- Germany transferred large amounts of BTC to accounts, causing uncertainty in the market.

- BTC’s correlation with traditional investments and asset classes decreased.

The recent Bitcoin [BTC] The crash has caused a wave of negative sentiment around the crypto market.

Germany makes a move

According to blockchain data analytics company Arkham, the German government transferred 700 Bitcoin on July 7, with significant financial implications.

The transfer, worth about $40.55 million, was sent to an unmarked address, raising questions about its purpose.

While the specific reason for the transaction remains unclear, the address may be related to a financial institution or an over-the-counter (OTC) service.

OTC services are aimed at large investors who want to trade large amounts of cryptocurrency outside of traditional exchanges.

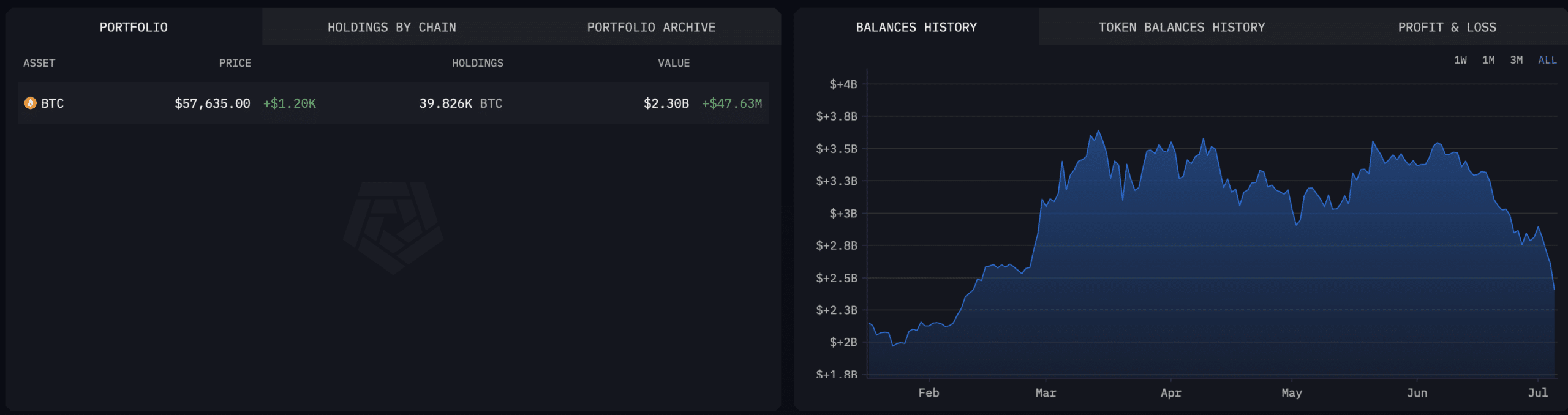

This transaction comes amid Germany’s continued ownership of a significant amount of Bitcoin. The German government currently owns approximately 39,826 BTC, worth approximately $2.31 billion.

This sizable holding suggests a potential long-term strategy for the German government regarding cryptocurrency.

The unmarked address associated with the transfer creates uncertainty about its purpose. Some may fear that this is a harbinger of a major sell-off by the German government, which will see investors lose their assets before the price falls further.

Source: Arkham Intelligence

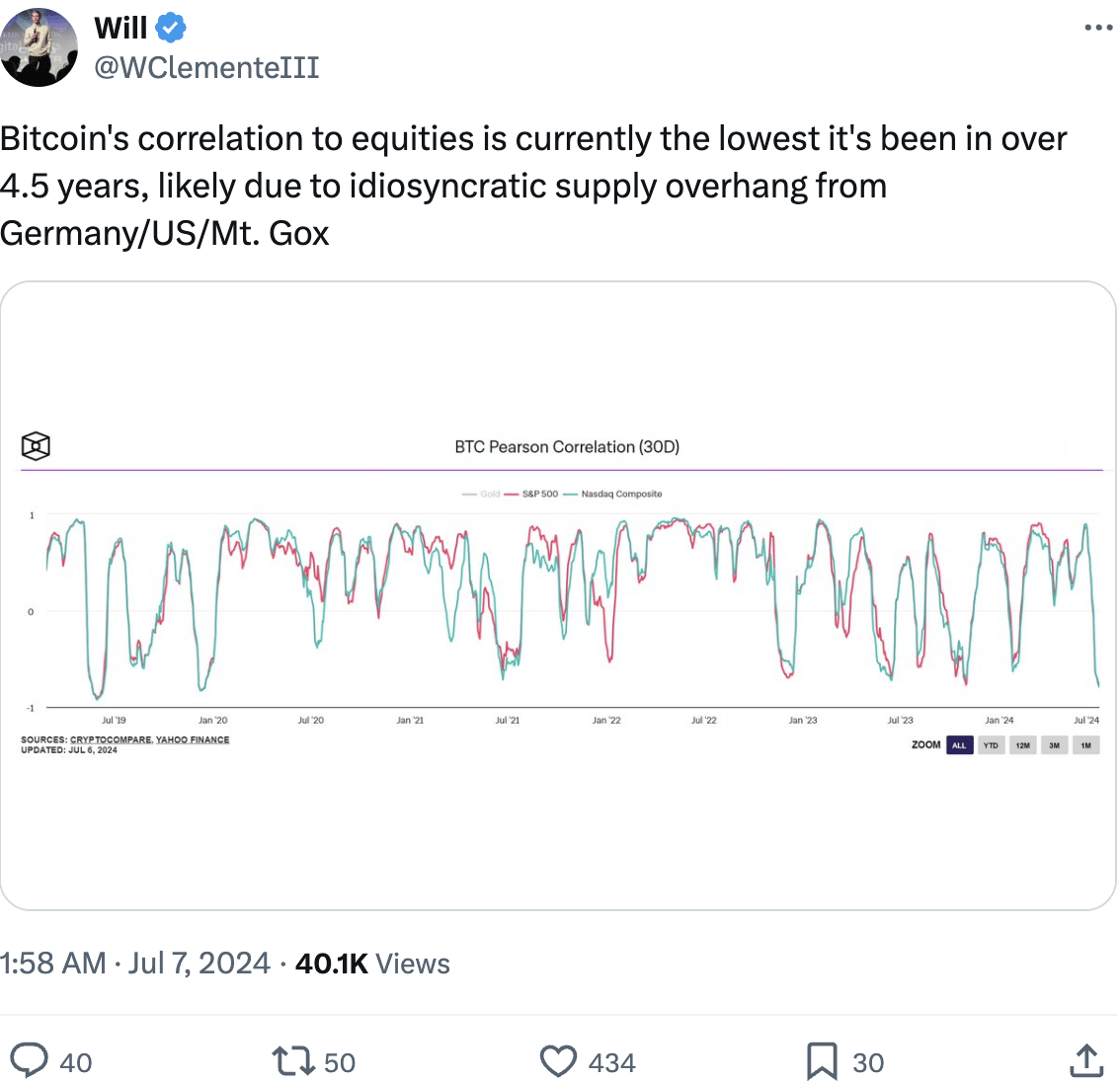

The co-relationship decreases

Separately, the relationship between Bitcoin and traditional stock markets has weakened significantly. This means that Bitcoin’s price movements no longer closely follow the ups and downs of stocks, unlike what was observed in previous years.

This decline in correlation was the strongest in more than four and a half years.

Analyst Will Clemente thinks this is likely due to a unique situation where there is an oversupply of Bitcoin hanging over the market.

This excess supply is believed to come from several sources, including Germany, the United States, and Mount Gox, a now-defunct Bitcoin exchange that lost a large number of Bitcoins years ago.

Read Bitcoin’s [BTC] Price forecast 2024-25

The presence of excess supply puts downward pressure on the price of Bitcoin, and this pressure is independent of what happens in the stock market.

Source:

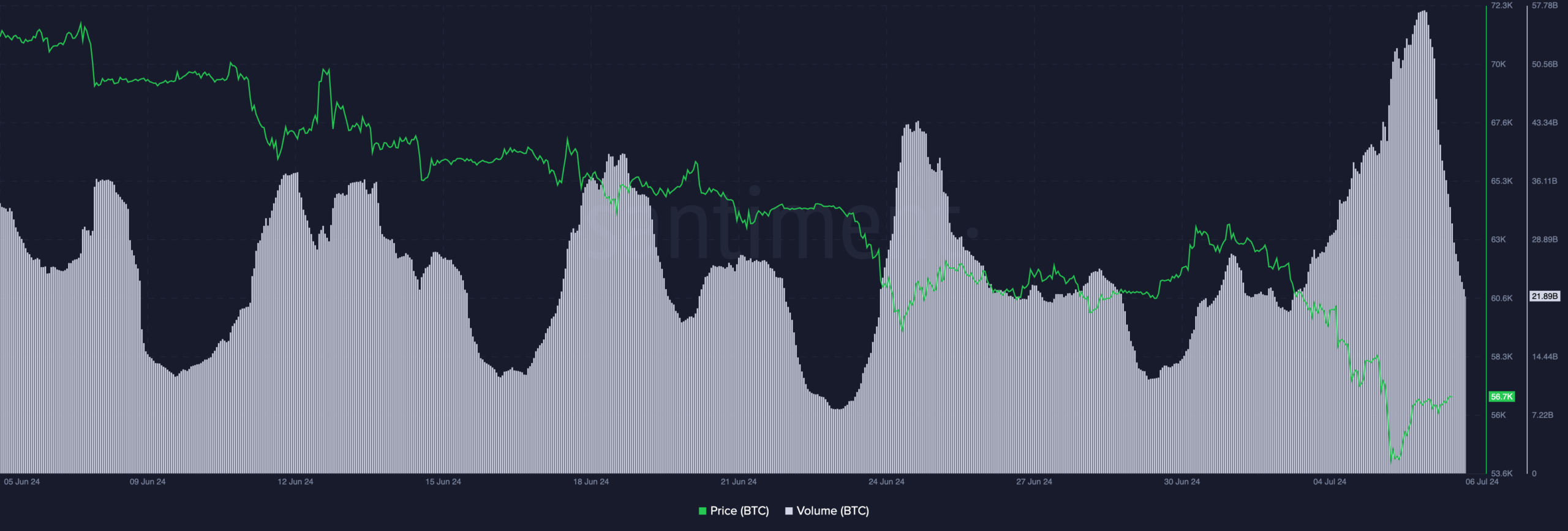

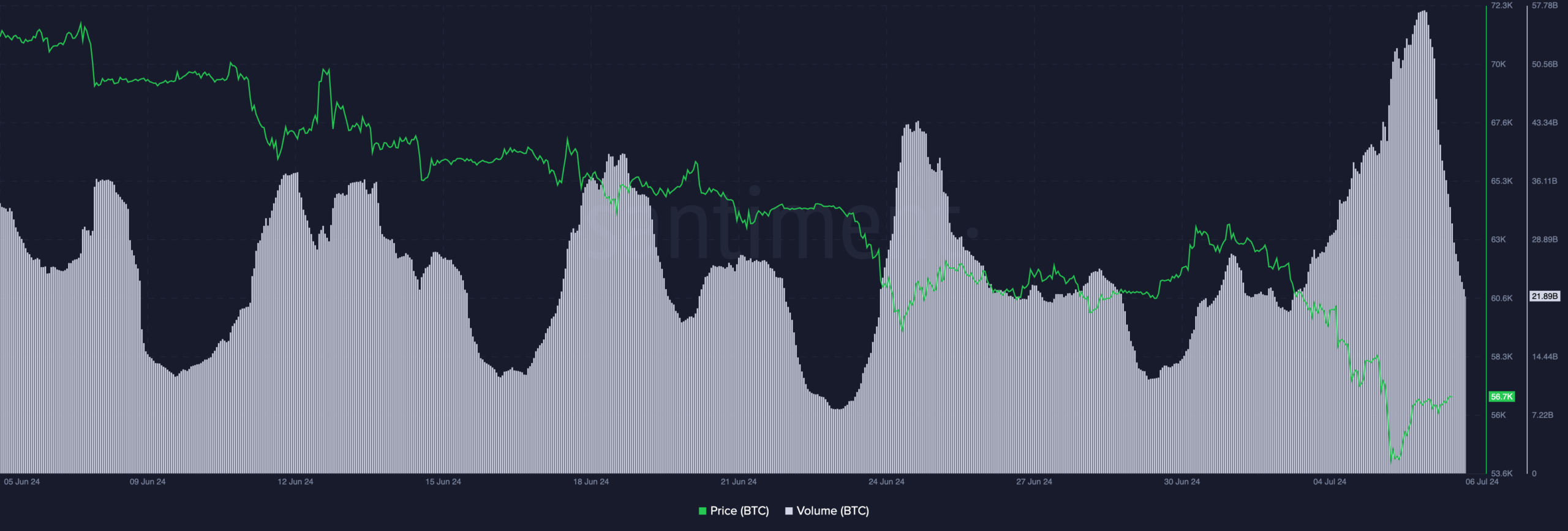

At the time of writing, BTC was trading at $57,482.70 and its price was up 1.42% in the last 24 hours. Coupled with this, BTC trading volume was down 47.14% over the same period.

Source: Santiment