- Bitcoin’s price plummeted after a stronger-than-expected US jobs report in May

- Market watchers can now turn their attention to next Wednesday’s Fed meeting

Bitcoin [BTC] fell below $71,000 in the early hours of the New York trading session on Friday, following a better-than-expected US jobs report in May. Within 24 hours of that, the cryptocurrency even fell below $70,000 on the charts.

May’s American Jobs report revealed that In May, 272,000 jobs were added, well above the expected 190,000. However, unemployment rates stood at 4%, compared to the expected 3.9%.

While this was great news for workers, it complicated the prospect of the Fed cutting rates at its June meeting. The jobs report is one of several data sets the Fed uses to make decisions about its monetary policy.

A weaker one could increase the chances of rate cuts, but a stronger one, like May’s report, could give the Fed a hawkish stance.

In response to BTC’s wild reaction to Friday’s report, Scott Melker of ‘The Wolf of All Streets’ said declared,

“Bitcoin drops $1000 in minutes because too many people have jobs. LOL. We live upside down. Strong jobs mean less chance of cuts, which means assets fall as a knee-jerk reaction.”

What’s next for Bitcoin?

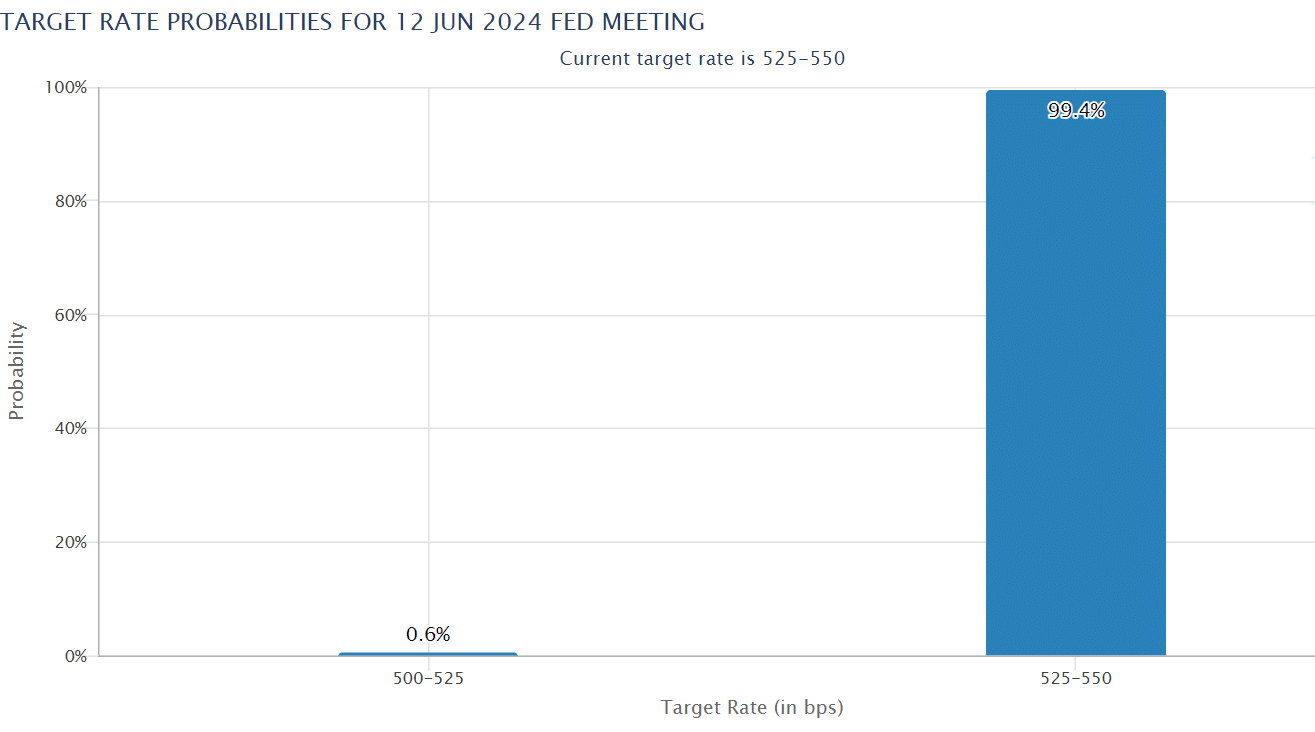

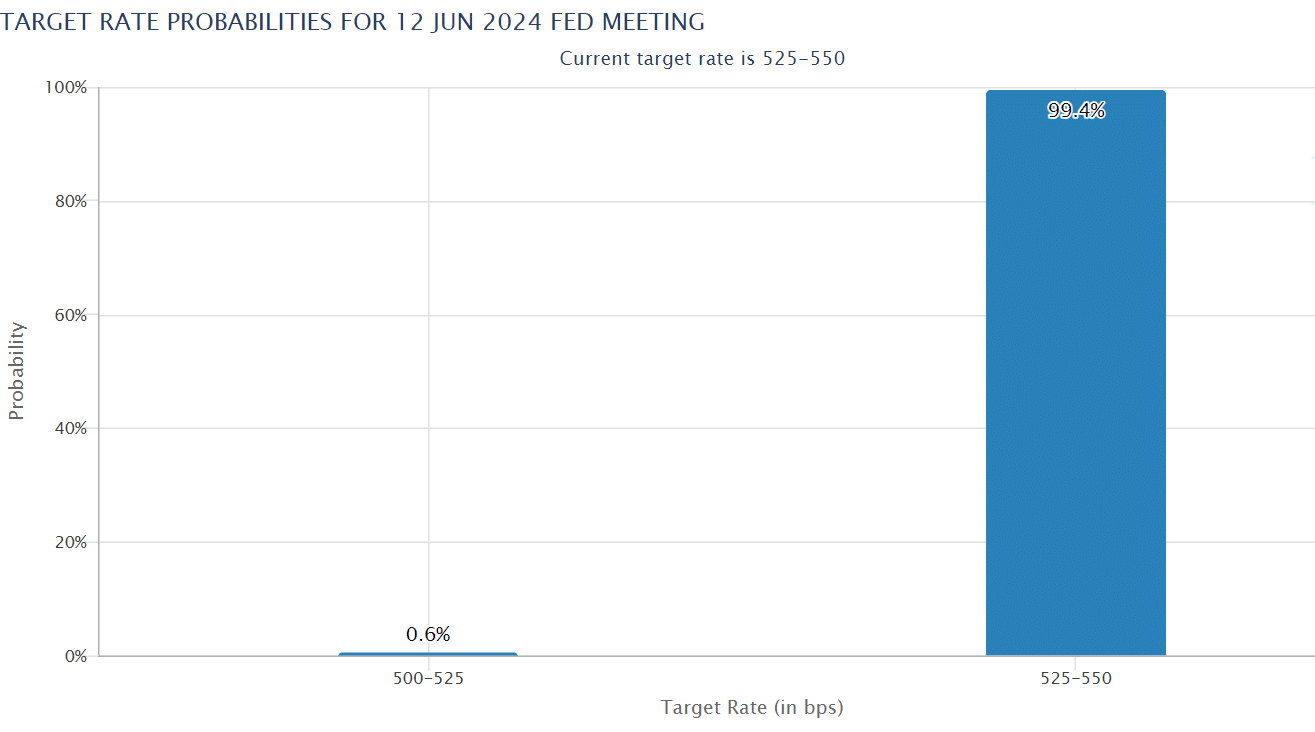

All eyes will now be on the Fed’s announcement next Wednesday (June 12). However, according to the CME Fed watch tool, it is true 99% interest rate traders expect these rates to remain unchanged.

Source: CME Group

Market watchers will be curious to see Fed Chairman Jerome Powell’s press conference next Wednesday to learn whether the agency is taking an accommodative or hawkish stance.

Many industry analysts expected the US Jobs report to be a major stepping stone in shaping BTC’s next price direction. According to Quinn Thompson of crypto hedge fund Lekker Capital:

“The market needs to be convinced that Powell will make cuts in July. That could be the result of a weak jobs report Friday, a weak CPI and/or a dovish Fed next Wednesday.”

There have been bullish expectations increased after the European Central Bank (ECB) and the Bank of Canada (BOC) cut their interest rates, which could trigger global quantitative easing.

The latest US jobs report complicates that. However, according to Charles Edwardsfounder of crypto hedge fund Capriole Investments, interest rate cuts were inevitable in the long term.

“Time will tell. But it certainly appears that unemployment has now bottomed out, suggesting that US liquidity should rise and rise quickly. Rate cuts on the way.”

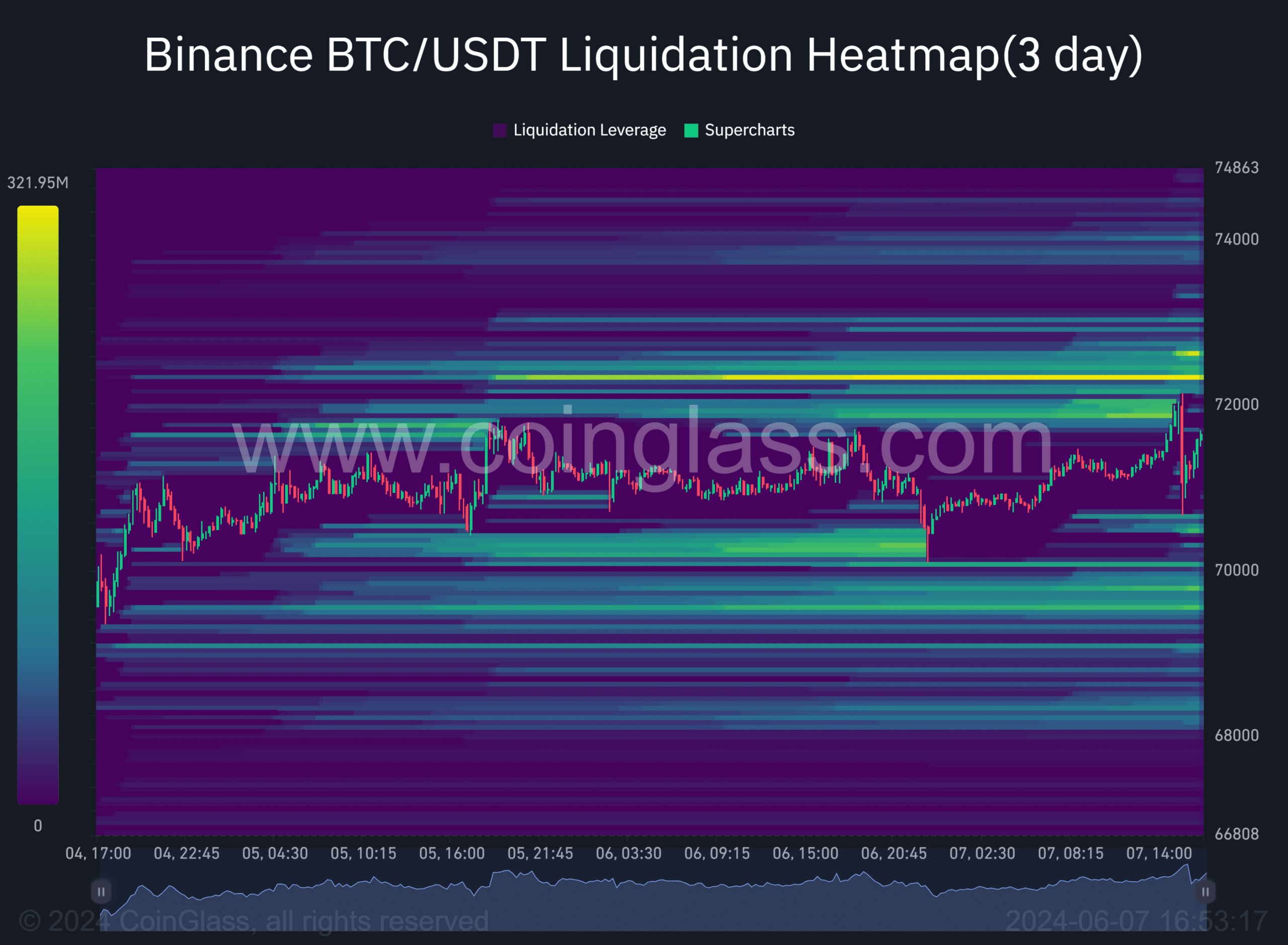

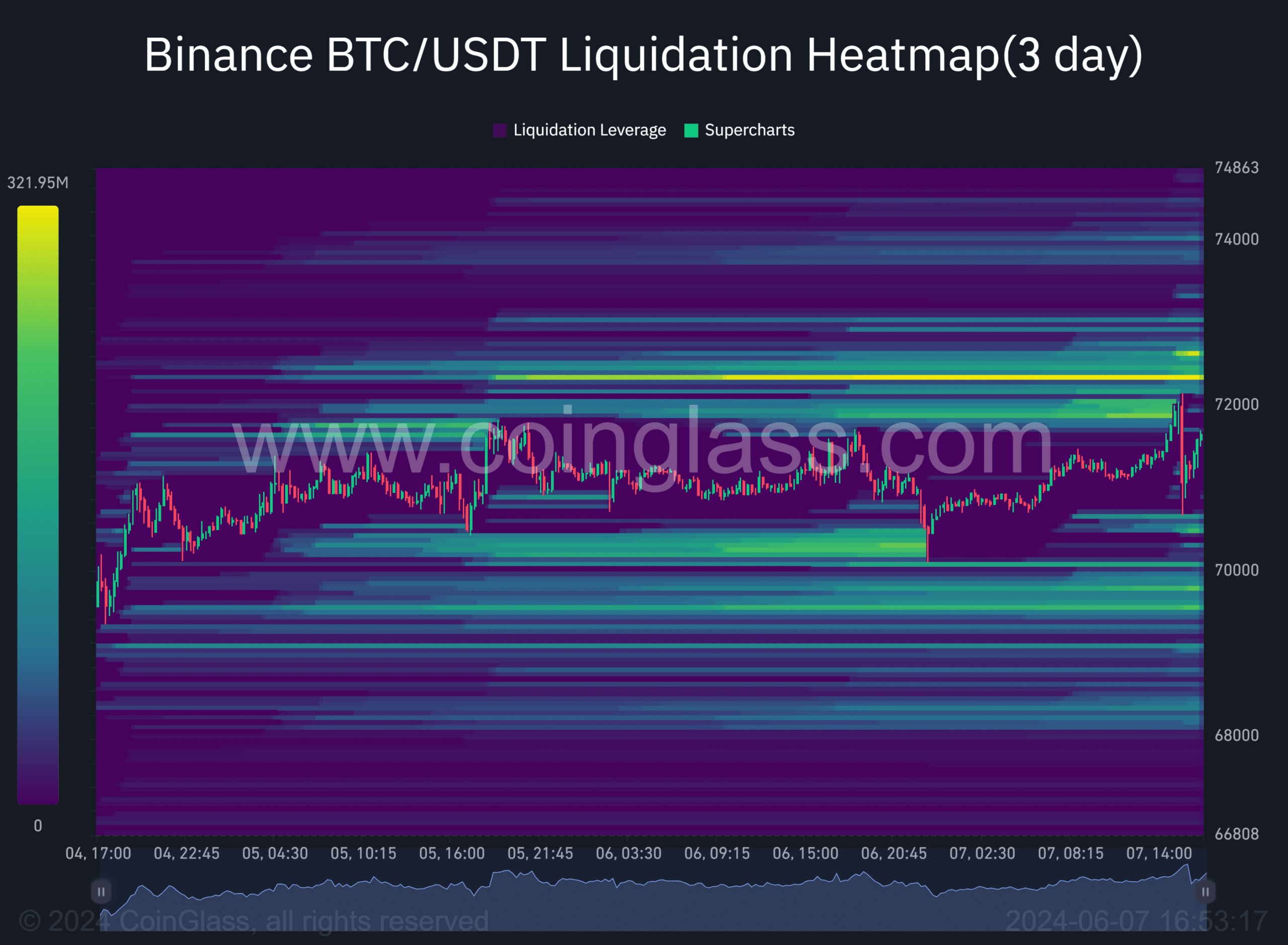

Source: Coinglass

In the meantime, there is still significant liquidity above $72,000 (highlighted in orange), which could act as a magnet for price action. However, Bitcoin’s sideways move could continue until the Fed meeting next week.