- The crash was a reflection of market uncertainty that the approval of Bitcoin ETFs in the United States may not happen immediately.

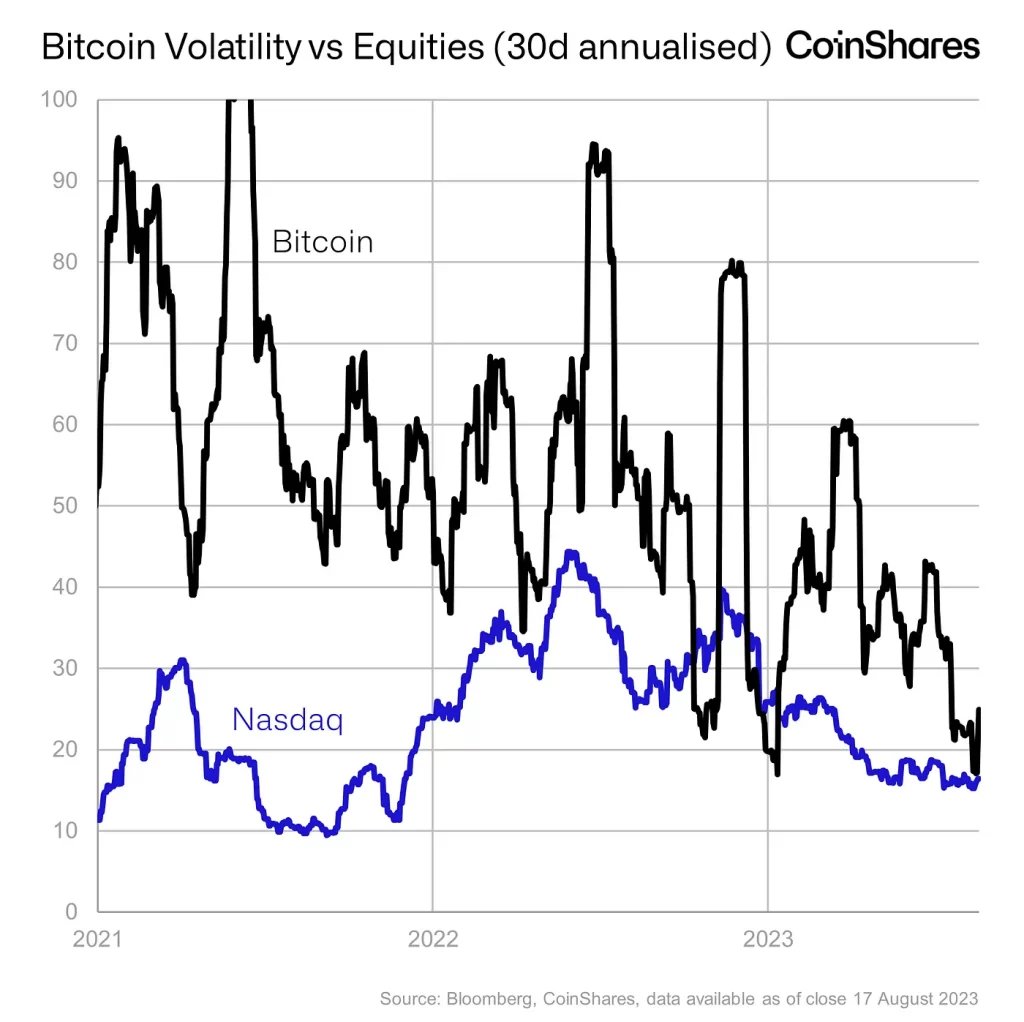

- The historic drop in BTC volatility has preceded violent moves in both directions.

Bitcoin [BTC] fell below $26,000 on August 18, as long-anticipated volatility brought more tears than cheers to much of market participants. The tumultuous week ended on a sad note for the bulls, with prices down more than 11% since the start of the week, data from CoinMarketCap revealed.

Is your wallet green? Check out the BTC Profit Calculator

The sudden dip created chaos in the market, with dire consequences for investors’ portfolios. Experts and observers began to examine the various circumstances leading up to the defeat. A recent research by CoinShares, digital asset investment company, touched on a few crypto-specific and macroeconomic triggers that have contributed to the turn of events.

Low volatility makes the market vulnerable

Bitcoin volatility has fallen sharply in recent weeks, similar to the historically low levels seen in the market in late 2022 and early 2023. As shown in the chart below, such levels always preceded large price swings in both directions.

Source: CoinShares

In addition, Bitcoin trading volumes on centralized exchanges have been steadily decreasing over the past few weeks. The daily average volume fluctuates between $2 billion and $3 billion, compared to the annual average of $7 billion and the 2022 daily average of $11 billion.

Source: CoinShares

According to James Butterfill, Head of Research at CoinShares, a volume drought like this made the market more sensitive to larger traders.

Regulatory uncertainty

Bitcoin’s latest bull rally in June was precipitated by growing optimism about the interest of TradFi giants in cryptocurrencies’ prospects. A wave of requests for a spot Bitcoin Exchange-Traded Fund (ETF), including that from the world’s largest asset manager BlackRock, sparked hopes that digital asset investment products would become more mainstream.

Cut to August, this euphoria has largely disappeared. The U.S. Securities and Exchange Commission (SEC) has subjected the applications to rigorous review, which has resulted in delays.

Some companies could even stop waiting until March 2024 for approvals for applications submitted in July 2023. Note that the regulator has the authority to defer all these ETF applications for up to 240 days.

The US is home to some of the largest TradFi institutions in the world. The crash thus reflected market uncertainty that approvals in the United States would not follow immediately.

Regulatory bottlenecks in the country cast a big shadow on the movements in the crypto market. According to a CoinShares survey, regulatory decisions were the top concern for investors.

Source: CoinShares

The Dragon that runs out of fire?

China, being the second largest economy in the world and the largest exporter, is closely linked to the world economy.

In recent years, China’s once famous real estate sector has been mired in a debt crisis. According to a recent report by ReutersChinese real estate giant Evergrande has filed for bankruptcy protection in the US, the latest in a string of defaults by major developers.

These developments have raised concerns about the health of China’s economy, as the real estate sector alone contributes to nearly a quarter of the country’s GDP. In turn, contagion risks to the global financial system became widespread, prompting investors to withdraw money from riskier assets like Bitcoin.

However, the report underlined that if a full-blown economic collapse were to happen, it could ultimately be beneficial for Bitcoin in the long run.

Broader market crash imminent?

Long-dated US Treasury bond yields hit a 16-year high above investor bets that the US Federal Reserve would continue to raise interest rates. Higher yields on bonds generally have a negative effect on riskier assets such as stocks and cryptos.

Therefore, Bitcoin’s decline can be seen as the start of a broader crash in other asset classes, the report said.

How much are 1,10,100 BTC worth today?

It remains to be seen how the crypto market would navigate the aforementioned headwinds. The expected move by the Fed not to raise rates in September could be a bullish trigger.

In addition, decisions on BlackRock and Grayscale’s ETF filings next month would be critical in determining the direction of the market.