Data shows that Bitcoin sentiment is about to enter the extreme greed zone. Here’s what this could mean for the cryptocurrency’s price.

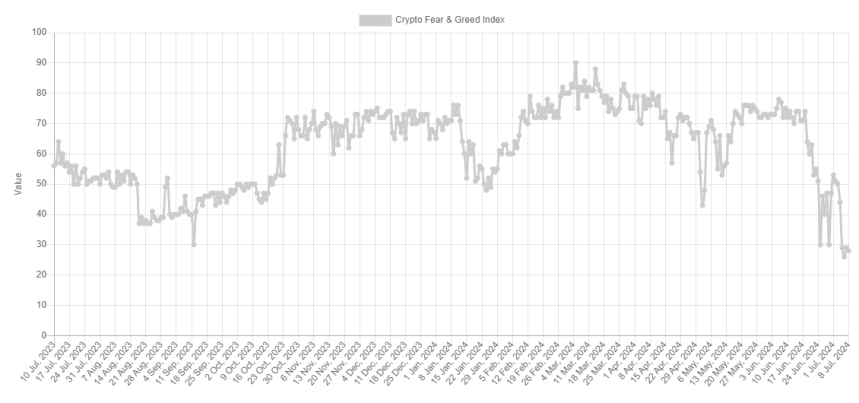

The Bitcoin Fear & Greed Index has continued to decline lately

The “Fear & Greed Index” is an indicator developed by Alternative that tells us about the average sentiment that traders in the Bitcoin and broader cryptocurrency market currently share.

The index uses five factors to determine this sentiment: volatility, trading volume, social media, market capitalization and Google Trends. The metric uses a numerical scale ranging from zero to one hundred to represent mindset.

All values of the indicator above 53 indicate the presence of greed among the investors, while values below 47 imply the dominance of fear. The area between these two thresholds correlates with neutral sentiment.

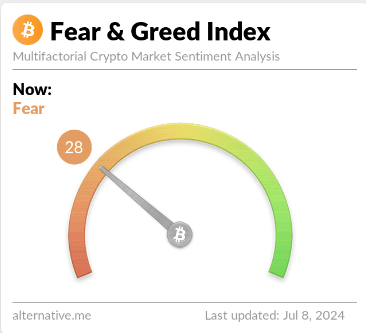

This is what the Bitcoin Fear & Greed Index currently looks like:

As visible above, Bitcoin Fear & Greed currently has a value of 28, meaning the average investor is showing fear. The level of fear must also be quite remarkable, as this current value is quite deep in territory.

In fact, the last level of the indicator is quite close to a special region called the “extreme fear.” Investors show extreme fear when the index falls below 25. There is also a similar zone for the greed side, known as ‘extreme greed’ and occurring above 75.

During the first half of last month the indicator was in or close to the latter region, but the recent market downturn has sharply deteriorated sentiment at the other end of the spectrum.

Historically, Bitcoin and other cryptocurrencies have often shown movements opposite to what the majority expects. The stronger the public’s expectation becomes, the greater the likelihood of such an opposing movement becomes.

With extreme sentiments, traders lean too much towards one direction. As such, large tops and bottoms have typically formed in the assets when the index has been in these zones.

Due to this fact, some traders prefer to buy when investors show extreme fear and sell during extreme greed. This trading philosophy is colloquially called ‘contrarian investing’. Warren Buffet’s famous quote sums up the idea: “Be fearful when others are greedy, and greedy when others are fearful.”

With the Bitcoin Fear & Greed index approaching extreme fear territory, it is possible that the cryptocurrency could soon see profitable entry points again, if history is anything to go by.

BTC price

Bitcoin has not been able to recover much from the recent crash so far, as the price is still trading around $56,700.