- 60% of US hedge funds bought Bitcoin when BTC/USDT broke out.

- Bitcoin ETF holdings soared as the Fear and Greed index reached sub-$30,000 levels.

Bitcoin [BTC] has received significant attention from governments, major financial institutions and major traders known as whales.

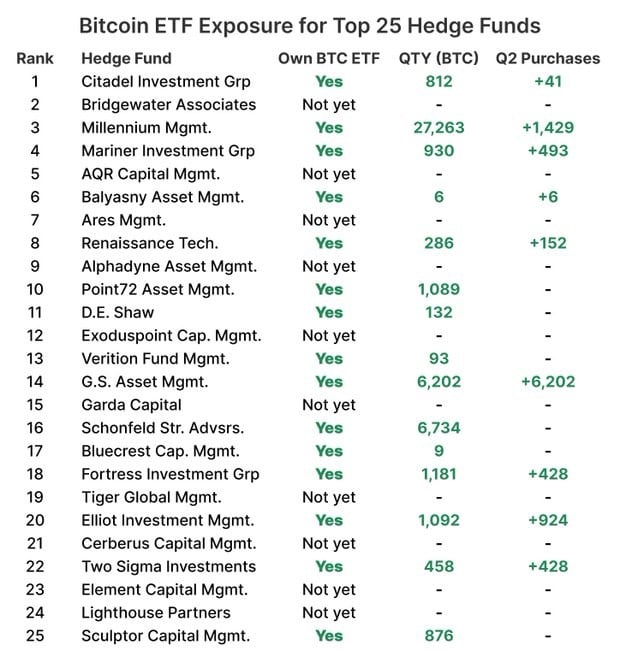

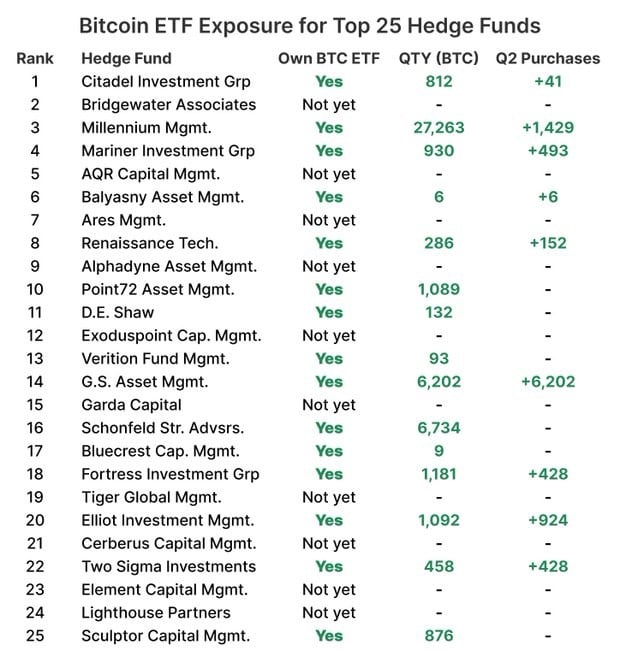

This growing adoption is further supported by China’s possible move to lift its ban on cryptocurrency. Globally, 60% of the largest US hedge funds, as Quinten says, have acquired exposure to Bitcoin noted on X (formerly Twitter).

These companies included leading companies such as Citadel Investment Group, Millennium Management, Mariner Investment Group and Renaissance Technologies, all of which purchased Bitcoin ETFs in the second quarter of 2024.

This trend highlighted the increasing institutional support for Bitcoin and the general crypto markets.

Source: Quinten/X

Bitcoin Price Action Analysis

Bitcoin (BTC/USDT) recently broke out of a symmetrical wedge on the 4-hour chart and is now trading at $60,000.

The price increase following the August 5 downturn is largely due to institutional involvement, which helped support this level.

Source: TradingView

While a pullback is expected in the near term, the $60,000 mark is a significant psychological level. Despite potential fluctuations, Bitcoin will likely continue to reach its all-time highs.

Bitcoin ETFs Rise as Mining Troubles Ease

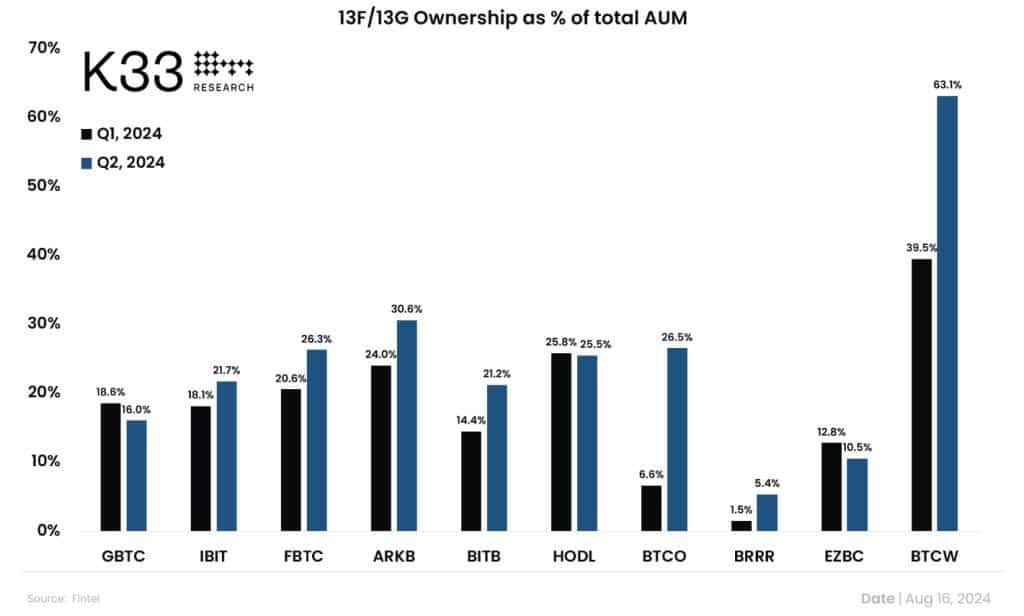

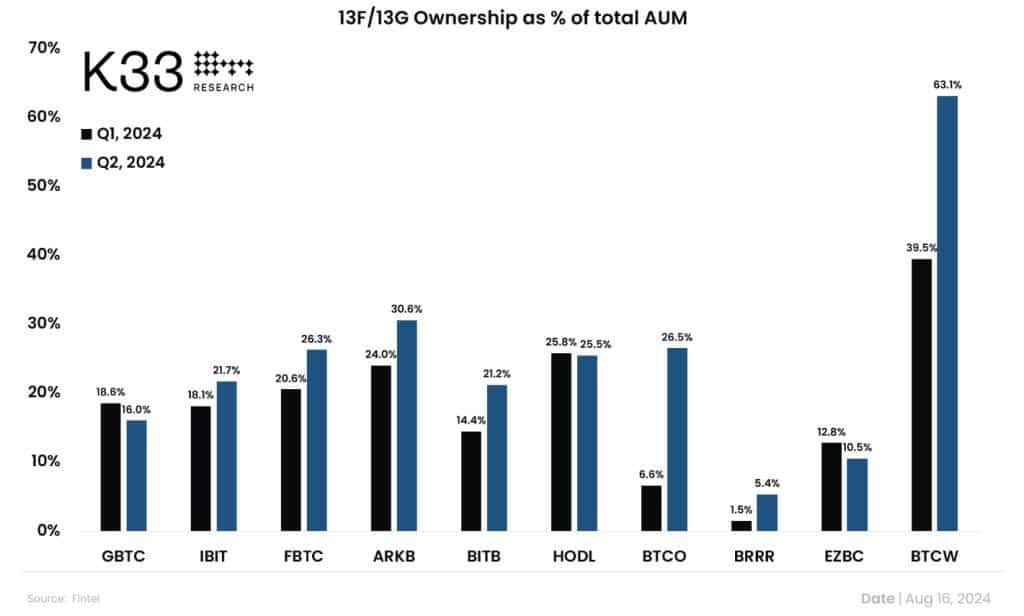

In the second quarter of 2024, institutional holdings of Bitcoin ETFs increased by 27%. K33 Research reported that 262 new companies entered the US spot Bitcoin ETF market, bringing the total to 1,199 as of June 30.

This increase reflected growing institutional confidence in digital currencies. As a result, Bitcoin is expected to hit a new all-time high in late 2024 or early 2025.

Source: K33 Research

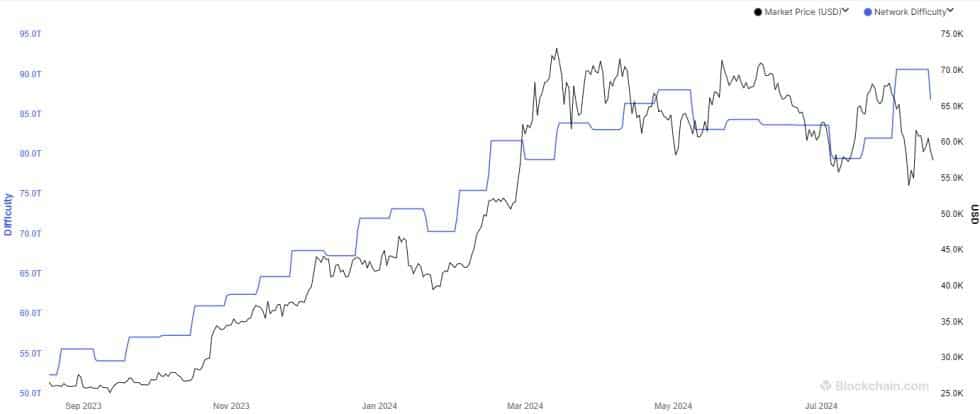

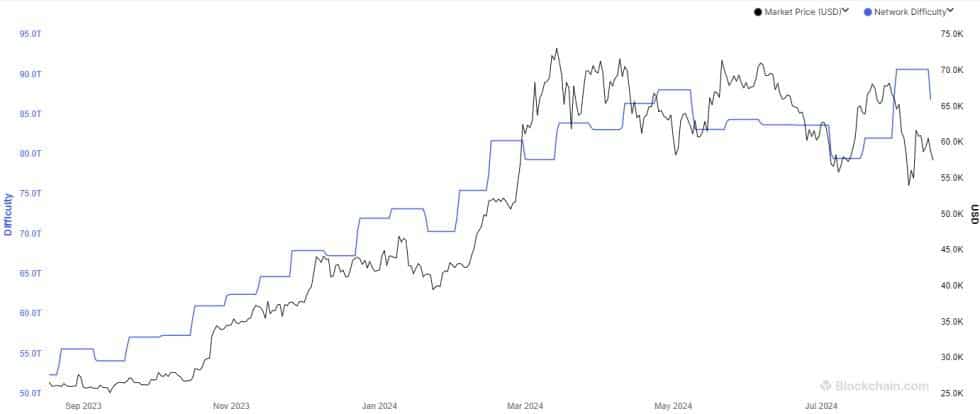

Recently, Bitcoin mining difficulty decreased during the last biweekly adjustment. This change affects how quickly new blocks are created and regulates the supply of Bitcoin.

The reduction in difficulty indicates a drop in overall computing power, allowing miners to keep the speed at which blocks can be created stable even with less processing power.

Source: Blockchain.com

Market sentiment at the same level when BTC was below $30,000

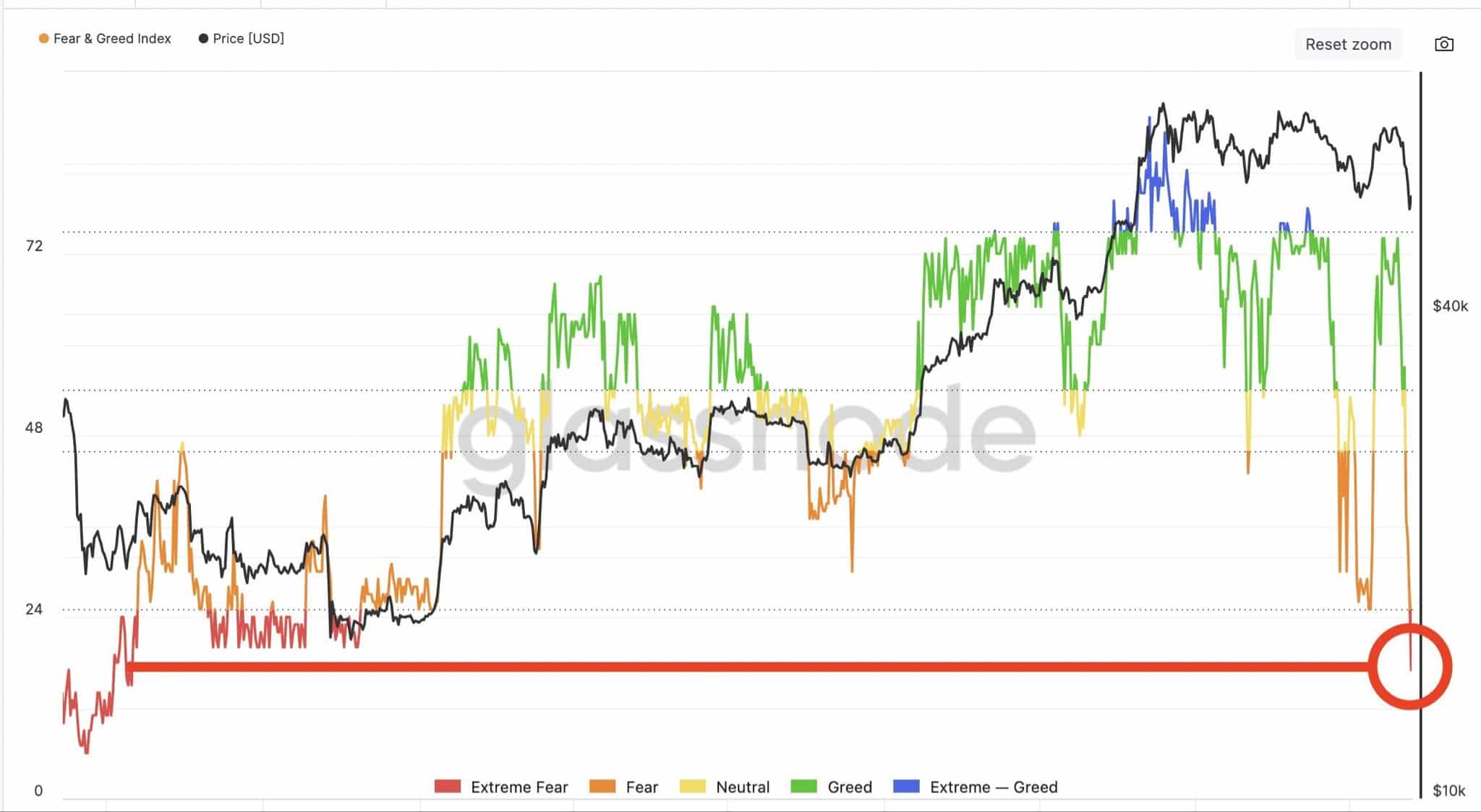

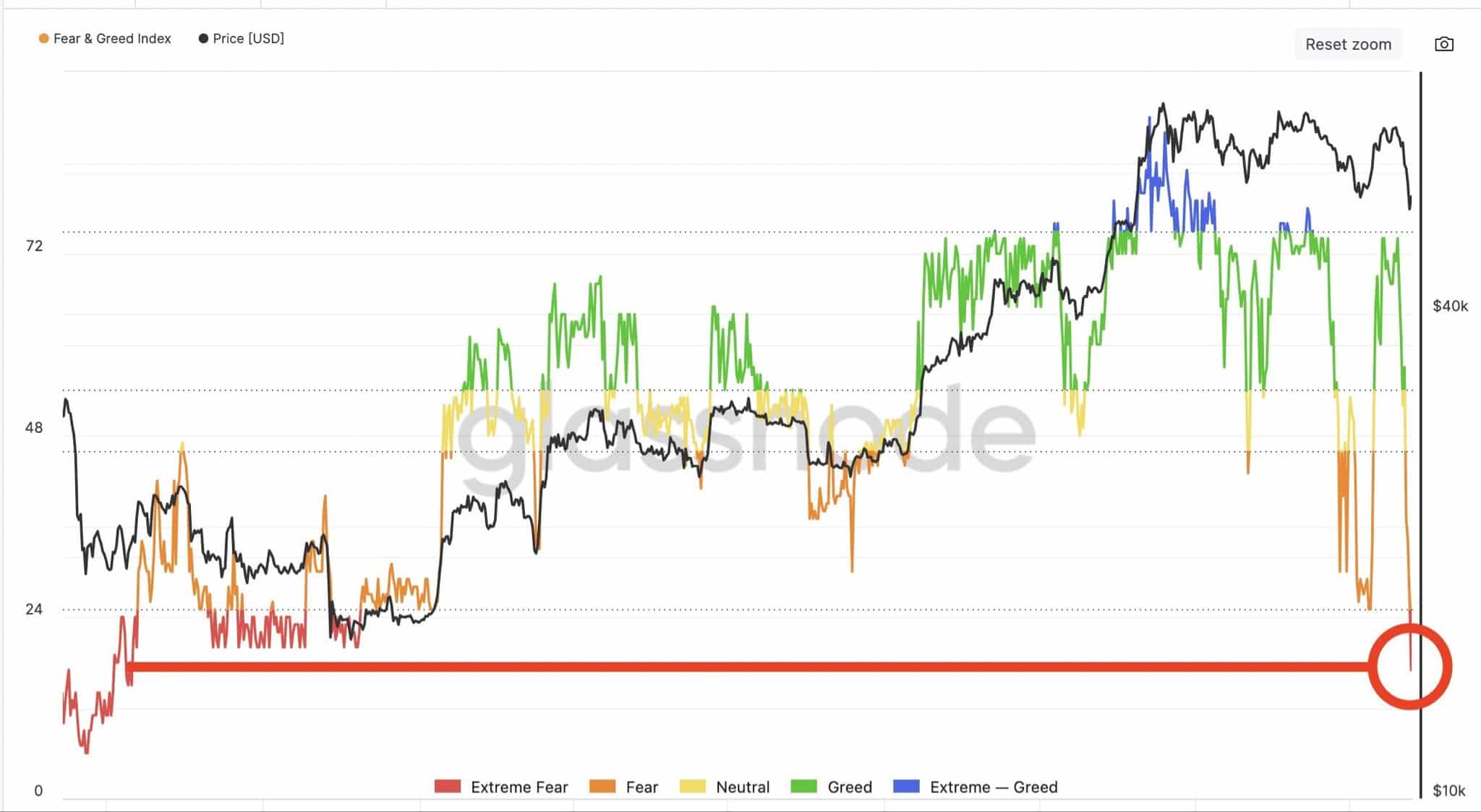

According to the Fear and Greed Index, market sentiment was fearful at the time of writing.

Read Bitcoin’s [BTC] Price forecast 2024-25

The Fear & Greed index is at the same level as when Bitcoin was below $30,000, which led to a price increase above $45,000.

In case other metrics remain progressive, BTC’s current price is a great zone to load your positions.

Source: Glassnode