- The SEC recently approved some BTC ETF options.

- Spot Bitcoin ETF saw increased net flows this past week.

Last week, the Securities and Exchange Commission (SEC) approved the listing and trading of several Bitcoin [BTC] ETF options.

This marked a significant step forward in bridging traditional financial markets with the rapidly growing digital asset space.

Major institutional players like Fidelity and Grayscale took the lead in establishing ETF options as a crucial part of a diversified investment portfolio.

The approval signals regulatory clarity

On October 18, the SEC approved the listing and trading of options for 11 spot Bitcoin ETFs, reinforcing the growing acceptance of Bitcoin ETF options by financial regulators.

This regulatory approval is key to promoting broader adoption.

As more ETFs gain approval for options trading, Wall Street’s interest in these financial products continues to grow.

Institutional traders now have a clearer regulatory framework for dealing with Bitcoin ETF options, increasing their confidence in the market.

The approval signals a broader shift toward recognizing Bitcoin ETF options as legitimate financial instruments, with Wall Street increasingly viewing them as valuable tools for portfolio diversification.

This regulatory clarity and growing confidence could mark an important step toward the adoption of digital assets into mainstream finance.

Bitcoin ETFs are experiencing a net flow increase

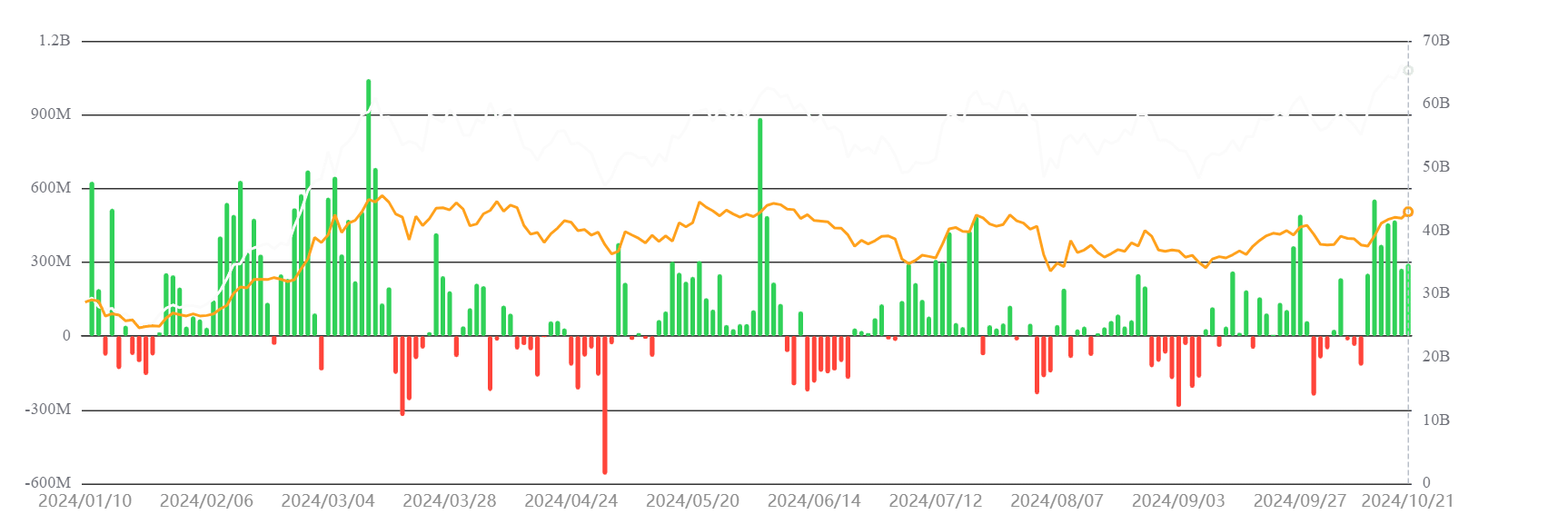

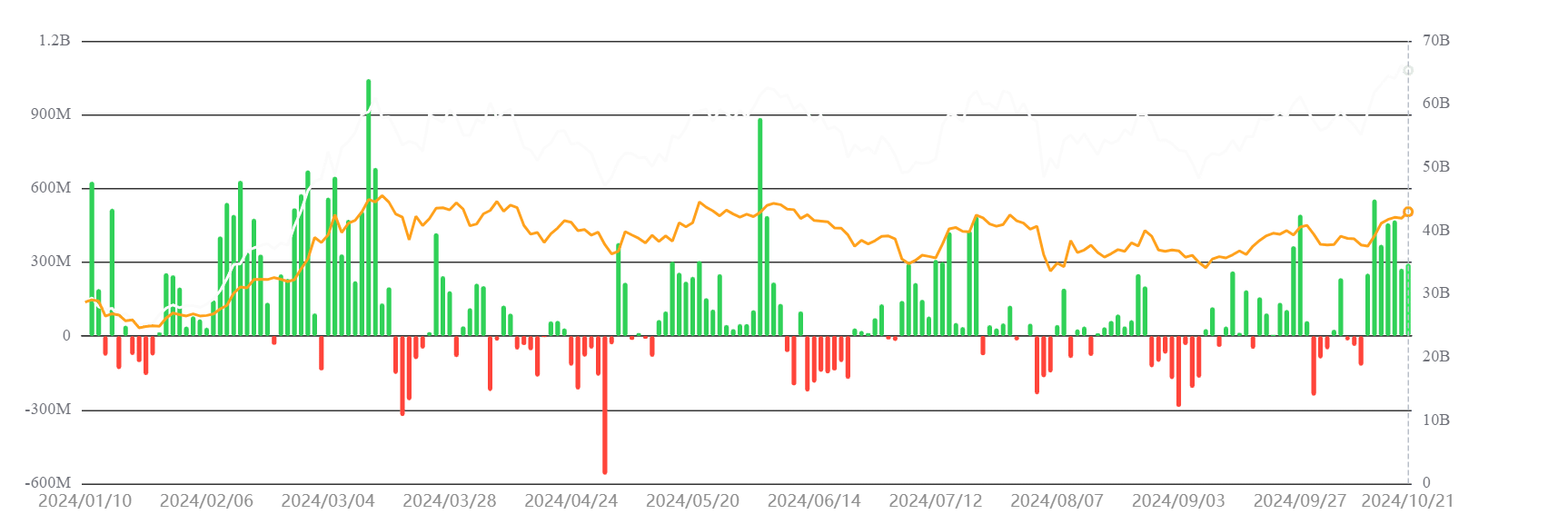

Recent data from SosoValue showed that Bitcoin ETFs have experienced positive inflows over the past week. The analysis showed inflows of approximately $2.7 billion, bringing total net assets to more than $65 billion.

These inflows underlined the increased interest from institutional investors, with capital flowing in and out of the market.

Source: SosoValue

With the introduction of Bitcoin ETF Options, liquidity is expected to increase. This will provide investors with new ways to hedge their positions or speculate on future price movements.

This could lead to more stable price action for both Bitcoin and its associated ETFs.

How options can shape Wall Street’s portfolios

The rise of Bitcoin ETF options presents a significant opportunity for traditional financial institutions and the broader crypto market.

Read Bitcoin’s [BTC] Price forecast 2024-25

These options provide a regulated and flexible approach to Bitcoin exposure and open new avenues for investors.

As regulatory frameworks continue to evolve and more financial institutions embrace Bitcoin ETF options, these products are poised to play a central role in future investment strategies on Wall Street.