- BTC ETFs have ramped up accumulation despite recent declines.

- Glassnode’s founders were bullish on BTC despite obstacles on the price charts.

Despite Bitcoin [BTC] With a drop of almost 20%, US spot BTC ETFs managed to bridge the dip, even as the largest digital asset fell below $55,000.

In June, BTC fell from $71.9K to $58.4K. Further negative sentiment in July saw it fall to a new low of $53.4K, before regaining $58K at the time of writing.

Bitcoin ETFs remain stable

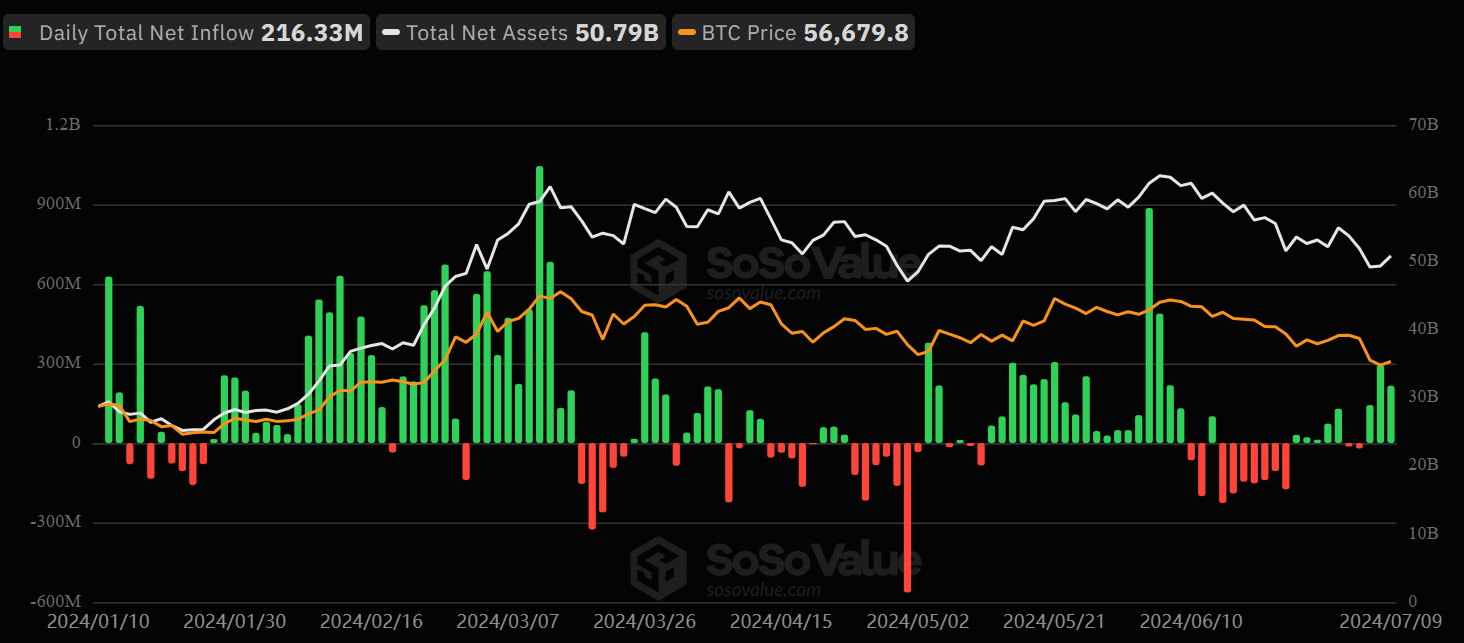

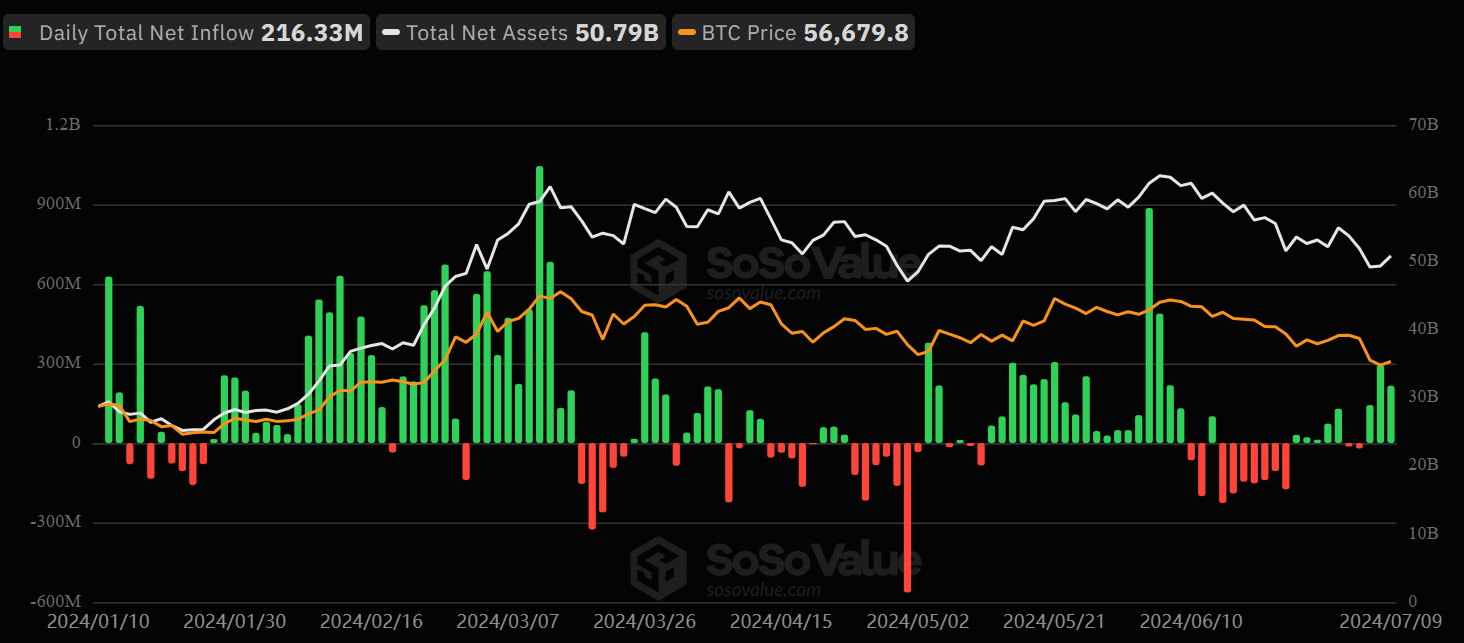

While we acknowledge the recent decline as “annoying,” Bloomberg ETF analyst Eric Balchunas noted that ETFs’ AUM (assets under management) and YTD (year-to-date) flows remained stable.

‘Bitcoin fell by 20% in a month. Pretty dirty. I would have been impressed if 90% of the aum stuck in there, but it was over 100% when they saw the inflows… keeping the all important YTD net number at +$15 billion.”

Balchunas added that BTC ETFs, which he equated with boomers’ holdings, “stayed hard” during the price declines.

Farside Investors facts backed Balchunas’ statement as YTD flows returned to the $15 billion mark after falling to $14.3 billion at the end of June.

Source: Bitcoin ETF

But Soso value facts revealed that BTC ETF assets under management fell by nearly $10 billion. Amid recent credit downturns, interest rates fell from $62.5 billion to less than $50 billion.

Community Reactions to BTC ETFs

However, assets under management have since recovered as flows improved at the start of the week. The products have had a positive net flow since last Friday.

On Monday and Tuesday, BTC ETFs saw $294.9 million and $216.3 million in inflows, respectively.

Nevertheless, other market observers viewed the improved ETF flows as irrelevant to BTC’s price action on the chart.

Basically one user claimed the inflow consisted of hedge funds shorting BTC on the futures market via cash-and-carry trading.

Another market analyst, Jim Bianco, countered Balchunas’ boomer story in BTC ETFs.

Bianco highlighted that boomers owned a “small percentage,” with the majority of BTC ETF holders coming from “self-directed investors.”

What is Bitcoin’s price action like?

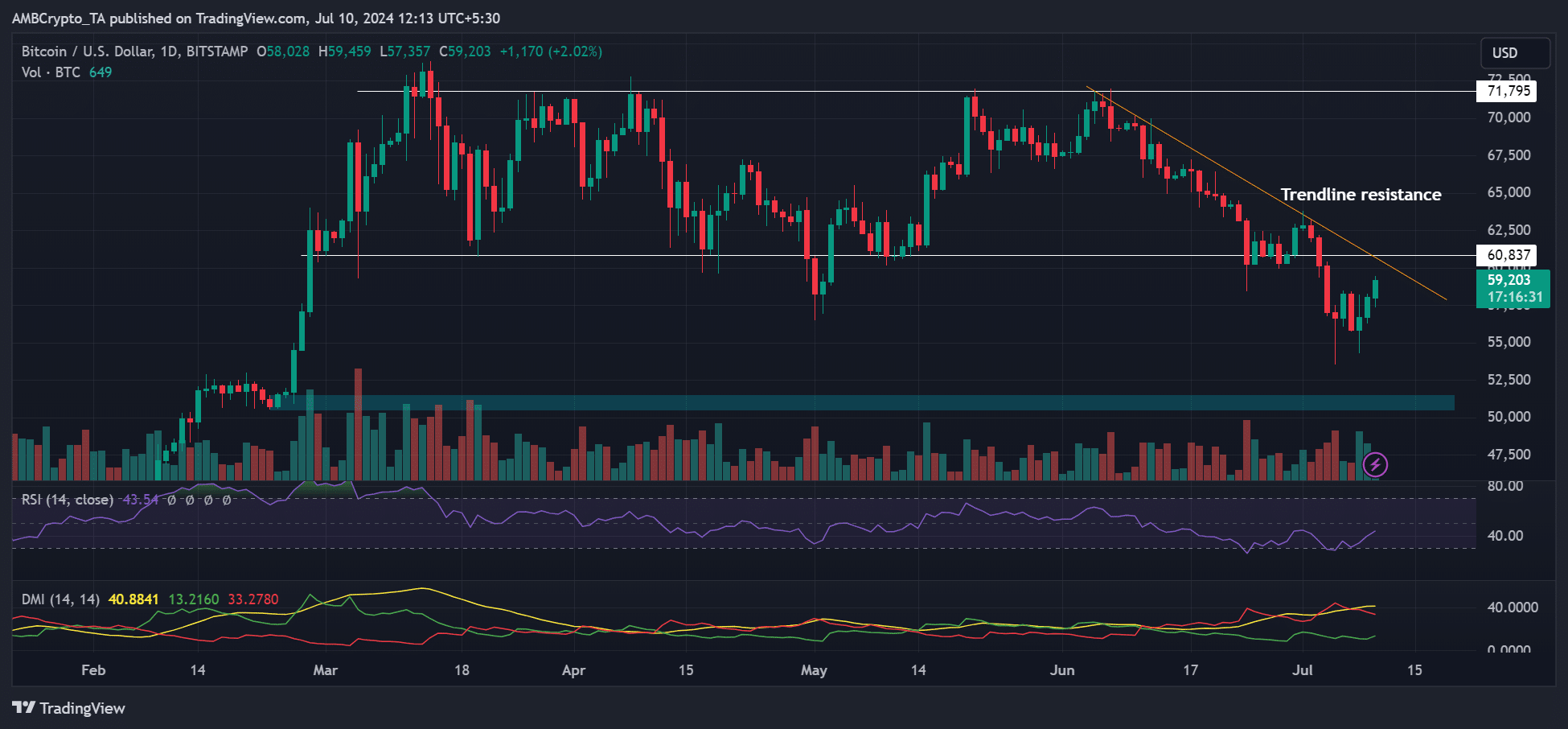

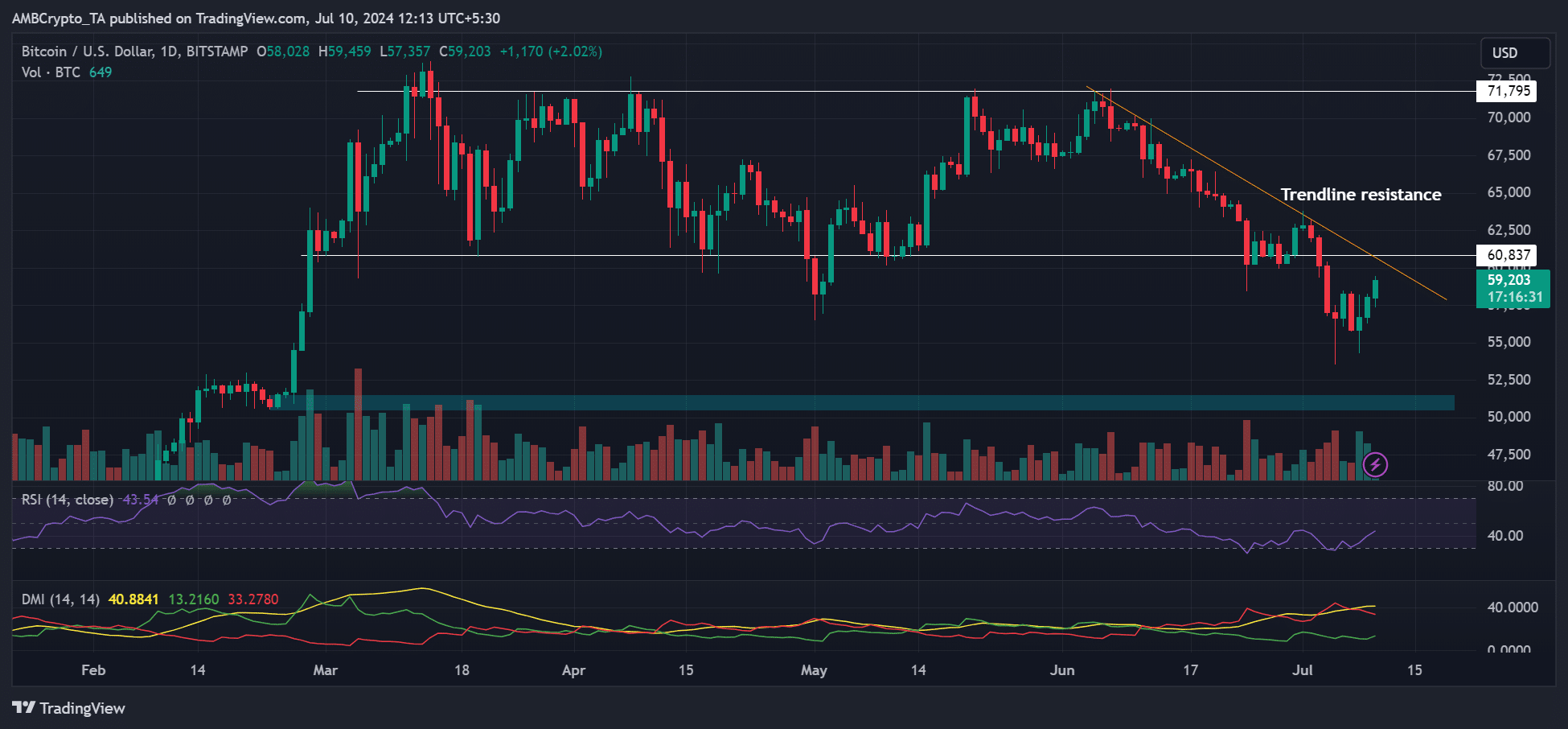

Source: BTC/USD, TradingView

At the time of writing, BTC was up 5.8% weekly and just above $59,000. However, to show further strength, the recovery must clear trendline resistance and reclaim the low in the $60.8K range.

The RSI (Relative Strength Index) and the Directional Movement Index (DMI) showed a remarkable positive strengthening.

However, the RSI was below average and the DMI was far from a positive crossover, indicating that bulls still lacked absolute market leverage.

Interestingly, Glassnode’s founders, Negentropic, claimed that BTC’s RSI has bottomed out on the daily chart, prompting them to take a bullish stance on BTC.