- Bitcoin must convert the $ 85,000 resistance into a support zone for a bullish breakout.

- Monitoring ETF current trends In addition to important technical levels, it will be essential when assessing the BTC process in the short term.

Bitcoin [BTC] is between $ 81,000 and $ 85,000, since its decrease up to $ 78ka week ago. Changing the $ 85k resistance to a solid demand zone is now the key to a rally.

Technical analysis suggests that if BTC has the support level of $ 81,000, this lower support zones could test around $ 78,446. Conversely, the recovery and consolidation of $ 85,000 can clear the way for higher goals.

Drawing a potential bitcoin base

Bitcoin saw half a billion dollars on 17 and 18 March intake In BTC ETFs. This meant the first consecutive institutional inflow this month.

In the meantime, the fear index, which shifts from “extreme fear” to fear, has indicated a potential soil historically, which offers a chance to buy BTC with a discount for surplus returns.

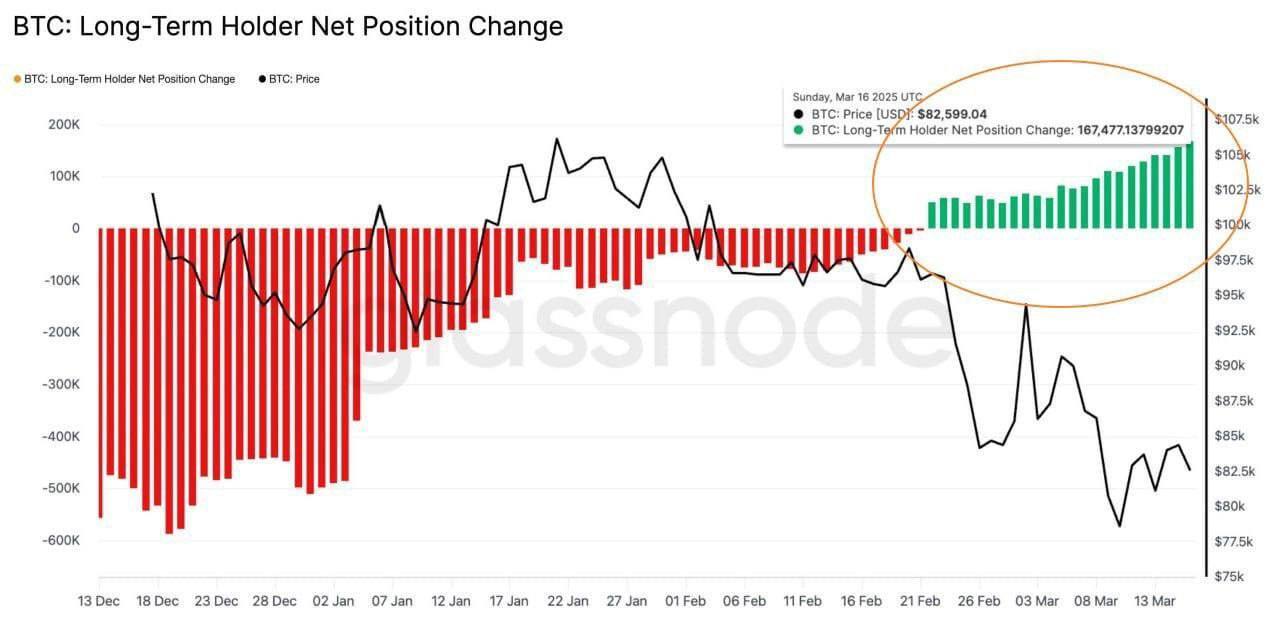

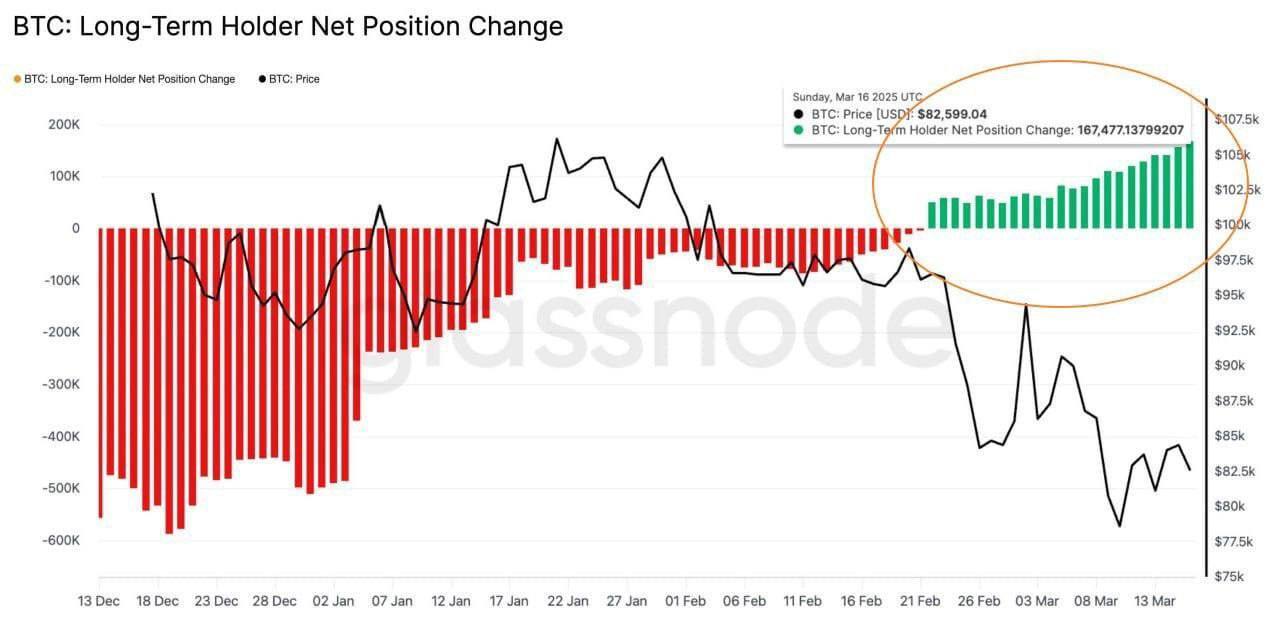

Long -term holders (LTHs) seem to agree. On March 16 she broke 167k BTC at $ 82k.

Source: Glassnode

But despite strong intake and accumulation, Bitcoin still struggled to break $ 85k. Heavy leverage with support keeps it above $ 80k, but prohibits liquidations when taking a profit starts at $ 85k.

In other words, every BTC dip sees a peak in it lever And a jump of $ 2 billion in open interest (OI). But while BTC $ 85k wins back, sluitations, OI relaxationAnd the price drops back to $ 80k.

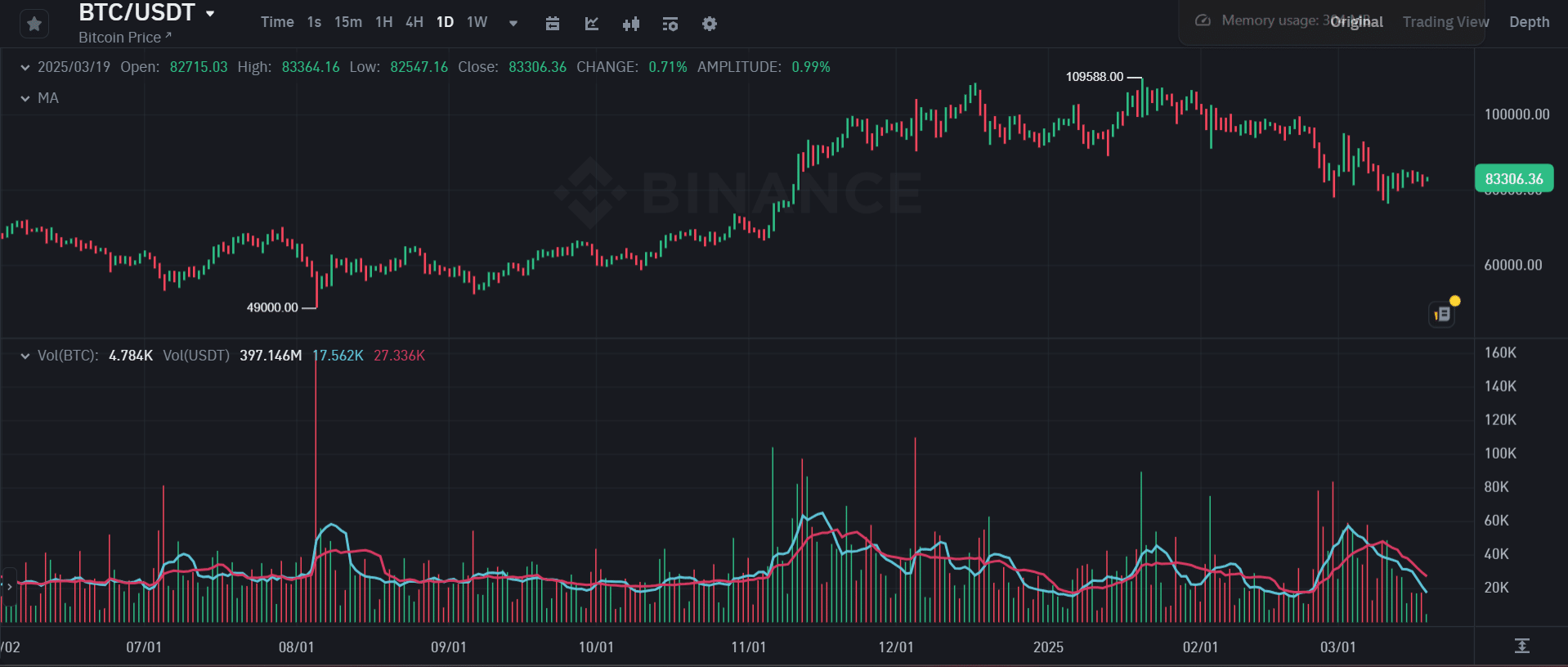

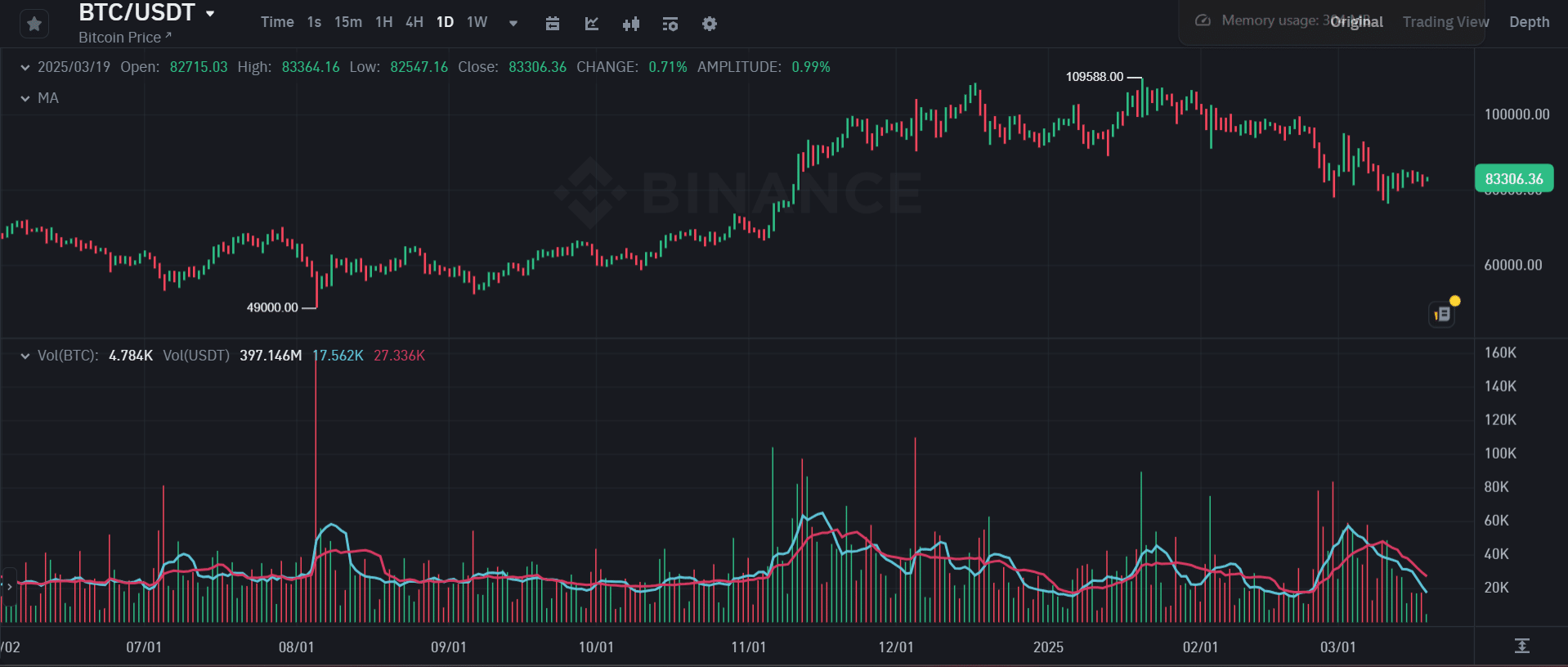

This pattern makes Bitcoin vulnerable, with a potential withdrawal in the midst of continuous macro -economic risks. Moreover, Binance data reveals a low trade volume, whereby spot markets do not miss important buying orders.

Source: Binance

It is clear that there are signs of $ 85k in support – but it is not there yet.

With a weak spot demand, there is still a risk with long squeeze

This graphic Show that a retest of $ 84,772 could still activate a flush-out, which means that 772.4k bitcoin runs the risk of sale.

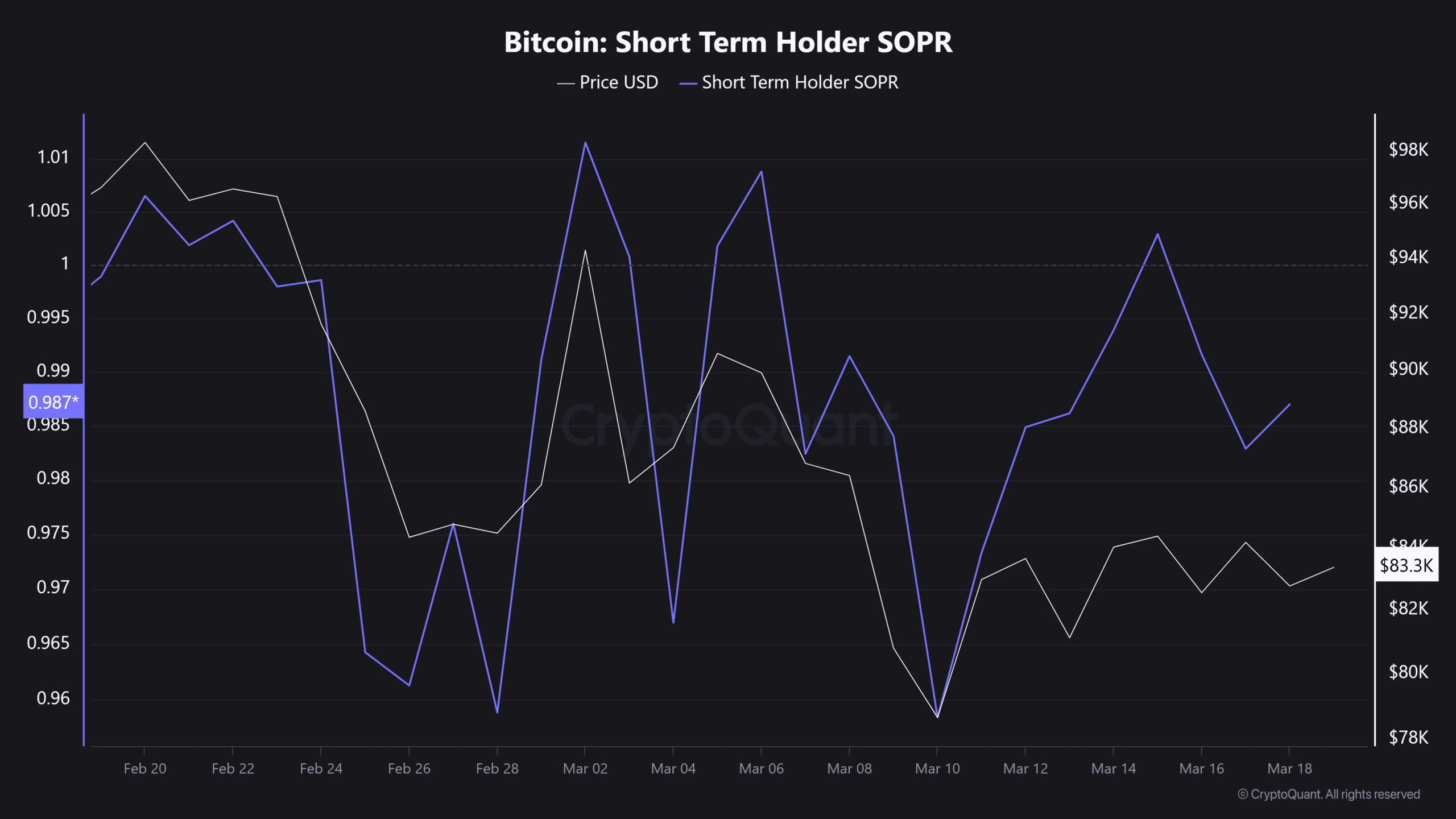

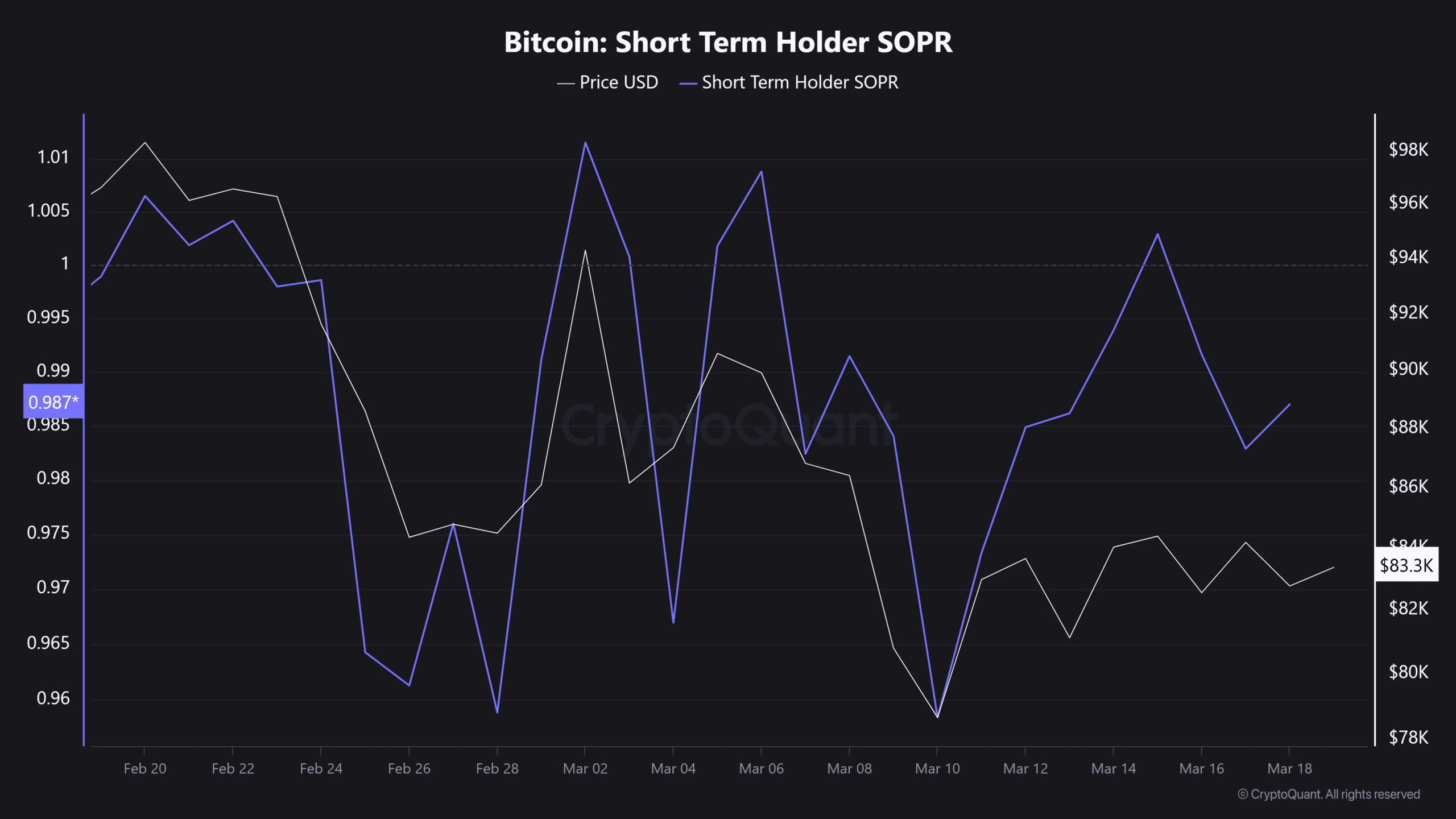

Short -term holders (STHS) remain careful because the volatility persists, not the preferred strategy with Hodling.

The STH output gain (Sopr) has become negative, indicating that STHS (retention <155 days) realizes losses, which contributes to the sales pressure.

Source: Cryptuquant

Leverage continues to rise, with Oi An increase of 0.64% to $ 48.80 billion. However, the weak spot demand increases the chance of a long squeeze as soon as Bitcoin crosses this level.

Without strong institutional accumulation, liquidity could rise on the sales side, leading to mass liquidations of long positions and withdrawing a potential retirement to the $ 80k demand zone.

To make this set -up invalid and to activate a Bear Trap, Bitcoin must generate a strong buying momentum for $ 85k to break resistance.