- Bitcoin ETFs showed signs of recovery, with net inflows of $73 million on June 28.

- Despite recent bearish signals for BTC, ETH, and SOL, decreasing price volatility indicated a stabilizing market.

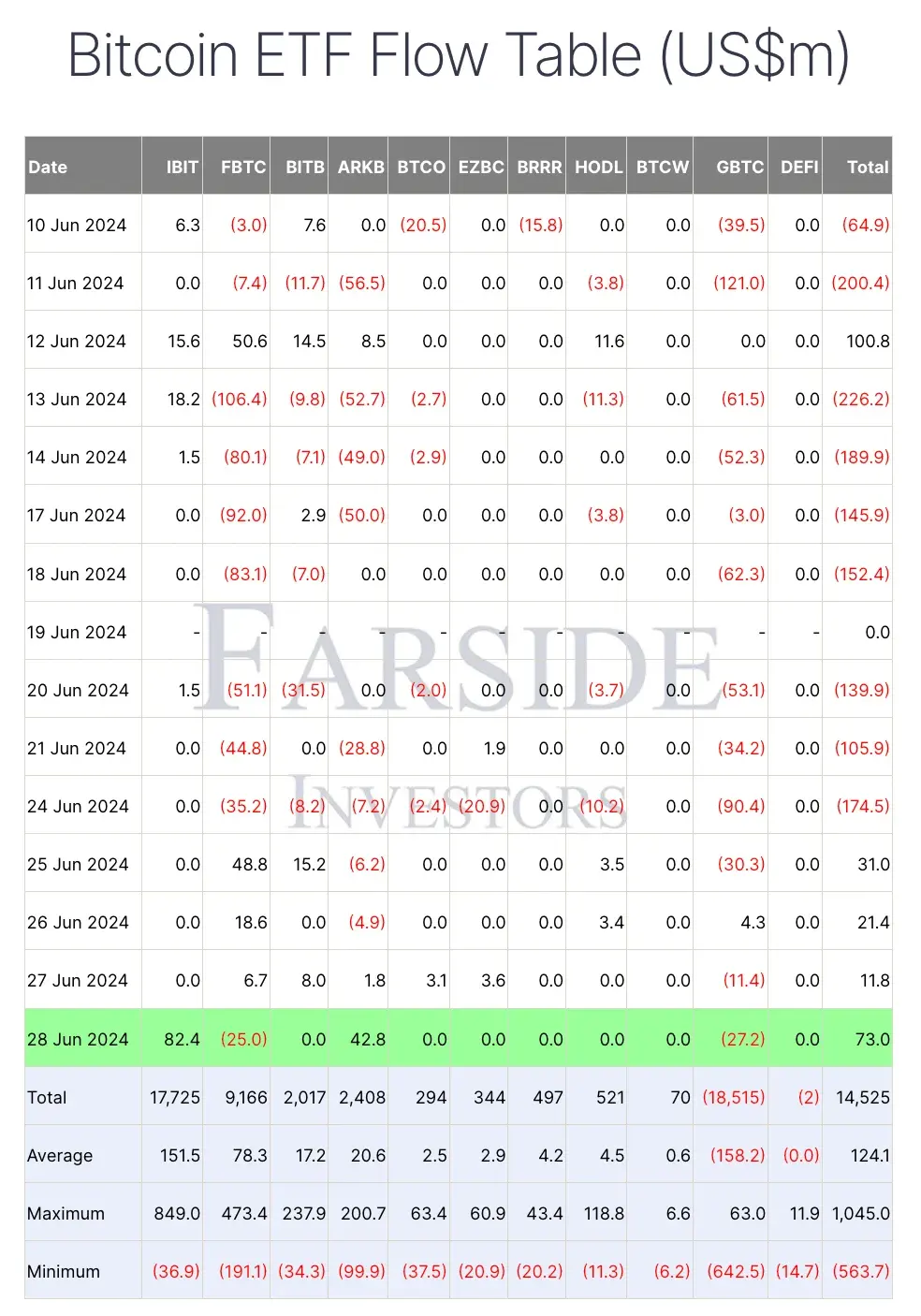

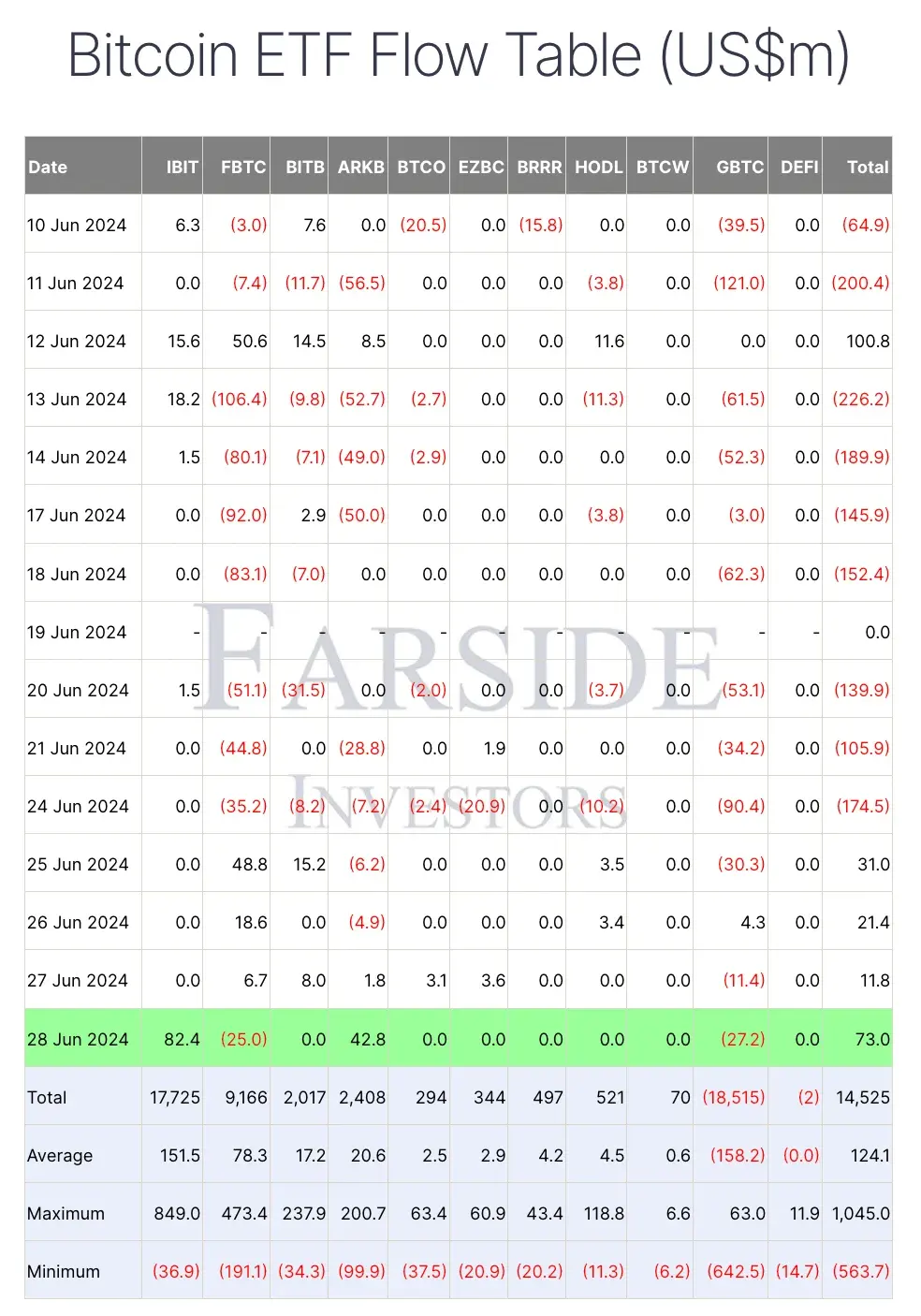

After experiencing continuous outflows, Bitcoin [BTC] ETFs seemed to recover. As of the last update on June 28, BTC ETFs recorded net inflows of $73 million.

Bitcoin ETF Cash Flow: Analysis

Leading the way was BlackRock’s iShares Bitcoin Trust (IBIT) with an inflow of $82.4 million. In contrast, Grayscale Bitcoin Trust (GBTC) saw outflows of $27.2 million, followed by Fidelity’s FBTC with outflows of $25 million.

Source: Farside Investors

This was the exact opposite of what happened on June 26, when FBTC and GBTC were the only ones to record inflows, with $18.6 million and $4.3 million respectively, along with VanEck’s HODL, which recorded $3.4 million.

All other ETFs had net-zero flows, except ARK 21Shares’ ARKB, which recorded outflows worth $4.9 million.

Peter Schiff criticizes BTC ETF

Given the uncertainty surrounding BTC ETFs, stockbroker and financial commentator Peter Schiffthe eternal Bitcoin critic, decided not to miss this opportunity.

Drawing parallels to the gold ETFs, Schiff turned to X (formerly Twitter) and noted:

“#Gold ended the second quarter with a gain of 4%. #Bitcoin has two more days of trading, but as of now it is down over 15%.”

He even went ahead and questioned the decisions of several investors, saying:

“Investors who sold gold ETFs to buy Bitcoin ETFs at the end of the first quarter are 20% worse off. The bad news for these investors is that things are likely to get much worse from here.”

However, X user Bitcoin Clown responded to his tweet by asking:

Source: Bitcoin Clown/X

Does Schiff’s analysis hold up?

This highlighted that Schiff’s analysis of Bitcoin ETFs’ underperformance lacked sufficient evidence.

This comes as the US Spot Bitcoin ETFs have experienced increasing investments over the past four days, recording positive inflows for three consecutive days.

In total, these ETFs received $137.2 million in new investments during this period, indicating growing investor interest and confidence in these financial products.

Just a note on this: an X user Lord Cryptotook against X and explained,

Source: Lord Crypto/X

However, it remains uncertain whether this strong investor sentiment around BTC ETFs will continue after Ethereum’s final approval and launch. [ETH] ETFs for trading.

Additionally, now that VanEck and 21Shares are officially applying for a spot for Solana [SOL] ETF, the uncertainties increase even further.

Impact on the price of the token

Meanwhile, Bitcoin, along with Ethereum and Solana, showed bearish signals with declines of 0.88%, 1.68% and 2.22% respectively in the past 24 hours, according to CoinMarketCap.

However, AMBCrypto’s analysis of Santiment price volatility data showed a decline, indicating that the asset’s price is becoming less volatile.

Source: Santiment

This means that the price experiences smaller fluctuations and stabilizes, indicating a more predictable and less risky market for investors.