The current sentiment among Bitcoin investors may be key to understanding whether the current decline is a buying opportunity or not.

“Buy The Dip” Optimism Is Fading In The Bitcoin Market

Into a new one insight messageon-chain analytics company Santiment has been exploring how trading sentiment in the BTC sector has changed since the crash a few days ago.

Related Reading: Will Bitcoin Retest $20,500? This pattern may suggest that

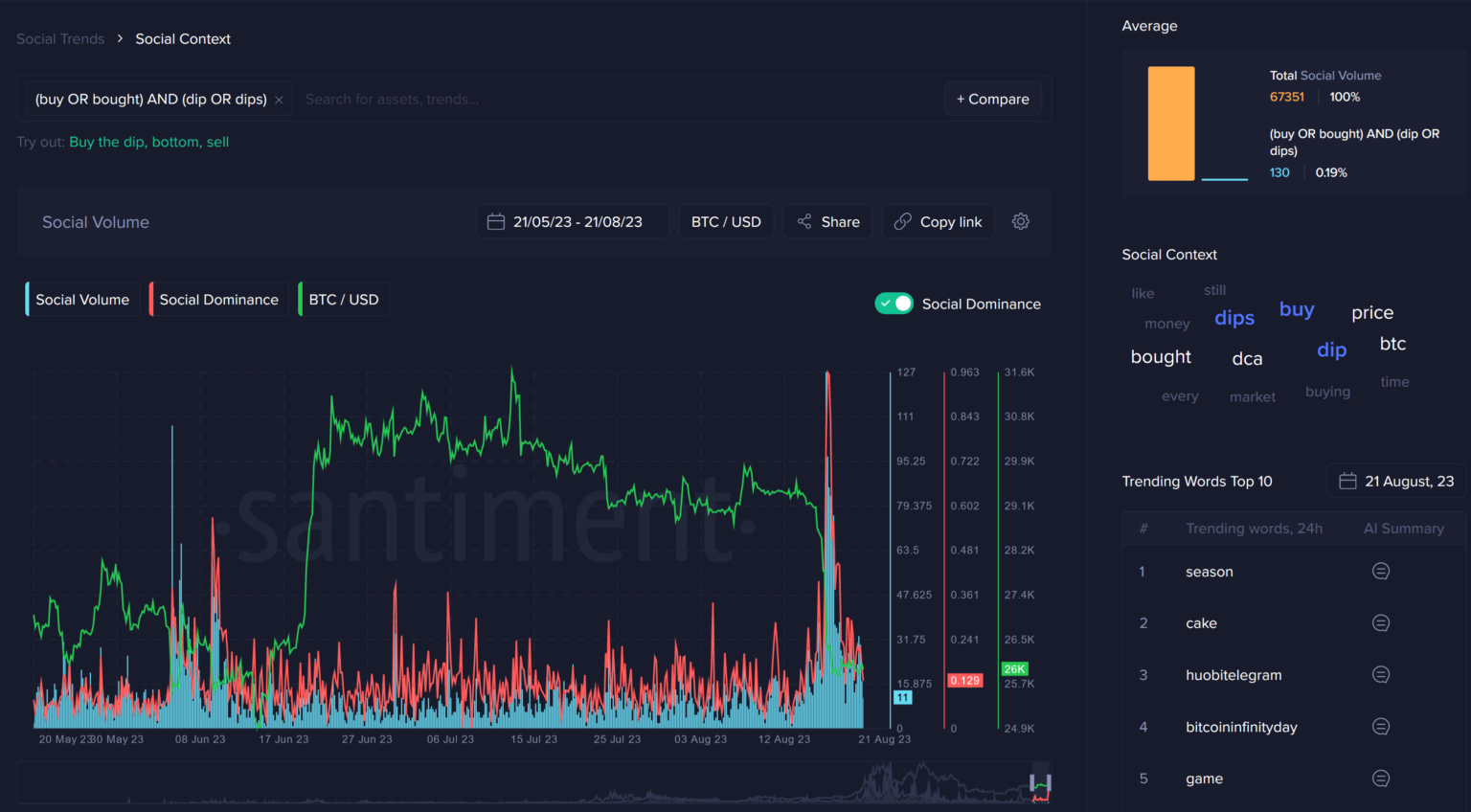

First, the analytics company checked for the number of “buy the dip” calls that have been happening on social media lately.

Looks like the value of the metric had been quite high not too long ago | Source: Santiment

Here, Santiment has tapped into its “social volume” metric, which finds the unique number of social media posts that mention a particular term or topic.

Obviously, social volume for Bitcoin/cryptocurrency is taken here and then filtered by terms like “buy” and “dip.” It can be seen from the chart that the social media users took part in a heavy discussion on such topics just as the Bitcoin crash to the $26,000 level happened a few days ago.

This implies that the traders were optimistic that the asset would recover soon and they believed the decline presented an ideal buying opportunity.

As the asset has only continued to move sideways since the crash, social media optimism seems to have slowly faded as “buy the dip” calls have plummeted. This isn’t all bad news, though, as Santiment points out.

Believe it or not, it’s a good sign that people aren’t sure anymore that this is a dip-buy spot. “It means pessimism is starting to take over again as market caps fade.”

Historically, bottoms have become more likely to make up the majority of traders the more pessimistic about the market. This development can therefore ensure that the currency recovers.

In terms of the social volume distributed across the major social media platforms, it seems that Redditors still haven’t given up hope of a turnaround.

Buy the dip calls on Telegram, Reddit, Twitter, and 4chan | Source: Santiment

While overall market sentiment may have cooled, it doesn’t appear to have happened equally across all platforms just yet. But it can provide a unique opportunity for a good entry point.

“When all four social platforms are aligned and settled back on neutral mentions of buying the dip, this is when the real opportunity historically presented itself for patient traders,” notes Santiment.

A sign that may not be so positive may be the fact that Bitcoin’s “social dominance”, the percentage share of the total social volume of the top 100 assets, has fallen back to normal levels, after briefly hitting its 2023 high. have reached. after the crash.

The metric's value has cooled down a bit | Source: Santiment

This would mean that social media users are still having discussions about altcoins, which is a sign that there is still greed in the market. Ideally, Bitcoin’s social dominance should remain high.

“Many discussions about the No. 1 assets are associated with fear, while discussions about more speculative assets often coincide with greed,” the analysis firm says. “Fear is when markets rise.”

Overall, it looks like market sentiment is moving in the right direction, but it’s not yet fully aligned in a way that has historically been favorable for a Bitcoin rebound.

BTC price

At the time of writing, Bitcoin is trading around $26,000, down 11% over the past week.

BTC has observed a plunge recently | Source: BTCUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.net