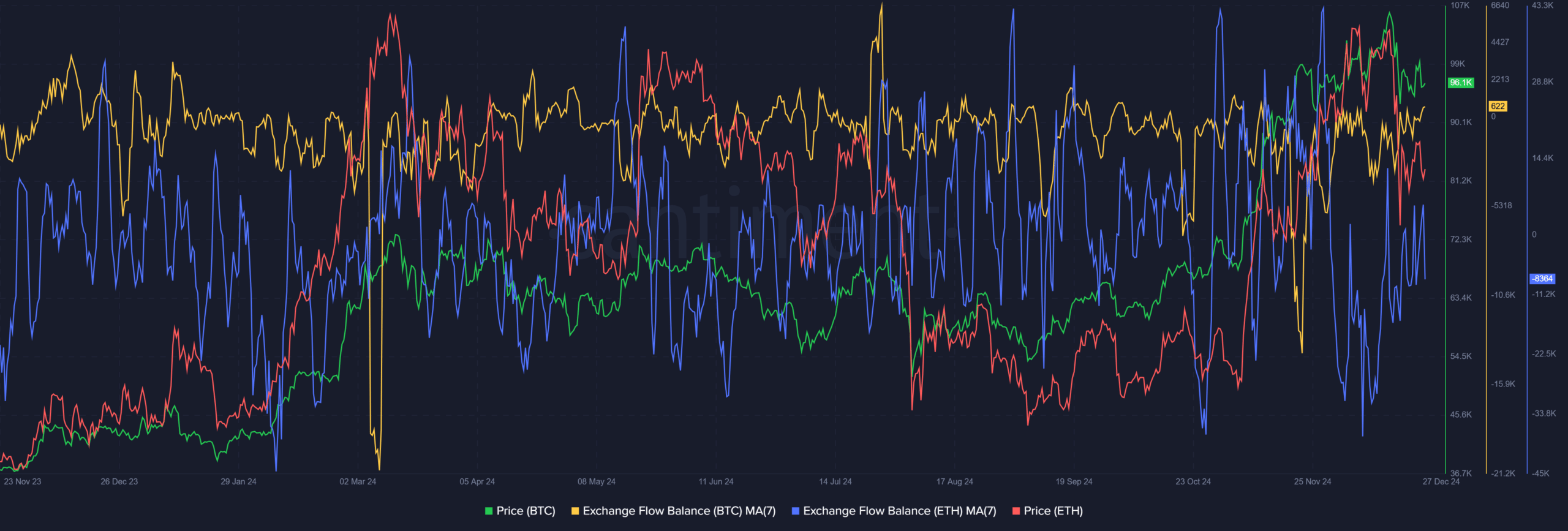

- Bitcoin and Ethereum net flows showed similar patterns around Christmas

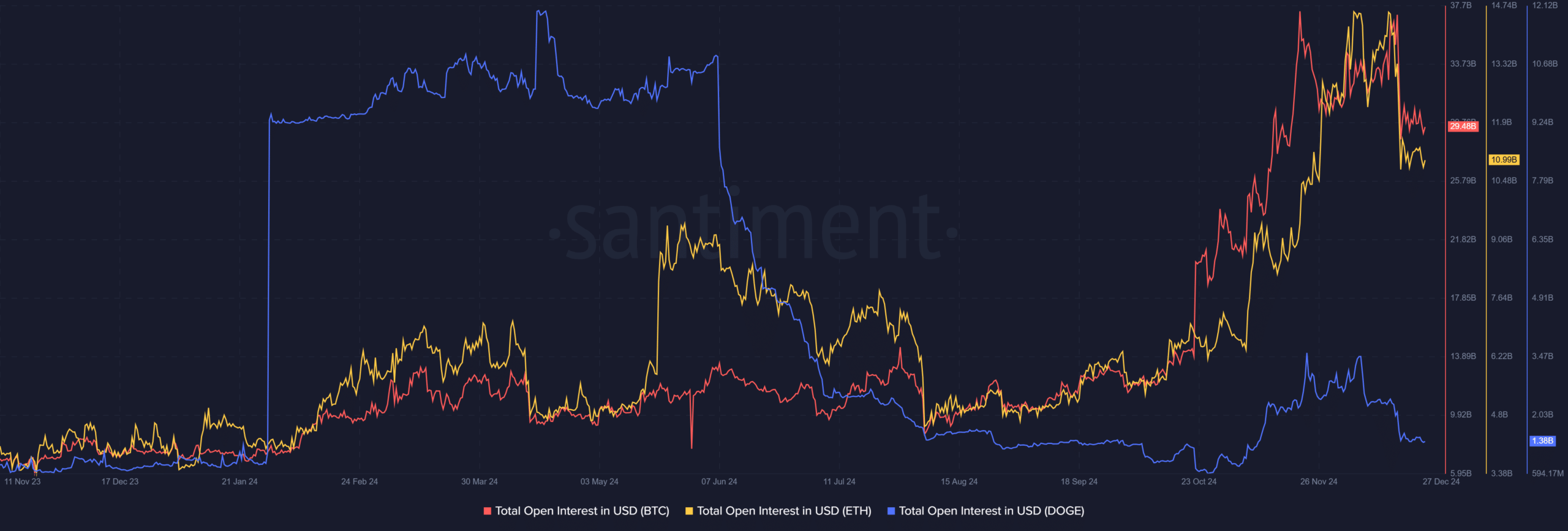

- Open interest trends showed a wary sentiment among traders

Bitcoin [BTC] tends to see a Santa Claus rally in the week leading up to Christmas, before relinquishing its winnings the following week. This has been the trend for the past few years, starting in 2021. The year before did not conform to this pattern.

This means that in addition to Bitcoin, other major altcoins such as Ethereum are also available [ETH] and Dogecoin [DOGE] tend to see their prices drop the week after Christmas. Will this trend continue in 2024?

The exchange rate flows of major assets and the price correlation

AMBCrypto examined the flow of BTC and ETH to and from exchanges around Christmas. To smooth out the measurements, a 7-day moving average was used. In 2023, the 7-day MA on December 22 saw BTC reach an inflow of 1,481 BTC, and the 7-day ETH inflow 32,805. A few days later they went in the opposite direction.

The moving averages for net exchange flows for BTC and ETH reached -5,915 and -9,626 for BTC and ETH on December 26 and 27, respectively – a sign of accumulation.

Meanwhile, token price trends were sideways for BTC and up 10% for ETH, leading into the final week of the year. Together, the statistics showed that participants preferred to send tokens to exchanges to make some profits, and collected even more tokens the following week.

2024 brought a Sinterklaas rally in crypto, sending BTC to $99.6k, ETH to $3,560 and DOGE to $0.342 – a gain of 6%-9% in three days leading up to Christmas.

At the time of writing, net foreign exchange flows were trending upward, showing that selling pressure was likely imminent. Meanwhile, BTC and ETH prices have already fallen by 5% and 6% respectively. Dogecoin lost almost 9%.

Open Interest showed a moderate sentiment in the run-up to the festive week

The open interest of Dogecoin, Ethereum and Bitcoin can also be compared. In 2023, the OI fell sharply from December 22 to 25, before quickly recovering in the first two weeks of January.

Read Bitcoin’s [BTC] Price forecast 2025-26

In 2024, there was a sharp decline in OI on December 17. This can be attributed to the market-wide decline following bearish news from the Federal Reserve, which sent the Dow Jones down 1,250 points last Wednesday.

The OI continued to swing sideways, a strong indication that market participants remained sidelined. Traders can look for long entries. And an OI and volume increase in the coming days could see the gains seen in early 2024 repeat in January 2025.