- Bitcoin formed an encouraging chart pattern just like it did in March 2020.

- The trading volume and fear factor are not the same, but this drop could still be a good buying opportunity.

Bitcoin [BTC] suffered another carnage this weekend, dropping from $65,000 on Friday, August 2nd to $49,000 in the early hours of Monday, August 5th. This steep drop was initiated by news of Mount Gox and the German government selling BTC.

The news that the Federal Reserve will not cut interest rates in September was another blow. The latest and strongest blow came after news of the Bank of Japan’s decision to raise interest rates by 15 basis points to 0.25% last week.

The wave of terrifying news reminded some market participants of the market-wide crash that occurred in March 2020, after coronavirus cases began to rise around the world.

There were similarities and differences between the current crash and the Bitcoin Covid crash.

The chart pattern and its implications for recovery

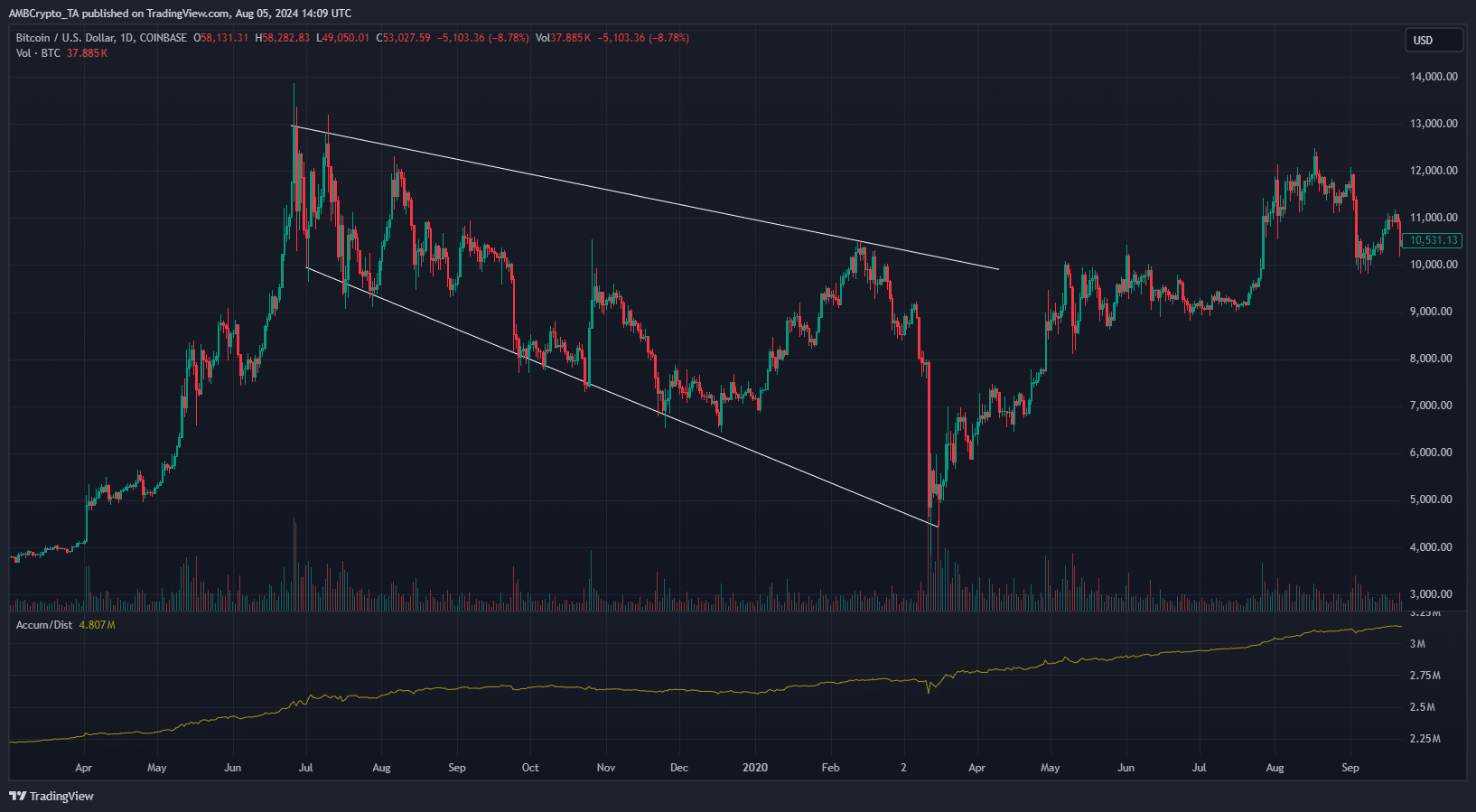

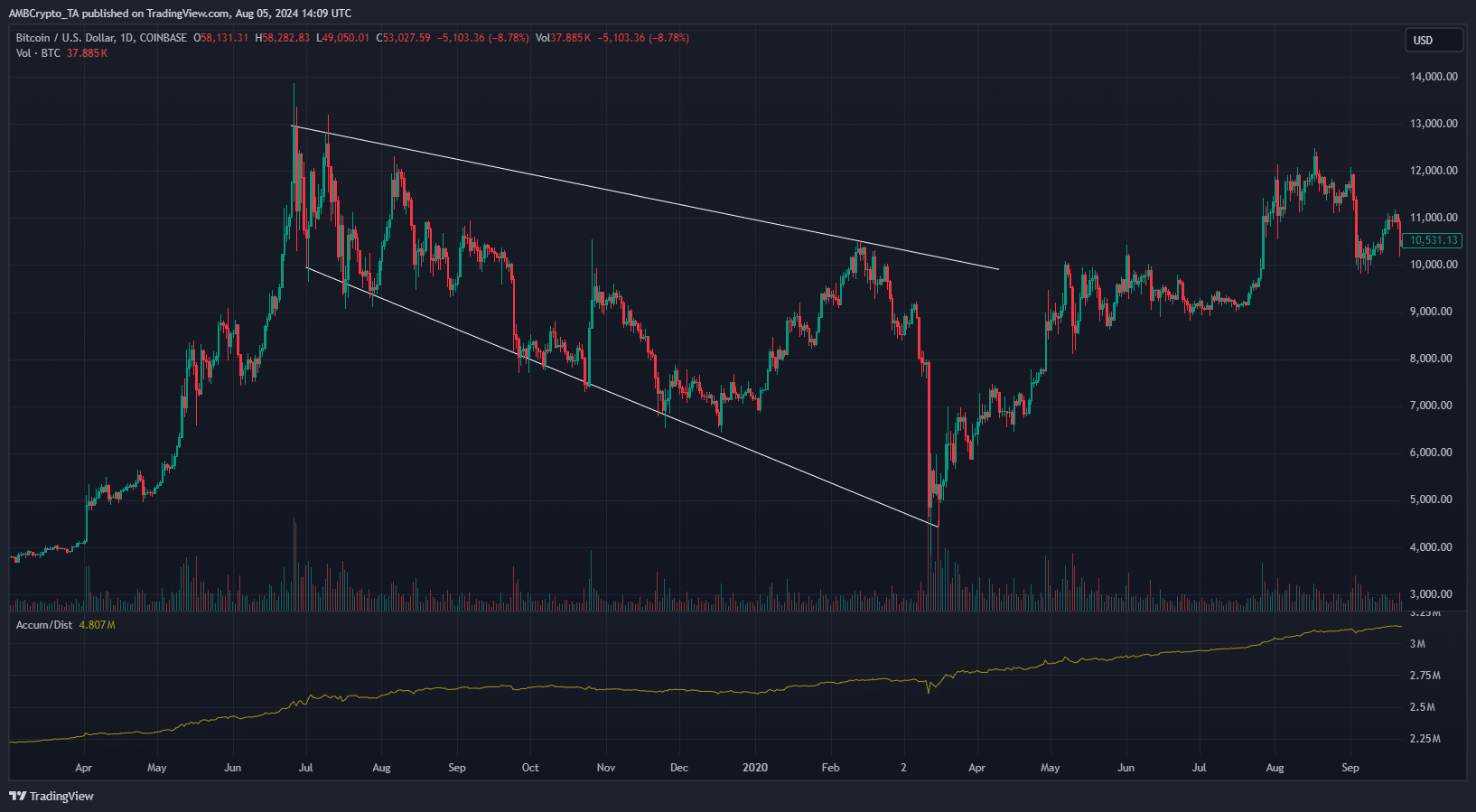

Source: BTC/USD on TradingView

On the one-day time frame of both charts, Bitcoin formed a declining, widening wedge formation. On the last retest, BTC soared over the next two months and bullishly broke past the $9,000 mark.

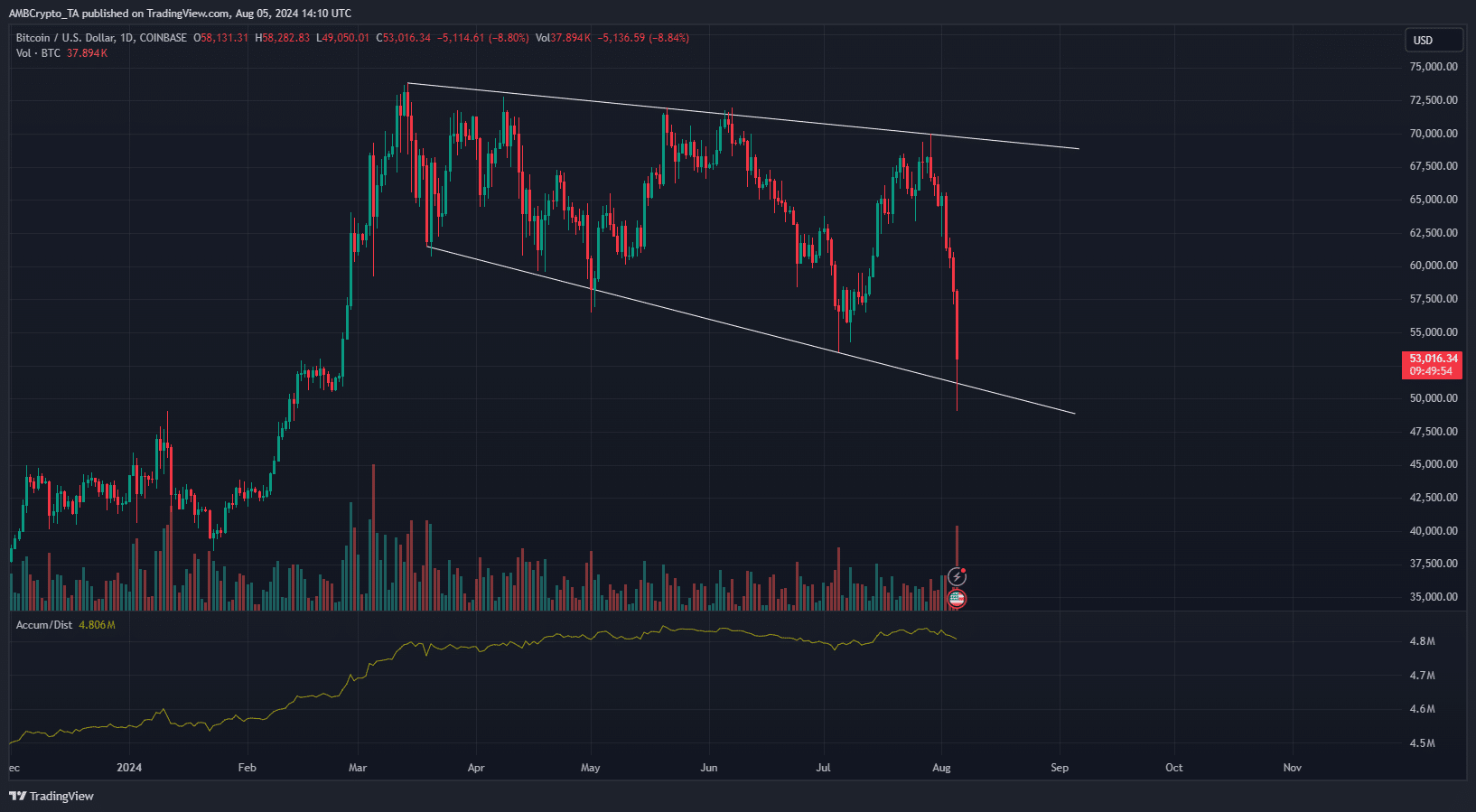

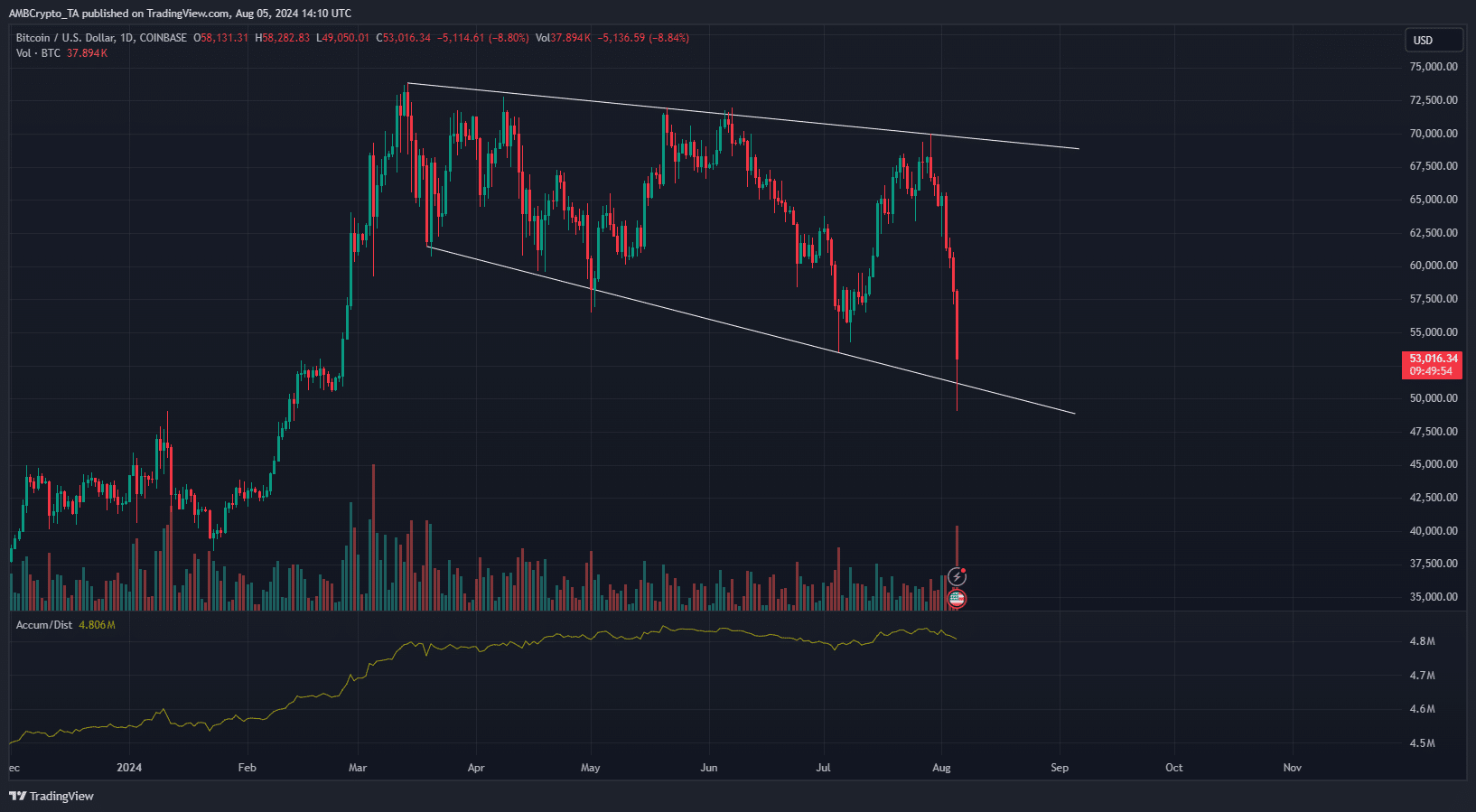

Source: BTC/USD on TradingView

The price action since March also formed a similar chart pattern, and statistics showed that BTC was too cheap.

At the time of writing, the $51.2k is the trendline support that BTC should not close a daily trading session below. If so, the wedge pattern would be obsolete.

Despite the market-wide panic, the Bitcoin Covid crash was worse

Judging from the BTC/USDT trading pair on Binance, March 13, 2020 saw the highest trading volume during the crash. It amounted to 402.2k BTC.

For comparison, the trading volume on Monday, August 5 was 125.5k BTC, although the day’s trading was not yet over.

More importantly, support from institutional investors was lacking. Also, retail interest was not as high as it was in 2024, with Bitcoin and Ethereum [ETH] ETFs approved.

Is your portfolio green? Check the Bitcoin Profit Calculator

Like the experienced crypto trader DonAlt points out that Bitcoin and the crypto industry were fighting for their survival.

This time, increased adoption meant a drop below $50,000, while Bitcoin still had a hard value Market cap of $1 trillion.