- There were notable moves from a category of long BTC holders.

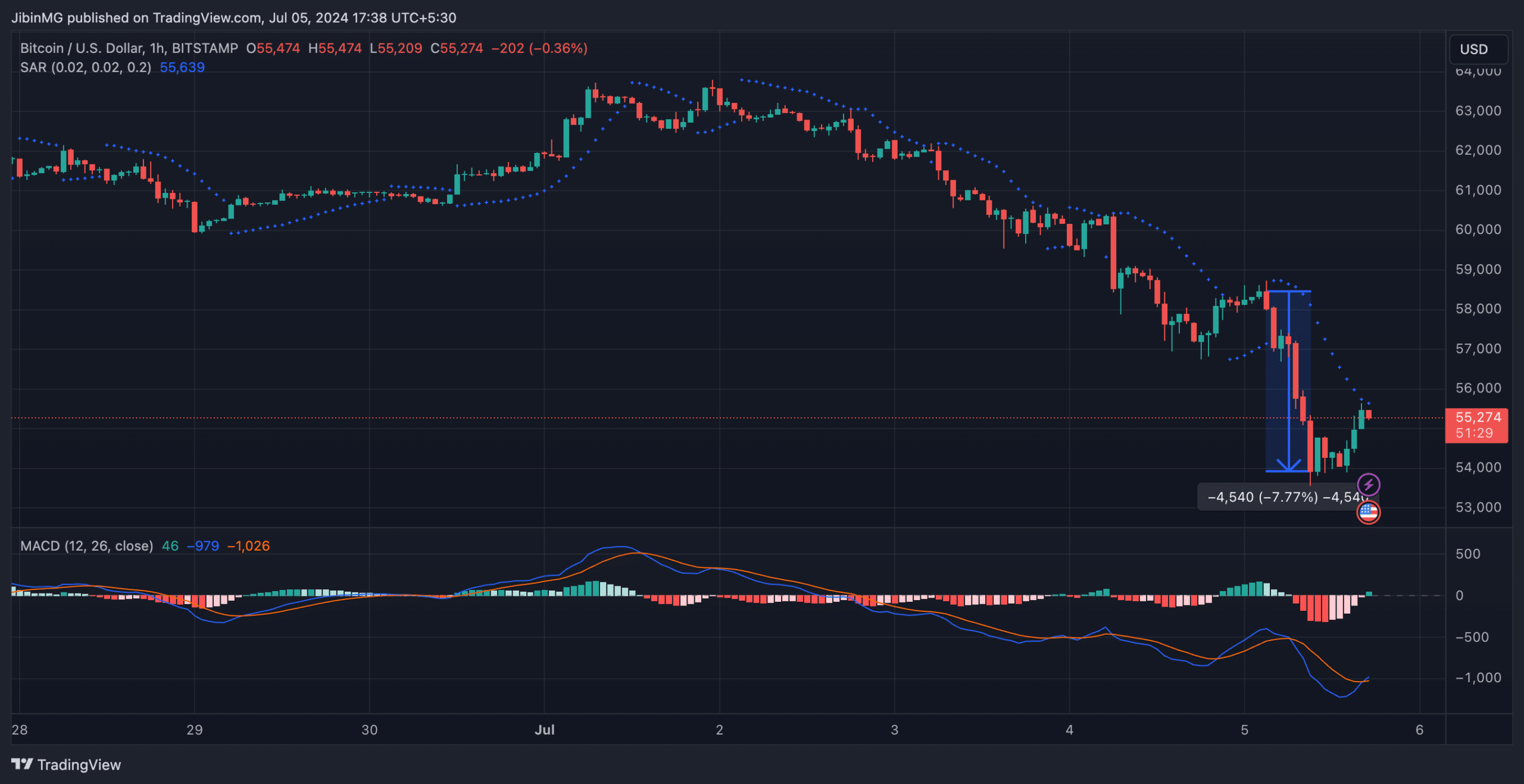

- BTC fell below a critical support line over the past 24 hours.

It hasn’t been a happy week for Bitcoin, with the world’s largest cryptocurrency losing 9% of its value over the past seven days. In fact, the magnitude of the depreciation was so great that BTC also briefly fell below $54,000 before recovering and trading at $55,275 at the time of writing.

In fact, Bitcoin has risen over the course of the price decline [BTC] A critical threshold was also crossed on the charts, prompting long-term investors to act cautiously. This shift could be related to recent activity surrounding a stock market that collapsed more than a decade ago.

Long-term BTC holders are making moves

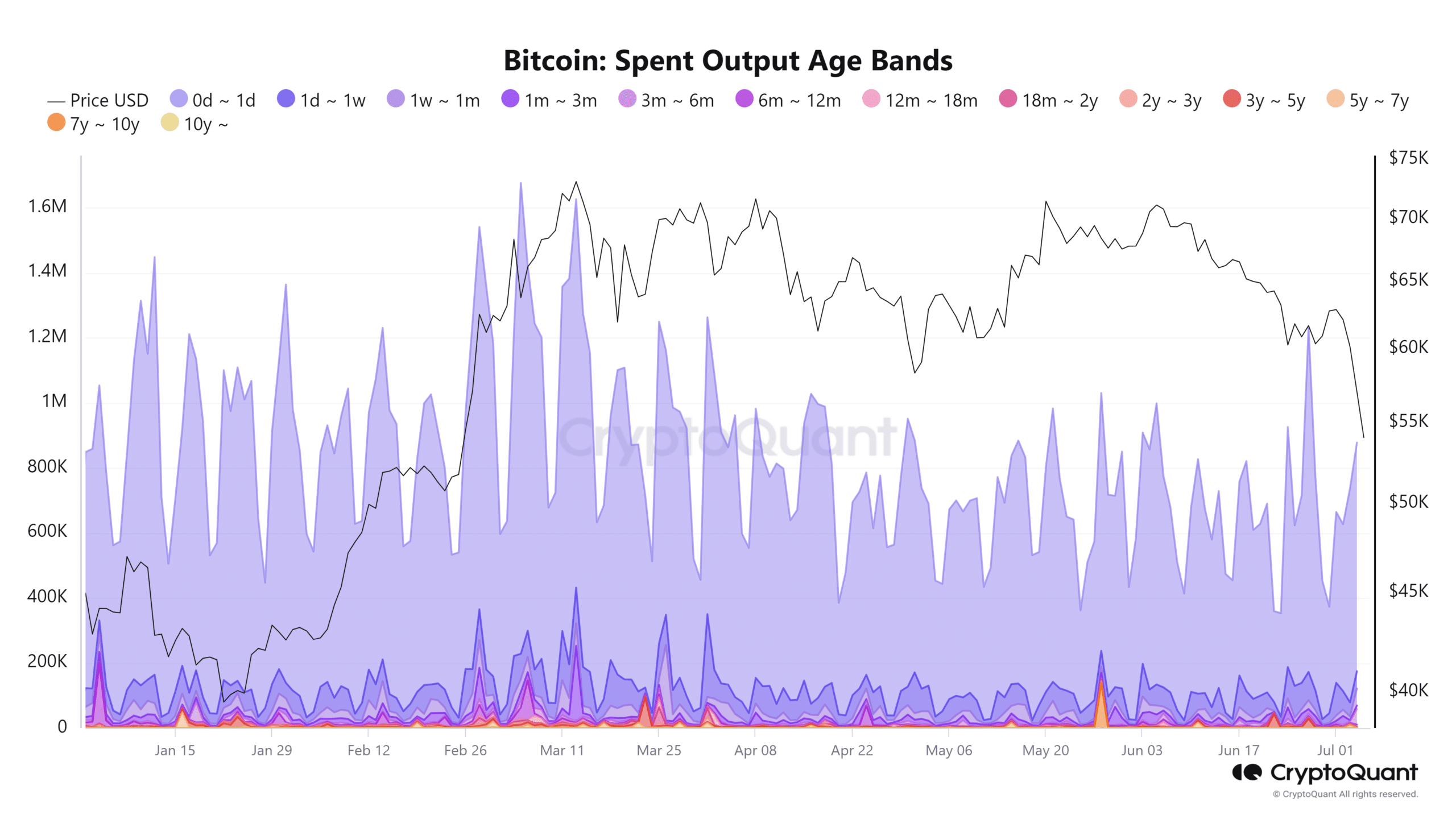

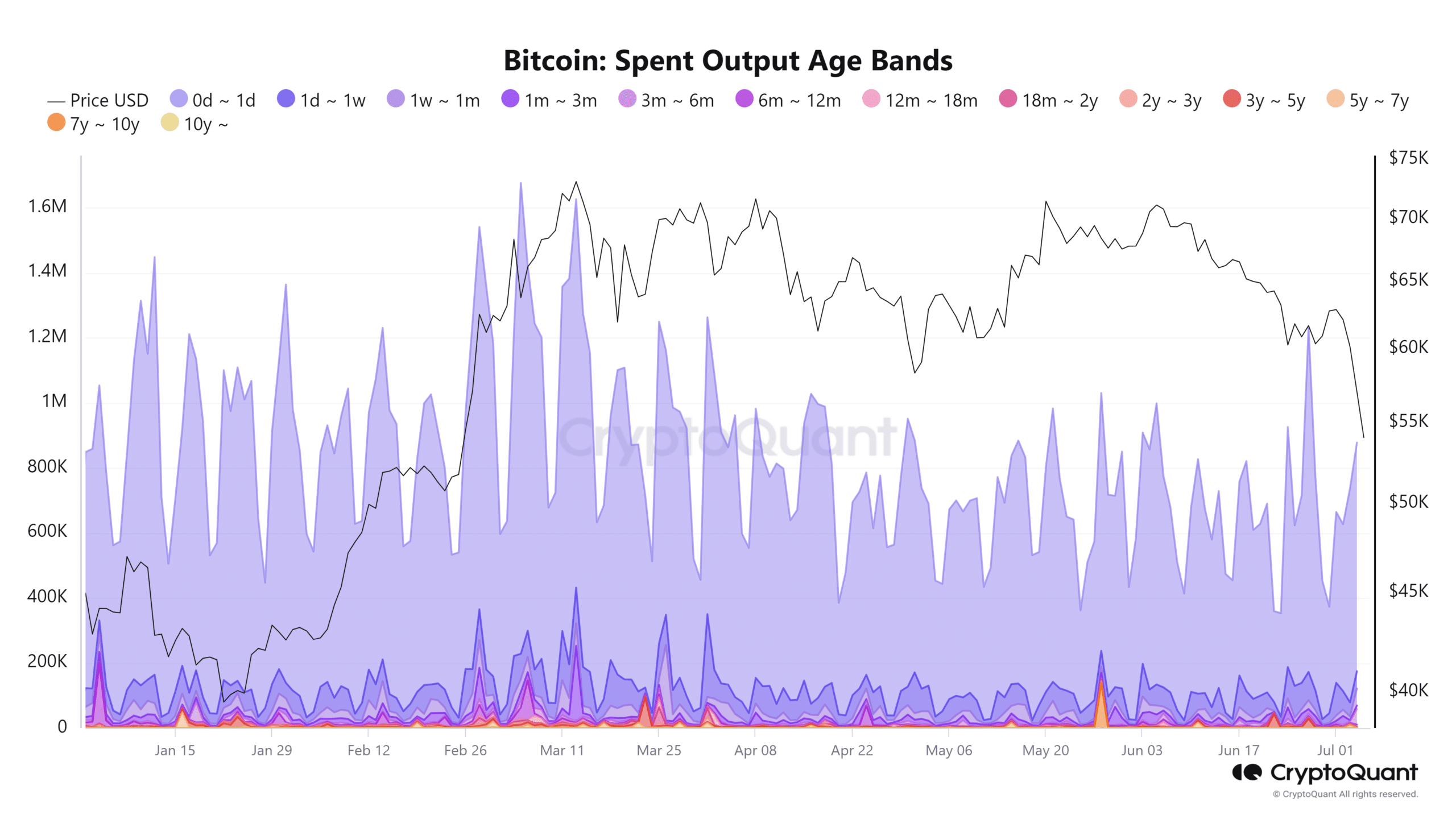

AMBCrypto is recent analysis of Bitcoin’s Spent Output Profit Ratio (SOPR) for Long-Term Holders and Spent Output Age Bands has revealed notable trends. The SOPR for long-term holders exceeded 10.

This indicated that despite falling BTC prices, these holders made significant profits when moving their BTC to exchanges. The SOPR value above one, as observed in the current graph, underlined this trend.

Additionally, AMBCrypto’s look at the Spent Output Age Bands provided insight into specific groups of long-term holders who are actively transferring Bitcoin.

The data showed that holders within the 5-7 year category were the most active, having moved over 10,000 BTCs on July 3. For this group, this was the highest transaction volume in months.

Source: CryptoQuant

The Mt.Gox corner

In addition to the impact of Bitcoin’s price drop, recent developments surrounding the defunct Mount Gox exchange could also impact the actions of long-term holders.

Reports indicate that Mount Gox recently moved a significant amount of Bitcoin to another wallet, including some transfers to a hot wallet.

These actions are part of the exchange’s preparations to repay its creditors more than a decade after its collapse.

This movement of BTC through Mt. Gox, that one Arkham reported to be 47,229 Bitcoins, worth approximately $2.71 billion, is significant.

With Mount Gox set to repay approximately $8.5 billion worth of Bitcoin to its creditors, anticipation of these transactions could cause long-term holders to move their holdings.

This move could be due to the fear of a further decline in the BTC price due to these large-scale refunds.

More shorts dominate Bitcoin trading

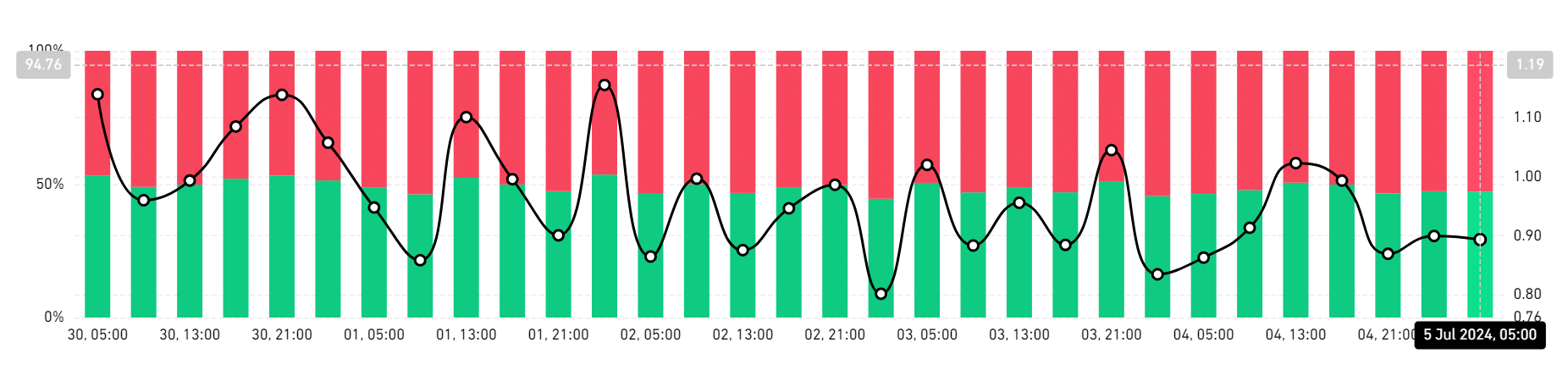

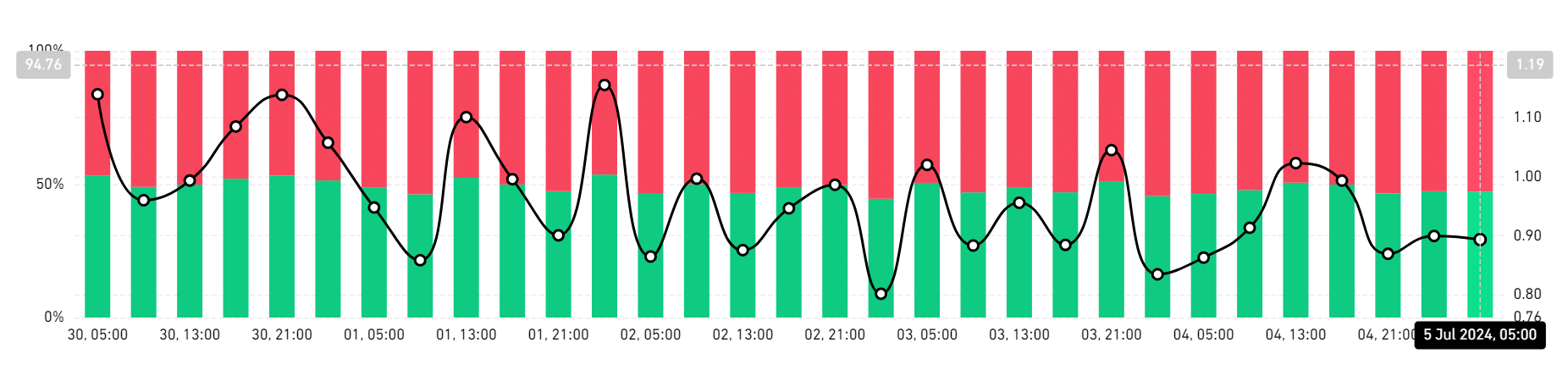

At the time of writing, Bitcoin was trading at around $55,300, based on the price movement in the daily time frame. Furthermore, a recent analysis seemed to indicate that short sellers have dominated the market over the past 48 hours.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024-25

According to Coinglass’s BTC Long/Short Ratio chart, the proportion of short positions stood at 52.64%, compared to 47.36% for long positions on July 4.

The short ratio has increased slightly to 52.81%, while the long ratio has decreased to 47.19%.