- Raoul Pal’s “Banana Zone” Predicts Bitcoin’s Consolidation Phase Before Transitioning to “Banana Singularity”

- Bitcoin’s price action ahead of Trump’s inauguration could trigger a rebound or panic sell-off.

Bitcoin [BTC]The recent price action has sparked intrigue bounced back above $94,000, after a brief dip below $92,500. This volatile move has left many investors questioning the cryptocurrency’s next direction amid growing uncertainty in the market.

Raoul Pal on current market conditions

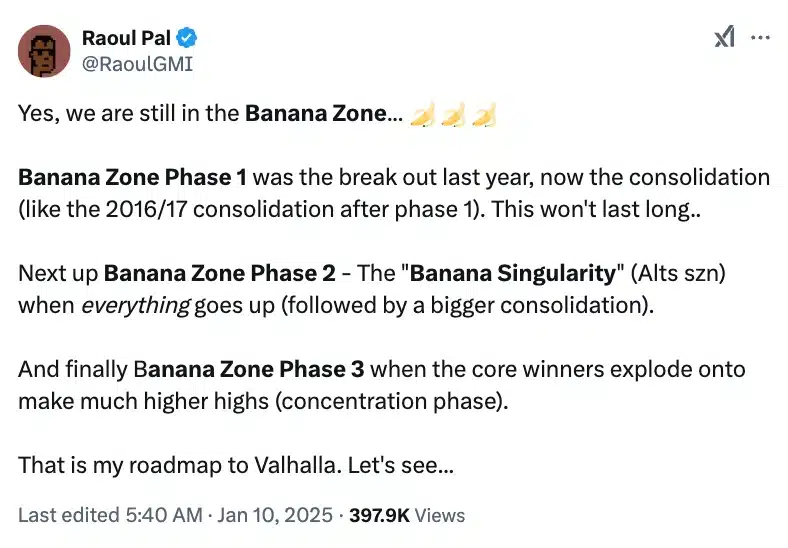

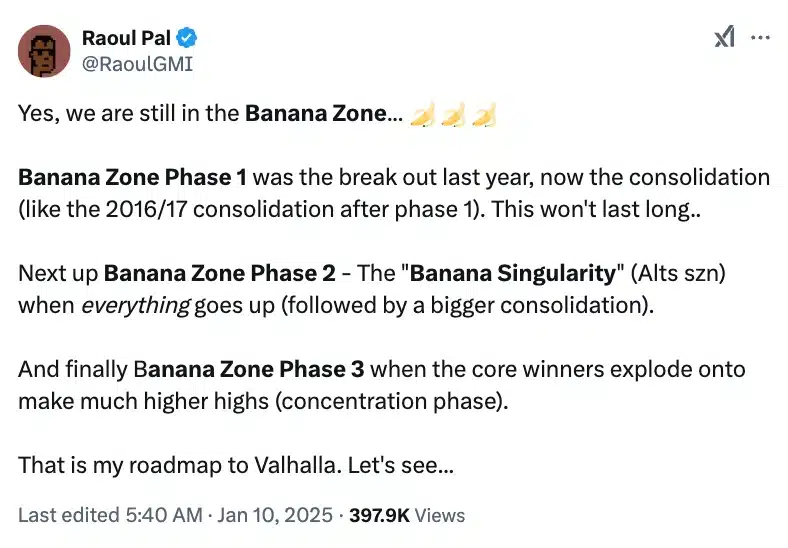

To add a unique perspective to the discussion, Real Vision founder Raoul Pal introduced the concept of the “Banana Zone” during a recent podcast. Pal further developed this idea through a after on X (formerly Twitter), with the cryptic statement:

“We are still in the banana zone.”

This has the community abuzz with speculation about what this means for Bitcoin’s trajectory.

Source: Raoul Pal/X

For context, Pal’s concept of the “Banana Zone” describes a rapid rise in the cryptocurrency’s price, with the price trajectory resembling the shape of a banana on a map.

Pal further explained that the market is currently in a consolidation phase, following what he calls ‘Banana Zone Phase 1’, which was marked by last year’s price breakout.

He compared this phase to market conditions during the 2016-2017 cryptocurrency boom.

Is altcoin season just around the corner?

Pal believes this consolidation phase won’t last much longer and he expects the market to soon move into “Banana Zone Phase 2,” which he describes as “Banana Singularity” – a phase he believes will trigger an altcoin season.

According to the latest update of BlockchainCenter.netthe altseason is still a distant prospect, as the current index stands at 51 – a sign that it is not yet the altseason.

During this phase, as Pal notes,

“everything goes up (followed by greater consolidation).”

Pal also suggested that the market will eventually enter ‘Banana Zone Phase 3’, which he describes as the ‘concentration phase’. This is where the core winners explode and hit much higher highs. This phase is expected to mark the final surge in the cycle, with select cryptocurrencies reaching new peaks.

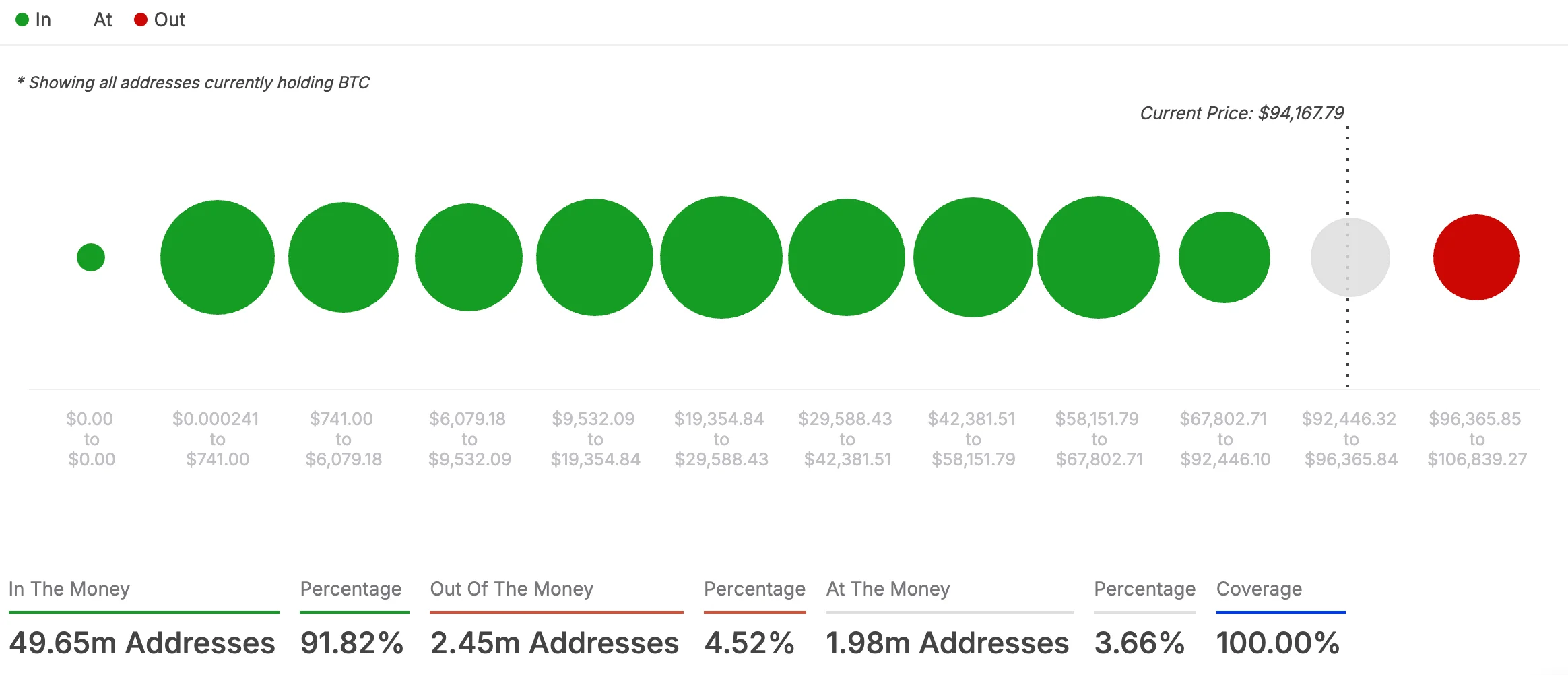

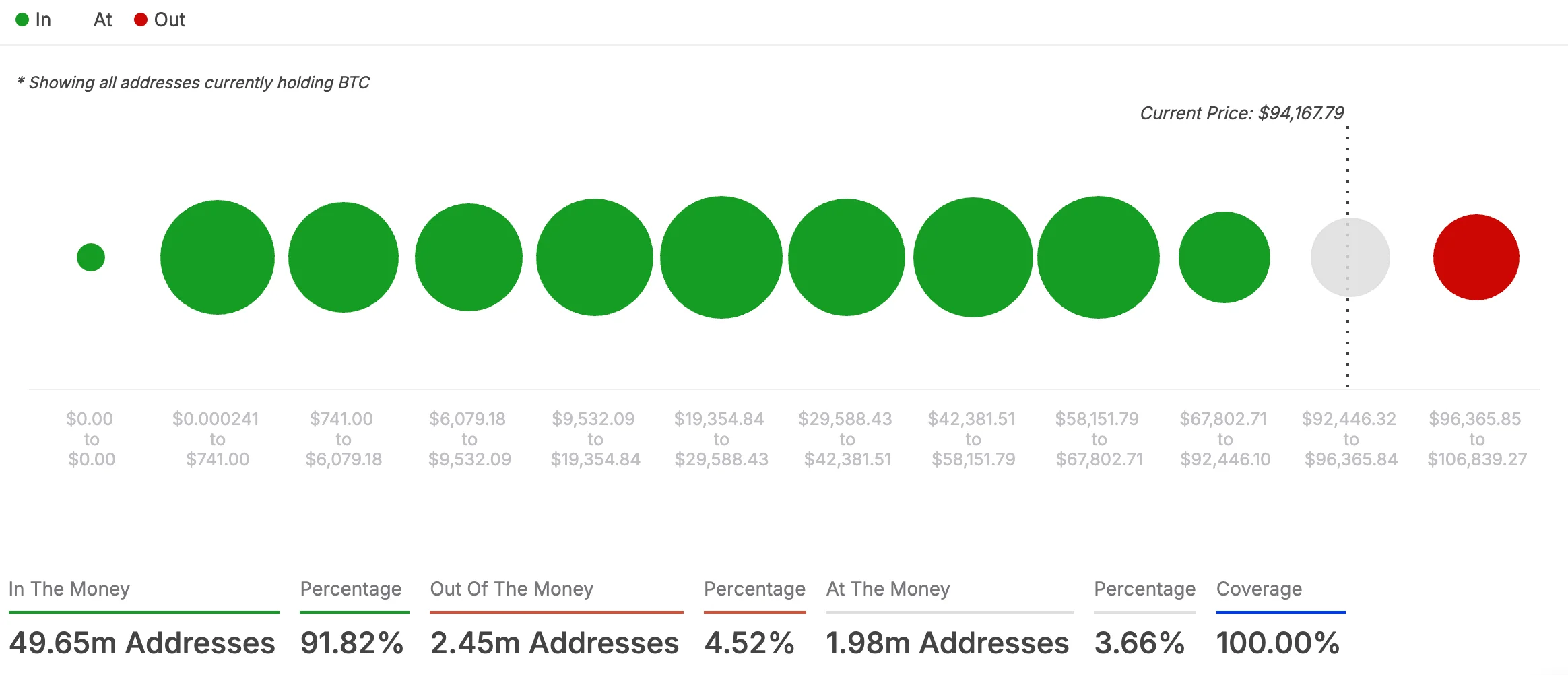

In line with this, an analysis by AMBCrypto using IntoTheBlock data revealed that a significant 91.82% of Bitcoin holders were ‘in the money’, holding tokens worth more than their original purchase price.

This overwhelming figure indicated bullish market sentiment, further supporting expectations of a price increase. Conversely, only 4.52% of BTC holders were ‘out of money’, holding tokens valued at less than their purchase price.

Source: IntoTheBlock

Given Bitcoin’s lead in the market, this momentum suggested that the broader crypto market is likely to follow suit, with a majority of assets poised for a rally in the near future.

Will Trump’s accession to the White House change the dynamics of the crypto market forever?

As Bitcoin faces a pivotal juncture ahead of Donald Trump’s presidential inauguration on January 20, its price trajectory remains uncertain. GConsidering the upcoming events, analysts believe that if BTC manages to defend the $88,000 level before or after the inauguration, a strong recovery could follow.

On the other hand, a dip below $88,000 could trigger a panic sell-off among the STH (short-term holders) cohort, potentially pushing the price down even further.

So it’s worth waiting to see what happens next. Especially as the market braces for volatility and the unfolding political events that could shape Bitcoin’s near-term prospects.