On-chain data shows that Bitcoin’s short-term holders have made only minimal gains of late, despite the asset’s latest rally.

Bitcoin Short-Term Holder SOPR is currently at a relatively low level

As noted by an analyst in a CryptoQuant Quicktake afterthe short-term holder SOPR is still within the range that has signaled overheated conditions for the asset over the past year.

The “Spent Output Profit Ratio” (SOPR) here refers to an indicator that tells us whether Bitcoin investors as a whole are selling their coins at a profit or a loss.

When the value of this statistic is greater than 1, it means that the average holder on the network transfers their coins at a net profit. On the other hand, the fact that it falls under this mark implies that loss-taking is dominant.

In the context of the current discussion, the SOPR of a specific segment of the BTC user base is of interest: the short-term holders (STHs). This cohort includes the BTC investors who purchased their coins in the last 155 days.

Statistically, the longer an investor holds onto their coins, the less likely they are to sell them at any time. Because STHs are relatively young holders, they don’t have much resilience and thus can be prone to panic selling when there is a major change in the market, such as a rally or a crash.

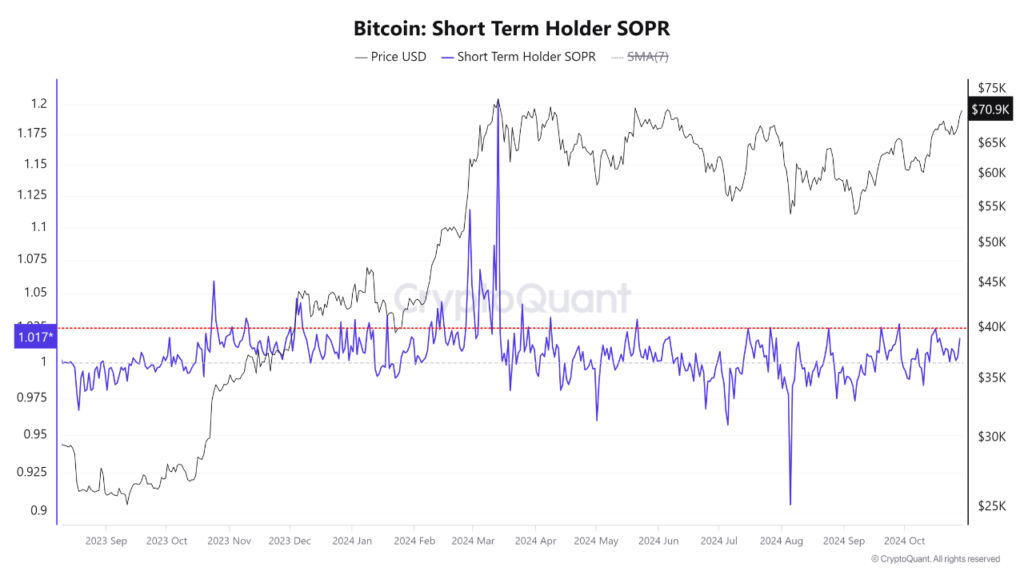

Here is a chart showing the trend in the Bitcoin STH SOPR over the past year or so:

As shown in the chart above, the Bitcoin STH SOPR has recently been above the 1 level, indicating that this group has made a net gain from their trades.

With the latest bullish push seeing BTC past the $71,000 level, the measure has seen some upside as STHs have ramped up their profit-taking. The indicator is now at 1.017.

However, the chat shows that this is actually not such a high value. According to the quantitative indicator, it has been found that the indicator is overheating when it breaks 1.03 during the recent consolidation phase. The last value was clearly below this figure.

As such, the rally could have more room to grow before the STHs’ profit-taking becomes a threat. This only assumes that the same 1.03 limit would also apply to the current market, as the STH SOPR could have reached much higher levels before Bitcoin topped out in March this year.

The indicator could be monitored in the coming days as the next move could provide hints as to where the cryptocurrency’s price could go next.

BTC price

Sitting at the $71,200 level, Bitcoin is now not far away from surpassing the June high.