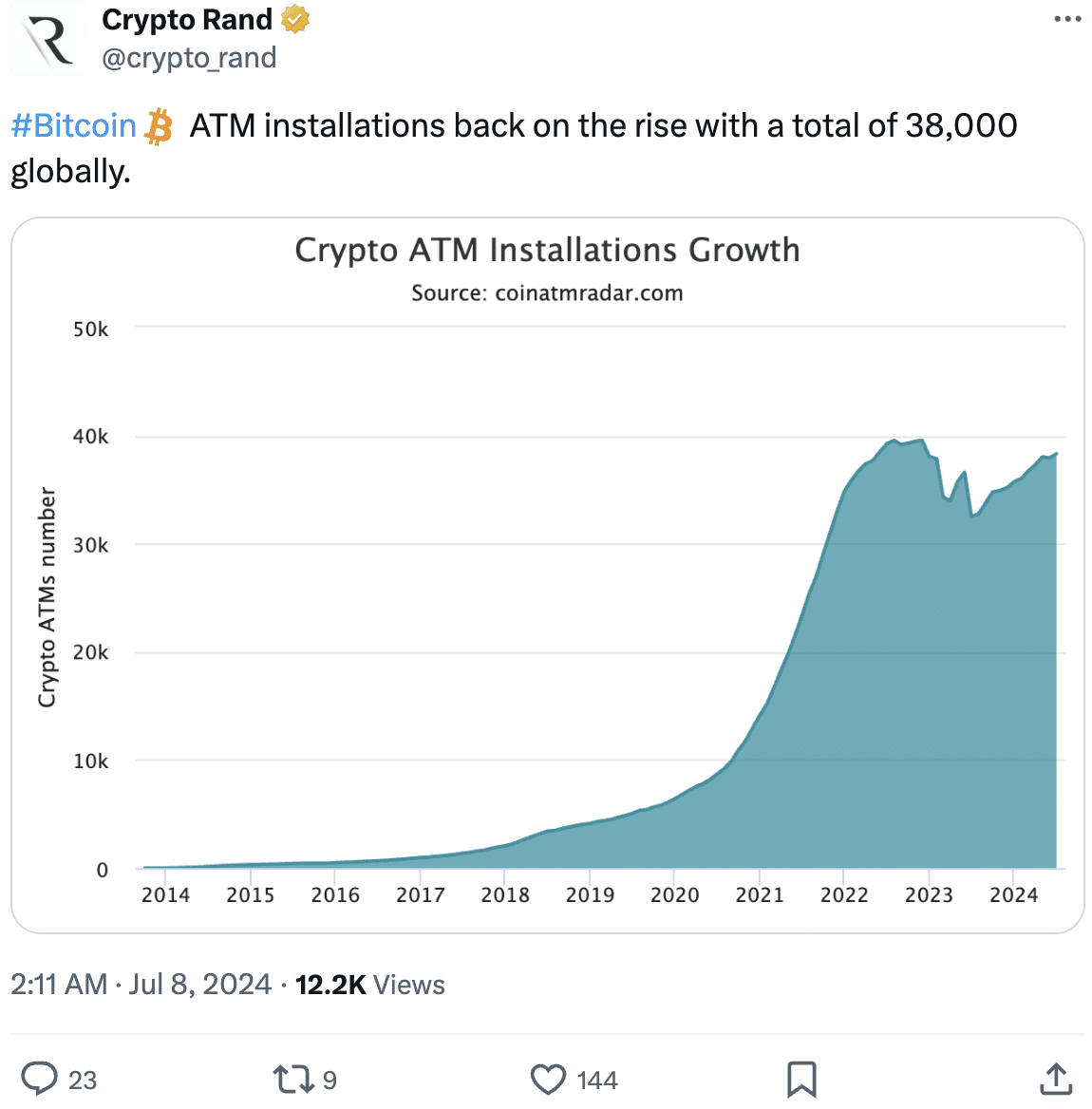

- Bitcoin ATM installations have increased significantly in recent weeks.

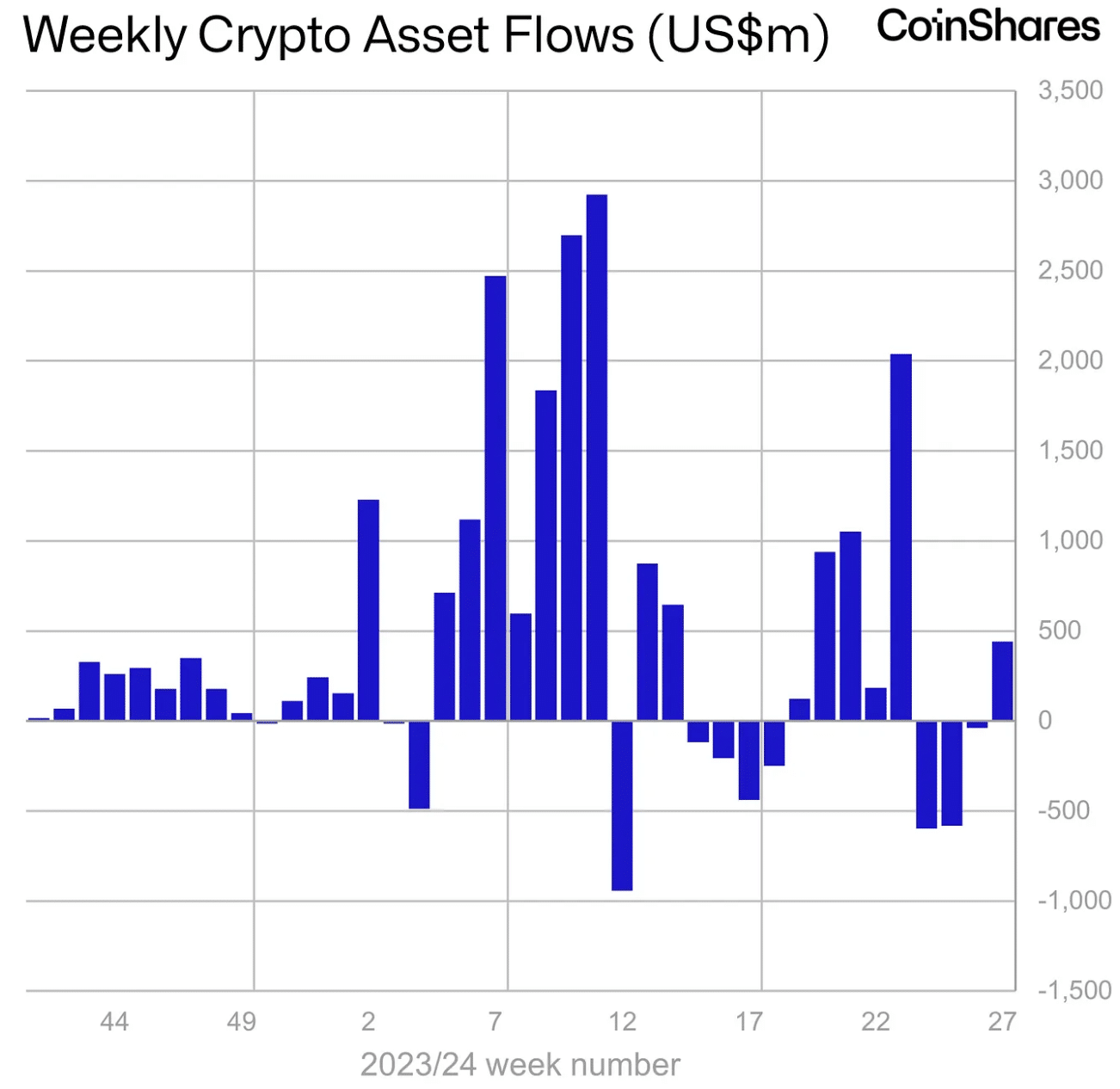

- Inflows into BTC investment products around the world grew.

Bitcoins [BTC] The price has fallen significantly in recent days, but there may be reasons for investors to be optimistic about the king coin.

ATM installations on the rise

Bitcoin ATMs saw a resurgence after a dip in late 2022.

As of July 2024, there are now over 38,000 Bitcoin ATMs installed worldwide.

More Bitcoin ATMs mean easier entry points for new investors. Now that ATMs are well known and widely used, purchasing Bitcoin becomes less intimidating for those unfamiliar with cryptocurrency exchanges.

This broader accessibility could lead to an increase in demand, potentially halting or reversing the price decline.

Furthermore, the growing number of ATMs indicated a more mature and potentially stable crypto ecosystem. This can increase investor confidence, which is a crucial factor influencing the price.

People are more likely to invest in an asset class that is considered legitimate and ‘here to stay’.

Source:

However, increased inflows could help BTC grow.

A new report from CoinShares paints a positive picture for Bitcoin, revealing total inflows of $441 million last week. This is a significant turnaround after several weeks of outflows.

The July 8 report went into more detail and highlighted substantial inflows into Bitcoin. Investors invested $398 million in Bitcoin products, which equated to approximately $57,207 per Bitcoin.

According to CoinShares, this buying spree was likely driven by a combination of factors, including recent weakness in Bitcoin prices, Mount Gox activity, and German government selling pressure.

These events may have been interpreted by some investors as an attractive entry point.

Geographically, the inflow was mainly concentrated in the United States, where no less than 384 million dollars was raised.

Other regions such as Hong Kong ($32 million), Switzerland ($24 million) and Canada ($12 million) also witnessed inflows, while Germany bucked the trend with outflows of $23 million.

Source: CoinShares

Read Bitcoin’s [BTC] Price forecast 2024-25

How are the addresses going?

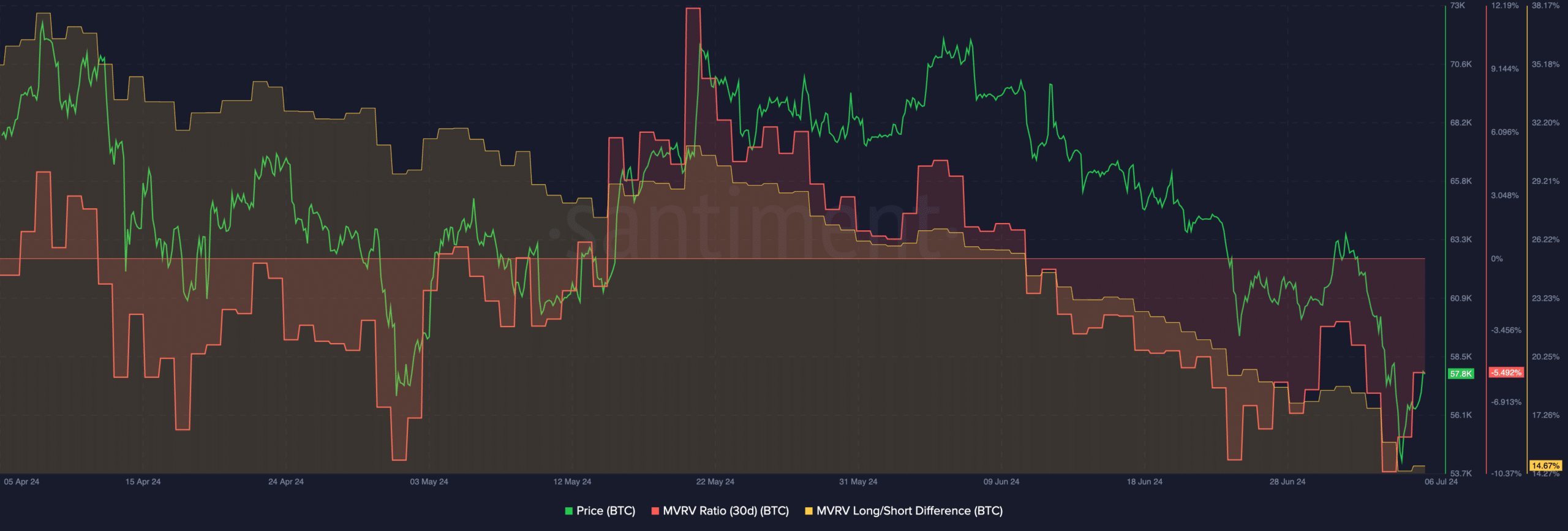

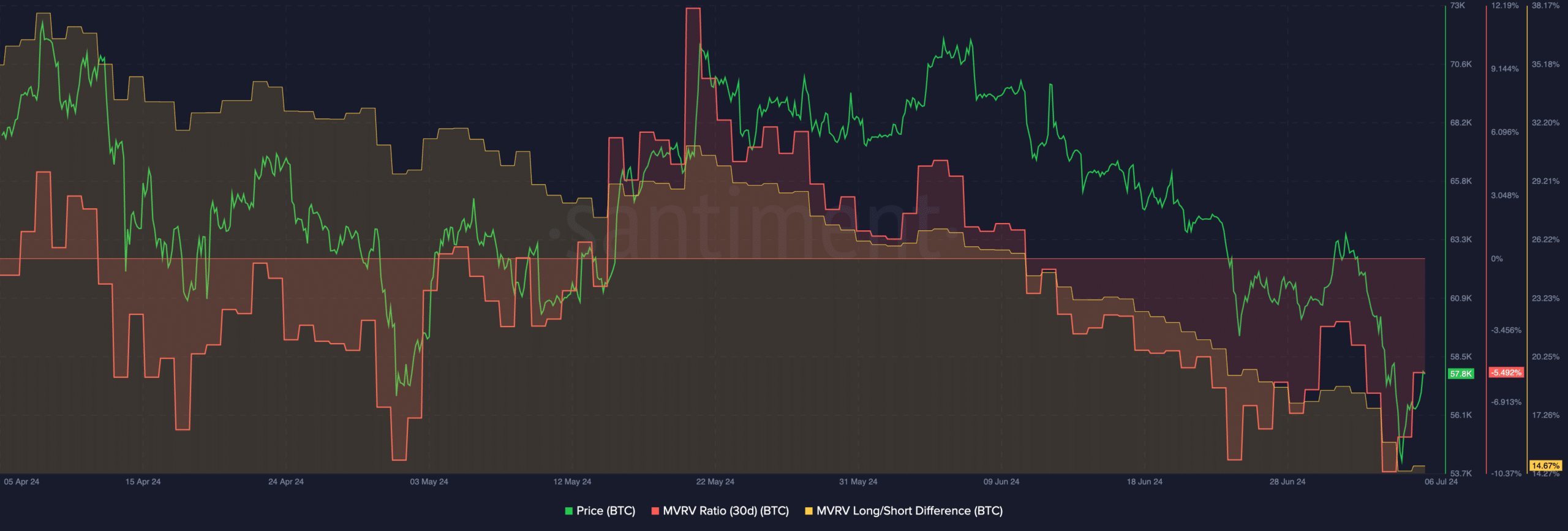

At the time of writing, BTC was trading at $57,149.91 and the price was down 0.75% over the past 24 hours. Due to the falling price, the MVRV ratio for BTC decreased.

This indicated that the number of profitable addresses holding BTC had decreased significantly. This could reduce the incentive for these holders to sell their holdings in the future.

Source: Santiment