- Bitcoin plunges below $53,000, leading to a broad crypto market downturn.

- The crypto market turmoil extends to stocks, with notable responses from former President Trump.

After approaching the $70K mark, Bitcoin [BTC] recently dipped below $53K. According to CoinMarketCapBTC traded at $52,591, reflecting a drastic drop of 13.42% in just 24 hours.

This sharp decline caused a widespread crypto massacre, with many altcoins suffering significant losses.

Crypto massacre

Ethereum [ETH] fell by more than 20%, and Solana [SOL] fell by more than 16%, among other substantial declines across the market.

Despite the recent decline in Bitcoin’s value, the crypto community has remained resilient. Jameson Lopco-founder and Chief Security Officer at CasaHODL, emphasized this sentiment by stating:

“If looking at charts makes you sad, just switch to the Bitcoin dominance chart.”

Following this perspective, Samson MaaiCEO of JAN3, a company focused on Bitcoin adoption, underlined the positive outlook for the leading cryptocurrency, stating:

“If you’re worried about the collapse of the financial system, you want #Bitcoin. If you’re worried about war, you want #Bitcoin. If you’re worried about the future in any way, you want #Bitcoin.”

He further highlighted the opportunities for investors who are not currently purchasing BTC, adding:

“If you don’t want #Bitcoin, then you don’t understand Bitcoin or what’s going to happen.”

Bitcoin continues to decline

Despite the positive sentiment surrounding Bitcoin, the cryptocurrency fell further below $49,000 at the time of writing. Commenting on this, Jason A Williamsco-founder of Morgan Creek Digital, said:

“If you become more excited to buy Bitcoin as the price continues to decline, please like and retweet this post.”

Even more criticism Frank ChaparroHost of The Scoop podcast and director of special projects, added,

“Bitcoin could go to $20,000 before I feel anything.”

It is striking that the turbulence did not only affect the crypto market; it also extended to the stock market, which suffered a significant downturn.

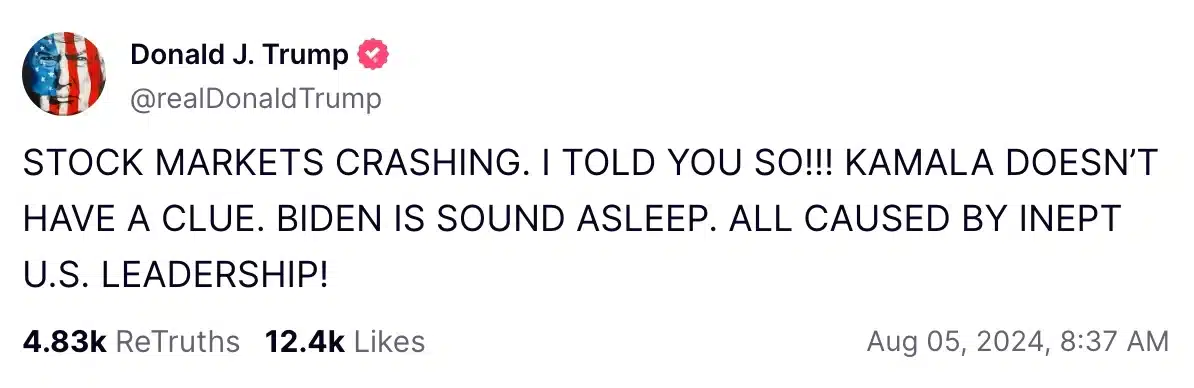

But what shocked the community was former President Donald Trump’s recent statement on Truth Social, in which he noted:

Source: Truth Social

Statistics about the chain paint a different picture

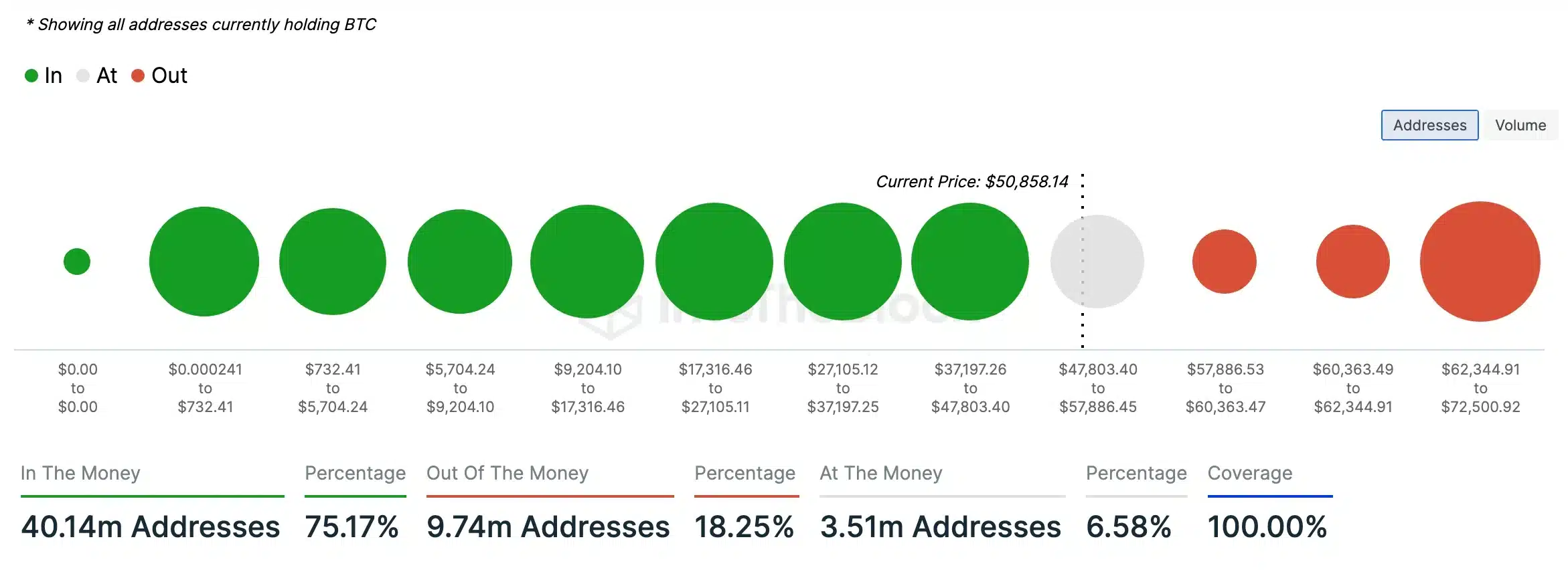

To understand the true essence of the market dynamics, AMBCrypto analyzed the IntoTheBlock data and revealed that a significant majority (75.17%) of BTC holders owned tokens valued higher than their purchase price at the time of writing, indicating that they were ‘in the money’.

In contrast, a smaller segment (18.25%) owned BTC tokens that were worth less than their purchase price, putting them ‘out of the money’. This suggested bullish sentiment or a possible upcoming price increase for Bitcoin.

Source: IntoTheBlock

That said, eToro market analyst Josh Gilbert, speaking at a publication, said it best when he said:

“When you invest in crypto assets, you enter the ring of volatility. This is a small jab for crypto, not even a black eye. We have more rounds left of this bull market before the bell rings.”