- BTCs 26% deviation can be a mid-bull correction or the start of a larger correction.

- Glassnode projected that a likely soil above $ 70k could be affected.

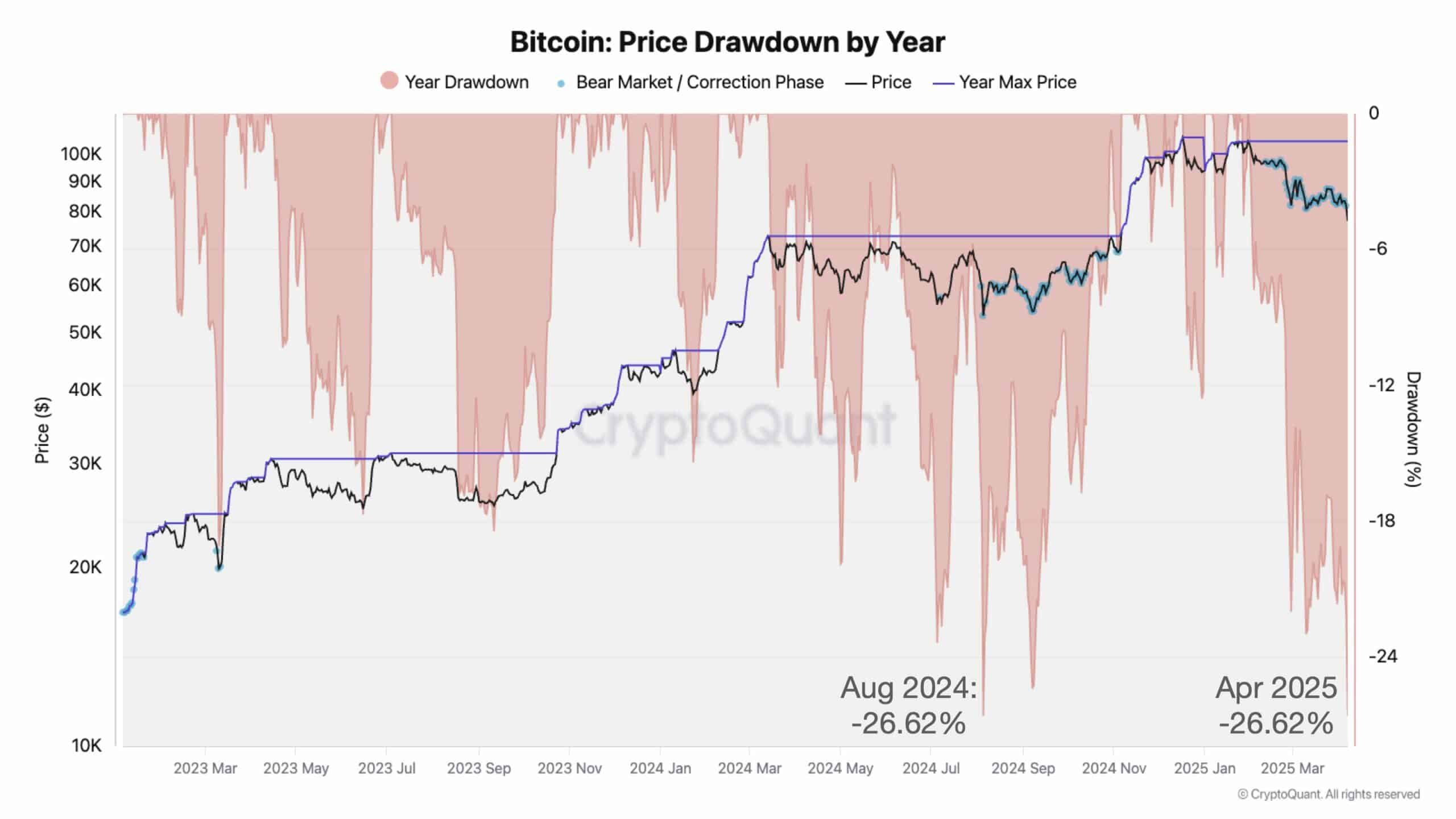

Bitcoin’s [BTC] 26% DrawDown In 2025, the largest in this current cycle can become if the decrease extends.

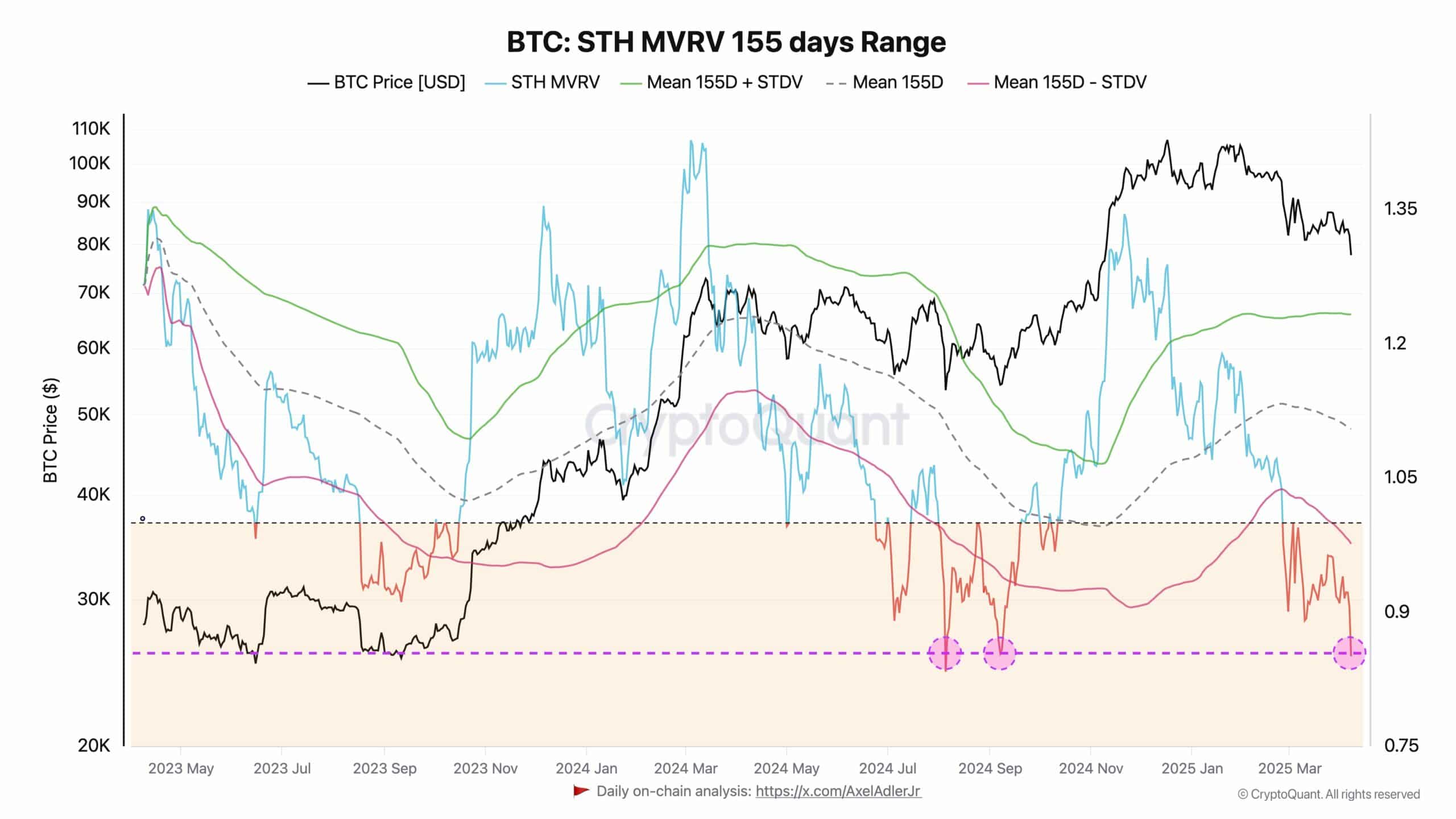

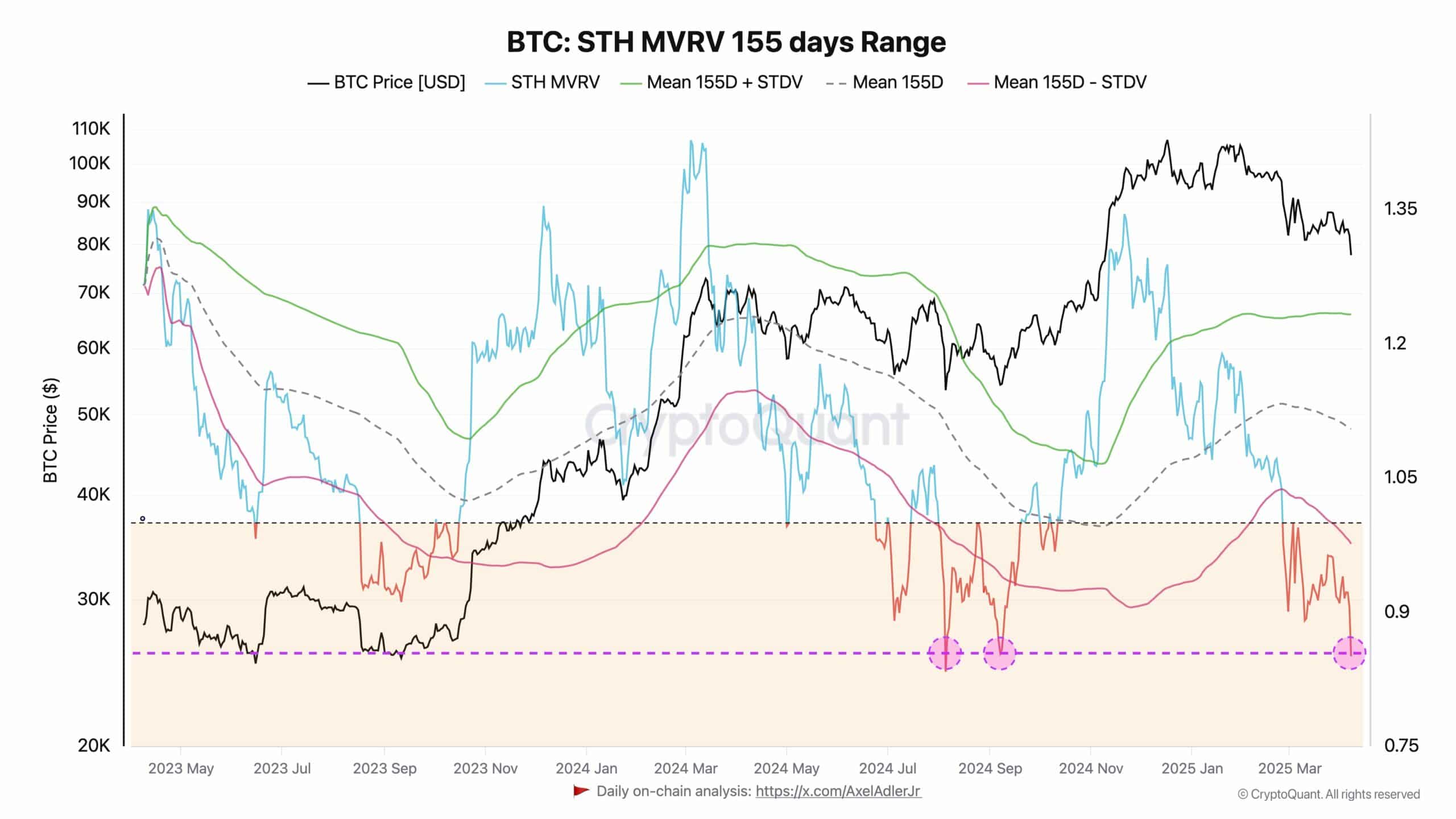

According to Julio Moreno, head of research at Cryptoquant, the 2025 was currently dive equivalent To the Pullback of August 2024.

Source: Cryptuquant

After a peak at $ 109k in January, BTC withdrew this week to $ 74k in the middle of macro uncertainty – that is more than 30% correction. Since then it has been found to $ 79k. Last year it fell from $ 73k to $ 49k, which marked a decrease of 33%.

But compared to historical drawings, is BTC out of the forest, or is the worst to come?

BTC – A rebound or more pain?

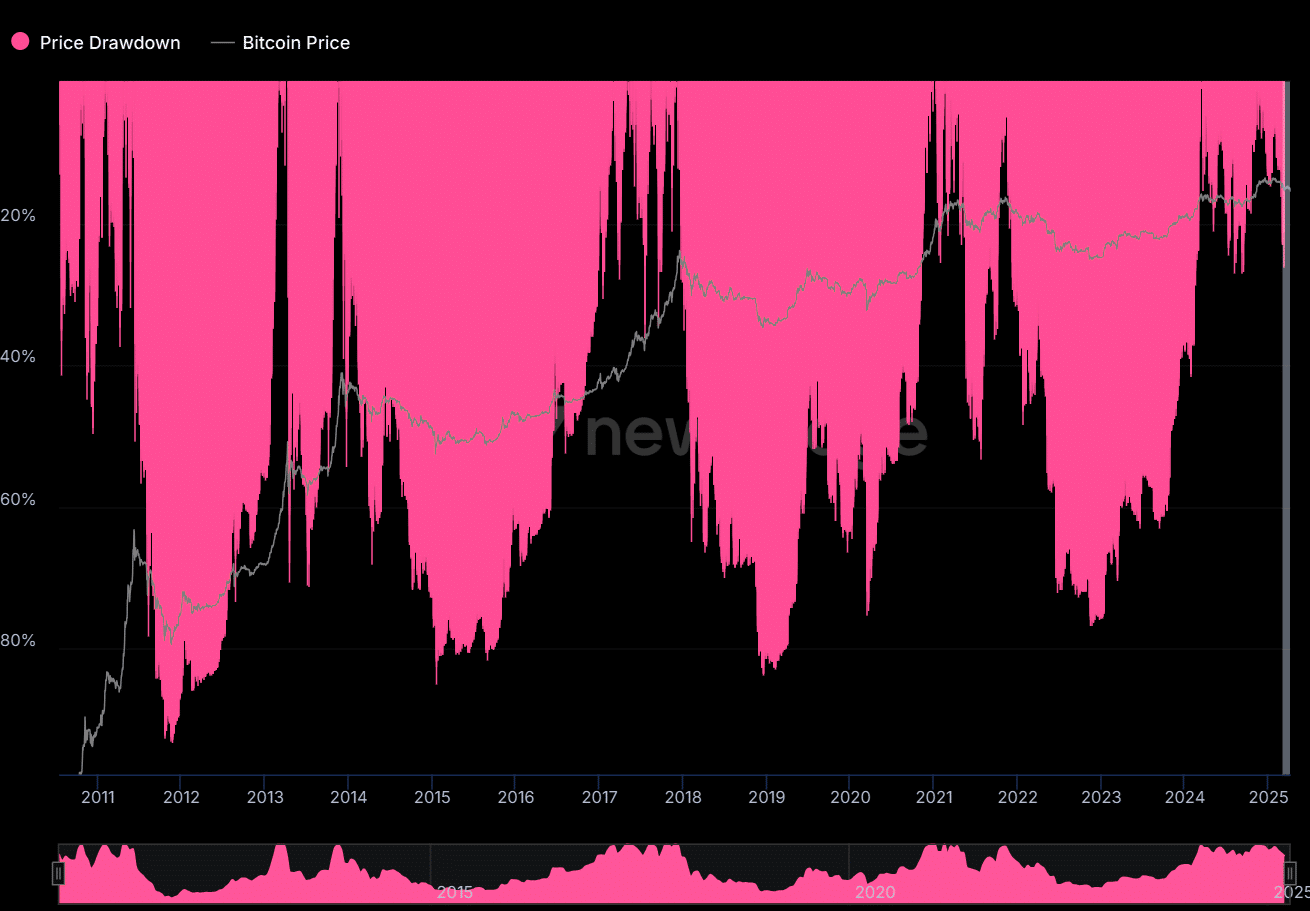

Source: Newhedge

Earlier BTC -DrawDowns, especially during the Bears market phase, were relatively more serious than the current decrease of 36% -30%. In 2012, 2025 and 2019, for example, BTC fell more than 80% and lasted 6-12 months after it reached a price peak.

BTC has currently fallen around 30% in the last 3 months. As such, if trends from the past take place, this can only be the start of a larger correction for the next 3-9 months.

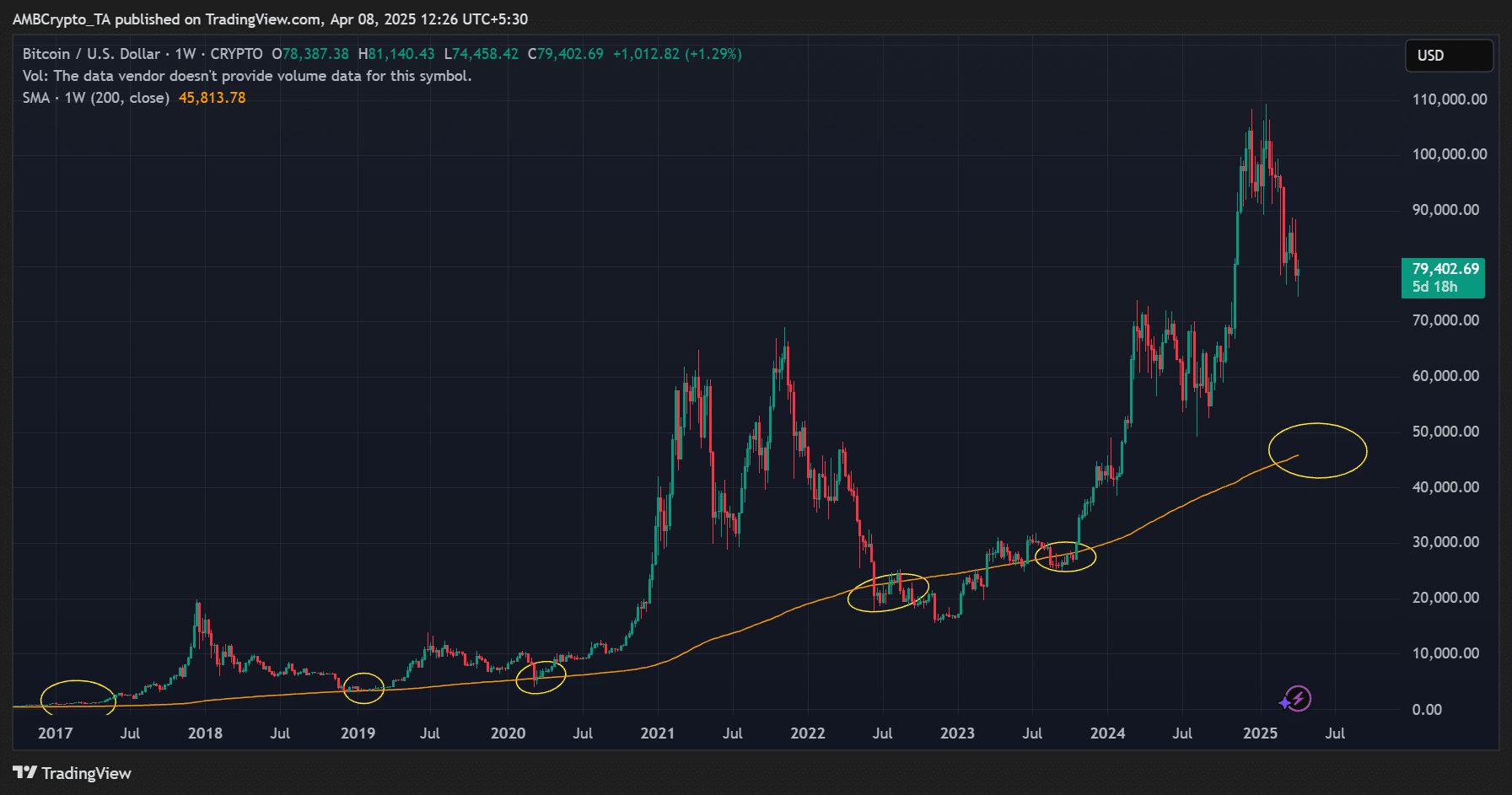

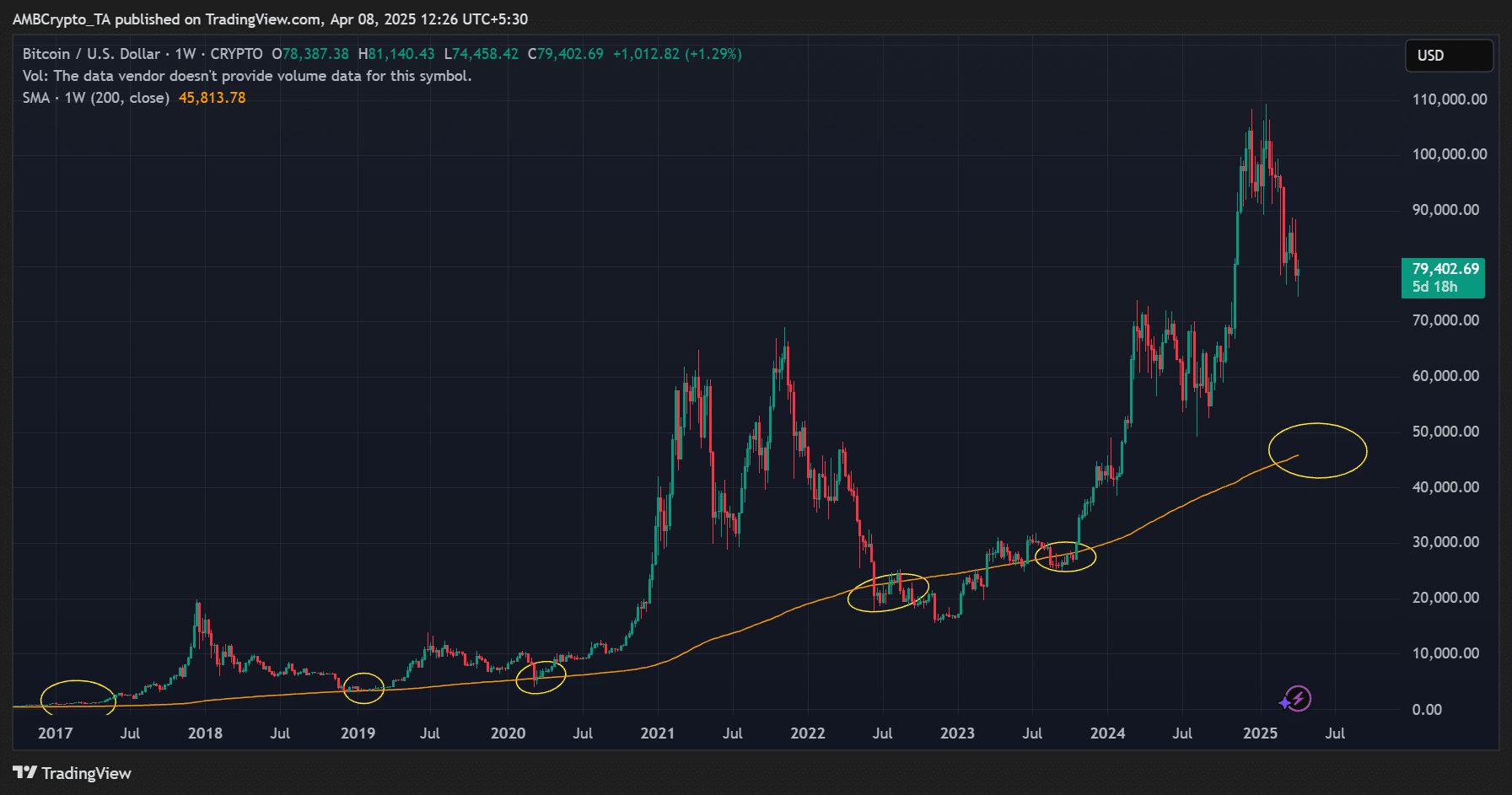

However, a decrease of 80% (up to $ 21k) can be unlikely, since the most important bull-market support, the 200-weekly advancing average, has risen to $ 45k.

Source: BTC/USD, TradingView

As an alternative, some analysts believe that current cycle collection can be less serious due to market maturation. Glassnode expected A potential soil around the $ 74k $ 70k area.

“The disadvantage can slow down a bit from here – between $ 74k and $ 70k, there is a total of ~ 175k $ BTC in cost -based cost -base clusters. The largest level within this reach is $ 71.6k, with ~ 41k $ btc.”

Analyst Axel Adler on chains, reflect A similar attitude, noted that BTC was brought to the bottom and was in an accumulation phase, referring to the MVRV indicator of the STH (short-term holder), which reflected the local soil that was seen last August.

“In essence, these conditions usually point at the end of a correction phase and the beginning of the accumulation.”

Source: Cryptuquant

Indeed, other smart investors, such as Philip Swift and StockMoney hace echoes were full of confidence bidding At these levels.

Moreno warned That the soil was not fully marked because various bullish indicators still had to show for BTC.

In conclusion, the current drawing of 30% was nothing compared to the bear phases of the previous cycle, which was on average a price decrease of 80%. That is why the current pullback can be a mid-bull correction for another leg up.

However, note that it can also be the start of a larger correction if bullish circumstances do not improve.