- Bitcoin ETF inflows have surged over the past week as prices soared.

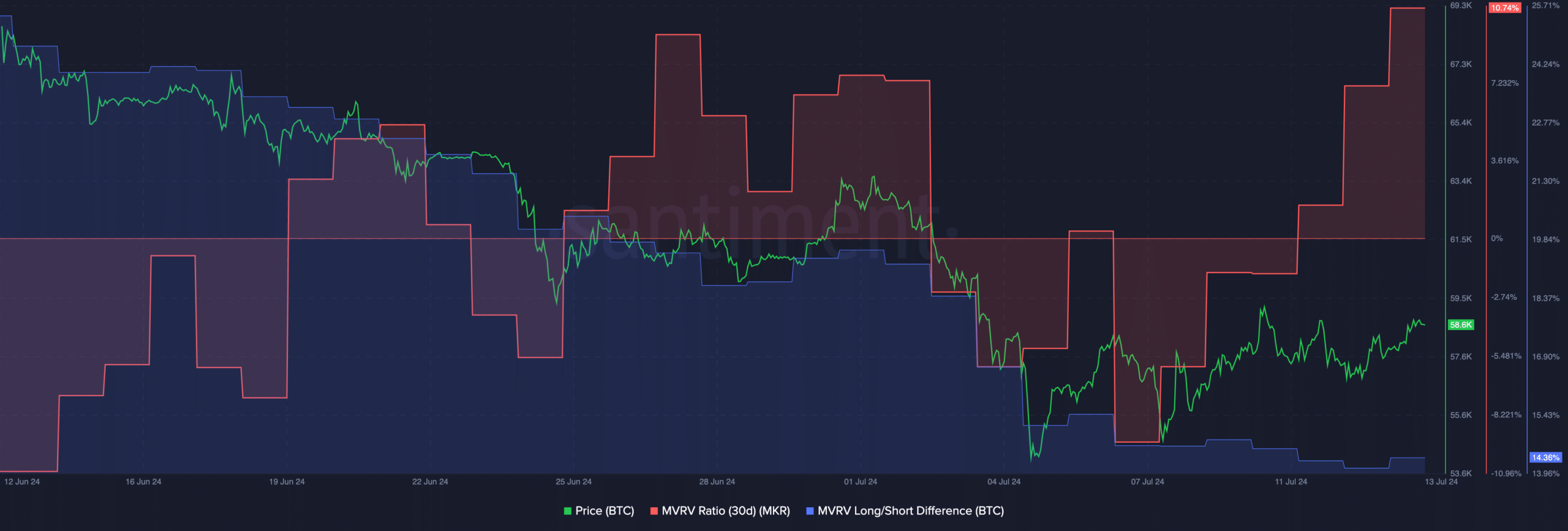

- The MVRV also spiked, indicating that holders’ profitability had soared.

Bitcoin [BTC] has managed to make a comeback in recent days and has seen a huge price increase, with Exchange-Traded Funds (ETF) playing a major role.

ETFs to the rescue!

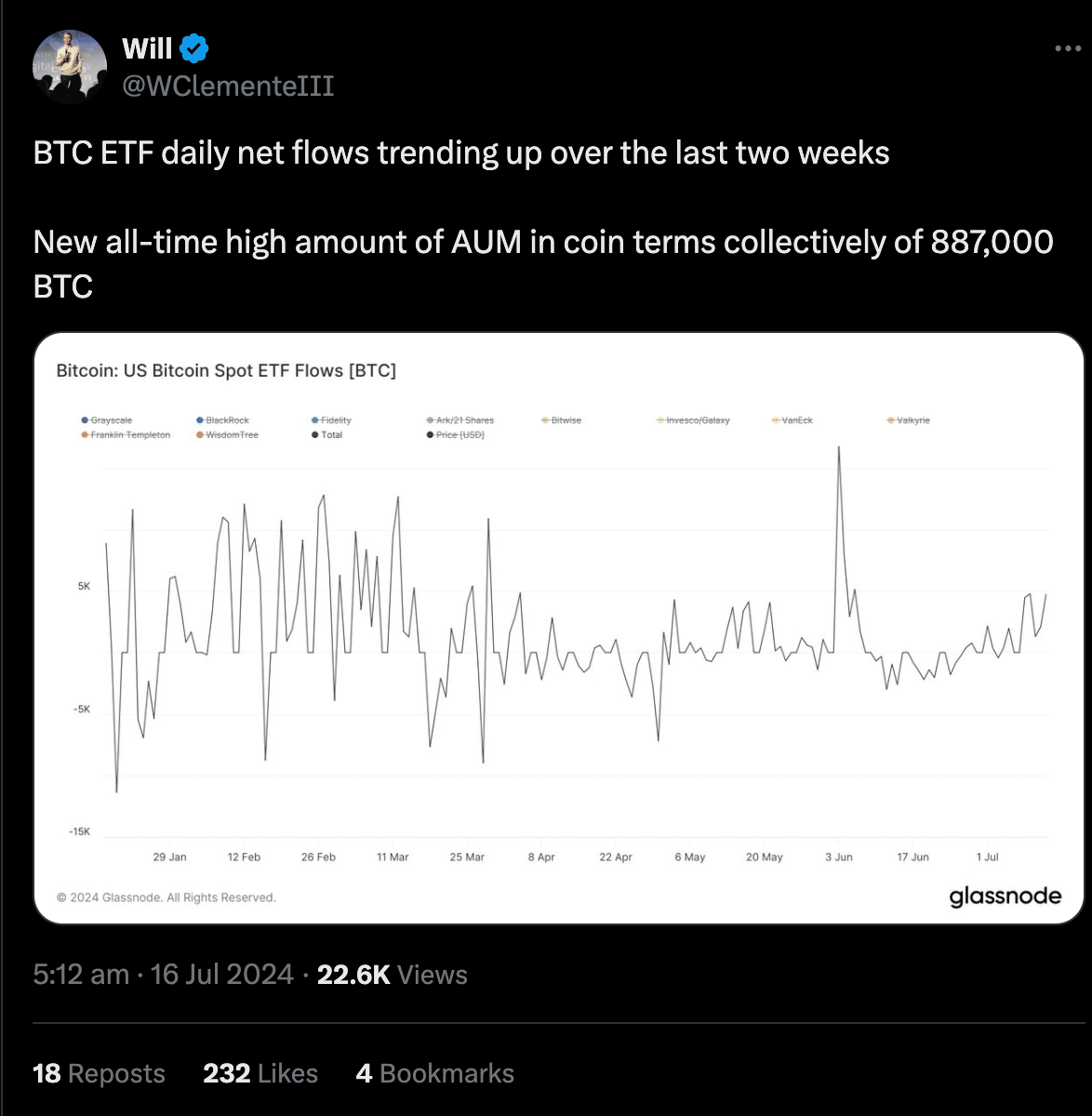

Bitcoin ETFs have seen a remarkable influx of capital since their launch in January 2024, totaling a whopping $16.35 billion. This surge in investor interest has culminated in a record week, with inflows reaching $1.05 billion on July 15.

The substantial growth of Bitcoin ETF assets under management is seen by market analysts as a bullish indicator, fueling speculation that the cryptocurrency may have bottomed out.

Collectively, these ETFs now hold an unprecedented 888,607 Bitcoin, accounting for approximately 4.5% of the total circulating supply.

This investment frenzy is being driven by both institutional and retail investors, with some funds experiencing inflows of up to $310 million in a single week.

Source:

German BTC shares

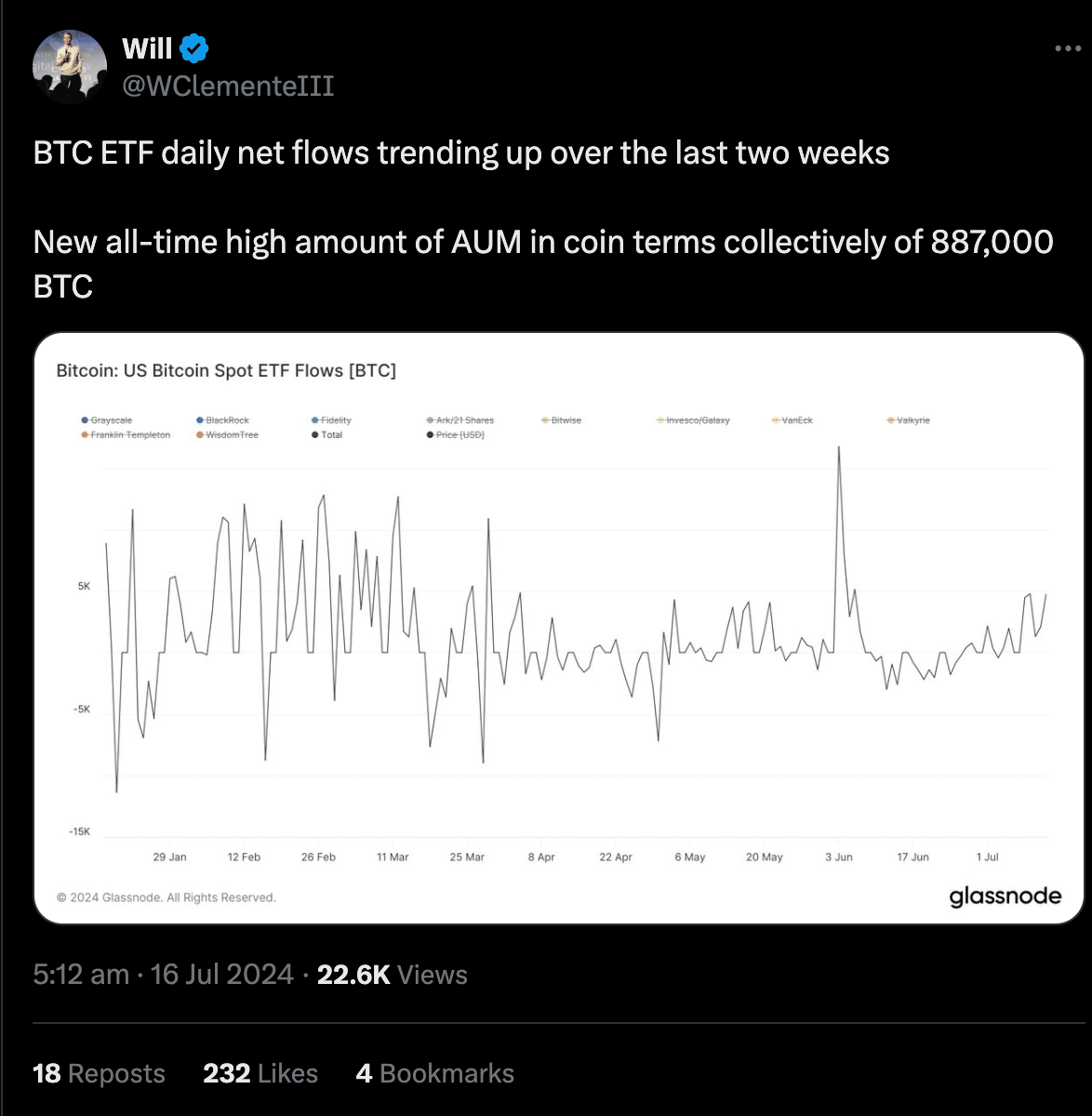

One of the reasons for the recent price drop before the rebound was the actions of the German government.

The recent $3 billion Bitcoin sell-off in Germany, conducted through several crypto exchanges and trading firms, sent shockwaves through the cryptocurrency market. However, the mass discharge was completed at the end of last week.

Surprisingly, the government has since received a modest influx of Bitcoin, totaling around $420, from multiple wallets.

These incoming funds were spread across more than four dozen transactions, the largest of which amounted to $118 and took place on July 13, as shown in blockchain data analyzed by Arkham.

The German government has quietly built up a small Bitcoin portfolio through a series of these transactions. This BTC was sent by users who wanted to express their dissatisfaction with the German government.

Some of these transactions contain unusual references, such as the names Adolf Hitler and Elon Musk, as well as other swear words.

Source: Arkham Intelligence

Read Bitcoin (BTC) price prediction 2024-25

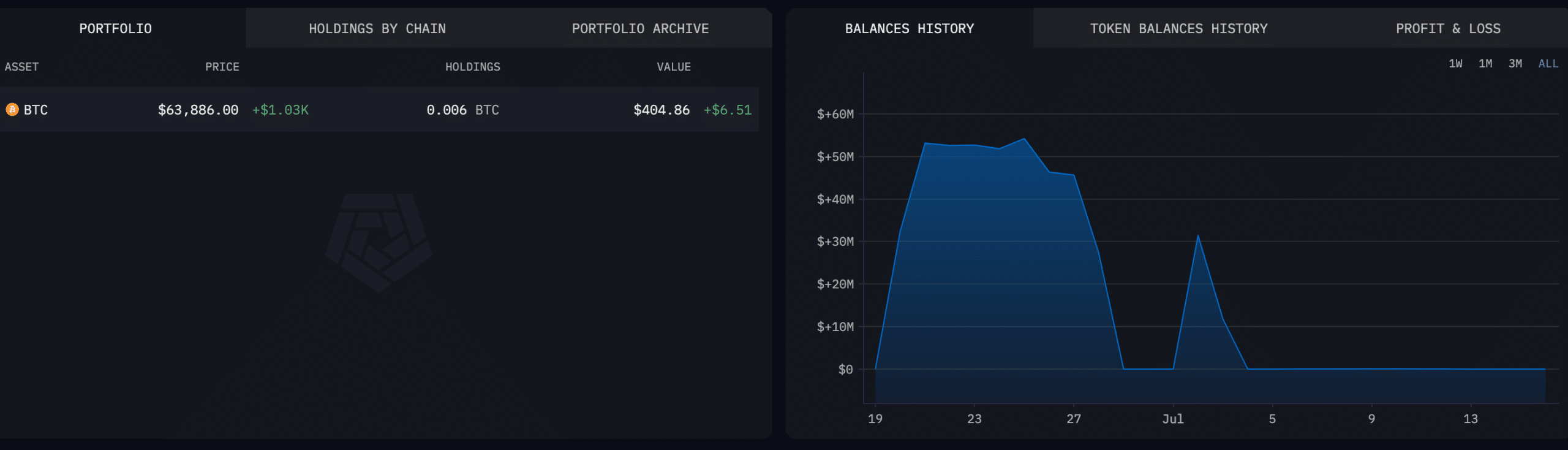

At the time of writing, BTC was trading at $63,882.81 and the price was up 1.53% over the past 24 hours. The MVRV ratio for BTC had skyrocketed due to the increase in the price of BTC. This meant that most addresses were profitable.

While profitability can positively impact sentiment, there is an incentive for holders to sell their BTC holdings, which could increase selling pressure on BTC.

Source: Santimet