- Profit-taking rose to a three-week high as BTC crossed $30,000.

- However, BTC witnessed a more negative flow as its price rose.

The price of Bitcoin has increased in recent months [BTC] has consistently run into a psychological barrier at the $30,000 mark. Recently, Bitcoin crossed this barrier, leading to a noticeable increase in activity and interest.

Read Bitcoin [BTC] Price Forecast 2023-24

Bitcoin profit taking is rising

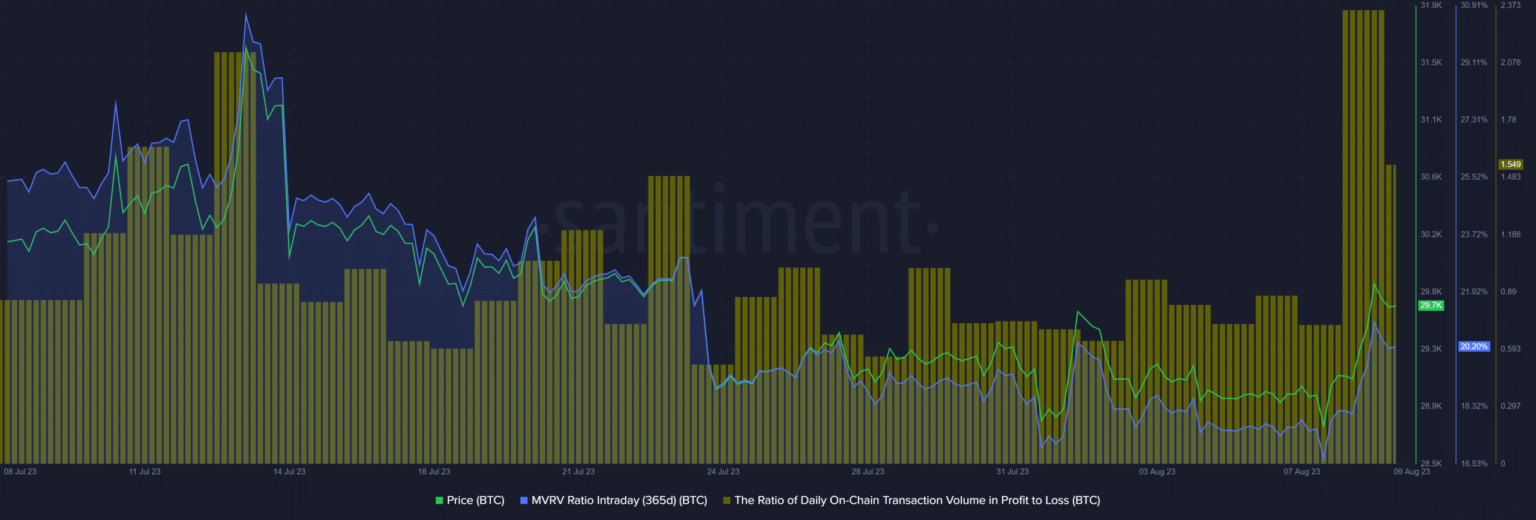

According to a Sanitation graph, there was increased profit-taking among certain Bitcoin holders, the highest level in nearly a month. Interestingly, this profitable business was primarily driven by long-term shareholders.

Source: Sentiment

Examining the market value to realizable value (MVRV) ratio over different time periods provided insight into the rationale behind this phenomenon. At the time of writing, the intensity of profit-taking has decreased, leading to a decrease in the ratio of daily on-chain transaction volume to profit and loss.

This ratio had fallen to approximately 1.5%.

Bitcoin MVRVs show different profit margins for holders

Comparing the Bitcoin MVRV (Market Value to Realized Value) over different time frames – 30, 60, 90 and 180 days – sheds light on why long-term holders were able to profit from the rising price. Analyzing the 30-day MVRV according to Santiment data, the rise in BTC price resulted in an increase of less than 1%.

At the time of writing, the 30-day MVRV was approximately 0.3%. This indicated that any sale by these holders would only yield a 0.3% profit.

A closer look at the 60-day MVRV showed that holders enjoyed more substantial gains within this time frame. At the time of writing, the MVRV was about 2%. This implied a potential gain of 2% for holders who sold during this period.

In addition, the profitability of the 90-day MVRV has increased by more than 1% compared to the 60-day MVRV. At the time of writing, the 90-day MVRV was above 3.7%.

Source: Sentiment

Finally, the 180-day MVRV underlined that long-term holders emerged as the beneficiaries of Bitcoin’s recent surge in price. Moreover, these long-term holders could be among those who took the opportunity to profit when the BTC price crossed the $30,000 mark. Currently, the MVRV of 180 days was over 6%.

More BTC flows outside the exchanges

In contrast to the profitable activity in the Santiment chart, the exchange rate flow metric revealed a clear pattern. As observed by Glassnode’s exchange flow metric, the data for August 8 indicated greater Bitcoin outflows from exchanges compared to inflows.

This notable outflow suggested that a greater volume of Bitcoin was being withdrawn from exchange platforms.

Source: Glassnode

How much are 1,10,100 BTC worth today?

This phenomenon also indicated that, despite the price increase, many holders were more inclined to transfer their Bitcoin holdings from exchanges rather than selling them immediately.

The value of BTC continued to hover above $30,000, albeit with a small downward trend becoming apparent.