- Bitcoin’s fear and greed index must be closely viewed for instructions on trade decisions

- This moment could be the scene for the next major market shift

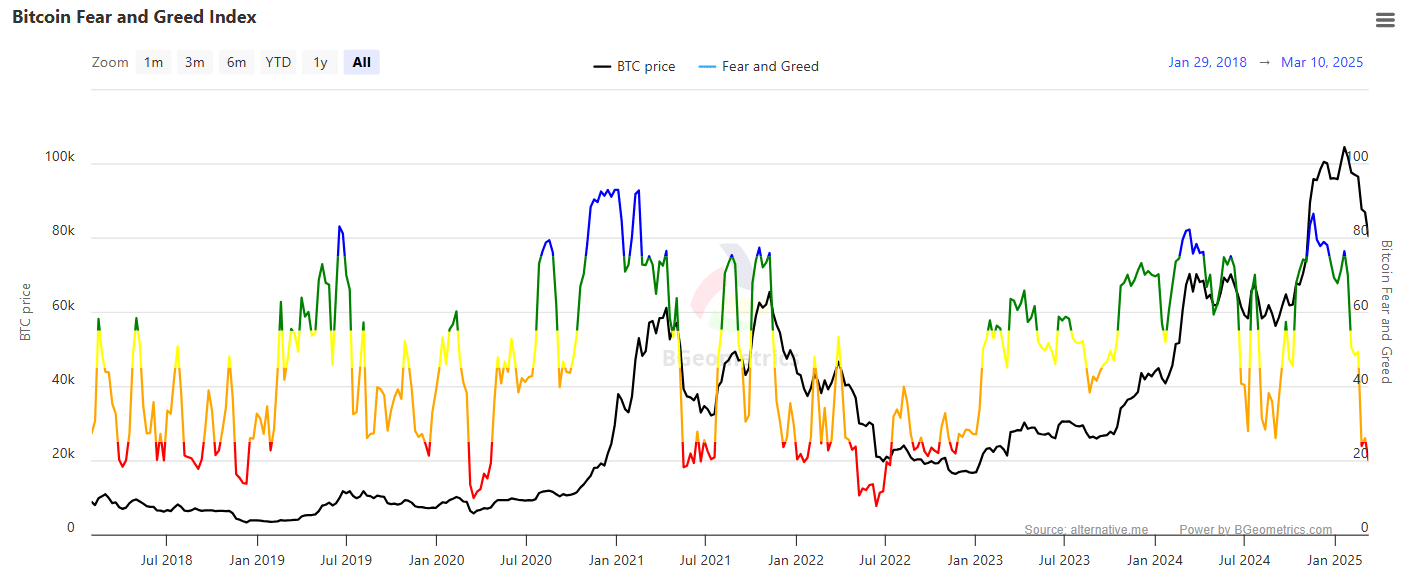

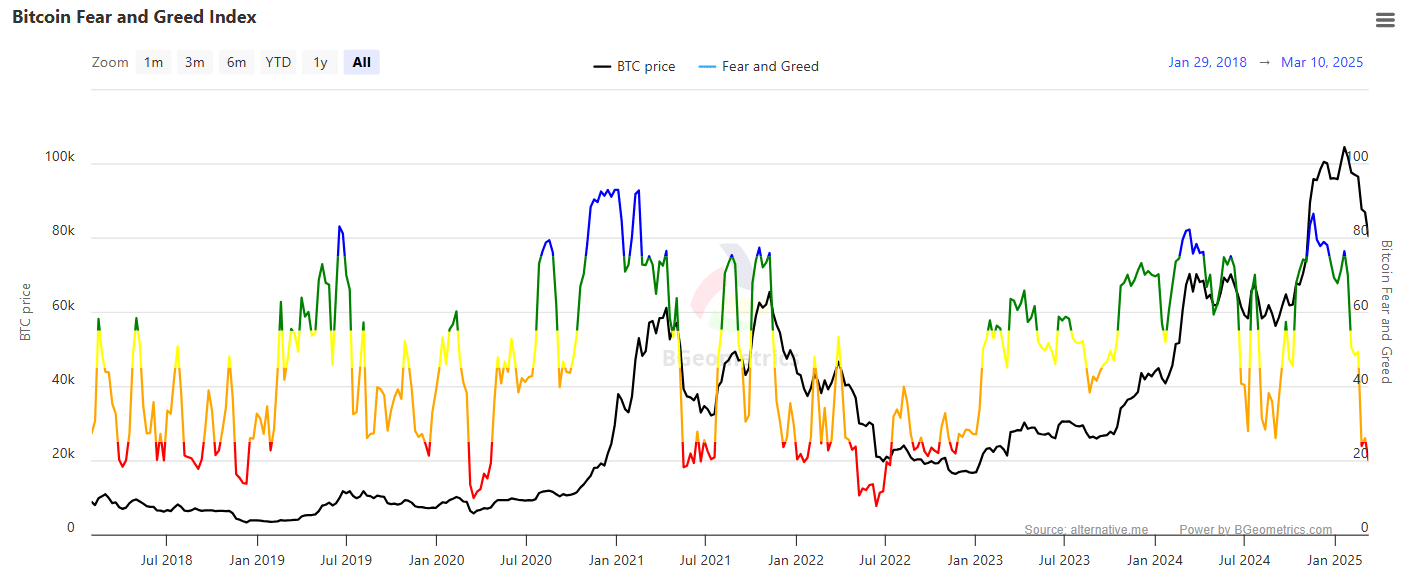

Bitcoin [BTC] a volatile phase has again been introduced, in which the fear and greed index flash a crucial signal for traders in the charts.

At the time of the press, BTC was slightly less than $ 80,000 and struggled to regain a momentum after a sharp sale of his peak of $ 97,000. The question now is – greed signals a deeper dip, or should fear take over?

Do traders follow the Playbook “Buy the Fear”?

Bitcoin’s sharp 17% decrease to below $ 80k This week, the anxiety and greed index pushed to “extreme fear” – a lecture of 20. This was the first time in two years that the market went into such a deep red area.

Source: Bgeometrics

In earlier cycles, Bitcoin has either organized a fast recovery because traders have been capitalized on the reduced prices or passed long -term anxiety -driven sale, so that the index was pushed even lower.

However, buying BTC for $ 16K is a world, except buying $ 80k.

This can be reflected in the outflows – when BTC was at $ 16k, the total outsource over 70k strived. With BTC for $ 80k, the outflows were only 14.2k.

That said, the 13% increase in sluice From the previous day, traders may use to buy the dip, which may make the $ 80k – $ 82k zone as an important area of demand.

If this trend continues, the fear and greed index could shift back to the “fear” zone. Historically it was a precursor to price rallies.

This would indicate the potential conclusion of the heavy distribution phase. In other words, the market can approach a turning point where the sales pressure starts to relieve.

Bitcoin’s future – What reveals the fear and greed index

Currently, with Bitcoin in the “Extreme Fear” zone, the market is at a critical bending point.

If the sales pressure decreases and the purchase activity increases, the index can move to a more neutral or greedy position, which may activate a bullish reversal.

In earlier cycles it is the fear of lack in combination with high-risk greed that has fueled explosive rallies, making Bitcoin well beyond the most important psychological levels, such as $ 100k.

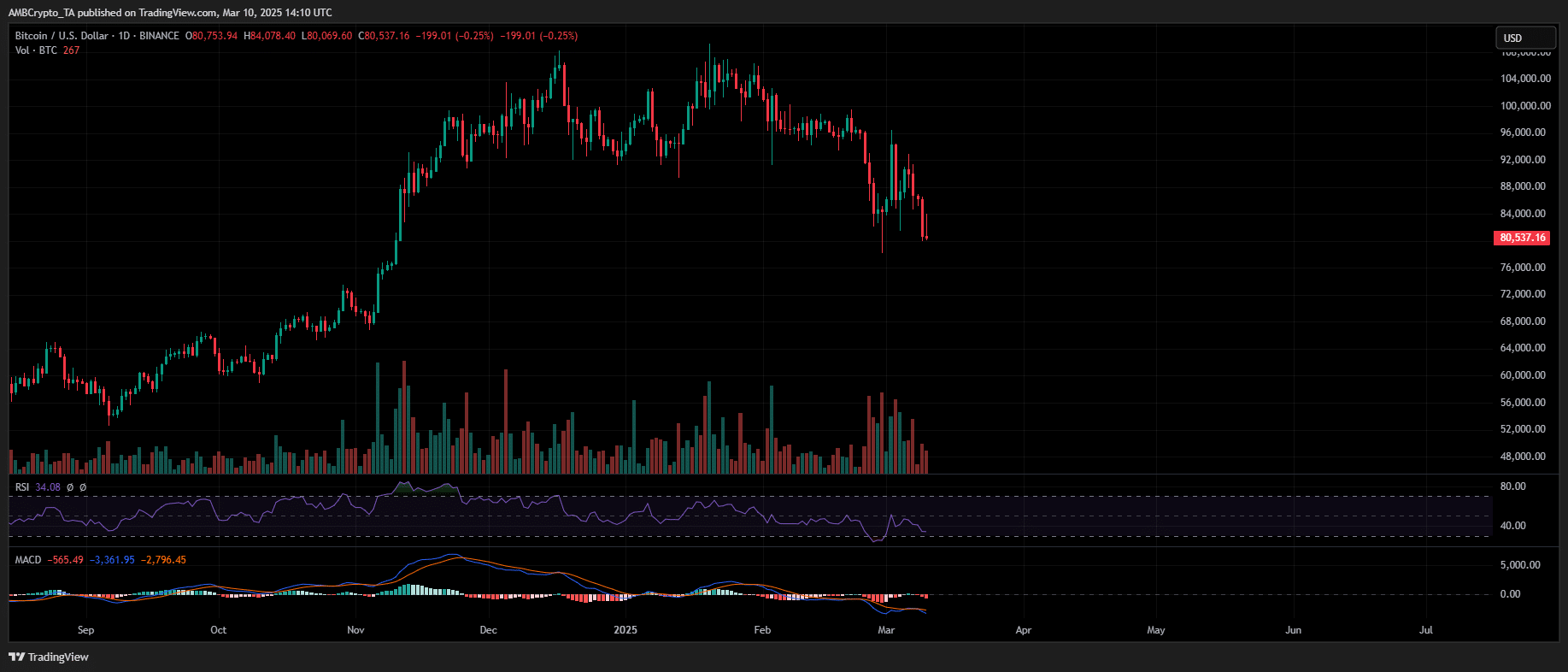

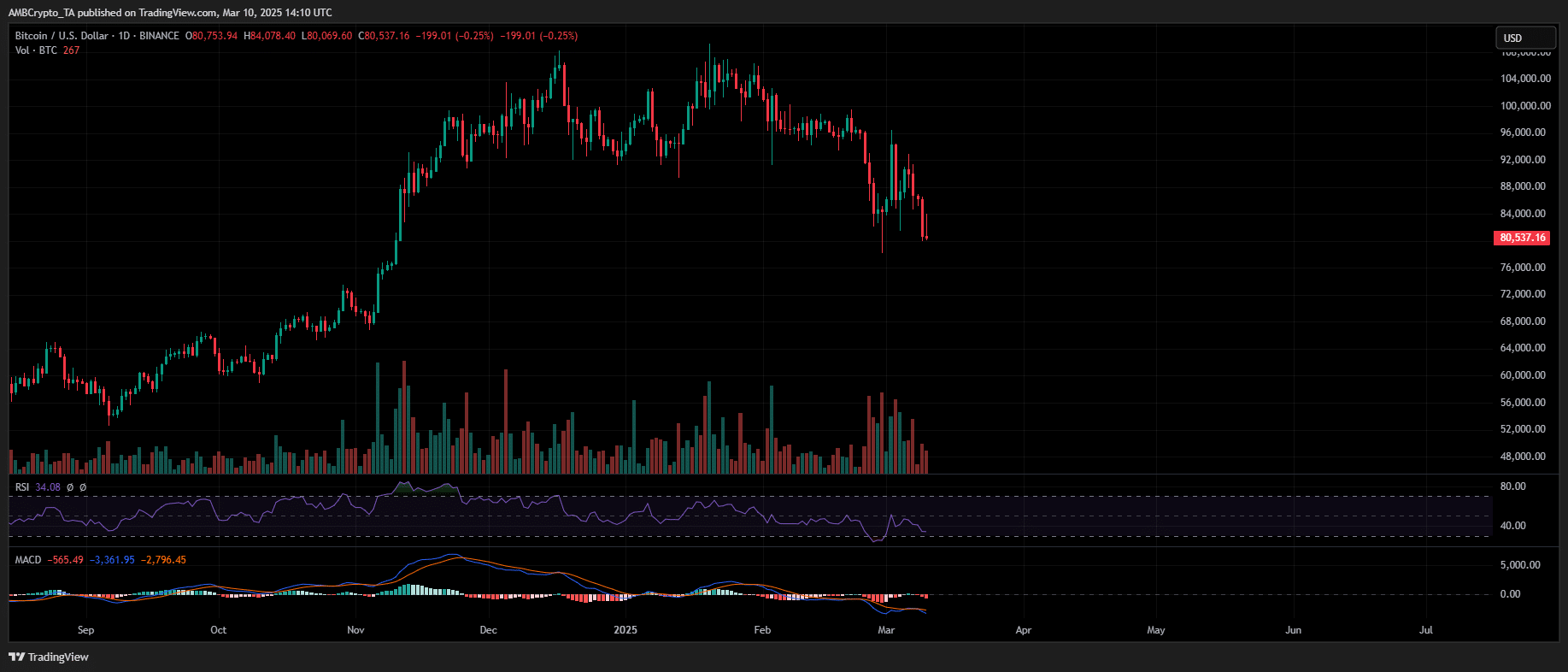

However, Bitcoin’s 1D graph does not yet give this shift. In fact, the MacD Beerarish turned and the volume became negative – a sign that selling Momentum remains largely intact.

Source: TradingView (BTC/USDT)

With the fear and greed in the index that may slip even lower, the risk of further downward increase increases. In this environment a retest of the support level of $ 78k is a high chance.