- BTC, ETH and Sol have followed almost identical price patterns, suggesting that macro -economic factors are driving the market.

- Main support and resistance levels indicated that an outbreak or deeper correction could be the next major movement.

Bitcoin [BTC]Ethereum [ETH]and Solana [SOL] Have shown a strong price correlation over the past two weeks and moved almost at the same time.

This pattern raises important questions about whether macro -economic factors, investor sentiment or structural market trends cause this coordination.

A further consideration of their price promotion shows how much each has actively purchased and what this correlation means for traders who are making progress.

BTC, ETH and Sol show a strong correlation

Recent market data emphasize that BTC, ETH and SOL went into close synchronization, whereby every actively experienced similar peaks and valleys.

The correlation card Illustrated how their prices have reflected each other, which suggests that wider market forces are all the assets right.

This coordination can often be attributed to market -wide sentiment shifts, liquidity trends and institutional trade strategies that at the same time influence several important assets.

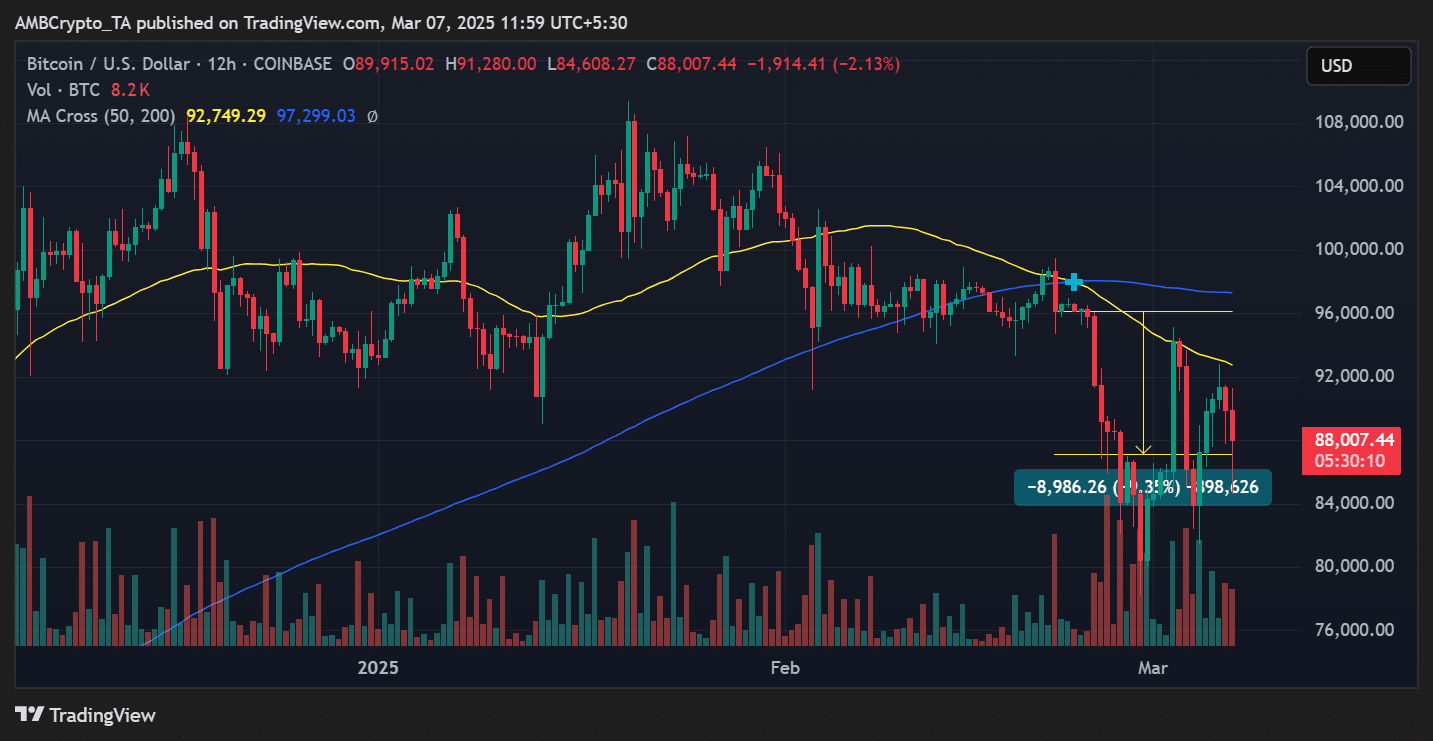

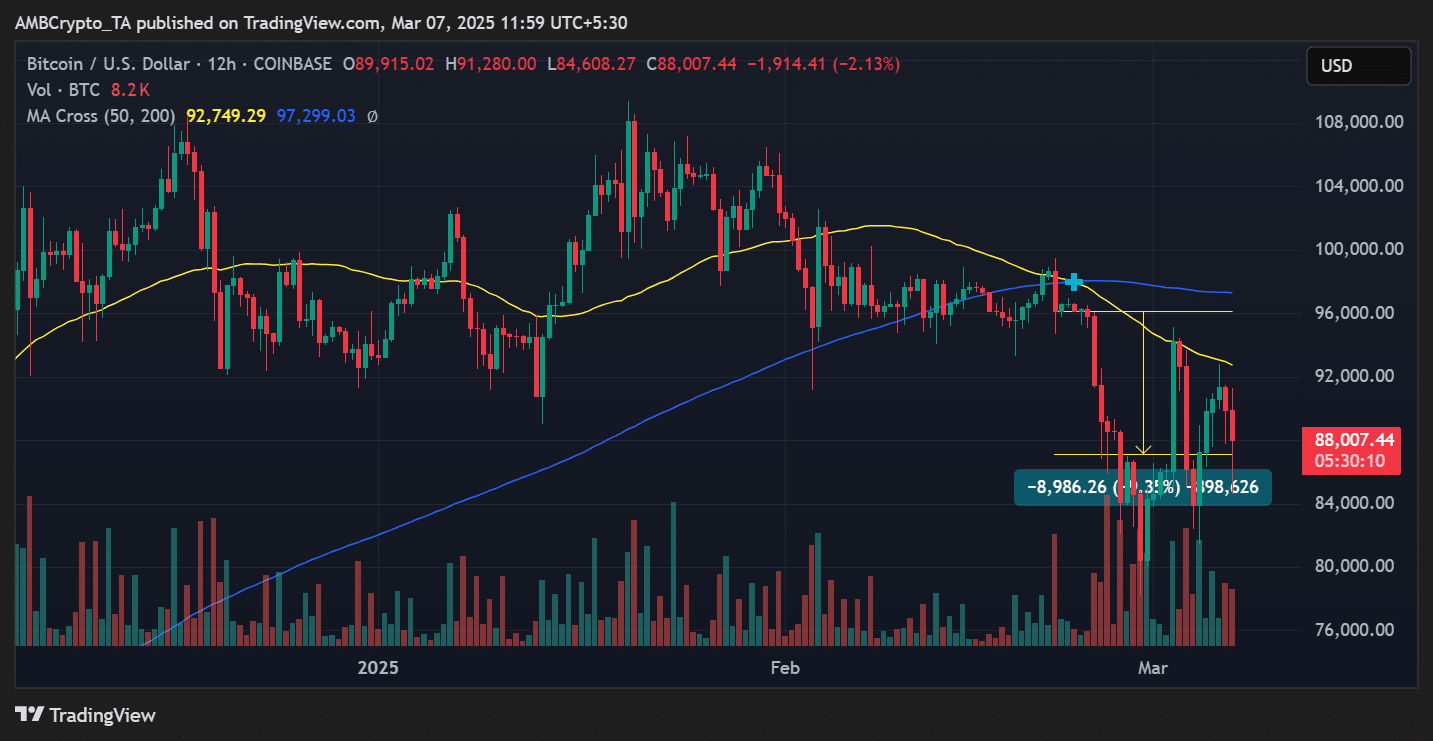

Bitcoin -Price analysis: Wrestling to keep support?

Bitcoin has seen a sharp decline in recent weeks, with BTC that is traded on the $ 88.007 press. The analysis also showed a price fall of 9.3% compared to two weeks ago.

Source: TradingView

The 50-day advancing average (MA) was at $ 92,749 and acted as a resistance. If BTC does not live this level back, the further pressure can push the price to the $ 84,000 support zone.

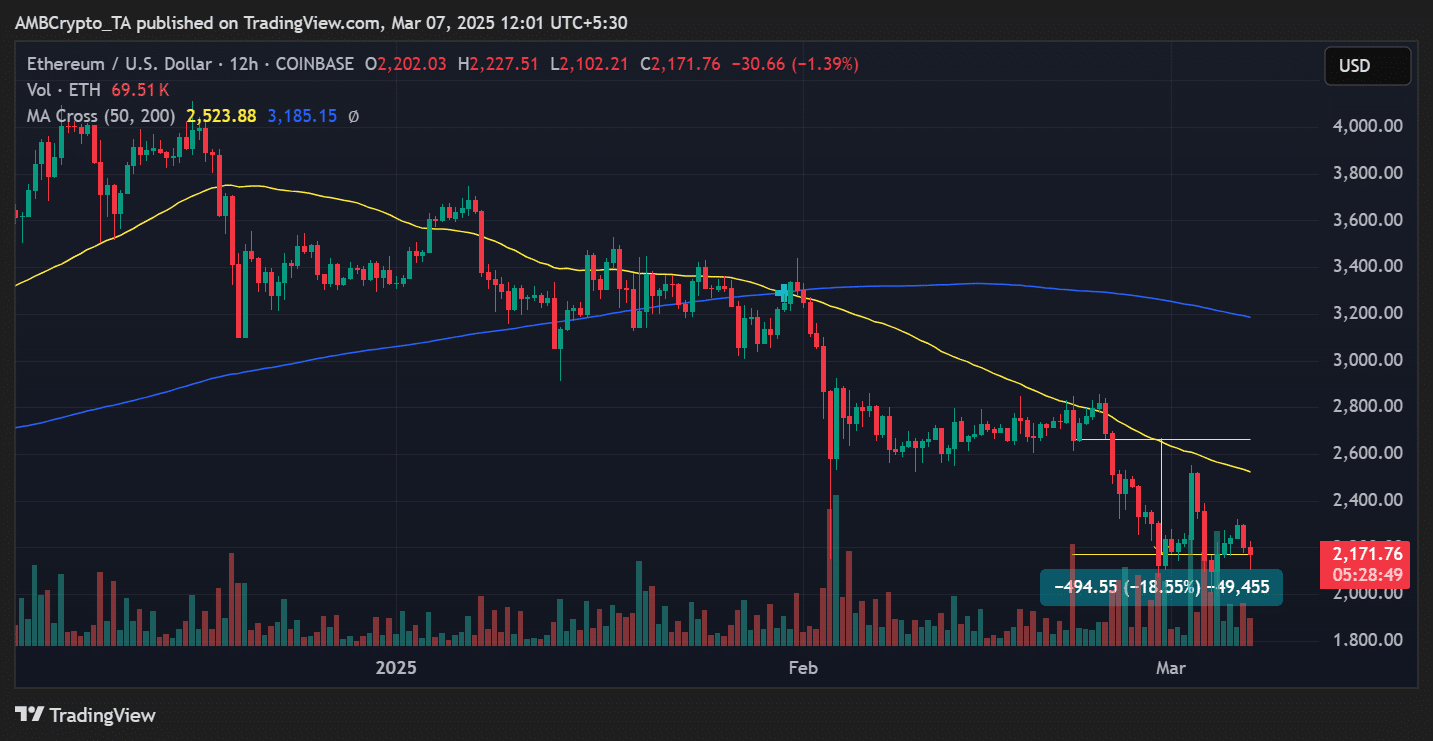

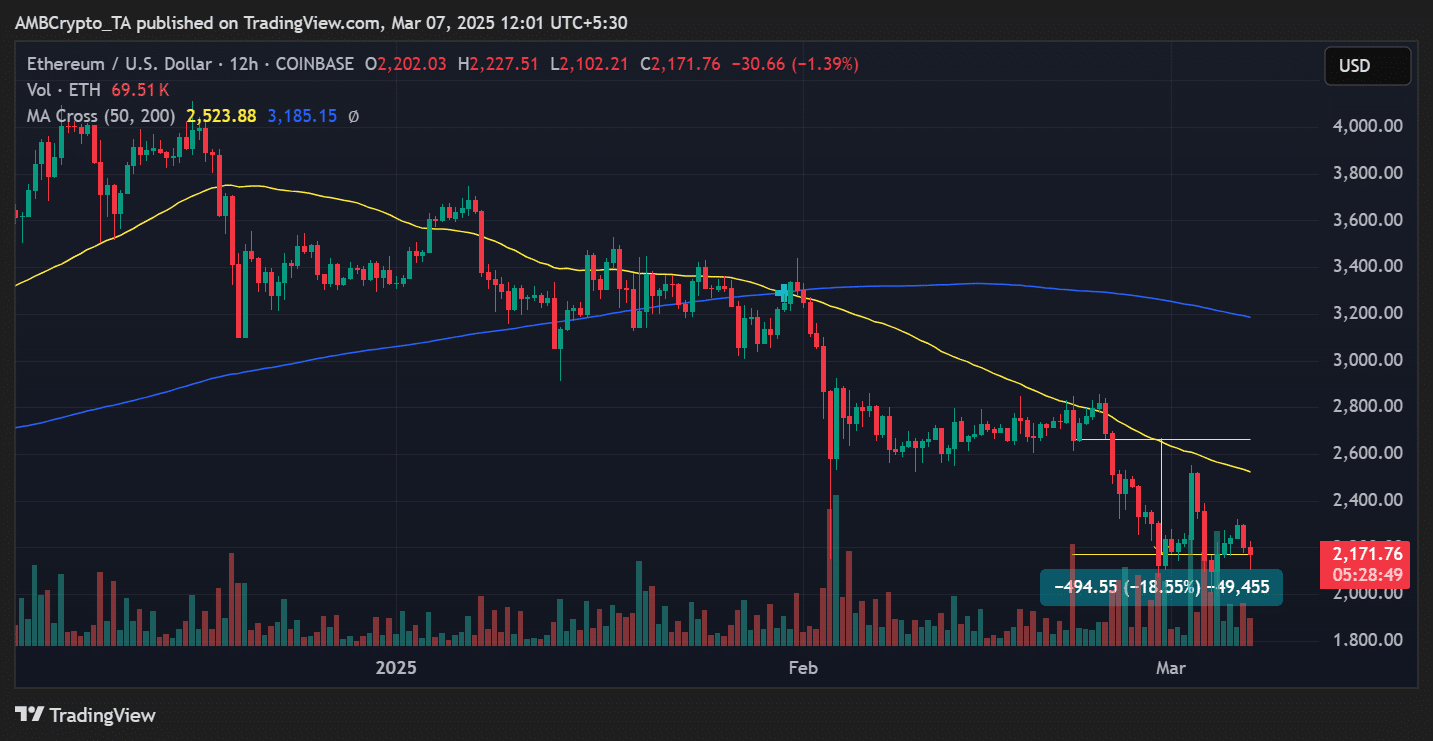

Ethereum Price analysis: a steeper fall

Ethereum also suffered considerable losses, with its price at $ 2,171, at the time of writing. The price range tool showed a decrease of 18.55% compared to previous levels.

Source: TradingView

ETH remains below the 50-day MA of $ 2,523, which now acts as an important resistance level. A further decline could see the ETH test support of around $ 2,100.

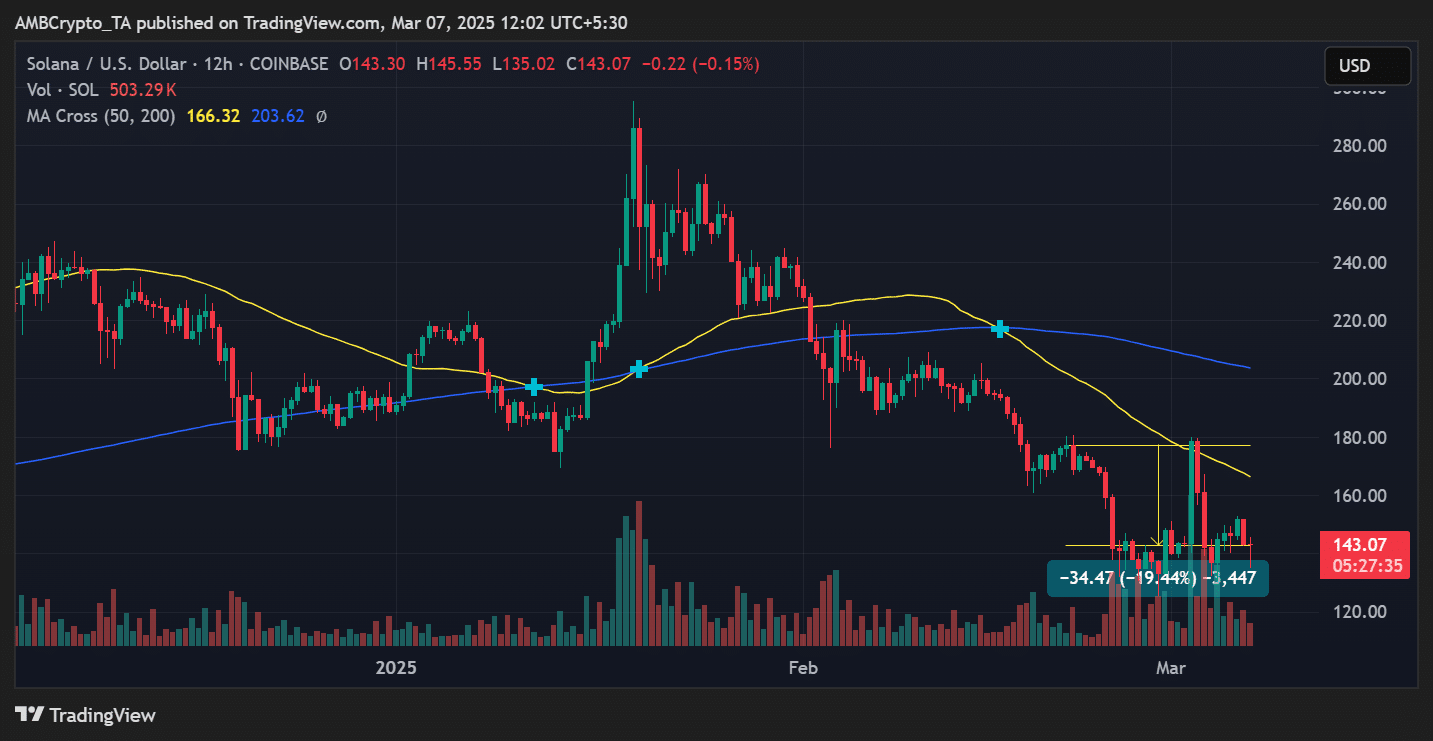

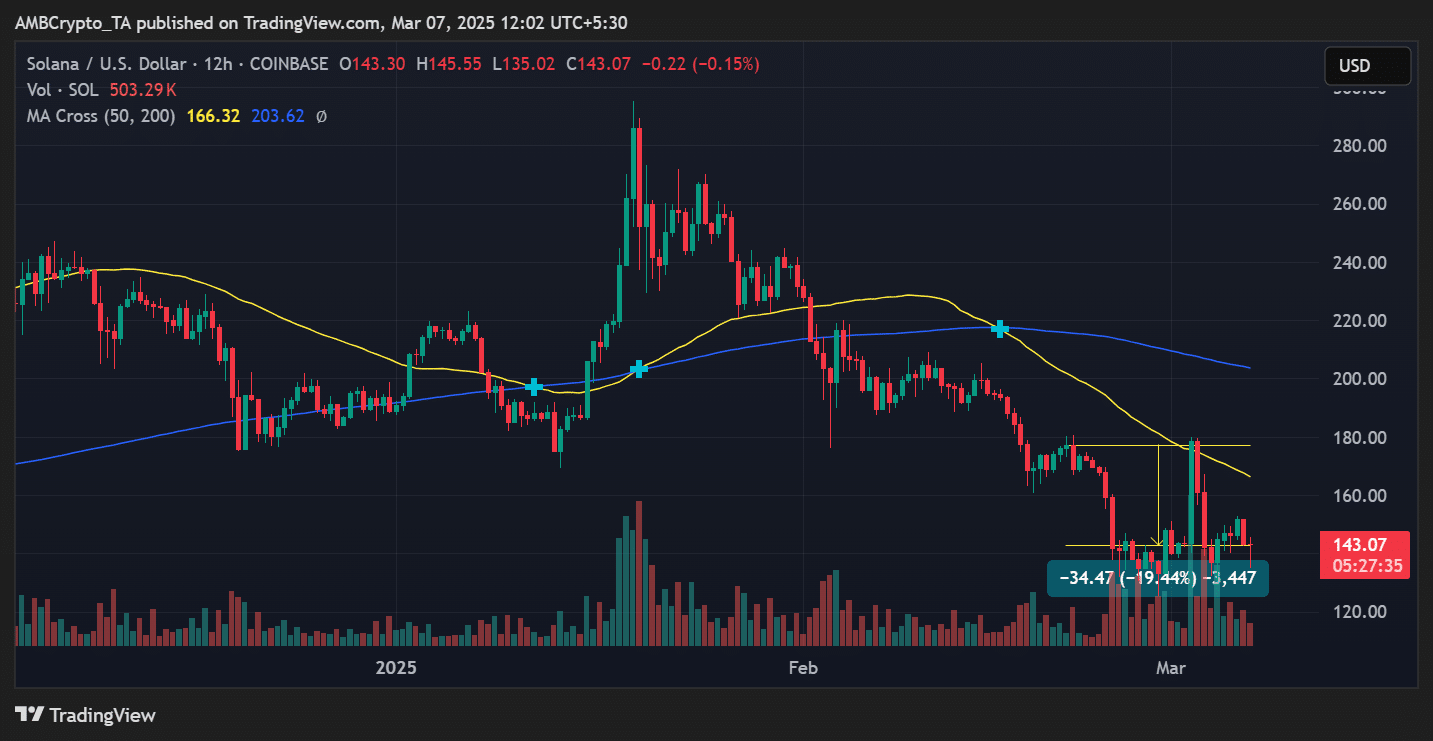

Solana Price Analysis: Can it restore?

Solana has reflected the downward trend of Bitcoin and Ethereum, but has seen more falls in the past two weeks. The tool showed a decrease of 19.44% compared to its price range two weeks ago. Sol currently acted at $ 143.

Source: TradingView

The 50-day MA for $ 166 remains a strong resistance level. If bulls do not push the sol above this number, this can look further at $ 135.

What feeds this correlation?

Various factors stimulate the synchronized movement of Bitcoin, Ethereum and Solana, including macro -economic conditions, change changes of the regulating and investor sentiment shifts.

Inflation problems and interest rate adjustments influence the risk -a little lust considerably on the financial markets, which influences this assets collectively.

Institutional trading patterns also play a role, because large investors often implement strategies with multiple assets, creating synchronized price shifts.

Moreover, liquidity trends within the cryptomarkt reinforce this correlation. High liquidity levels make fast price fluctuations possible, so that multiple assets are affected at the same time.

What is the next step for BTC, ETH and SOL?

The strong correlation between Bitcoin, Ethereum and Solana emphasizes the importance of monitoring the general market sentiment about individual activatrends.

If Bitcoin applies to the most important support levels, ETH and Sol will probably follow. However, not regaining critical advancing averages can lead to increased downward pressure.

Traders must keep an eye on a resistance outbreak, because they can indicate whether the market is reached for recovery or another round of sale.

Given the high correlation, the movement of one actively could indicate the possible direction of the entire market.