- Bitcoin could fall in the new year based on historical patterns.

- BTC has fallen 6.01% since the Christmas rebound.

Bitcoin last week [BTC] acted against market expectations. On Christmas Eve, BTC saw a significant increase, from $92,000 to $99,000.

The price movement initially created optimism in the market, with investors expecting a strong start to the new year. However, Bitcoin has experienced extreme volatility since then, hitting a low of $91,315.

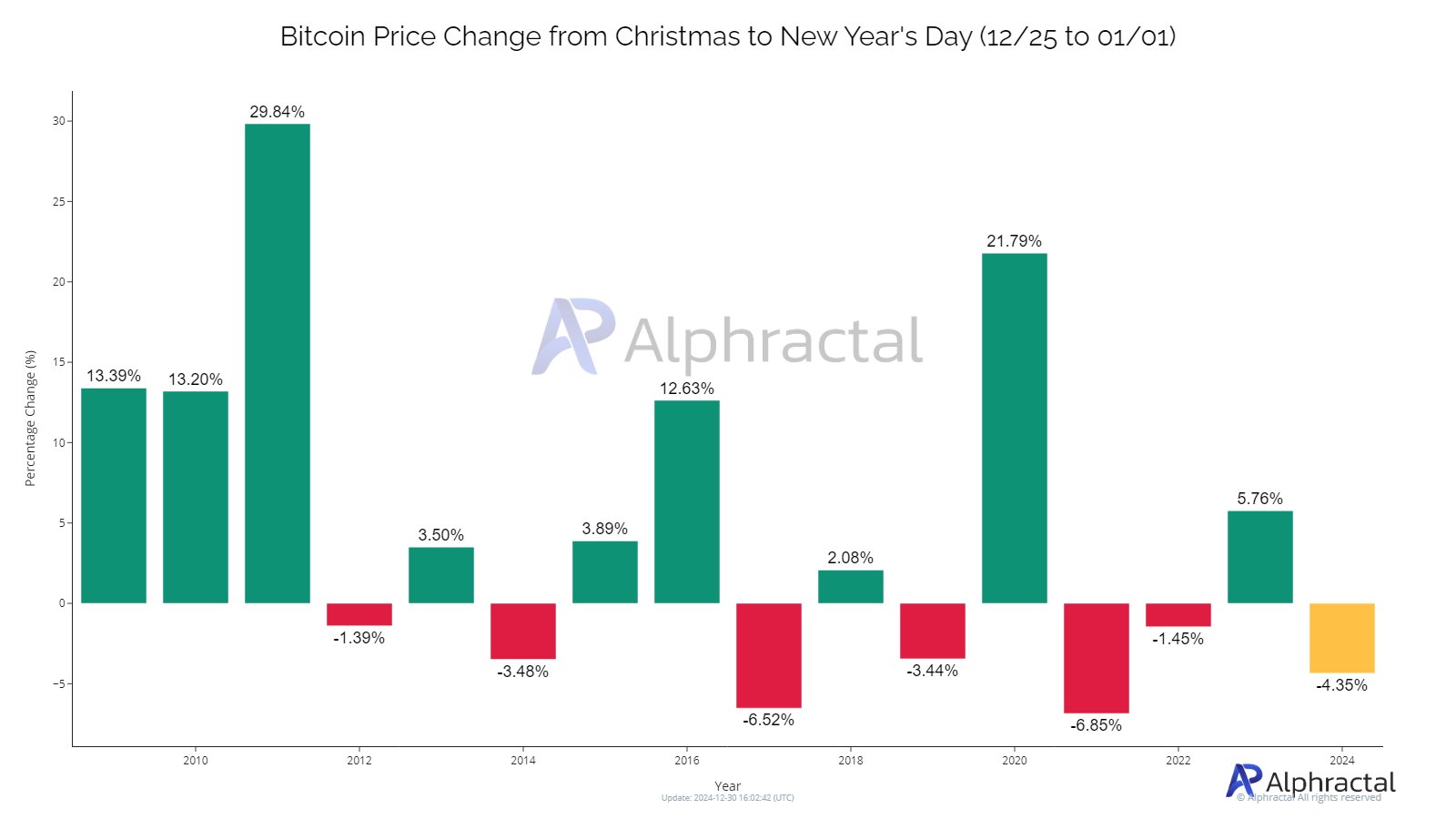

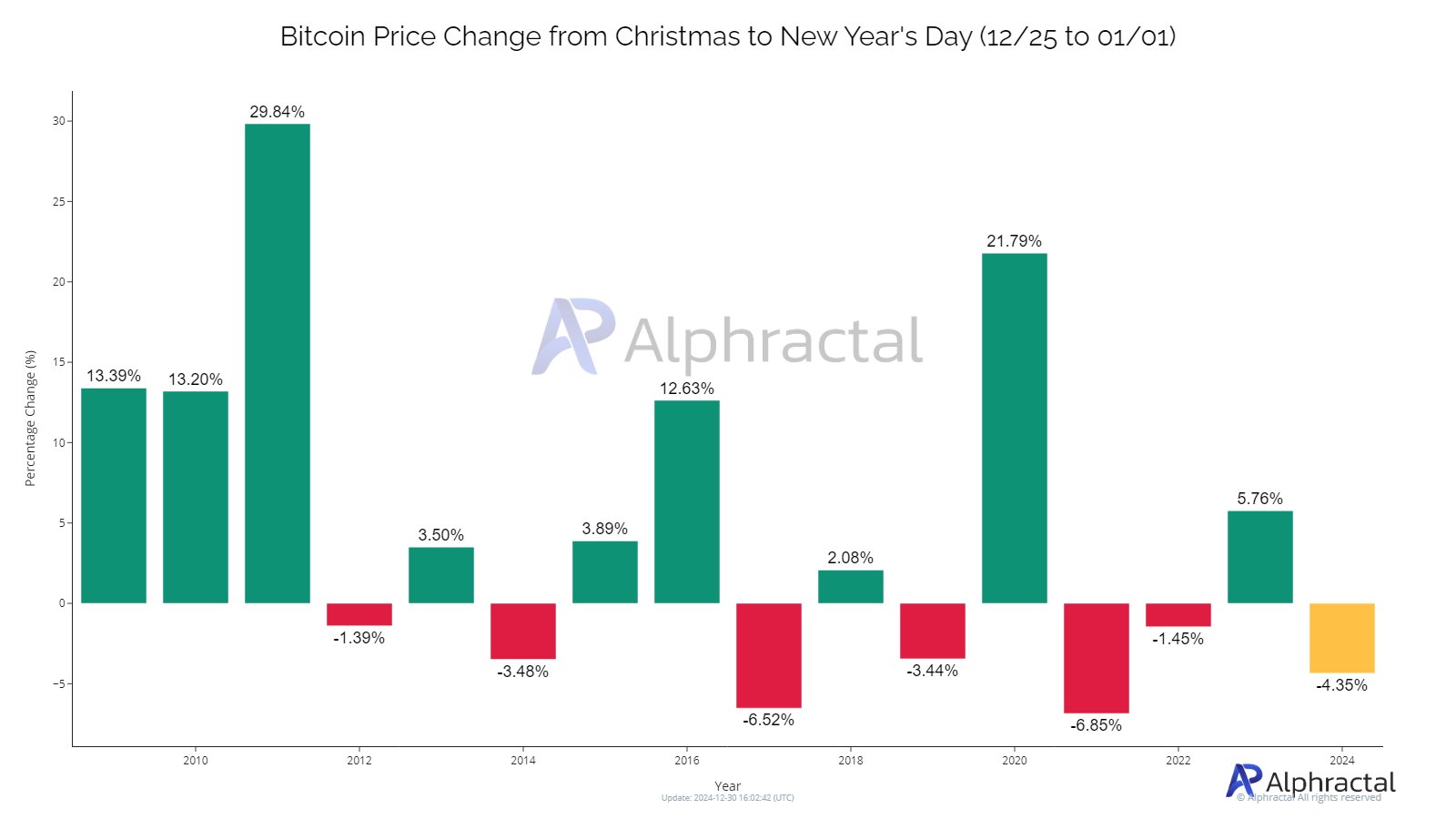

These market conditions have prompted analysts to discuss BTC’s price movement through 2025. According to Alpharactal, Bitcoin could see a sharp decline as we approach the new year, based on historical cycles.

Bitcoin price variation analysis

Based on Alphractal According to analytics, Bitcoin has experienced mixed behavior between Christmas and New Year’s Eve over the years.

Source: Alpharactal

Bitcoin has seen both peaks and valleys. Since December 25, BTC has fallen 6.01% at the time of writing, from $99,881 to $93,879.

According to Alpharactal, this decline may indicate a negative trend heading into the new year, based on historical patterns.

In previous cycles, negative variations were observed during specific years, including 2012-2013, 2014-2015, 2017-2018, 2019-2020 and 2021-2022. These periods saw a negative trend in Bitcoin prices, with market behavior reflecting typical year-end volatility and uncertainties.

However, in some years Bitcoin showed positive performance or modest variations. For example, in 2013-2014 and 2015-2016 there was a moderate appreciation.

Based on previous cycles, late 2024 could follow this negative pattern, following the 6% decline since Christmas. Therefore, the new year could start with a negative trend that will continue into 2025.

What lies ahead for BTC

While historical patterns rarely repeat themselves, it is essential to look at other market indicators and see what they say about BTC heading into the new year.

According to AMBCrypto’s analysis, Bitcoin is currently in a consolidation phase and it appears that investor sentiment has turned bearish as they worry about crypto’s lack of clear direction.

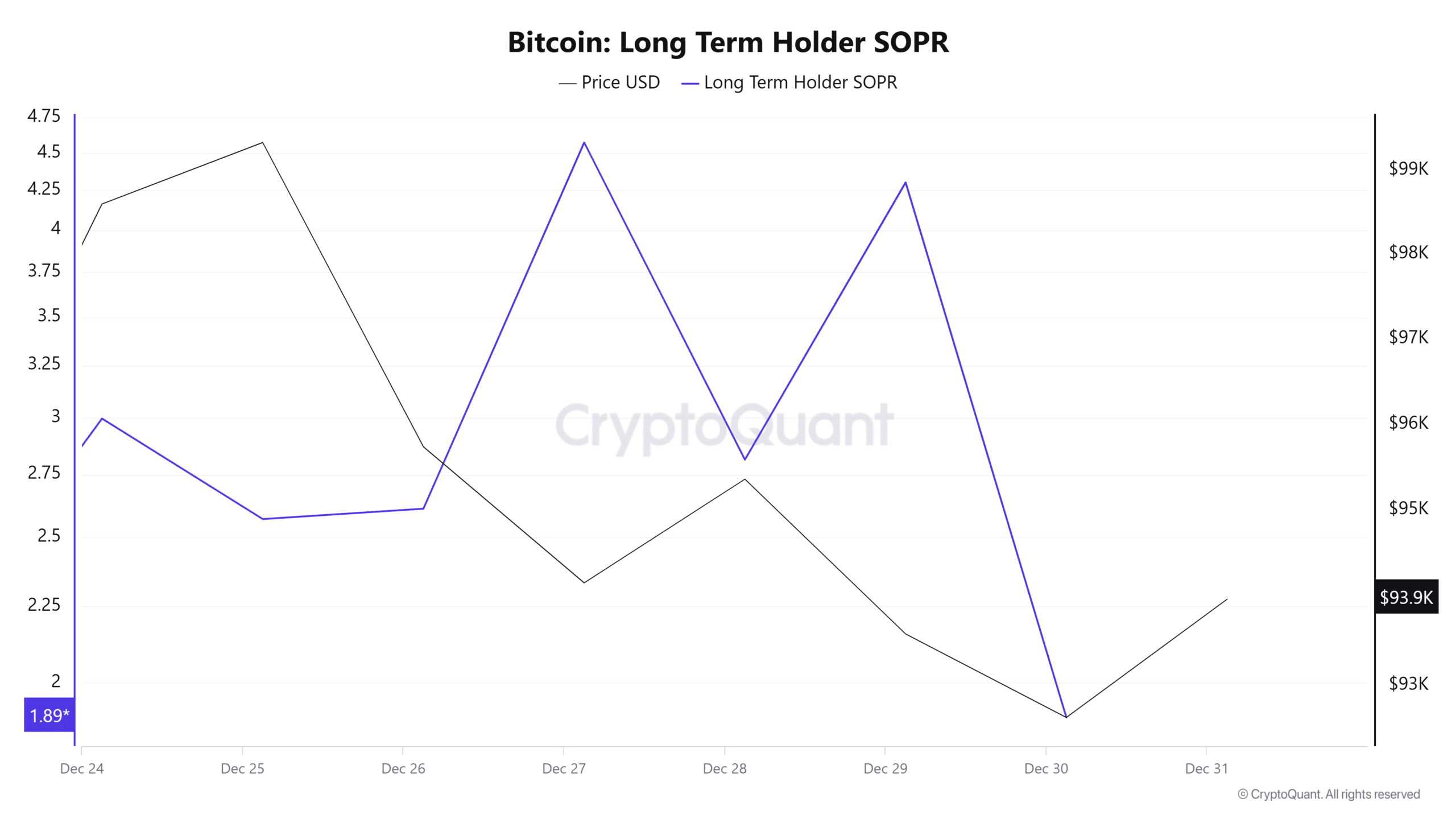

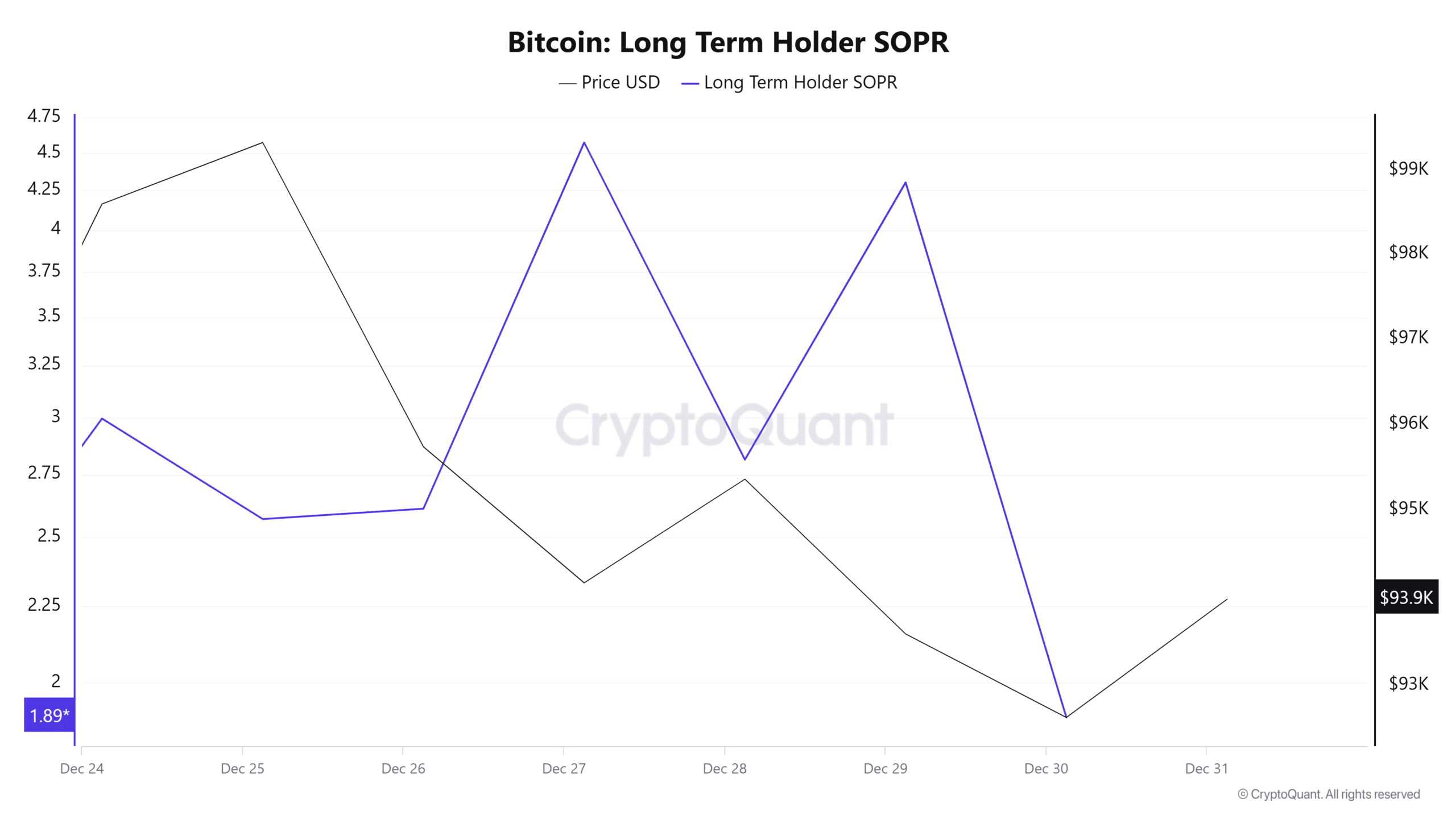

Source: CryptoQuant

For example, the long-term holder SOPR of Bitcoin has fallen from 4.5 to 1.8, indicating that long-term holders have less confidence in the market and are willing to sell at a loss. This can put downward pressure on prices, further increasing this bearishness.

Source: Santiment

Read Bitcoin [BTC] Price forecast 2025-2026

Furthermore, Bitcoin’s Price Daily Active Addresses (DAA) differential has remained negative over the past week. This indicates a decrease in the number of active addresses and participants. Therefore, the current price may be relatively high and can be adjusted to meet actual demand.

In conclusion, Bitcoin could experience a decline in the new year. If the historical pattern repeats, BTC could drop to $91,500. However, if buyers enter the market in anticipation of a post-new year rally when participants return, Bitcoin could reclaim $95,400.