Following Monday’s market crash, concerns have arisen about the stability of Bitcoin’s bull run. Still, Ki Young Ju, founder and CEO of CryptoQuant, a leading blockchain analytics company, has a positive outlook. He suggests that despite the recent crash, on-chain data continues to support the idea that Bitcoin’s bull market remains intact.

Bitcoin On-Chain Analysis: Bullish Arguments

#1 Bitcoin Hashrate

The Bitcoin hashrate, which measures the computing power used in mining and processing transactions, is approaching an all-time high (ATH). Ju notes: “The miners’ capitulation is almost over, with hashrate approaching ATH. The US mining cost is ~$43,000 per BTC, so the hashrate is likely to be stable unless prices fall below that.”

#2 Whale behavior

Bitcoin’s significant inflows into custodial portfolios are another argument to be bullish, pointing to strong accumulation by large-scale investors, often called whales. Ju emphasizes: “Significant inflow of BTC into custodial portfolios. Permanent holder addresses increased by 404,000 BTC in the last 30 days, including 40,000 BTC in US spot ETFs. New whales are piling up.”

Related reading

#3 Private investor participation

Current moderate retail investor participation is similar to patterns observed in mid-2020. Ju notes: “Retail investors are largely absent, similar to mid-2020.” This absence could contribute to less volatility, as retail trading often leads to rapid price swings.

#4 Old whales still HODL

Between March and June, long-term holders (those who have held for more than three years) transferred their Bitcoin holdings to newer investors. Currently, there is no significant selling pressure from these experienced holders.

Bearish on-chain data

#1 Macro risks

On the other hand, Ju points to macroeconomic risks and recent market activities that could impact Bitcoin’s price stability: “Macro risks could lead to forced sell-offs. There have been large crypto deposits recently made by Jump Trading, and Binance ranked high YTD in daily deposits.”

Related reading

#2 Borderline indicators on the chain

While some on-chain indicators have turned bearish recently, Ju says they are borderline. He states: “Some indicators on the chain have turned bearish, but are on the borderline. If bearish trends persist for more than two weeks, market recovery could become challenging.”

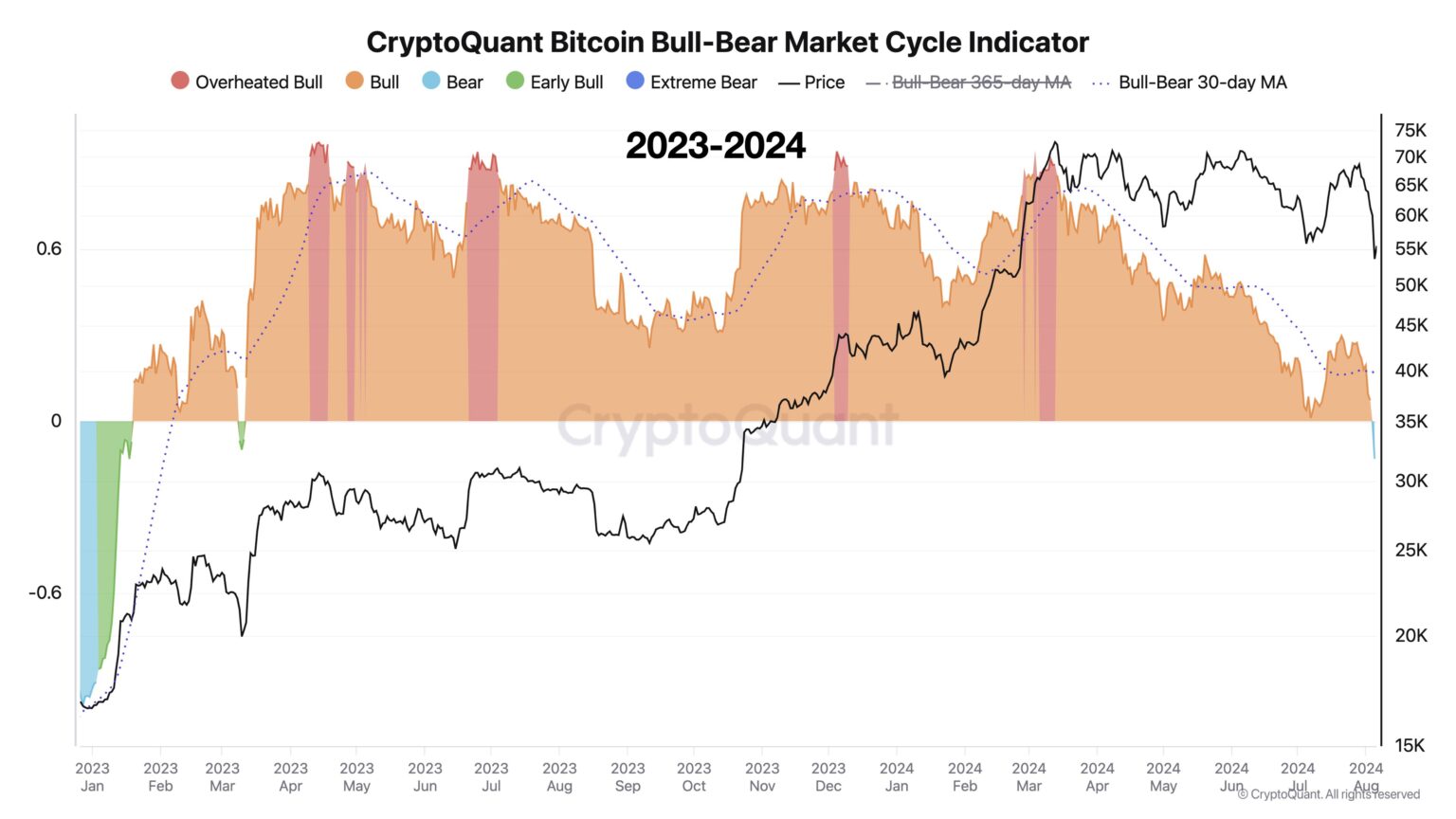

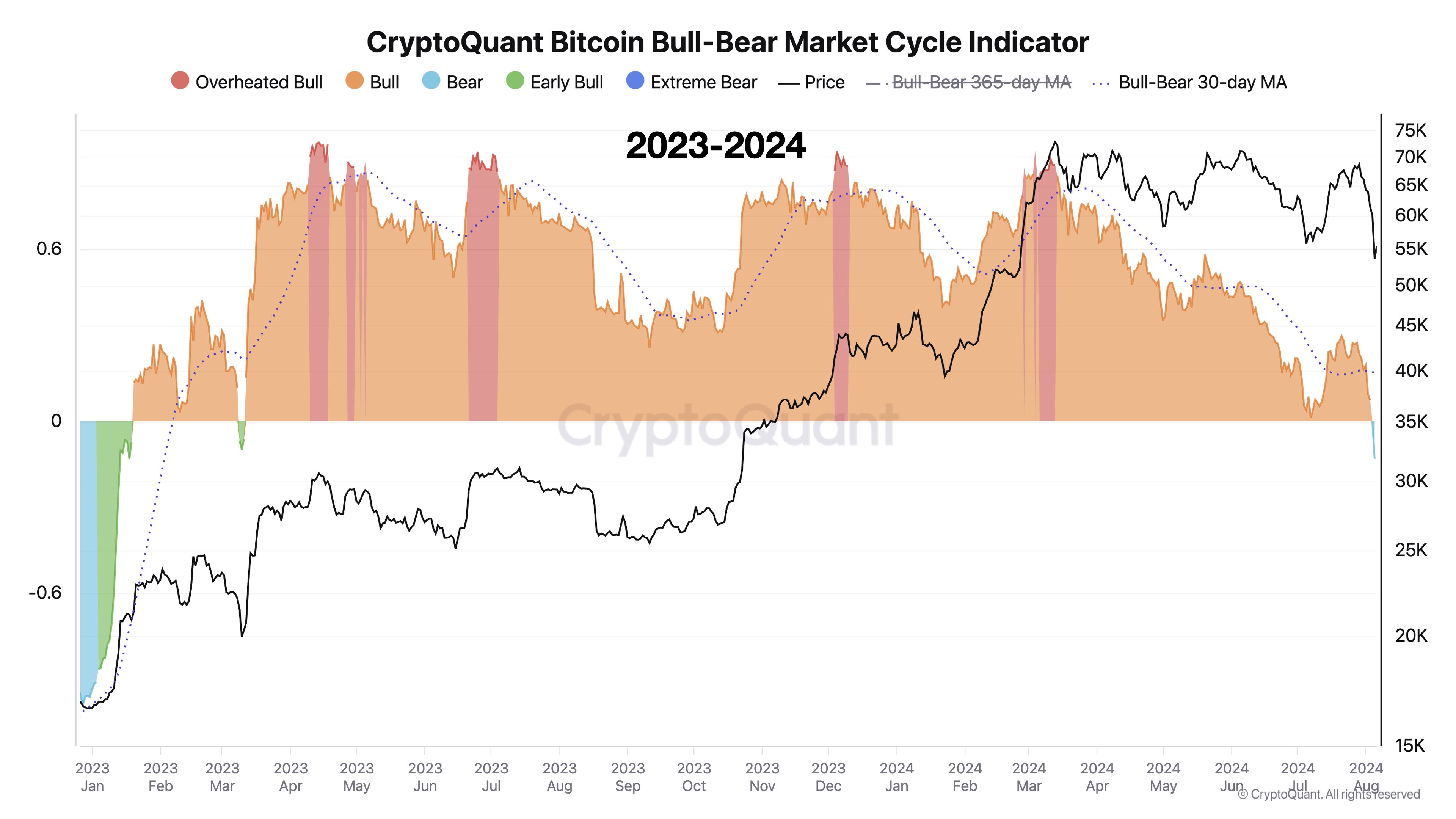

#3 Bull-Bear cycle indicator flags bear phase

Notably, the Bull-Bear Market Cycle Indicator has also marked a bear phase (high blue area in the chart) for the first time since January 2023, which warrants close observation. Julio Moreno, CryptoQuant’s head of research, added that this indicator has previously identified limited bear phases during major market events such as the COVID sell-off in March 2020 and the Chinese mining ban in May 2021. Furthermore, it also correctly anticipated the onset of the bear market. in November 2021.

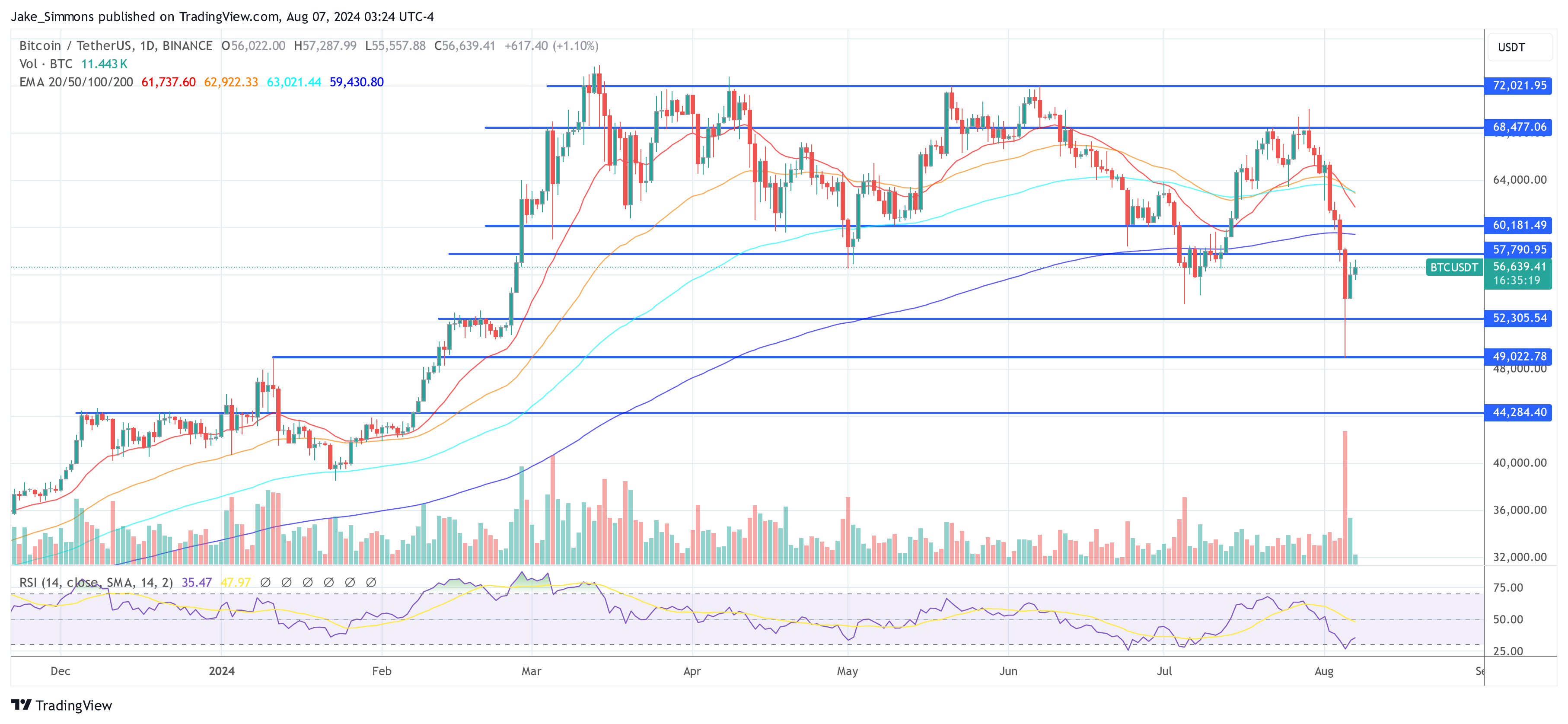

Despite these bearish undercurrents, Ju remains cautiously optimistic about Bitcoin’s potential to reach a new all-time high through the end of the year. “As long as the Bitcoin price stays above $45,000, it could break its all-time high again within a year, imo. Some indicators show bearish signals. However, they can still recover with a rebound, so we have to see if it stays at this level for a week or two. If the period lasts longer, the risk of a bear market increases, and the recovery may be difficult if it lasts more than a month,” Ju concluded.

At the time of writing, BTC was trading at $56,639.

Featured image created with DALL.E, chart from TradingView.com