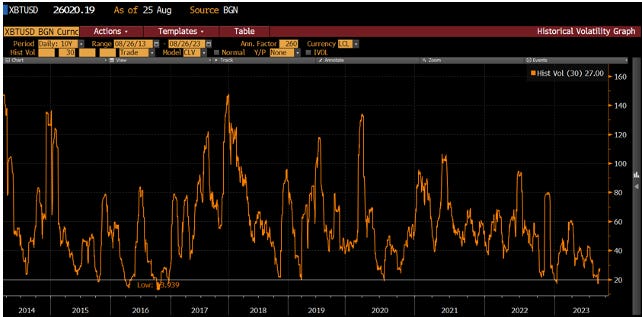

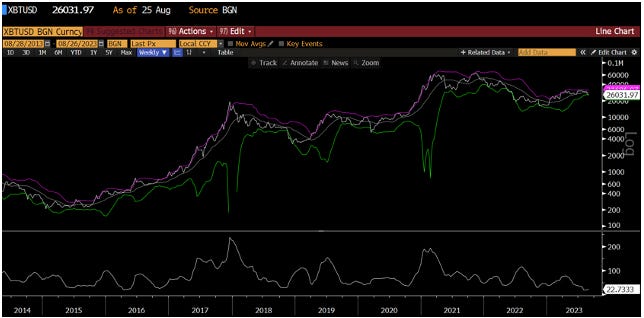

In a blog post, the macro guru says Bitcoin’s 30-day historical volatility has dipped below 20 for the first time since the start of the year.

Friend say Reaching the 20 level has historically set the tone for a massive Bitcoin boom in the ensuing months.

“After a strong start to the year (rises from 60% to 100%), crypto markets were completely dead last summer…

This 20 level has always produced huge moves over the next two to four months…

April 2016: +83% in two months

October 2016: +85% in two months

March 2019: +214% in three months

July 2020: +102% in four months

January 2023: +85% in three months.”

Pal also keeps a close eye on the Bollinger Bands, a widely used volatility indicator. According to the macro guru, Bitcoin’s Bollinger Bands are “currently the tightest on record,” as it also hovers close to the 20 level.

“Only one other month have we ever been under 25 historically, and that was in April 2016.

At the time, Bitcoin surged 44x to its 2017 high…”

At the time of writing, Bitcoin is worth $26,127.

Looking at Ethereum (ETH), Pal says the leading smart contract platform continues to trade within a bullish continuation pattern despite the market-wide correction in recent weeks.

“Additionally, as we highlighted last week, ETH also appears to be forming a major bull flag pattern…”

At the time of writing, Ethereum is trading at USD 1,636.

Don’t miss a single beat – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney