- Bitcoin Bear Market could start if BTC breaks under the most important support levels.

- With BTC who bounces from $ 94k to $ 96,200, volatility is high.

With Bitcoin [BTC] In short baptisms of less than $ 94k before they return to $ 97,200, volatility remains high.

In this climate, a potentially Bitcoin -bears Market risk continues to exist as important investor groups, which are currently in a profit of non -realized profit, start selling.

Main levels to view

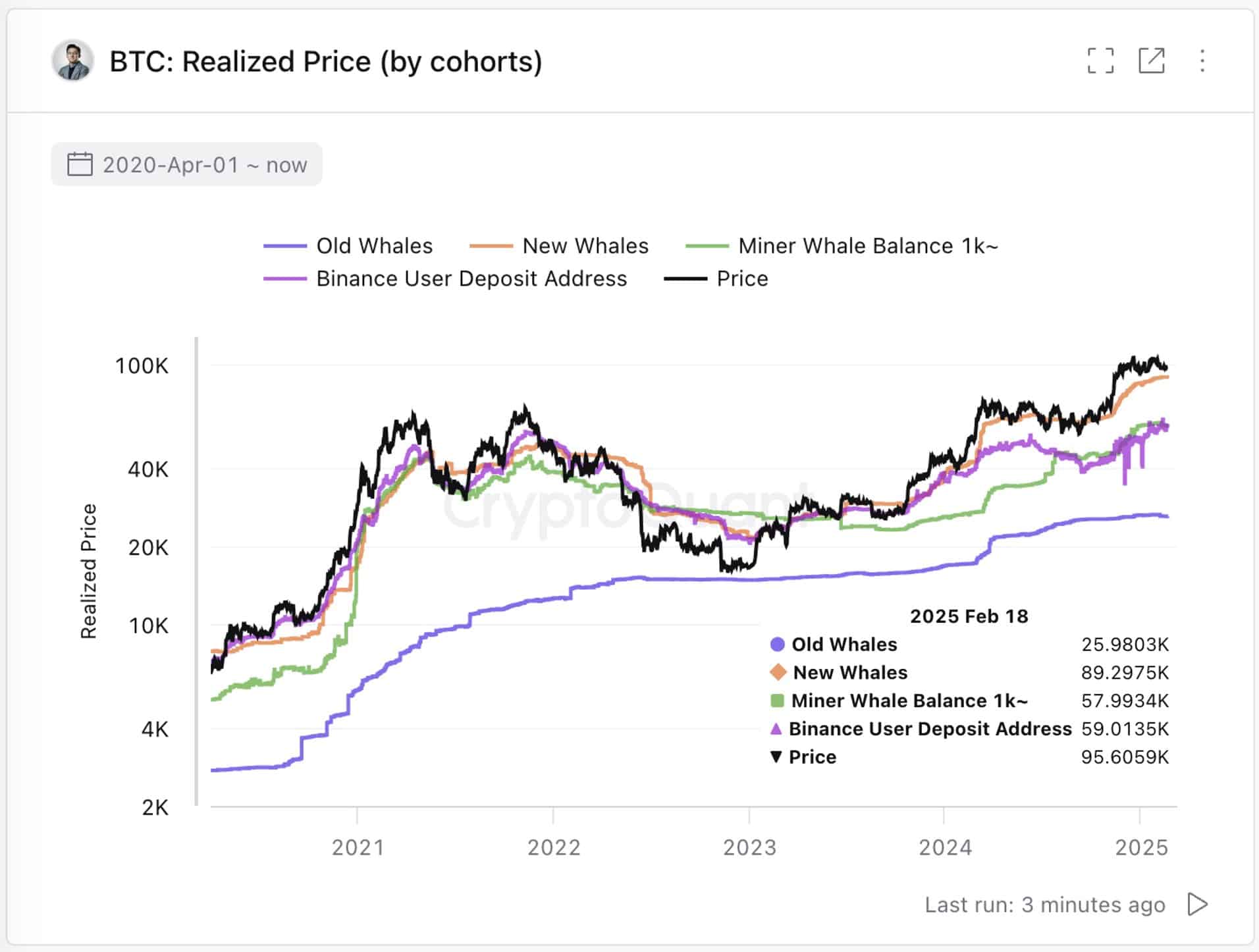

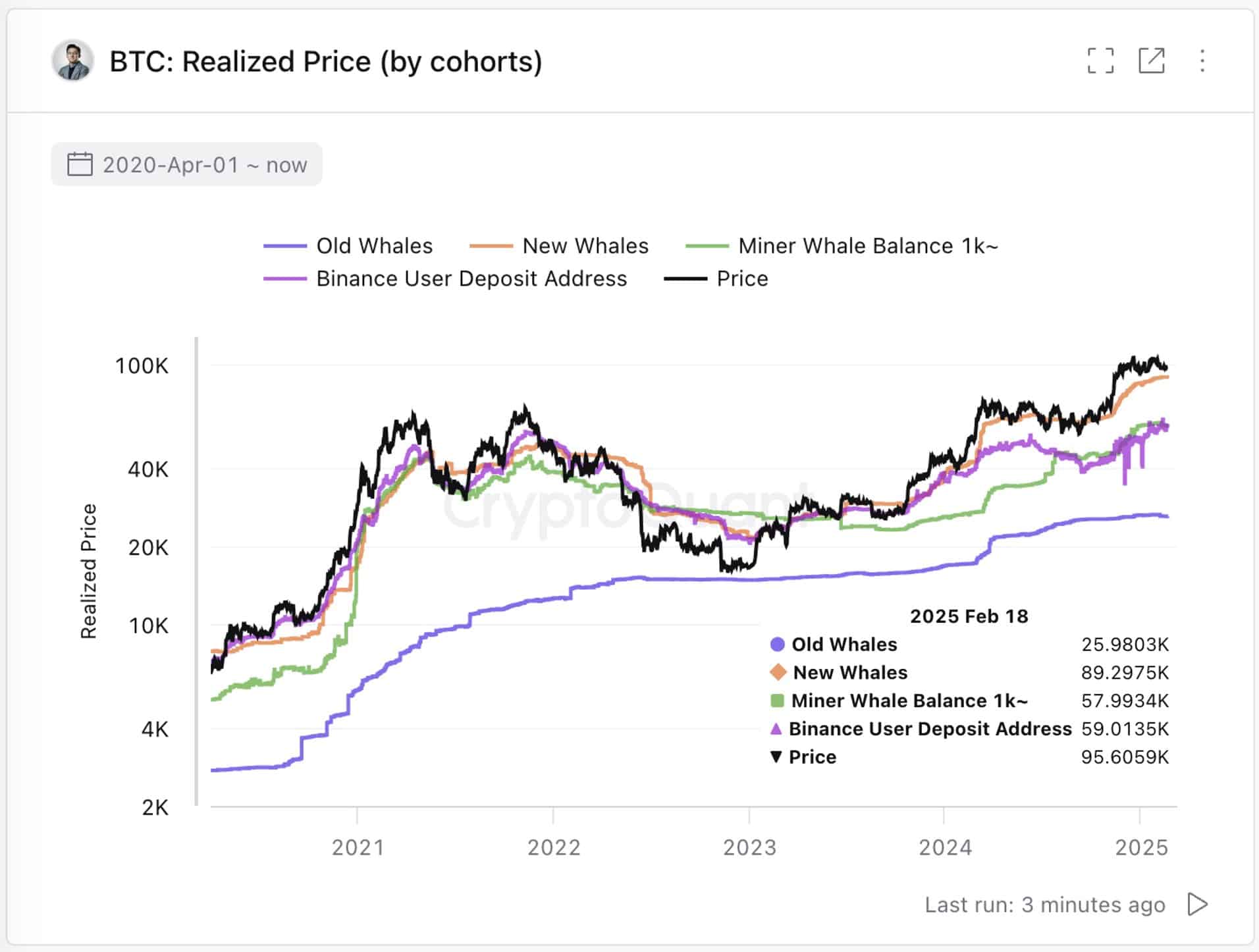

If BTC loses the momentum, a decrease of less than $ 89,300 could cause profit for holders in the short term (1,000+ BTC, held <155 days) whales, which increases the sales pressure.

The most important level to view, however, remains $ 58,000 – the price realized of my work whales (portfolios of mining companies with more than 1,000 BTC).

Source: Cryptuquant

Historically, breaking under this brand has confirmed Bitcoin Bear-MarktCycli, making it long-term critical support.

While BTC has a safe margin for the time being, hold changing Could test these levels. Holding above them is crucial for maintaining the bullish market structure.

Will bulls prevent a Bitcoin hole market?

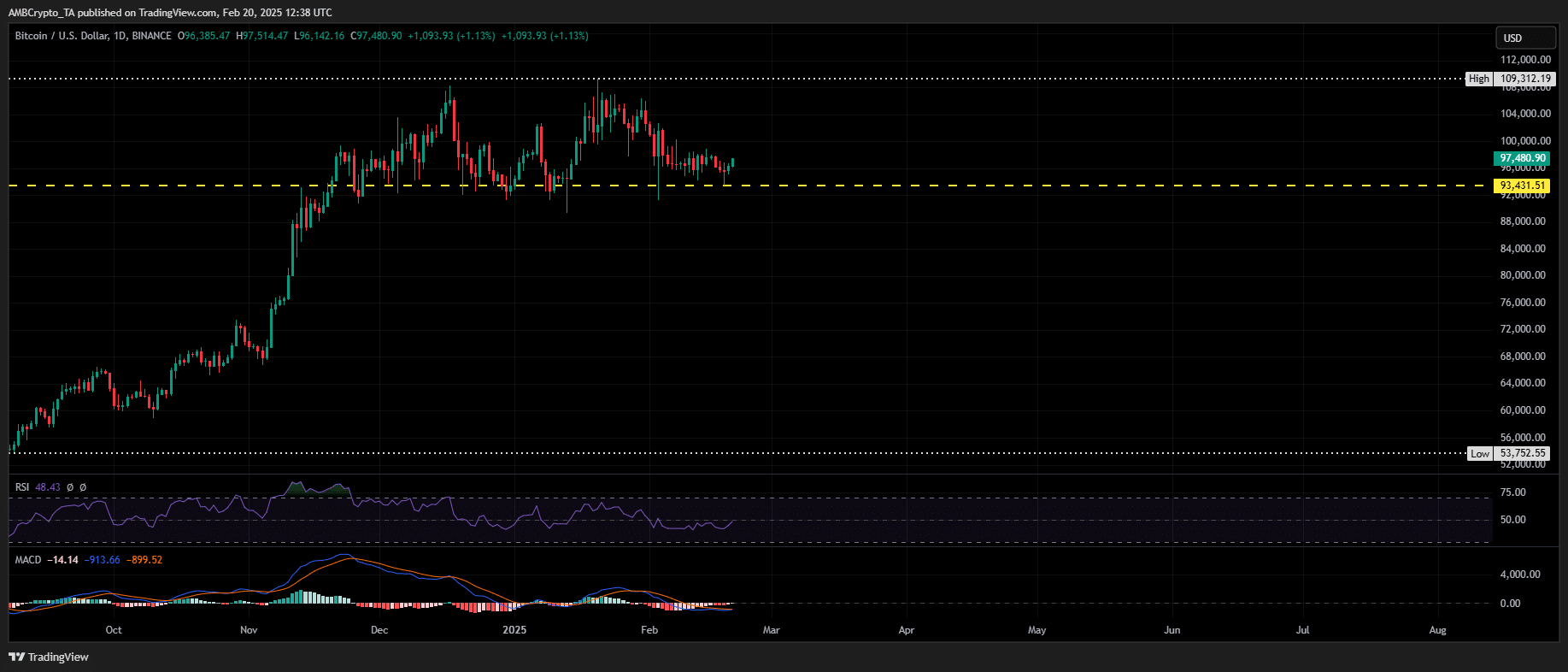

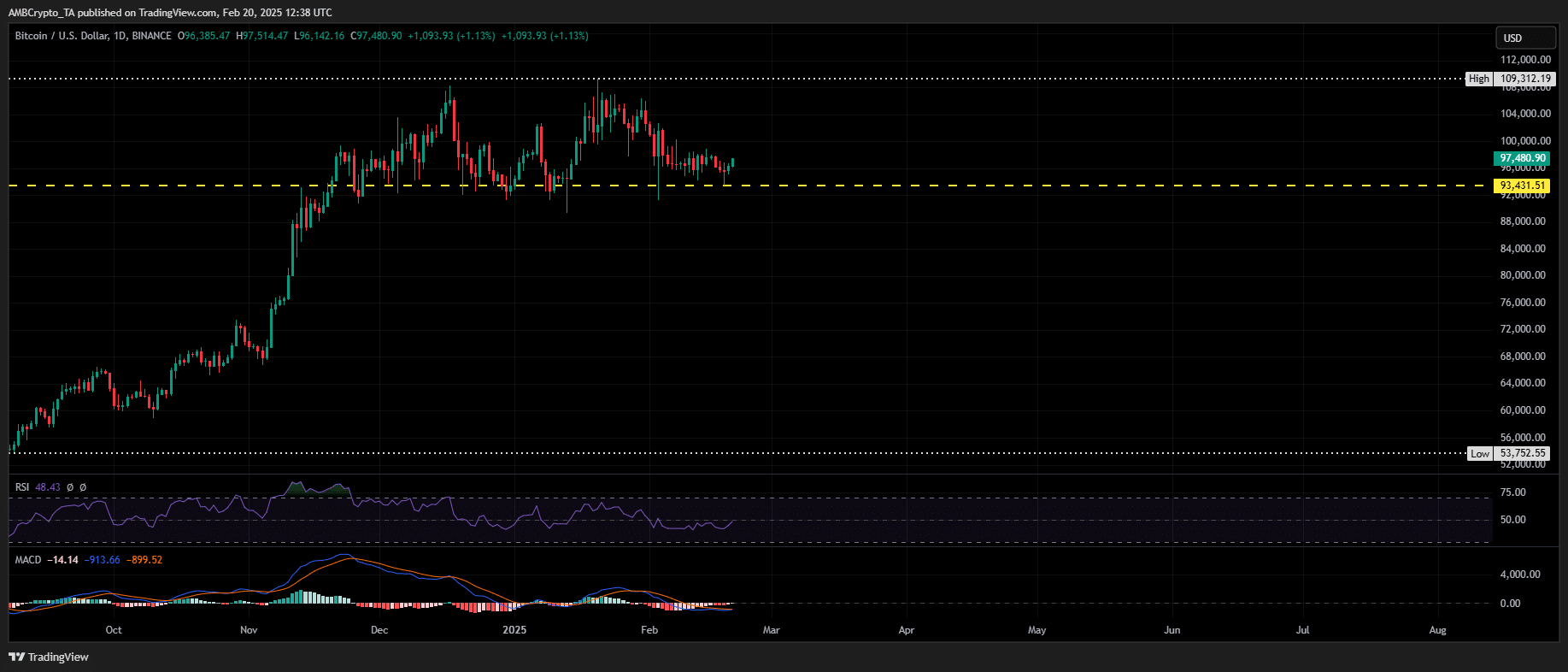

Despite a Hawkish macro background in the US, Bulls have avoided a Bitcoin Bear market by defending the $ 90k level for more than a month, which indicates a strong question.

Source: TradingView (BTC/USDT)

However, long -term consolidation in the vicinity of resistance suggests a possible liquidity trap.

If BTC violates $ 99k without a strong demand for spot, Livered Long positions can close, which activates liquidation cascades.

A decrease back to $ 90k would then be a key test. Losing this level can push BTC to $ 89,300, where STH whales can start loading, increasing the downward pressure.

Although a Bitcoin hole market is not confirmed, weak ETF intake, the fading of FOMO and falling network activity can cause a sharp reversal, so that billions are abolished.