- Bitcoin and Ethereum recorded a decrease in volatility in recent days

- Bearish sentiment maintained the dominant position in the market

After noticing huge price swings in recent weeks, both Bitcoin [BTC] and ether [ETH] experienced a period of stagnation on the price front.

Silence before the storm?

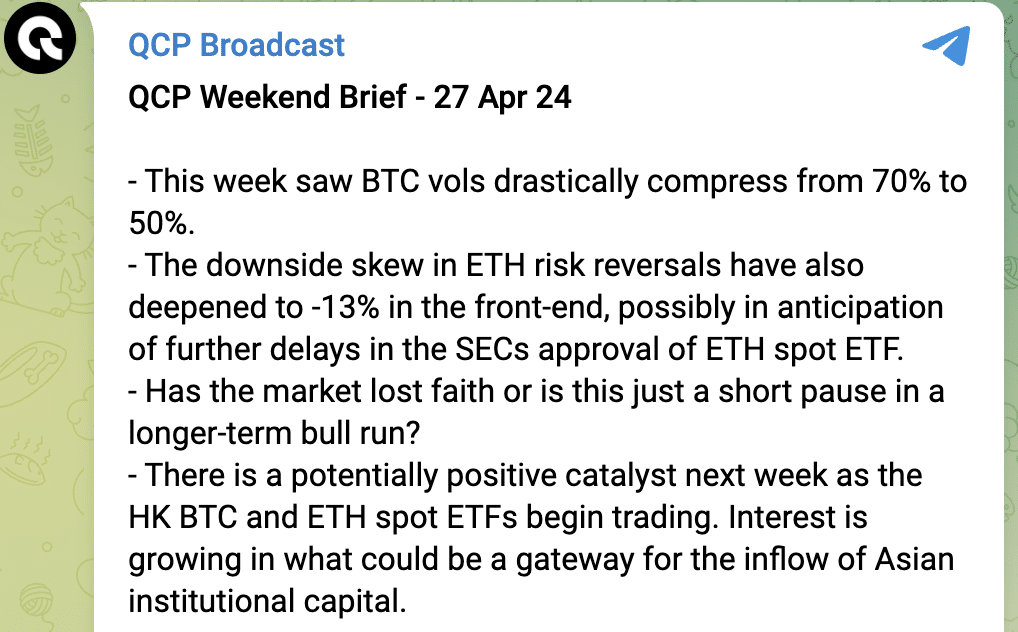

In fact, Bitcoin trading has calmed down significantly this week, with volatility falling as trading volumes compressed from 70% to 50%.

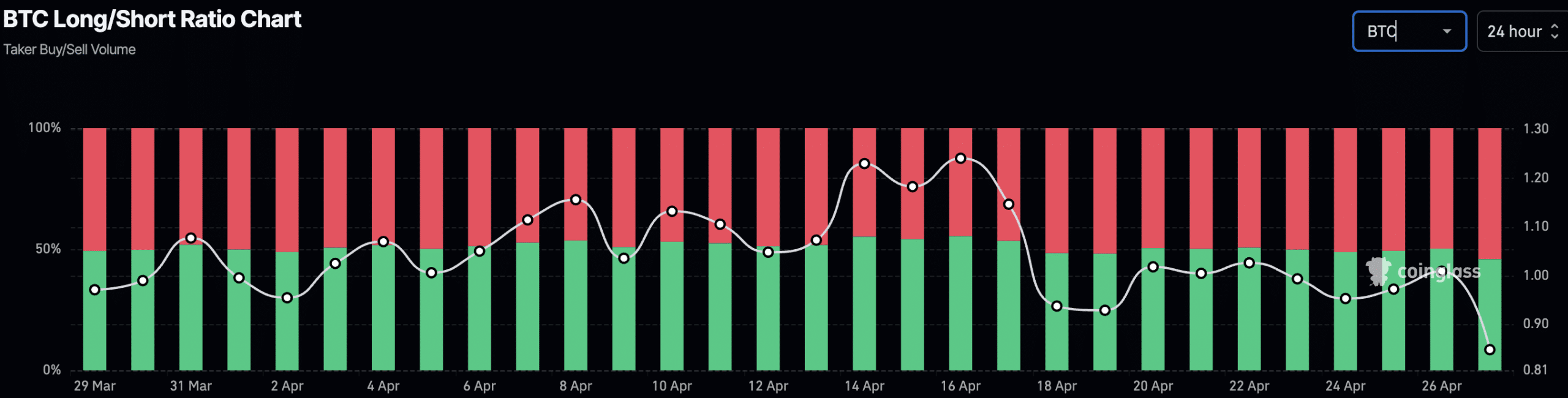

When a market consolidates, many traders prefer to build long positions. However, despite this trend, most traders have decided to be bearish on BTC and ETH.

One reason for this is that the market appears to be anticipating further delays in the US Securities and Exchange Commission’s (SEC) approval of a spot Ethereum ETF. This is reflected in the increasing negative skew of ETH risk reversals, which now stand at -13% in the front month contract. A negative skew means that put options are more expensive than call options for the same strike price and expiration date.

In this context, a negative skew of -13% in front-month contracts indicates a stronger preference for put options. This indicates that investors are more concerned about possible price declines than they are excited about price increases in the near future.

Source: QCP

For Bitcoin, the percentage of short positions taken against BTC has increased from 49% to 54% in the past 24 hours.

Source: Coinglass

However, there may be a bright spot on the horizon next week. The launch of Hong Kong-based spot ETFs for both BTC and ETH could serve as a gateway for institutional capital inflows from Asia.

This could help turn the tide in favor of both BTC and ETH and reduce bearish sentiment around both cryptos.

A tale of two coins

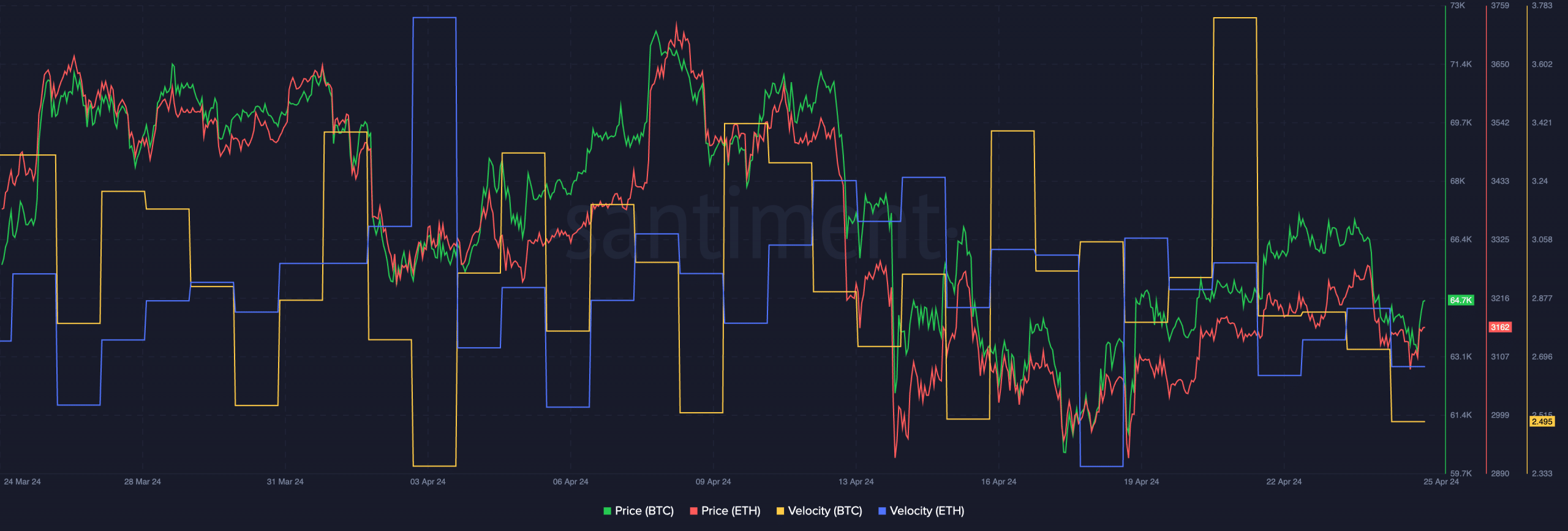

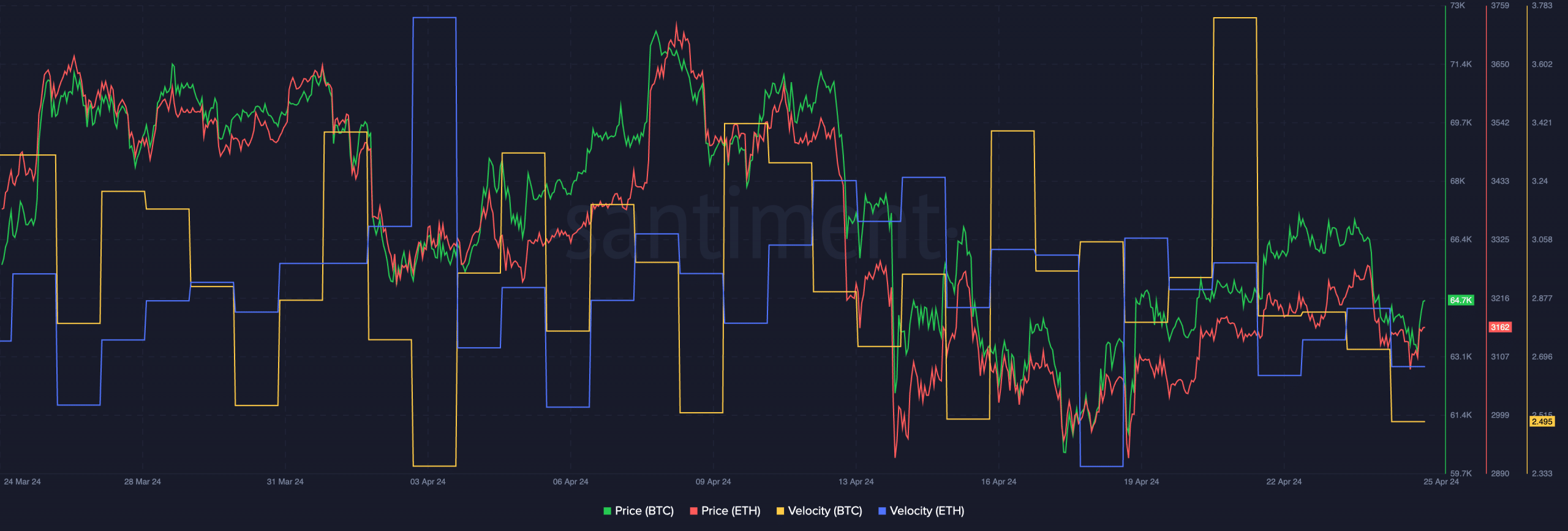

In recent weeks, the price movements of BTC and ETH have been highly correlated. Both coins have undergone some corrections in recent days that have contributed to the bearish sentiment surrounding these cryptocurrencies. Moreover, the speed at which both cryptos traded has also decreased recently.

Simply put, the frequency with which BTC and ETH were traded fell on the charts.

Source: Santiment

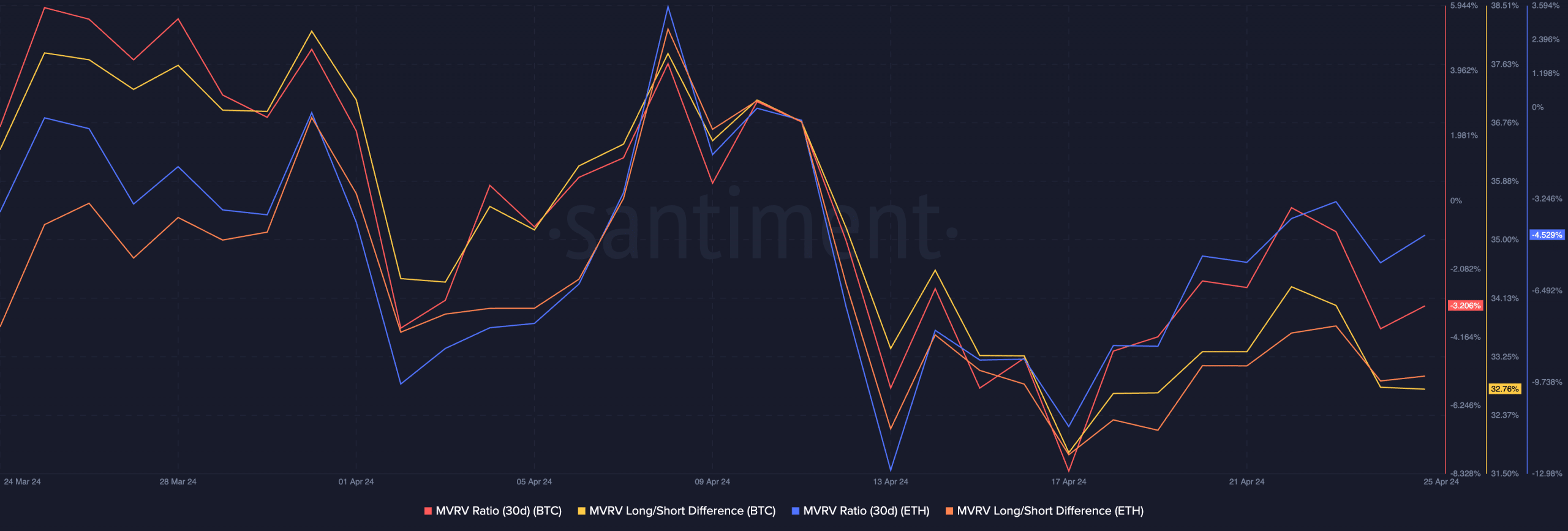

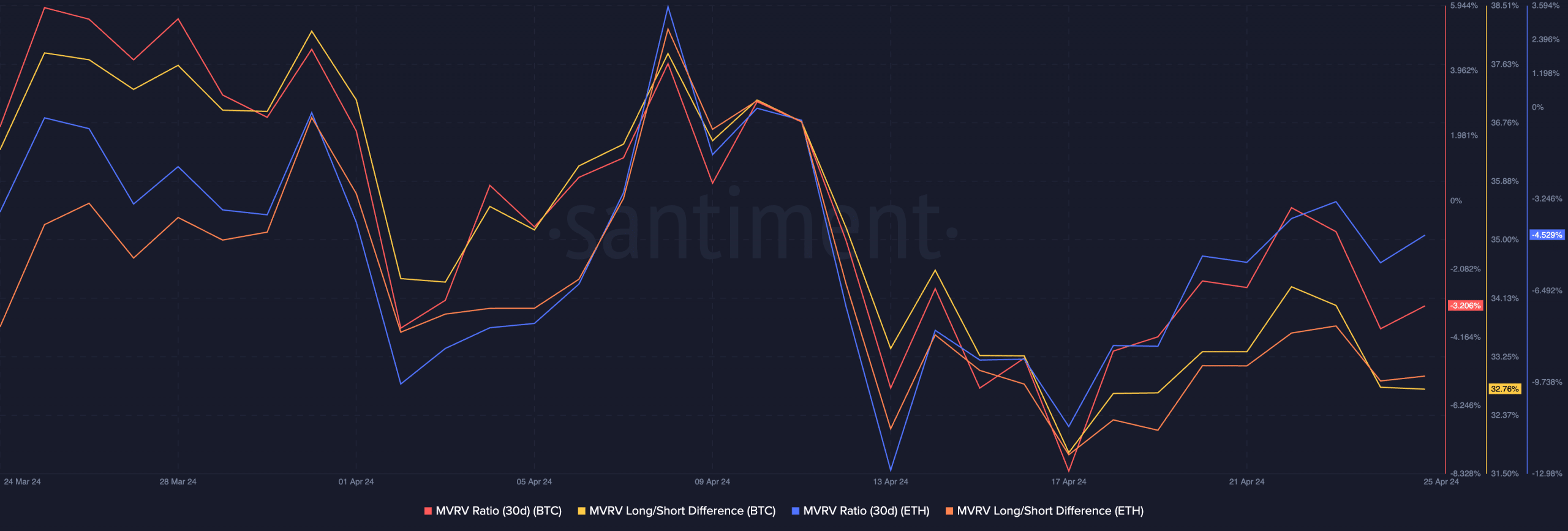

Finally, the MVRV ratio increased for both BTC and ETH, indicating that the profitability of most addresses holding these coins was relatively high.

Furthermore, the difference between long and short for these coins has also increased dramatically – indicating that there was an increase in the number of long-term holders of BTC.

Is your portfolio green? Check out the BTC profit calculator

Source: Santiment