- BTC spot ETF saw outflows of over $200 million.

- The alternating current was dominated by positive current.

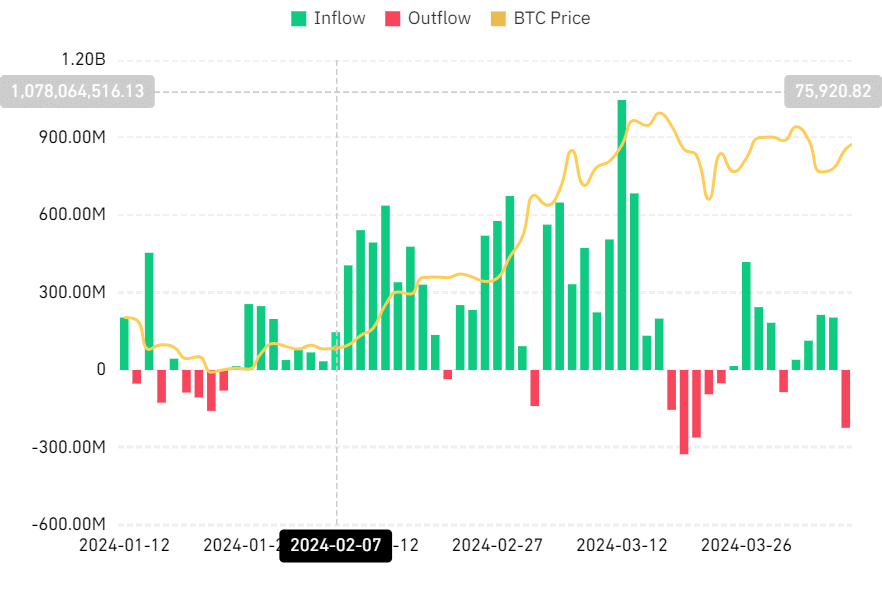

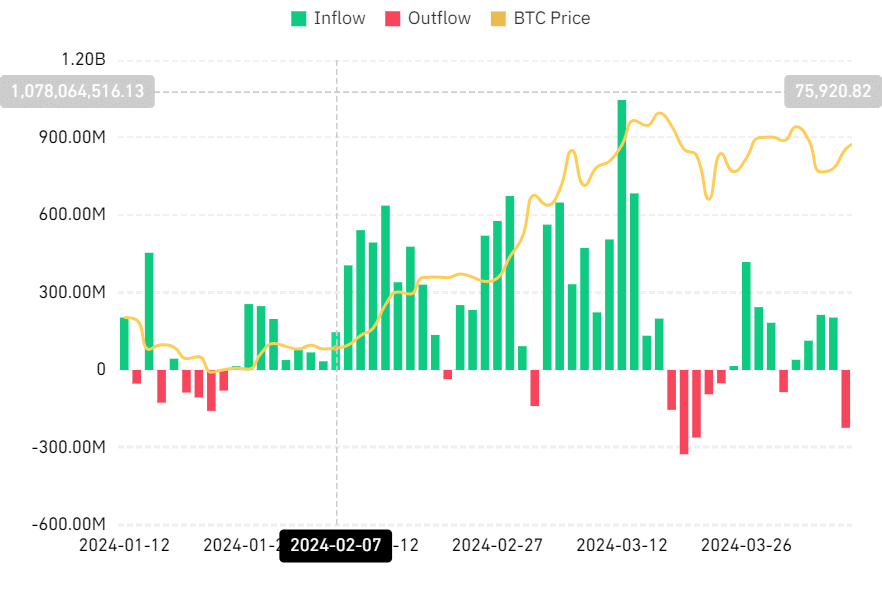

After the approvals of spot Bitcoin [BTC] ETFs in the US, Bitcoin has experienced continued high volume flows. As the price of BTC seemed about to hit its all-time high, the flow of ETFs spiked this month.

Outflows dominate Bitcoin spot ETF volume

Analysis of the Bitcoin spot ETF Netflow Mint glass revealed that on April 8 it observed the highest flow since March 27. However, this flow marked a deviation from the trend observed in recent days.

Source: Coinglass

According to the chart, there was a significant outflow on April 8, the first of its kind since March 20. The data showed an outflow of over $223 million worth of BTC on April 8.

Interestingly, the last time such an outflow occurred, Bitcoin experienced a price drop. Unlike previous cases, this outflow occurred as Bitcoin rose and crossed $71,000.

Bitcoin is seeing greater currency inflows

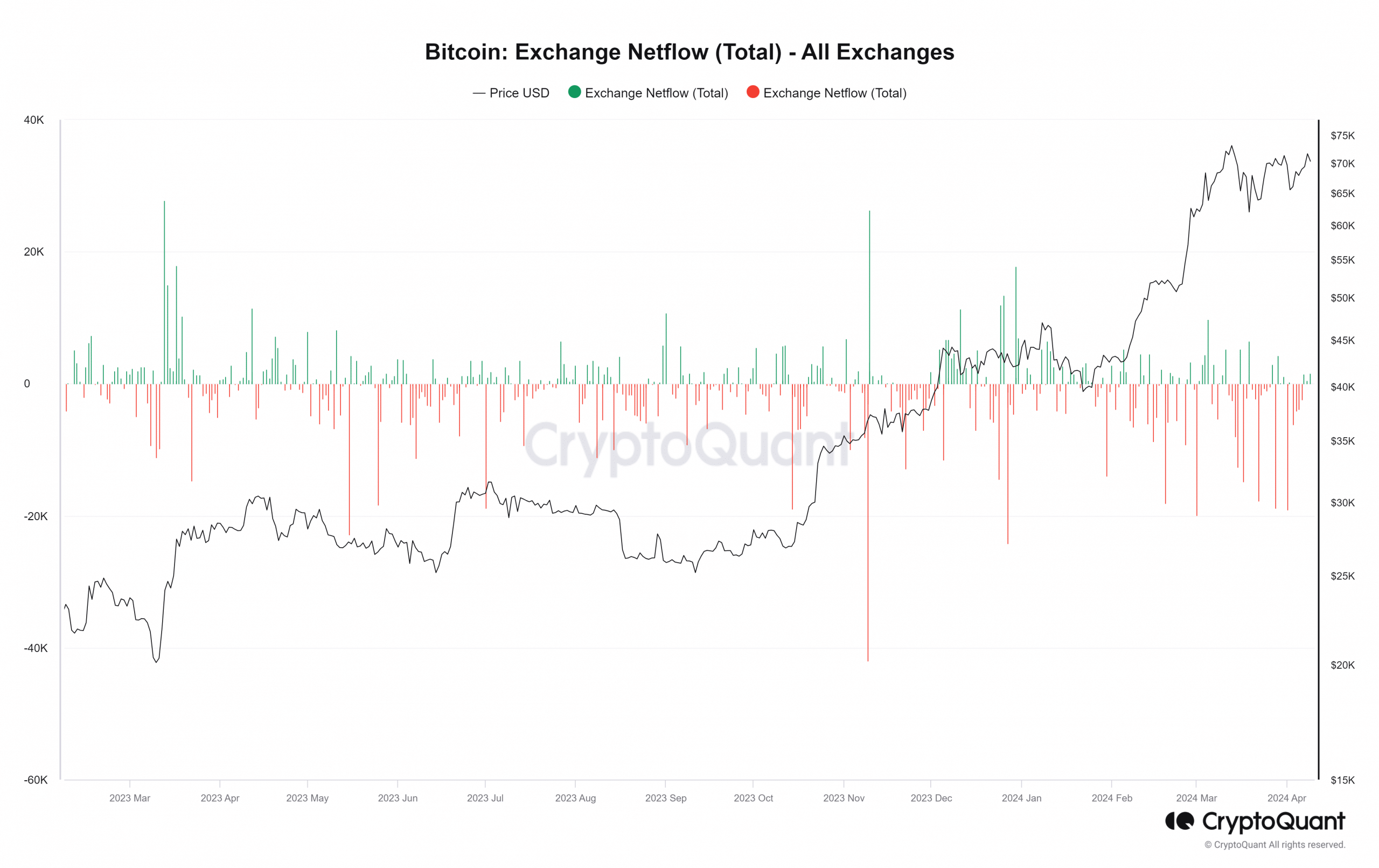

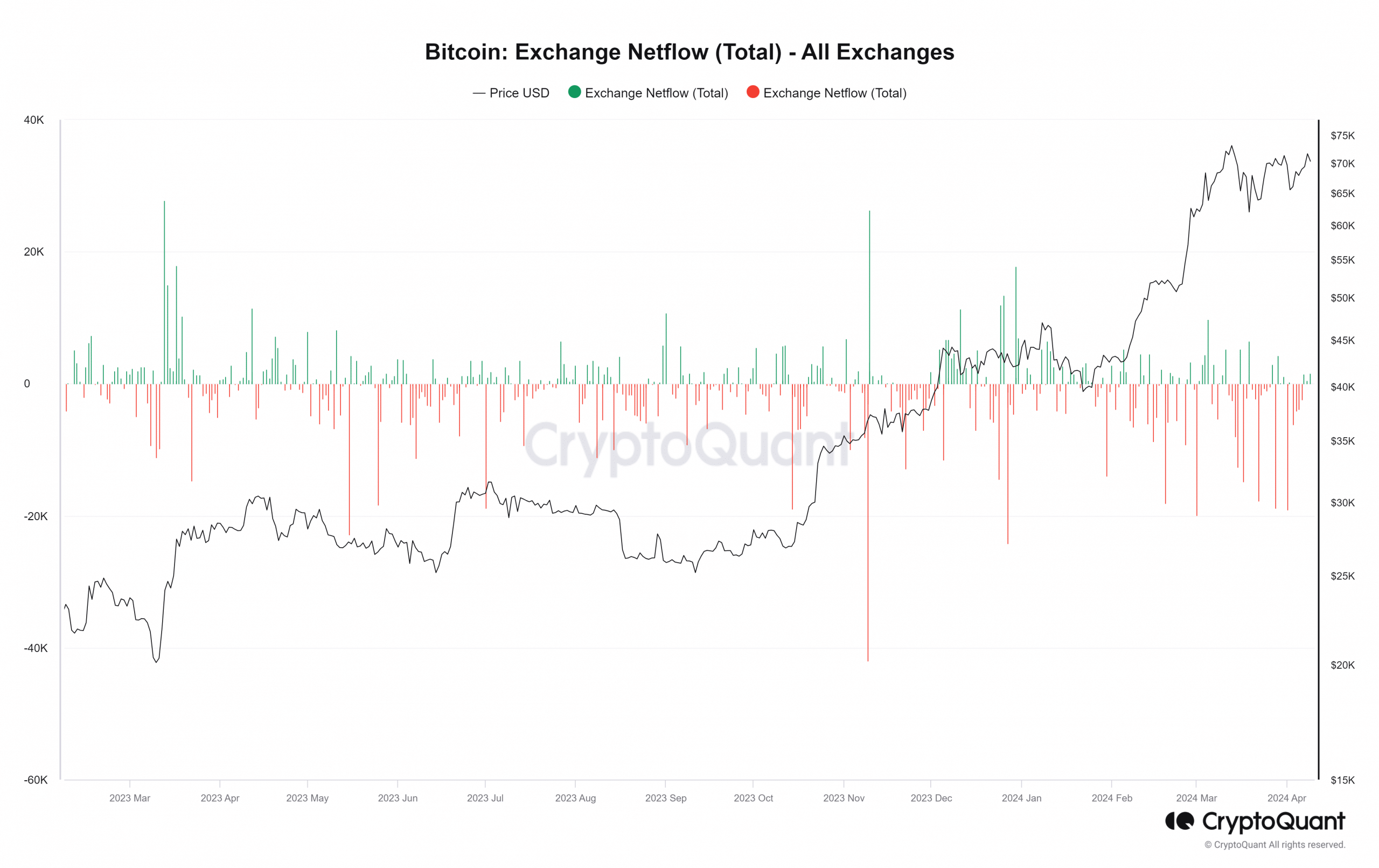

While the Bitcoin spot ETF saw significant outflows amid the price surge, the overall BTC net flow showed the opposite trend on April 8. Net flow analysis indicated a dominance of inflows, suggesting more traders were pouring their holdings into exchanges.

Source: CryptoQuant

However, it is noteworthy that despite the dominant inflow, the volume was not particularly large. The total recorded inflow was approximately 555 BTC. Currently, the inflow has increased to over 1,300 BTC.

Although the Bitcoin spot ETF and Exchange Netflow metrics seemingly moved in opposite directions, their underlying responses are similar.

A surge in spot ETF outflows indicates that shareholders are selling, possibly motivated by several factors, including profit-taking. Similarly, the prevalence of inflows in the net exchange of currencies suggests that holders are also selling to secure profits.

In both scenarios, the driving force is the increase in the BTC price, a common factor influencing these actions.

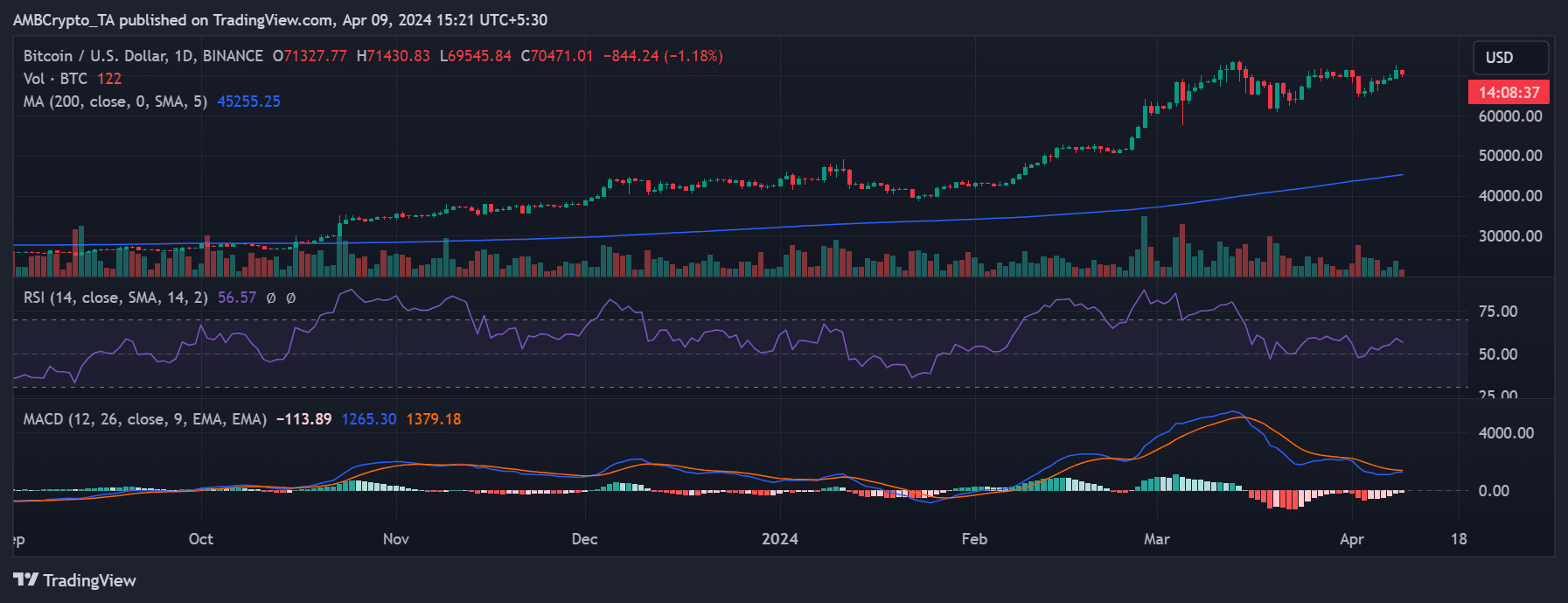

The BTC price increase is taking a breather

On April 8, Bitcoin’s price rose by about 1.73%, reaching about $71,313. While this was not Bitcoin’s high, analysis indicated that this was the third highest price in its history.

Read Bitcoin (BTC) price prediction 2024-25

However, at the time of writing this, the price had dropped. BTC was trading around $70,400, reflecting a decline of more than 1%.

Although this decline represented a setback from the previous day’s rally, BTC remained within a bullish trend regardless.

Source: TradingView