- When the price of BTC crashed, it caused a major dent in miners’ overall earnings.

- Miner reserve increased significantly, indicating a hoarding mentality.

Bitcoin [BTC] Miners’ predicament would continue as the revenue earned from creating new blocks on the chain sank to new depths.

Read Bitcoin [BTC] Price Forecast 2023-24

According to an update shared by on-chain analytics company Glassnode dated August 19, total transaction fees paid to miners fell to a new 5-month low of $21,256. This drop was worse than the previous 5-month low, recorded more than a month ago.

📉 #Bitcoin $BTC Total Fees Paid (7d MA) just hit a 5-month low of $21,256.10

The previous 5-month low of $21,272.32 was observed on July 13, 2023

View statistics:https://t.co/651pr49pgN pic.twitter.com/epdqmcV3Xv

— glassnode alerts (@glassnodealerts) August 19, 2023

The miners’ misery continues

The fall in fee income came even as Bitcoin recorded its sharpest decline of 2023 last week. After drifting in a tight trading range for over a month. the king coin broke steeply with weekly losses of 11% at the time of going to press, data from CoinMarketCap revealed.

It is a known fact that miners depend on fiat currency to fund their ever-increasing hardware and other infrastructure costs. Therefore, they regularly convert their BTC holdings into cash.

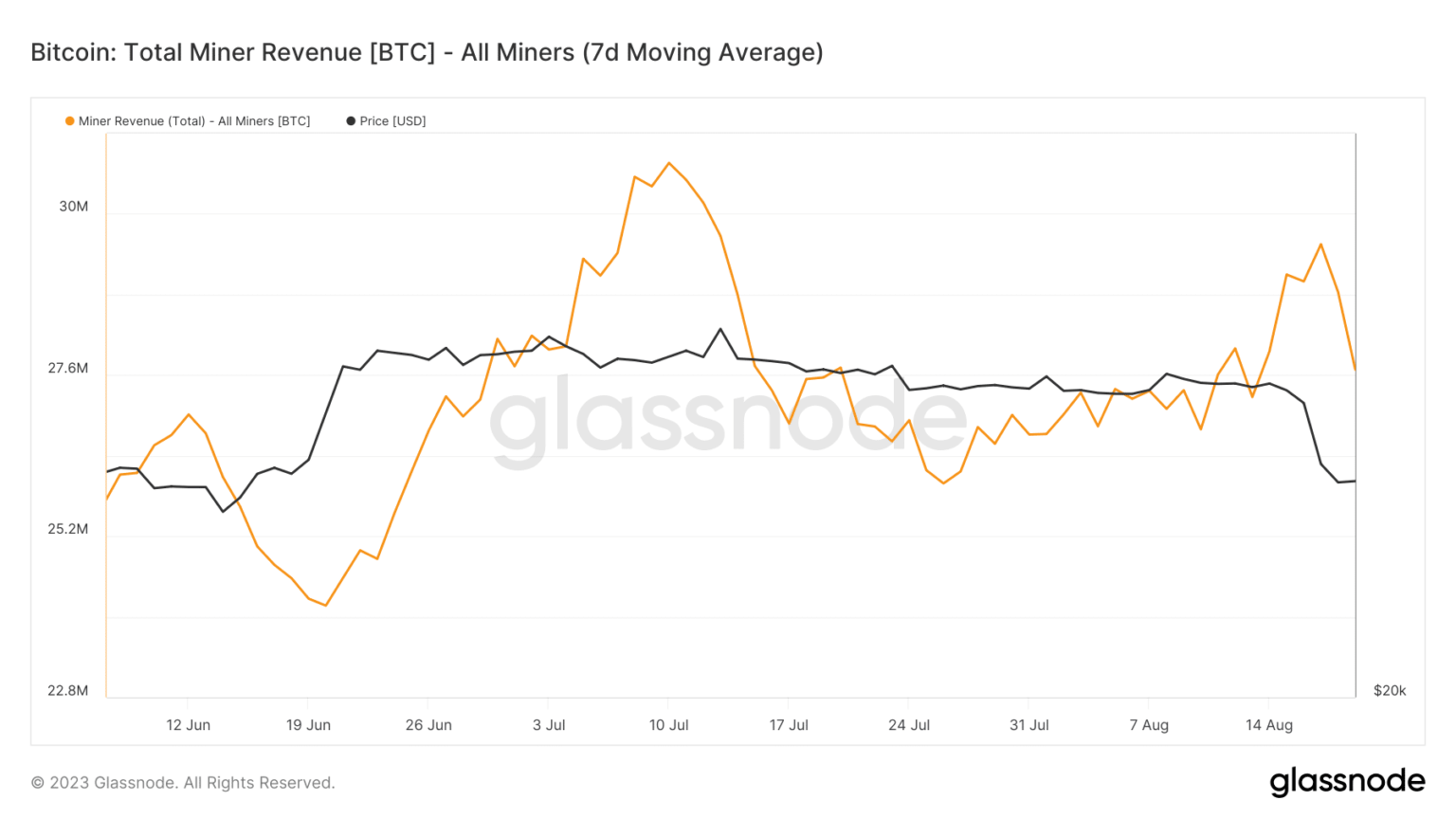

However, when prices crashed, it caused a major dent in miners’ overall earnings, as shown in the chart below.

Source: Glassnode

Note how the decline in sales came abruptly after a sustained period of increase. This potentially messed up their liquidation plans.

According to CryptoQuant, the amount of BTC held by miners has increased significantly over the past week, forming a negative correlation with its price. As a result, miners developed a hoarding mindset and waited for prices to recover slightly before dumping their stock.

Source: CryptoQuant

The hash rate continues to increase in the long run

Despite the ebb and flow of the mining industry, it was pertinent to note that the overall hash rate for Bitcoin has only gone up over the years. A higher hash rate is imperative for the overall security and decentralization of the blockchain. It helps prevent malicious players from launching attacks such as the 51% attack.

The hashrate doesn’t care about last year, month or day’s prices. It just goes up, up, up ⛏https://t.co/ptrEnBSiP7 pic.twitter.com/LcV6UufeuX

— Maartunn (@JA_Maartun) August 19, 2023

Is your wallet green? Check out the Bitcoin Profit Calculator

However, a rising hash rate requires the installation of sophisticated and expensive mining equipment. With the drop in revenue, as highlighted earlier, less efficient miners could eventually be forced to close their rigs.