- The global reach of BTC ETFs is expanding as the Australian Stock Exchange is set to relist on June 20.

- It remains to be seen whether the US spot ETH ETF approvals will increase demand for BTC ETFs.

Australian Stock Exchange (ASX), the largest stock exchange in Australia, has joined the Bitcoin [BTC] ETF party by approving its first BTC ETF product from asset manager VanEck.

The product, VanEck Bitcoin ETF (VBTC), will list on June 20, marking the historic debut of an ETF containing the largest digital assets on ASX.

Andrew Campion, ASX managing director of investment products, told the Australian Financial Review (AFR) states that the delay in the approval of BTC ETFs on the exchange was due to the crypto winter of 2022. Campion added,

“But with the recovery in cryptocurrency prices, we’ve had quite a bit of interest over the last twelve months, and that has resulted in the approval.”

ASX spotted renewed interest after US and Hong Kong spot BTC ETFs went live.

Ask about Bitcoin ETF Australia

For his part, Arian Neiron, Asia-Pacific director at VanEck, highlighted the growing investor demand for BTC.

“Bitcoin is still an emerging asset class that many advisors and investors want”

The ASX listing is a great signal for Australian investors looking for regulated BTC trading and investing opportunities.

Similar products have also recently been launched on Australia’s second largest stock exchange, Cboe Australia, a major competitor to ASX.

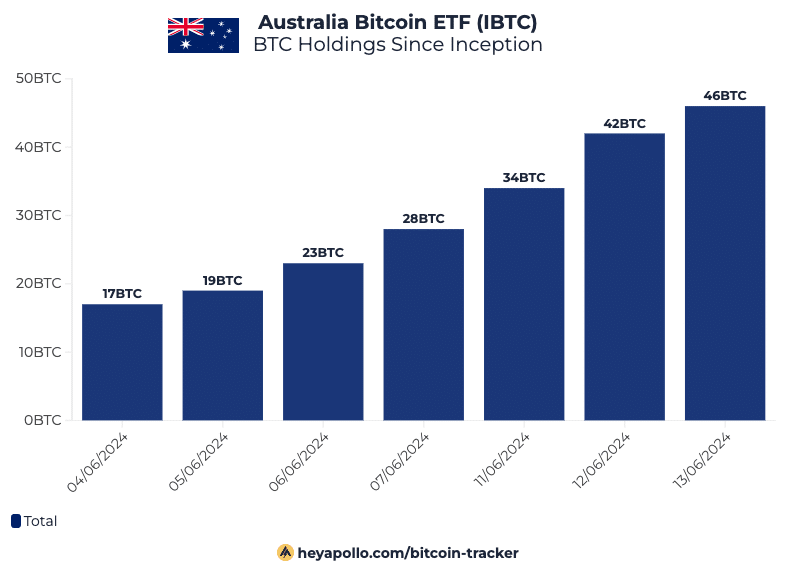

Notably, Monochrome Bitcoin ETF (IBTC) debuted and began operating on Cboe Australia on June 3. By June 14, the product had accumulated 46 BTC, Julian Farher, a Bitcoin analyst and investor, revealed.

Source: X/Julian_Farher

Interestingly, the ASX listing will start trading just a few days before the US stock exchange Ethereum [ETH] ETF approval. Many analysts consider it a catalyst for the overall market. Whether this will increase demand for the Australian BTC ETFs remains to be seen.

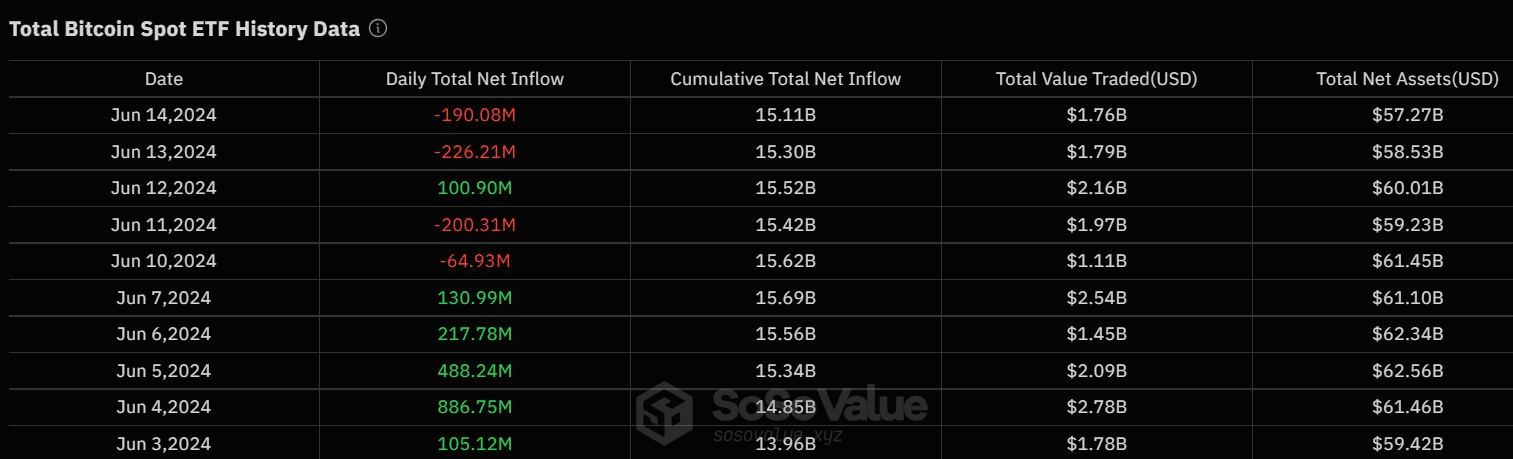

However, spot US BTC ETFs recorded significant outflows last week as investors de-risked before and after the Fed’s decision to leave rates unchanged for the seventh time.

Source: Sosowaarde

Apart from June 12, the rest of last week saw massive outflows worth more than $680 million, underscoring the risk-off approach of US investors.

At the time of writing, the king coin fell below $66,000. If bearish sentiment continues, the price could fall to the lowest level.

Additionally, per Coinglass factsMarket Open Interest (OI) rates were red at the time of writing, indicating low liquidity in the derivatives market and reinforcing bearish sentiment.