- The price of BTC has risen by more than 10% in the past seven days.

- A number of market indicators looked bearish on the coin.

Bitcoins [BTC] the price action remained bullish as it traded above $65k. As that happened, long-term investor confidence in the currency also rose. But will that be enough to sustain this bull rally? Let’s find out.

Bitcoin is holding strong

CoinMarketCaps facts revealed that the price of Bitcoin had risen by more than 10% in the past seven days. In the last 24 hours alone, the value of the king of crypto has increased by more than 3%.

At the time of writing, BTC was trading at $65,362.47 with a market cap of over $1.289 trillion.

In the meantime, IntoTheBlock recently released a tweet to draw attention to an interesting development. According to the tweet, long-term Bitcoin holders showed confidence last week, adding to their holdings.

It was interesting to note that this increase in LTH confidence in BTC increased as several major players indulged in sell-offs. For example AMBCrypto reported rather, the German government sold all its BTC holdings, bringing the balance to zero.

Apart from that, another notable development related to Mount Gox took place in the recent past. Lookonchain’s latest tweet pointed out that Mount Gox moved 44,527 BTC, worth over $2.84 billion, to an internal wallet.

The motive behind this move could be payback. Mount Gox currently owns 138,985 BTC, which is worth $8.87 billion.

Will this be enough for BTC?

AMBCrypto then planned to look at other data sets to see if LTH’s confidence in BTC would be enough to support the bull rally.

Our analysis of CryptoQuant’s facts revealed that BTC’s exchange reserve was declining, meaning buying pressure on the token was high.

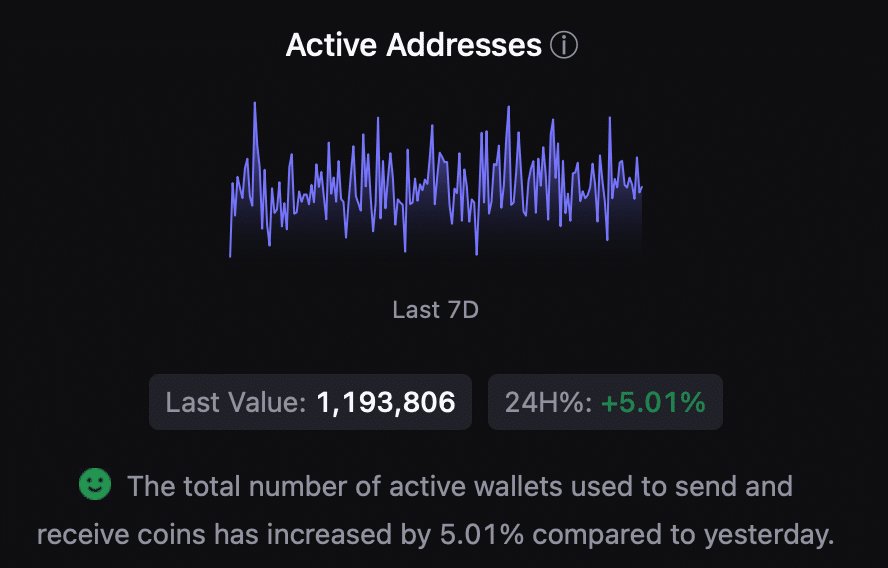

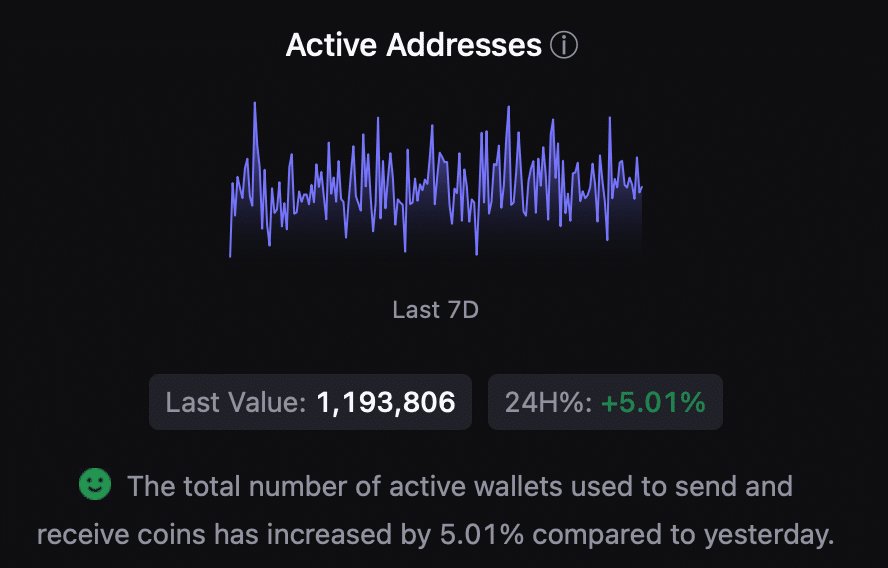

The Coinbase premium was green, suggesting that buying sentiment among US investors was strong. Furthermore, BTC’s network activity rose, evidenced by the increase in its active addresses compared to the previous day.

Source: CryptoQuant

However, at the time of writing, BTCs fear and greed index had a score of 75%, indicating that the market was in a ‘greed’ phase.

When the measure reaches this level, it suggests that the likelihood of a price correction is high. That’s why we reviewed the King of Crypto’s daily chart to better understand what to expect.

Read Bitcoins [BTC] Price prediction 2024-2025

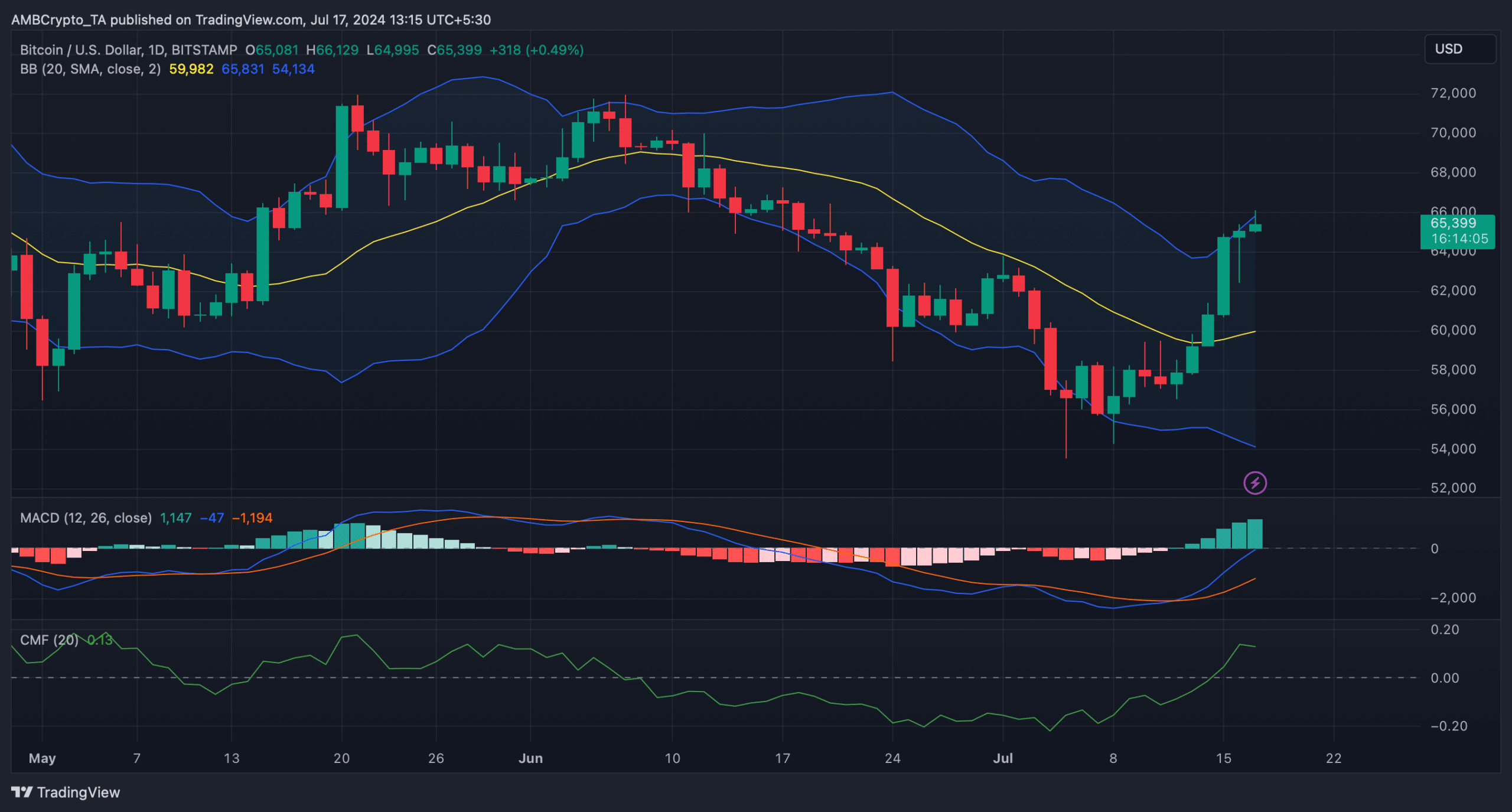

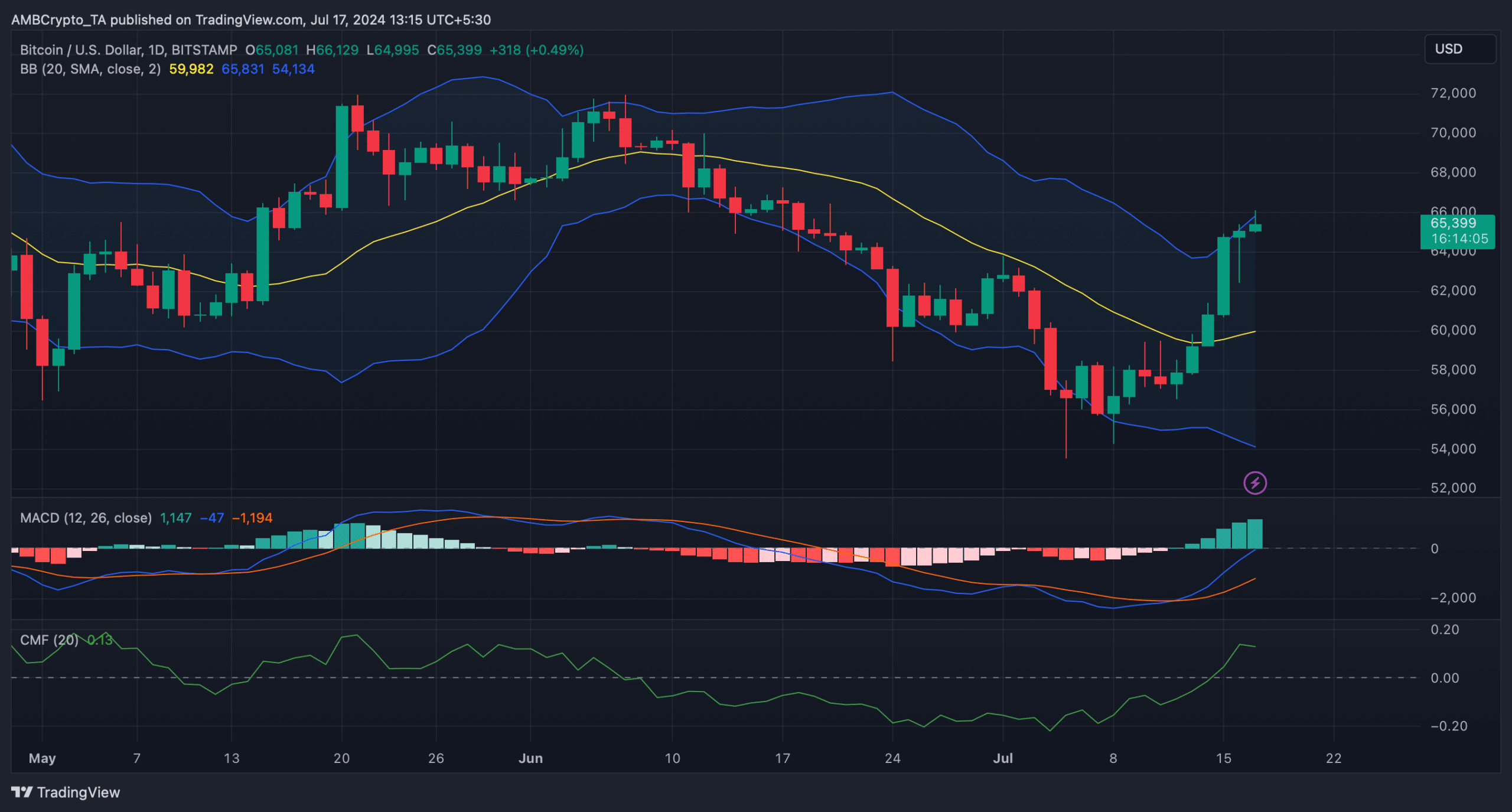

We discovered that the price of BTC had reached the upper limit of the Bollinger Bands. The Chaikin Money Flow (CMF) also recorded a decline.

Both indicators pointed to a price correction. Nevertheless, the MACD remained in favor of buyers as it showed a bullish edge.

Source: TradingView