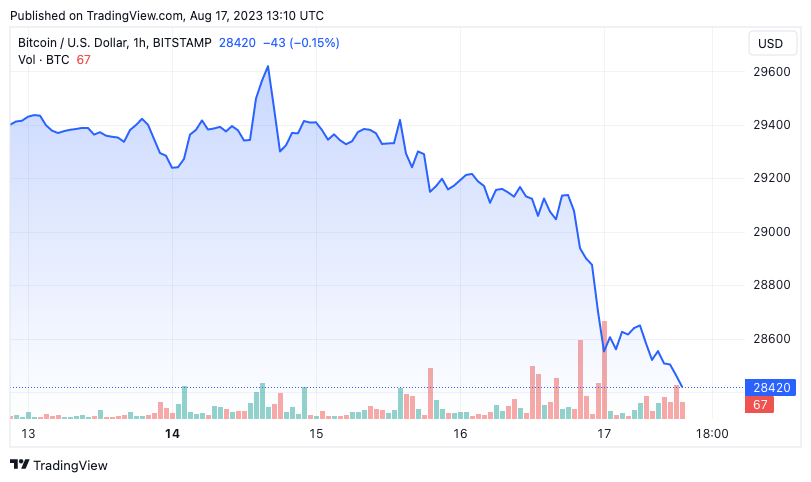

On August 17, the price of Bitcoin dropped below $29,000, settling at around $28,500. While this drop may seem insignificant given Bitcoin’s historically volatile nature, the context of its recent trading reach heightens the importance of this move.

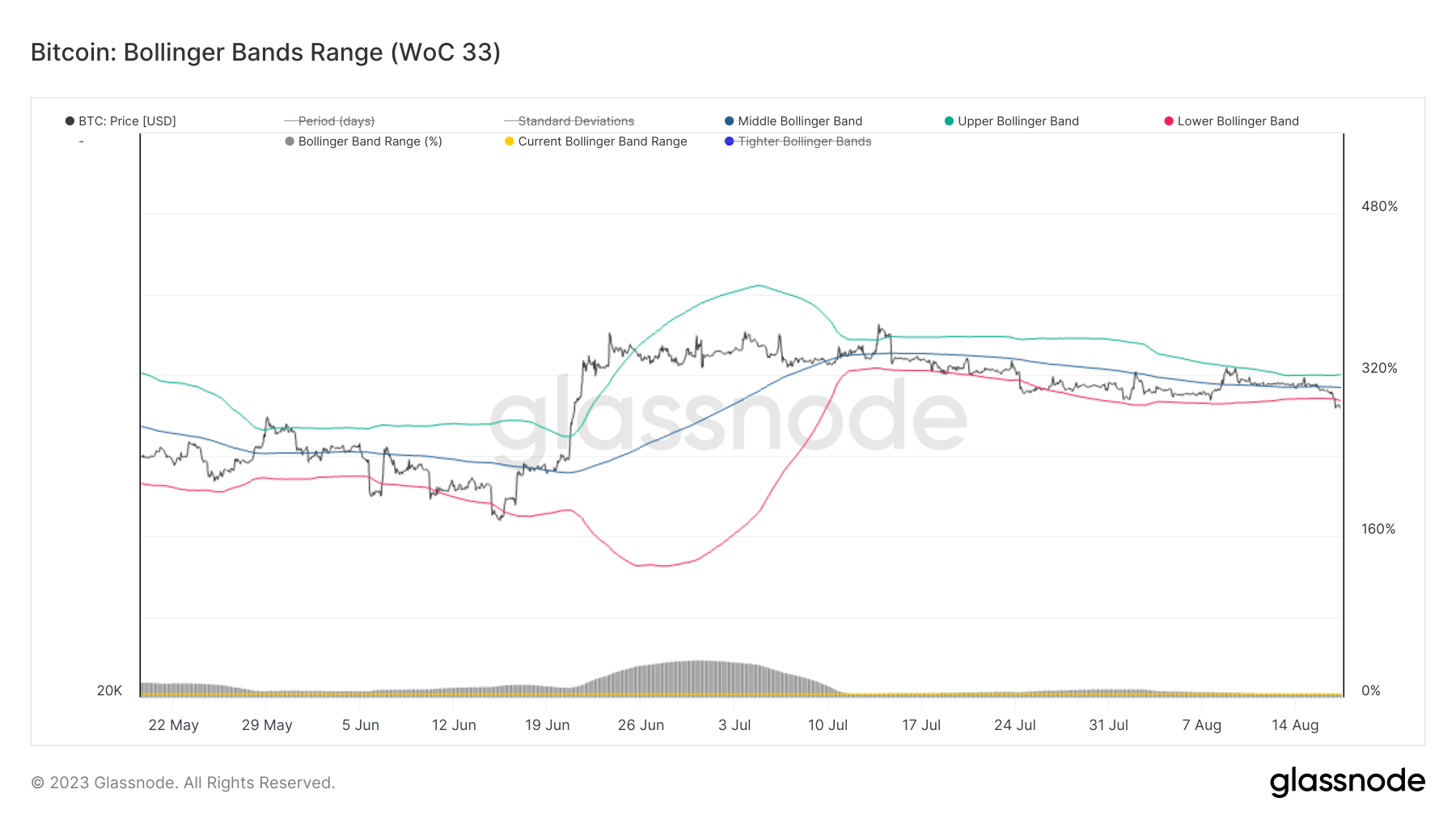

Bollinger Bands are a financial tool used to assess the price volatility of various assets, including Bitcoin. The tapes contain three lines – a central line and two outer ones. The central line on the chart represents the simple moving average (SMA) of the asset’s price, while the outer bands are defined by standard deviation, a measure of how spread prices are from the average.

These bands widen during periods of high volatility and contract during low volatility. These bands are a crucial market indicator and help traders identify potential buy and sell signals. When the price of an asset moves outside of these bands, it may indicate a significant price movement in the breakout direction.

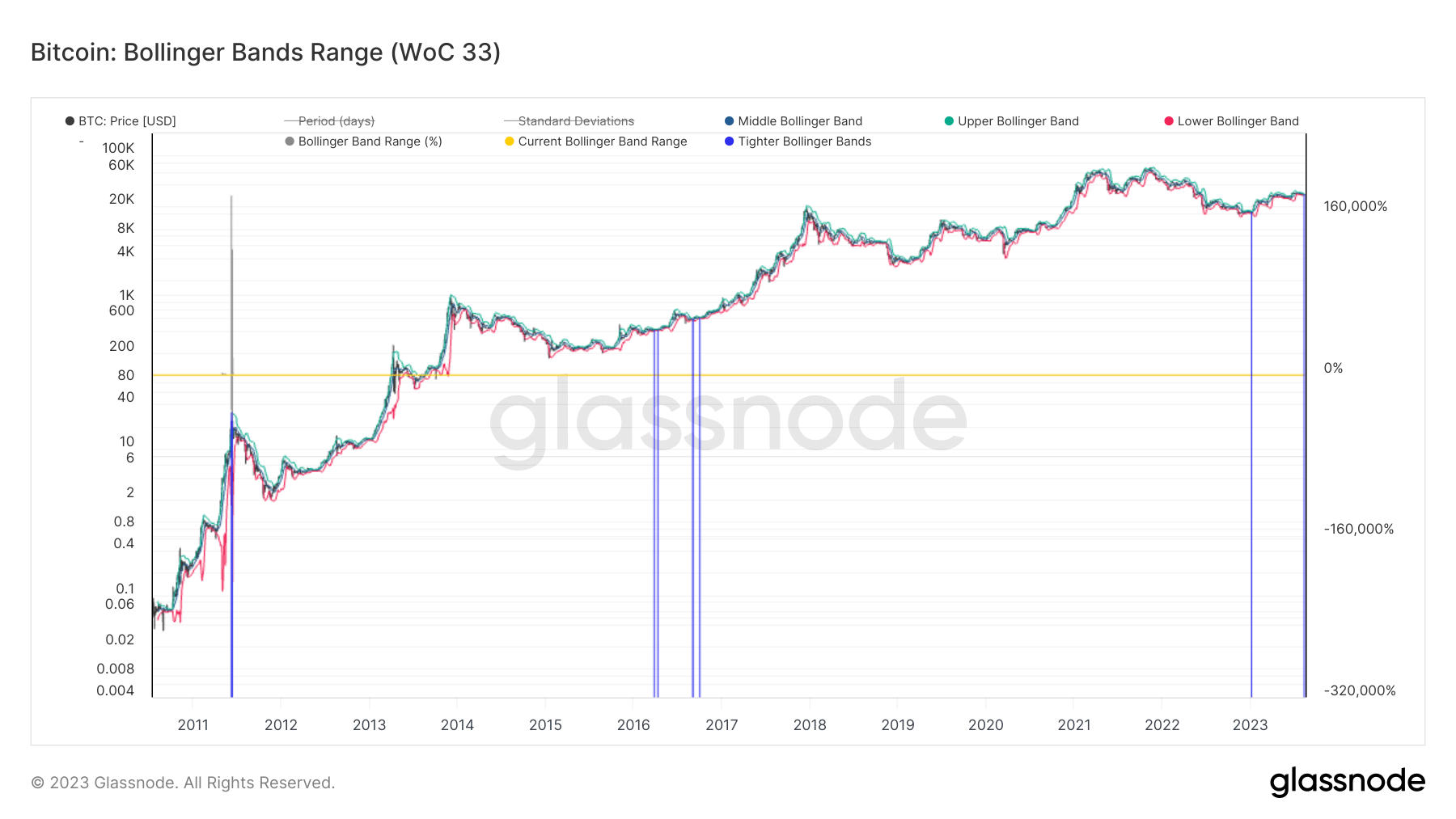

In August, Bitcoin price volatility fell to historic lows. Before today’s drop to $28,500, the upper and lower Bollinger Band were separated by just 2.9%. Such a tight spread has only been seen twice in Bitcoin’s history. With the drop to $28,500, Bitcoin’s price broke through the lower Bollinger Band, which reached $28,794. As a result, the Bollinger Band range expanded slightly to 3.2%.

Historical data suggests that when Bitcoin’s price drops below the lower Bollinger Band, it is often followed by a quick recovery and an upward trajectory. This pattern has been observed multiple times, reinforcing the significance of the Bollinger Bands as a predictive tool.

Furthermore, every instance of extremely tight Bollinger Bands in Bitcoin’s history has preceded a notable price swing. In 2016, for example, equally tight tires were recorded several times. This period presaged the rally that propelled Bitcoin to its all-time high in 2018. More recently, in January 2023, Bitcoin price held steady around $16,800, the bands indicating low volatility. Soon after, Bitcoin skyrocketed and nearly doubled its value to $30,000.

What do these observations mean for the market? The current tightness of the Bollinger Bands, combined with Bitcoin’s price movement below the lower band, suggests a potential for significant price appreciation in the near future.

The post Bitcoin at $28.5K: Unwrapping the Meaning of Tight Bollinger Bands appeared first on CryptoSlate.