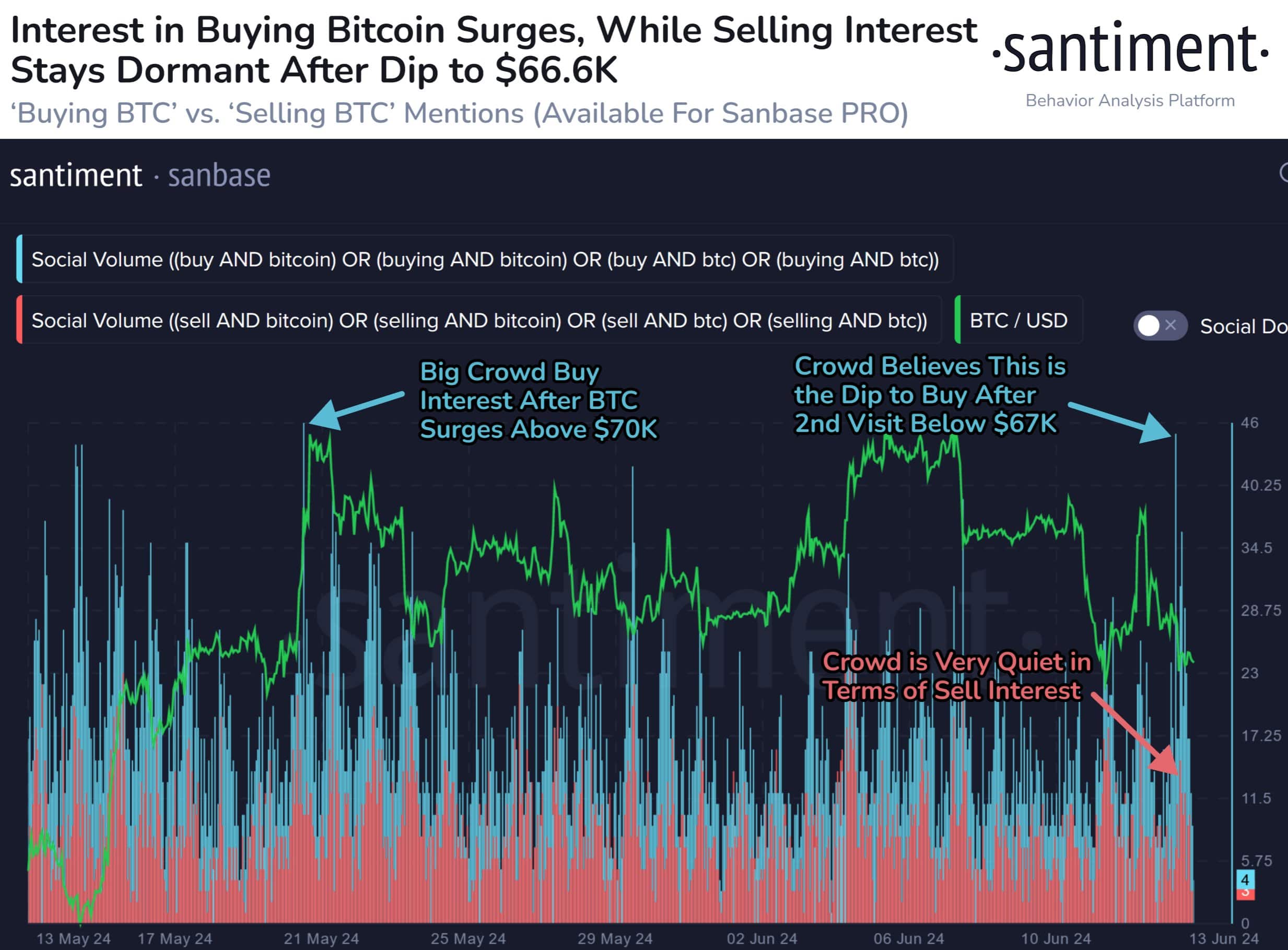

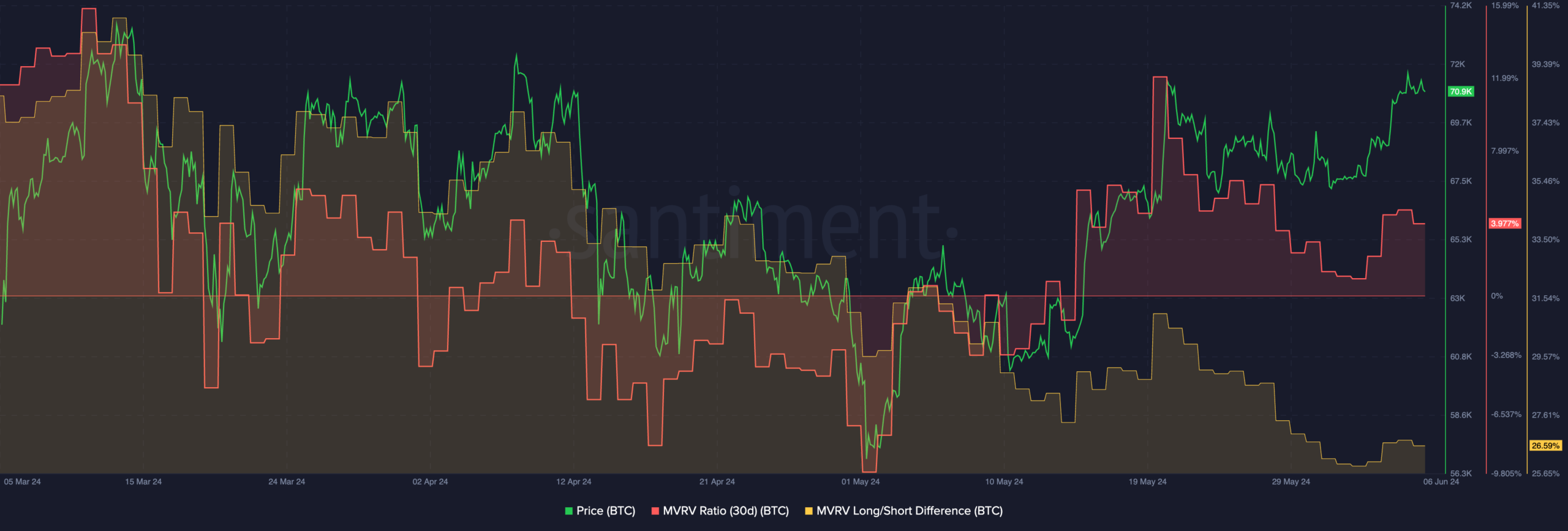

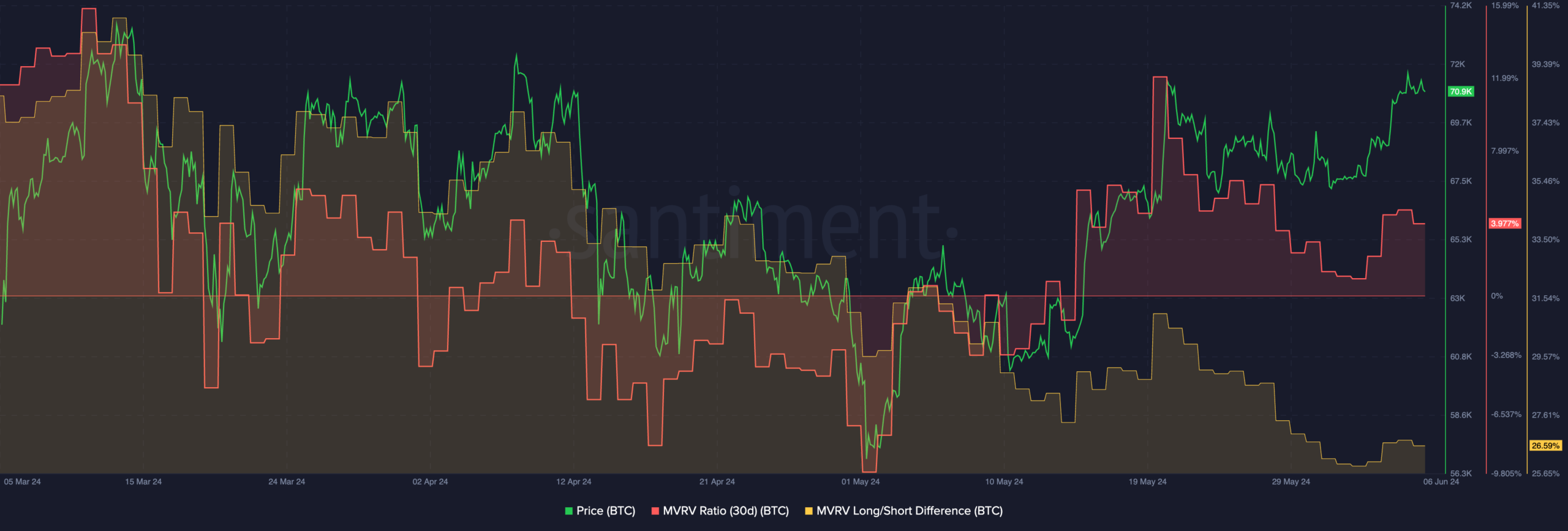

- Interest in Bitcoin accumulation remained high despite the recent correction.

- BTC profitability was high even as prices fell.

Bitcoin [BTC] There has been a significant correction in recent days. Despite the price drop, buyers remained optimistic.

Revival of interest

According to Santiment data, a recent drop in Bitcoin’s price below $67,000 on June 13 caused a surge in buying activity, marking the second-largest spike in investor interest in Bitcoin in the past two months.

The first scenario where this happened involved a sudden price increase in May 2024. These types of increases can prompt traders to jump in, anticipating further price increases and potential profits.

They may be driven by the belief that they will miss a lucrative opportunity if they do not participate in the rally.

Conversely, a price drop, such as that of June 13, can also trigger a buying frenzy. In this scenario, some traders might think that the price drop is unwarranted and represents a buying opportunity.

They expect a quick recovery and an opportunity to profit from a temporary dip.

Source: Santiment

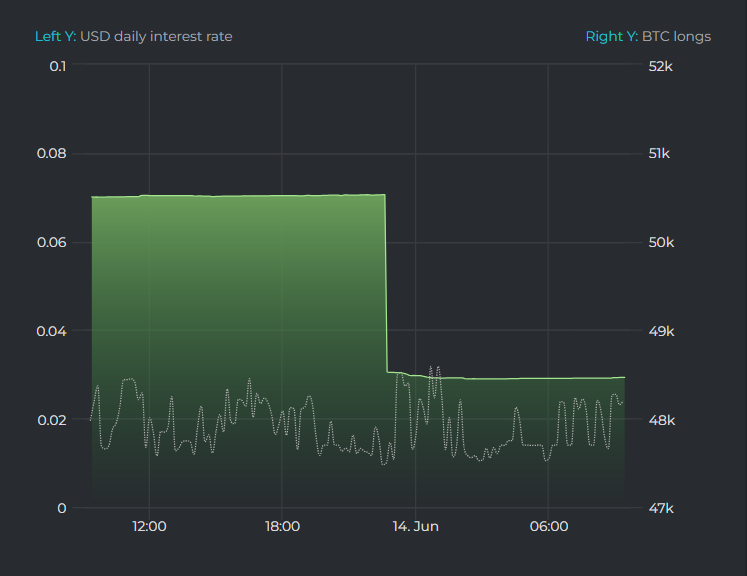

Bitcoin traders are taking a step back

On the other hand, traders became increasingly cautious. Data from Datamish revealed significant movement of Bitfinex whales between 10:35 PM and 10:41 PM UTC+8 on June 13.

During this short period, these large-scale investors reportedly reduced their long positions by approximately 2,000 BTC, reducing their current holdings to 48,464 BTC.

This coincides with a broader trend of liquidation of long positions on Bitfinex since June 11, totaling approximately 76.4 BTC.

This whale sell-off suggests that despite the surge in retail buying, some larger investors are taking a more cautious approach, possibly anticipating further price swings or trying to lock in their gains.

Source: Datamish

Read Bitcoin (BTC) price prediction 2024-2025

At the time of writing, BTC was trading at $66,918.83, with its price down 0.18% over the past 24 hours. The volume it was traded on was also down 24.99%.

The MVRV ratio for BTC remained high, indicating that most holders were profitable at the time of writing.

Source: Santiment