- Grayscale implemented reverse stock splits of Bitcoin and Ethereum ETF.

- Options trading for the company’s BTC ETFs begins today.

Grayscale Investments, a digital currency asset manager, has completed the reverse stock split for its Bitcoin [BTC] Mini Trust ETF (BTC) and Ethereum [ETH] Mini Trust ETF.

The changes took effect on November 20, following the reverse stock split that took place the night before.

David LaValle, Grayscale’s Global Head of ETFs, stated in a recent publication blogging after,

“Based on our clients’ feedback, we believe this is the right decision and beneficial for our clients and the investment community.”

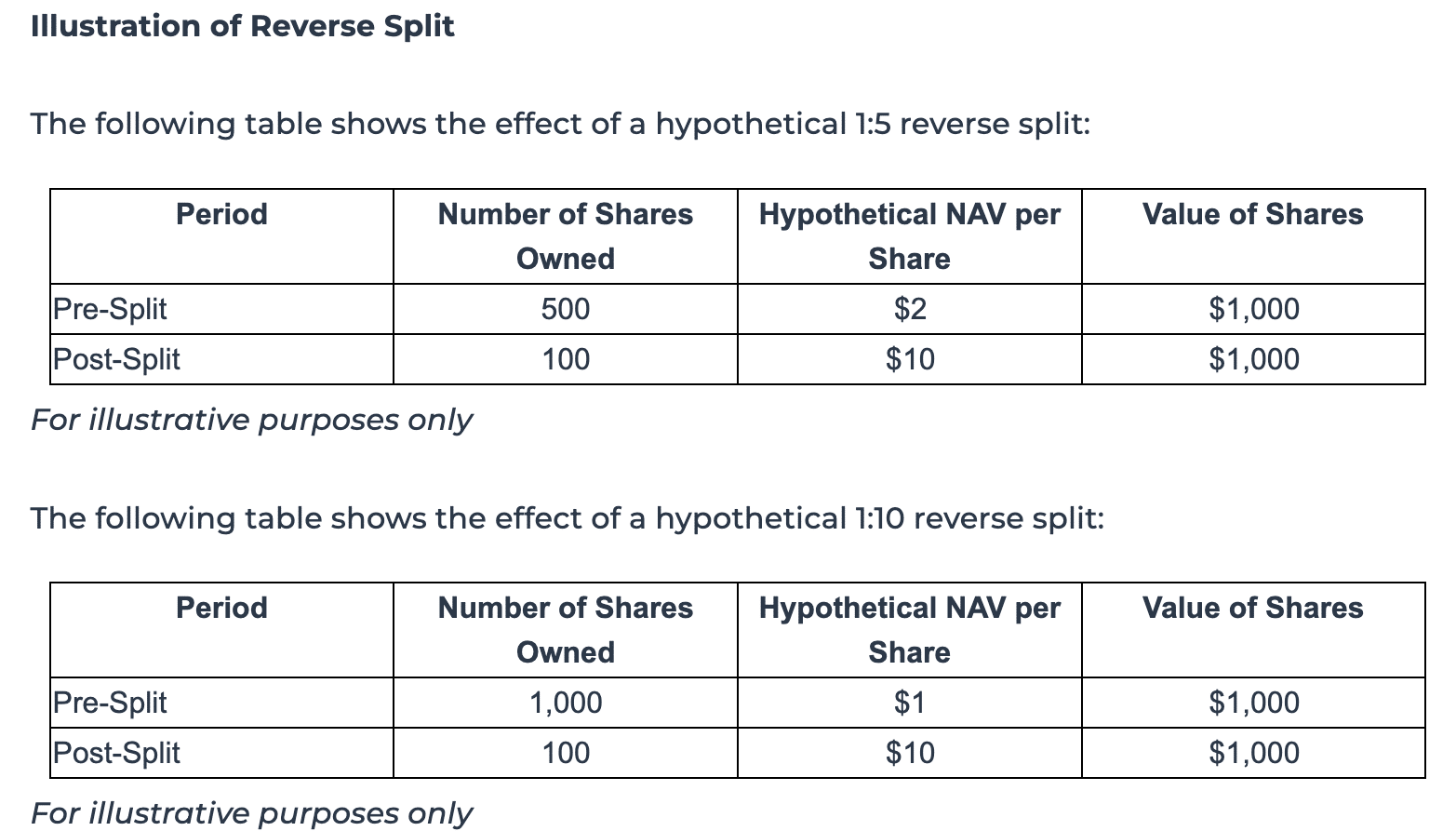

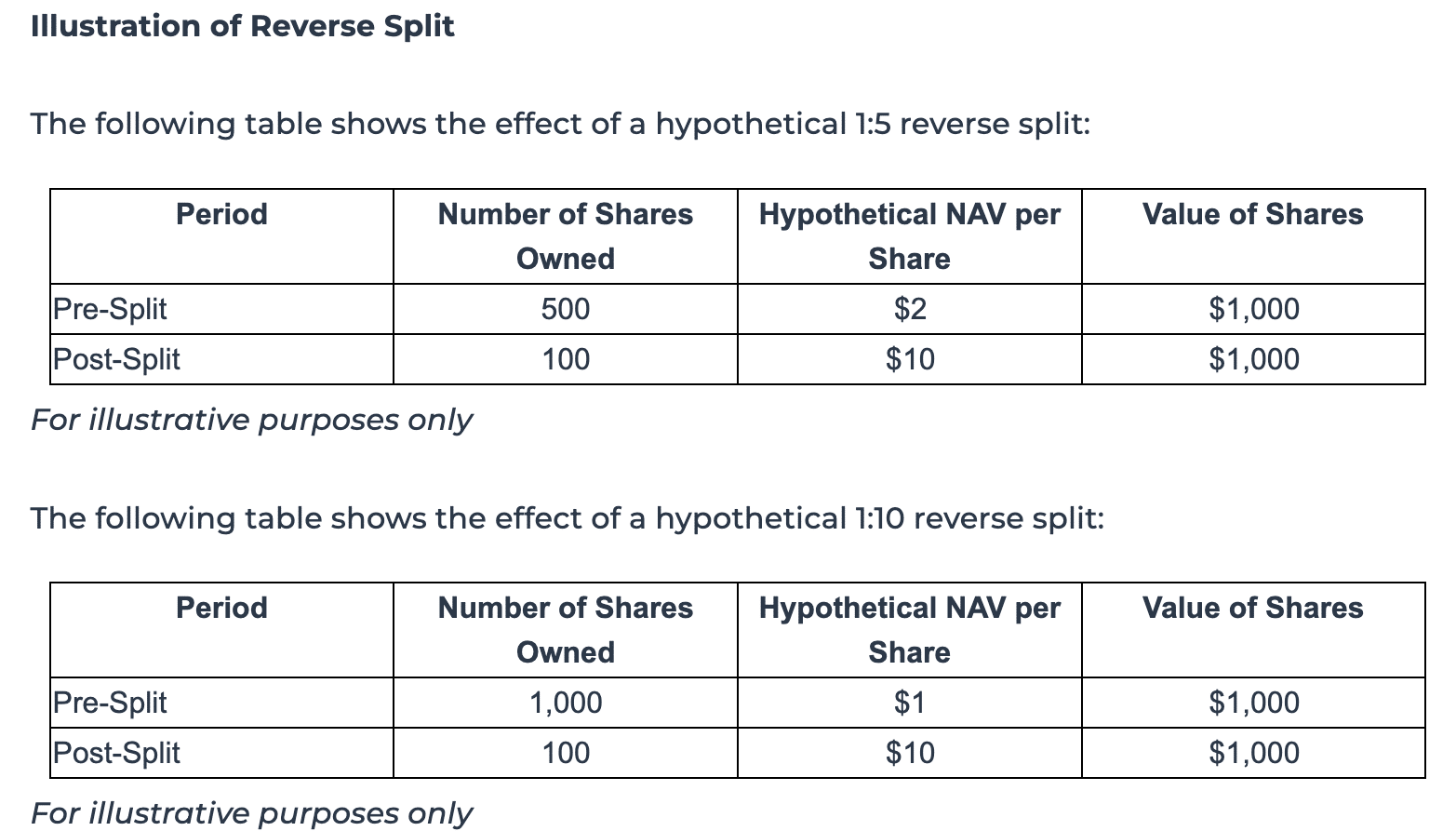

For context, a reverse stock split combines several stocks into one, which decreases the total number of shares but increases the stock price.

Consequences of the reverse stock split

The company pointed out the benefits of reverse stock splits, highlighting its ability to streamline trading and make it “more cost-effective” for market participants.

As a result of this latest move, Grayscale Ethereum Mini Trust ETF underwent a 1:10 reverse stock split.

This increased the price per share to ten times the net asset value (NAV) before the split, while the number of shares outstanding was proportionally reduced.

Similarly, Grayscale Bitcoin Mini Trust ETF performed a 1:5 reverse split, increasing its price per share to five times its pre-split net asset value, with a corresponding decrease in the number of shares outstanding.

Source: grayscale

However, the asset manager emphasized that shareholders will be able to hold fractional shares after the split.

Depending on the policy of the Depository Trust Company (DTC) participant, these fractional shares may be tracked internally or pooled and sold, with shareholders receiving a cash proceeds.

Notably, fractional shares are not eligible for trading on the NYSE Arca.

Grayscale’s Bitcoin and Ethereum ETF Performance

After the split, the company’s ETFs for Bitcoin and Ethereum showed mixed performance, according to Yahoo Finance.

The Bitcoin Mini Trust ETF Closed at $41.84, up 1.80% during regular trading hours.

On the other hand, the Ethereum Mini Trust ended at $28.93, representing a 0.92% depreciation. However, it saw a pre-market increase to $29.58, a gain of 2.25%.

BTC ETF options start trading

The reverse stock split precedes an important development for the company. Grayscale will launch Bitcoin ETF options for its Grayscale Bitcoin Trust (GBTC), the Mini Trust, on November 21, marking a significant expansion into the US market.

The asset manager recently shared its enthusiasm about this milestone after on X.

Source: Grayscale/X

This move follows that of BlackRock IBIT options debut, which saw trading volume of nearly $1.9 billion on its opening day.