- Bitcoin costs fell after the halving, reducing miners’ revenues.

- Runes could cause an increase in activity on Bitcoin’s block space, and fees could rise again.

Bitcoin [BTC] Fees have been an important topic in the crypto market since the halving on April 20. The day before the halving, the average fee on the Bitcoin network rose to $128.

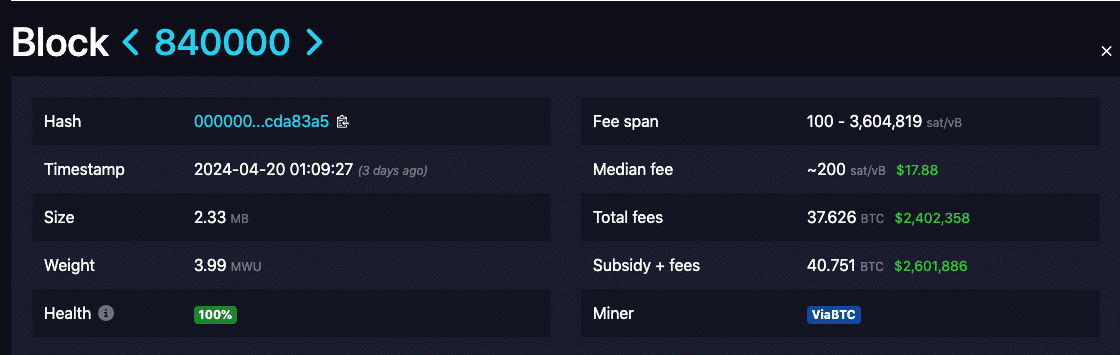

On the halving day itself, the total fees paid to have a transaction processed on the 840,000th block amounted to a staggering $2.40 million. This value was according to mempool.space.

Source: mempool.space

But at the time of writing, costs have dropped and averaged $8 to $10. But why have costs increased in the first place?

In this piece, AMBCrypto explains Bitcoin fees, why they’re suddenly rising, and what else you can expect. Read more.

Bitcoin fees: a way to reward miners

Bitcoin fees are also called transaction fees on the network. They are paid to miners as an incentive to keep the network running.

Typically, the average cost required to process a transaction is small. However, the unexpected increase that sometimes occurs may be due to the size of the transaction or network congestion.

Here’s a simple explanation. On the Bitcoin network, the data space for each block is not limitless but limited.

Therefore, if miners have to process a large number of transactions within one block, the costs for the participant increase.

When does this happen? Bitcoin fees become extremely high when many participants want their transactions to be processed quickly. However, last weekend wasn’t the only time rates on the network spiked.

In January 2023, the launch of Ordinals caused congestion on the network. At that time, in addition to the high fees, miners found it difficult to process every transaction on every block, causing the network to crash for some time.

So if you want faster transactions when the network is congested, you’ll have to pay a higher rate. You can also wait until fees are lower before attempting to have your transactions confirmed.

However, this could take hours, and in the past it has taken days.

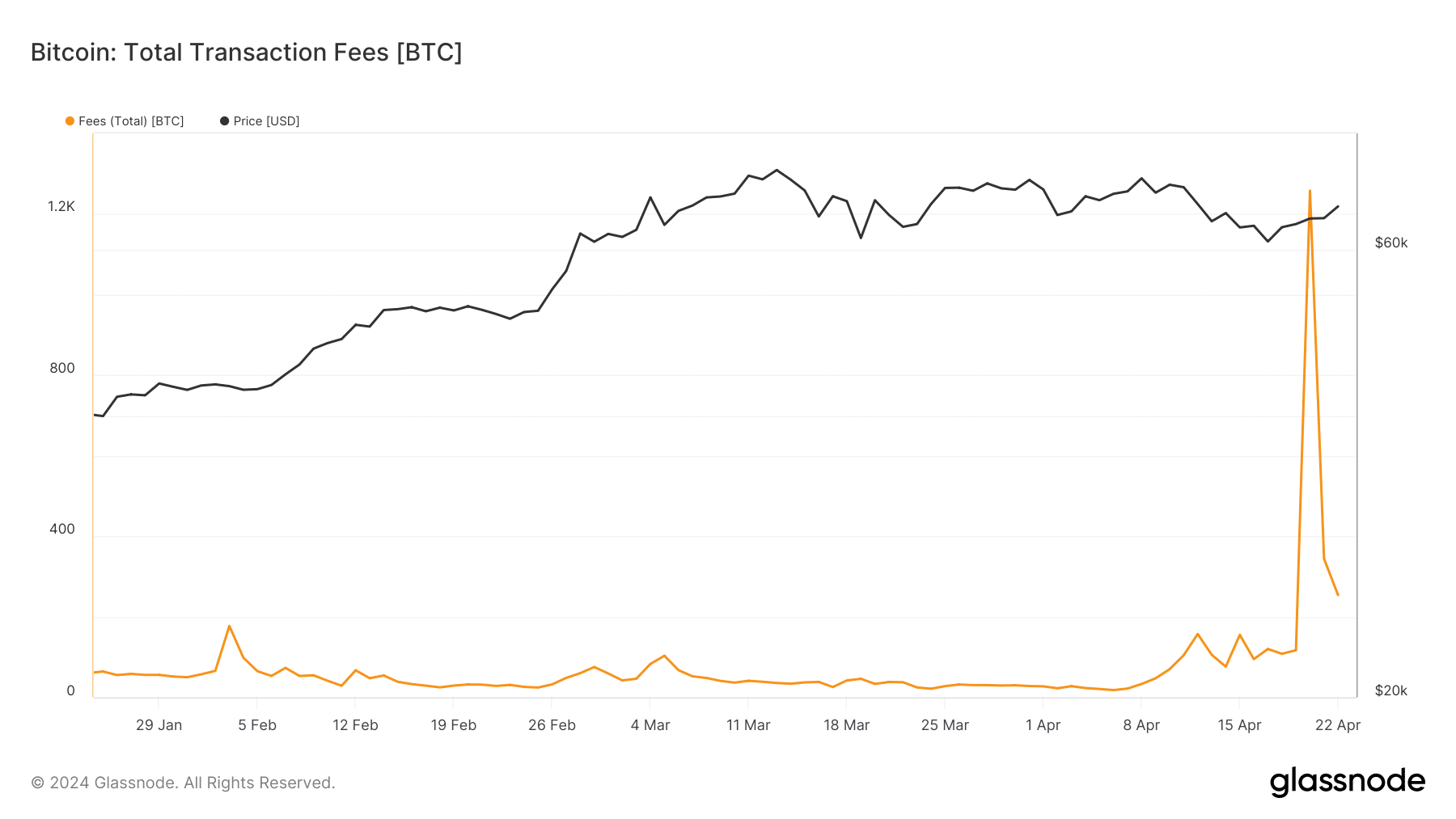

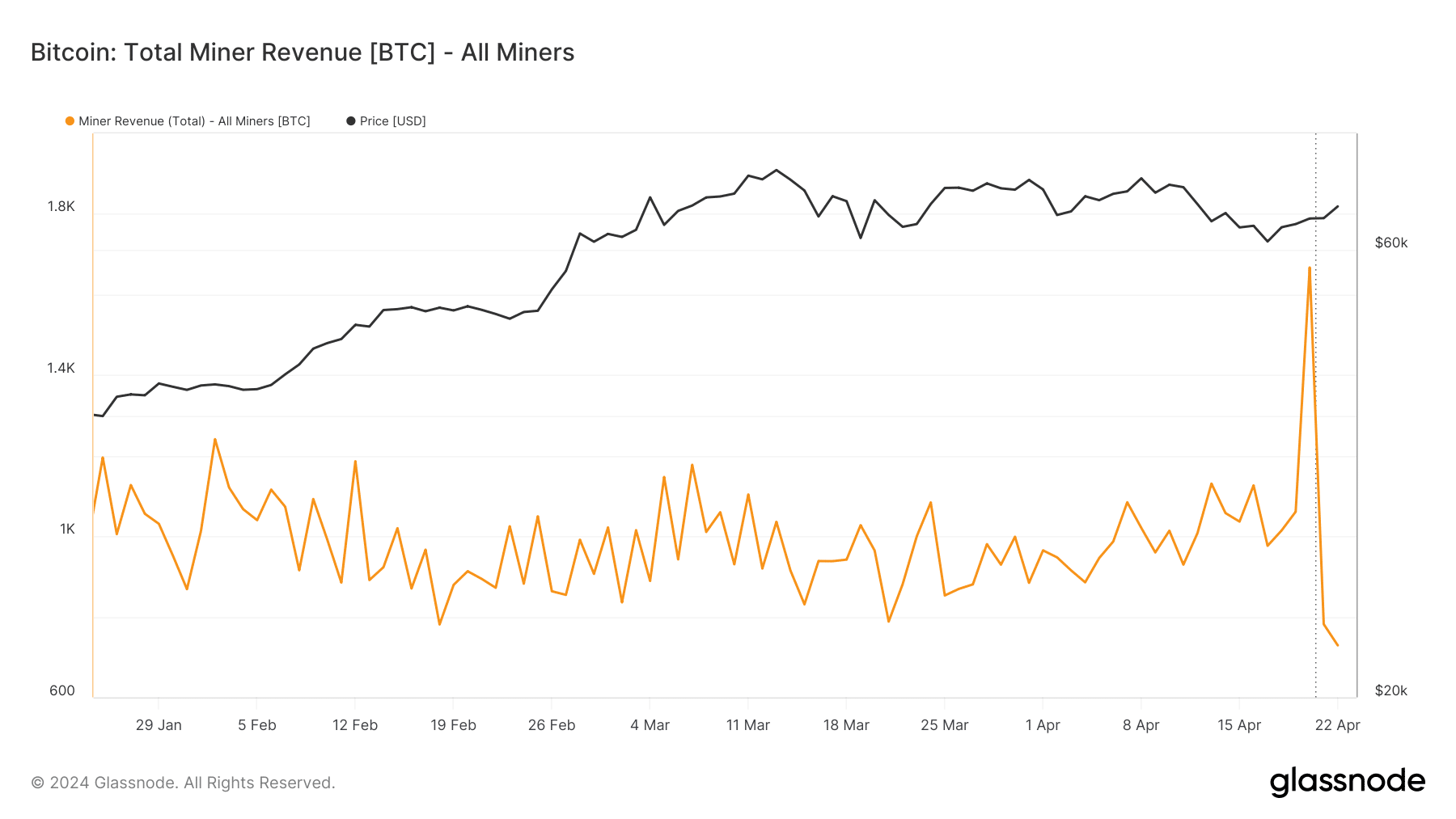

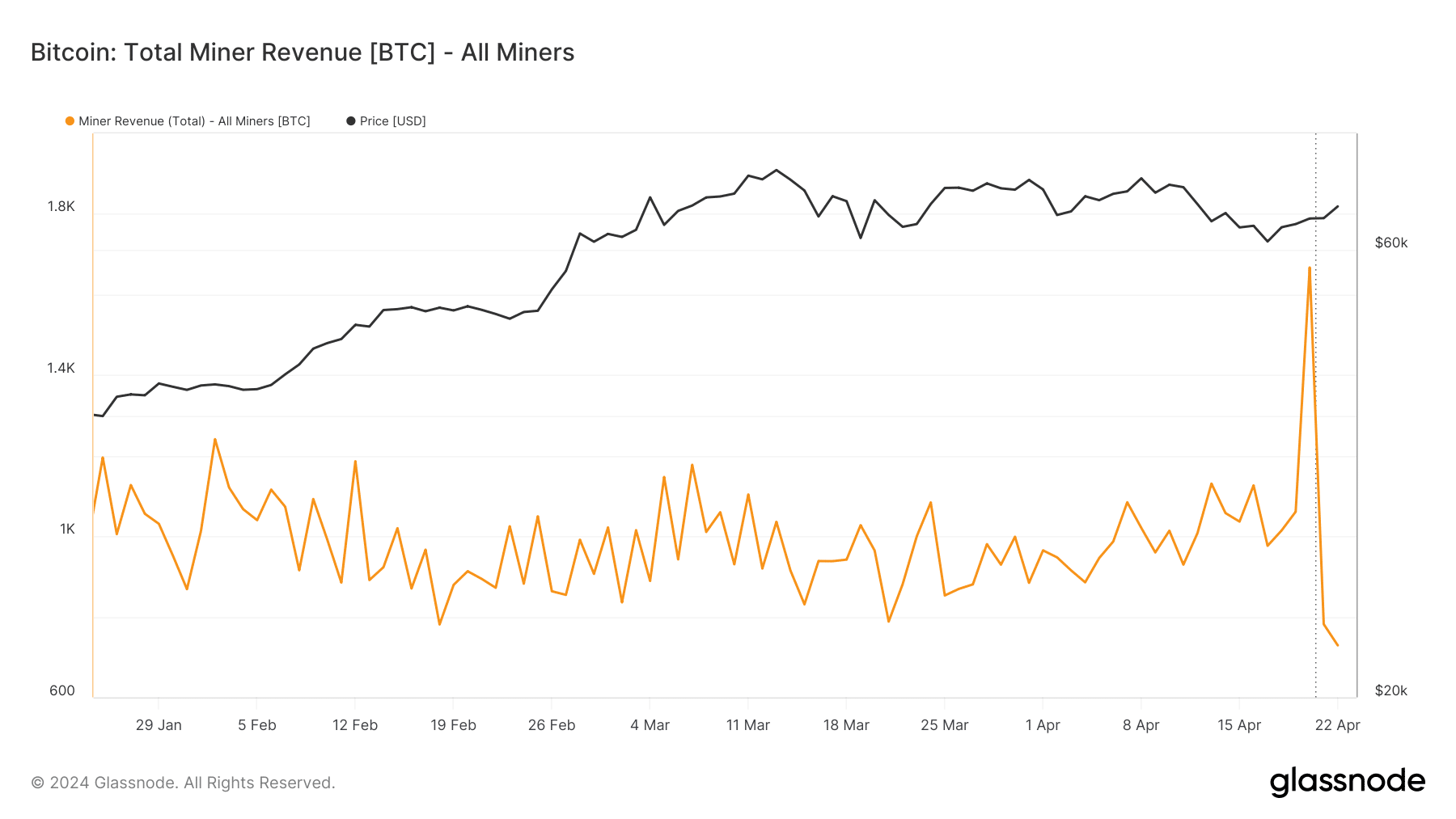

According to AMBCrypto’s on-chain analysis using Glassnode, fees on the network rose to 1,257.71 BTC on April 20.

Recall that it was also on the same day that miner rewards were halved – from 6.25 to 3.125 BTC.

But at the time of writing the metric had dropped to $253.93 BTC, indicating that network congestion had decreased.

Source: Glassnode

Runes and Ordinal Numbers Can Affect Bitcoin Fees and Miners – How?

In the future, there is a chance that traffic congestion will return due to the development of Runes. The Runes Protocol is a standard for minting tokens on the Bitcoin network.

For Bitcoin developer Casey Rodarmor, Runes offers a more efficient way to create fungible tokens in a way that Ordinals cannot.

Interestingly, Rodarmor was also the creator of Ordinals, which led to the development of BRC-20 tokens.

Although tokens have not yet been officially launched on Runes, Rodarmor explained why Runes was better than BRC-20 on his X page (formerly Twitter). According to him,

“One advantage of runes over BRC-20 is that if you have a UTXO that has a certain amount of runes, you can create multiple PSBTs that offer to sell different amounts of those runes from the UTXO, with runestones that have different amounts of transfer to the buyer and return the remainder to the seller.”

For context, UTXO stands for Unspent Transaction Output. On the protocol, the UTXO represents the balance of coins that a user can spend in the future via a specific address.

For miners, Runes can have many benefits. Theoretically, the development could increase transaction volume on the network.

This in turn could improve Bitcoin costs and miner revenues, which are expected to shrink, could be a saving grace.

In the meantime, AMBCrypto looked at the gain. This metric is the total of fees and block rewards that miners receive.

At the time of writing, the total turnover was 728.93 BTC, which was a drop of 38.83% from what it was on the day of the halving.

Source: Glassnode

In the short term, Bitcoin costs can remain low and affordable. However, users should not rule out a new spike in fees, especially since tokens on the Runes Protocol can soon be staked.

Read Bitcoin’s [BTC] Price forecast 2024-2025

When the tokens come to life, participants can use the OP_RETURN. For context, the OP_RETURN allows people to randomly add to transactions.

Should this become rampant, the default lock scripts could cause a high demand for BTC, again causing congestion on the network and causing fees to return to the anomaly.