An analyst who continues to build a following with his longstanding crypto calls warns that Bitcoin (BTC) is sending a signal that could send the leading digital asset to lower levels this month.

Pseudonymous analyst Rekt Capital tells his 349,300X followers that the month of August leading up to Bitcoin’s halving was historically bearish for BTC.

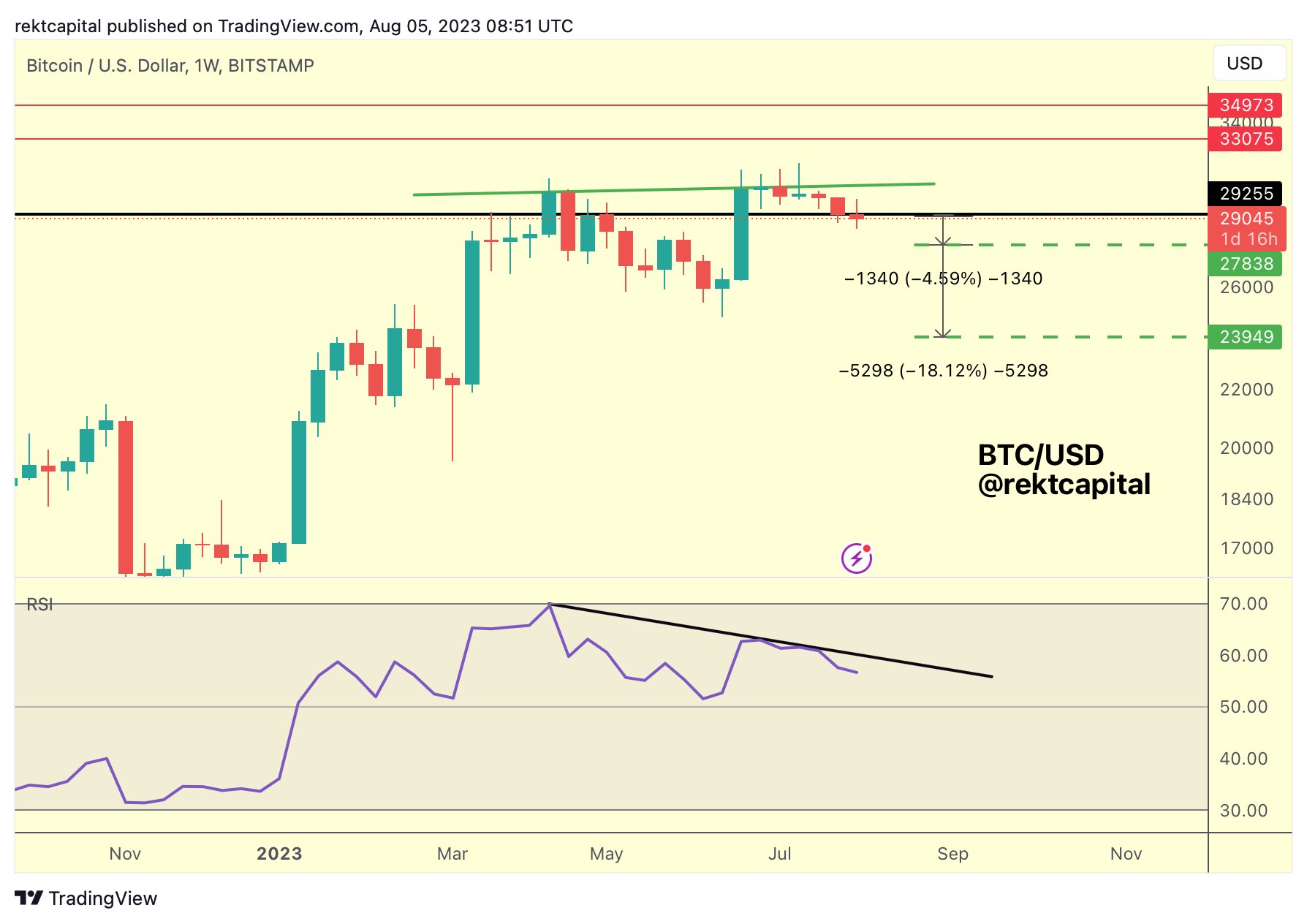

The trader also notes that BTC’s relative strength index (RSI) could form a bearish divergence on the weekly chart, suggesting that momentum is waning for the crypto king. According to Rekt Capital, Bitcoin could drop to $24,000 if the bearish signal plays out.

“BTC weekly bearish divergence may be forming.

If ~$29,250 acts as resistance, this bear div is more likely to play out.

Should that happen, what kind of downside can be expected in August?

It’s worth looking at the historical downside of last August, focusing on the years before the halving (2015 and 2019).

After all, 2023 is currently a pre-half year…

If BTC were to repeat the downside of August 2015, the price could drop -18% to ~$24,000

If BTC were to repeat the downside of August 2019, the price could only drop slightly by -4% to ~$28,000.

According to Rekt Capital, the weekly bearish divergence does not necessarily mean that prices are guaranteed to move lower. He say that the bearish signal is likely to be invalidated if Bitcoin manages to regain a key level or break the diagonal resistance of the RSI.

“The BTC level of $29,250 acts as resistance again.

If this continues, there is a higher chance that this weekly bearish divergence will play out.

However, if the price reclaims ~$29,250 as support or if the RSI breaks its downtrend, that’s the invalidation.

At the time of writing, Bitcoin is trading at $29,127.

Don’t Miss Out – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Image generated: Midway through the journey