- Bitcoin has seen a slight decline, pausing the revision of its ATH.

- The market is now in greed as many expect BTC to reach its ATH again.

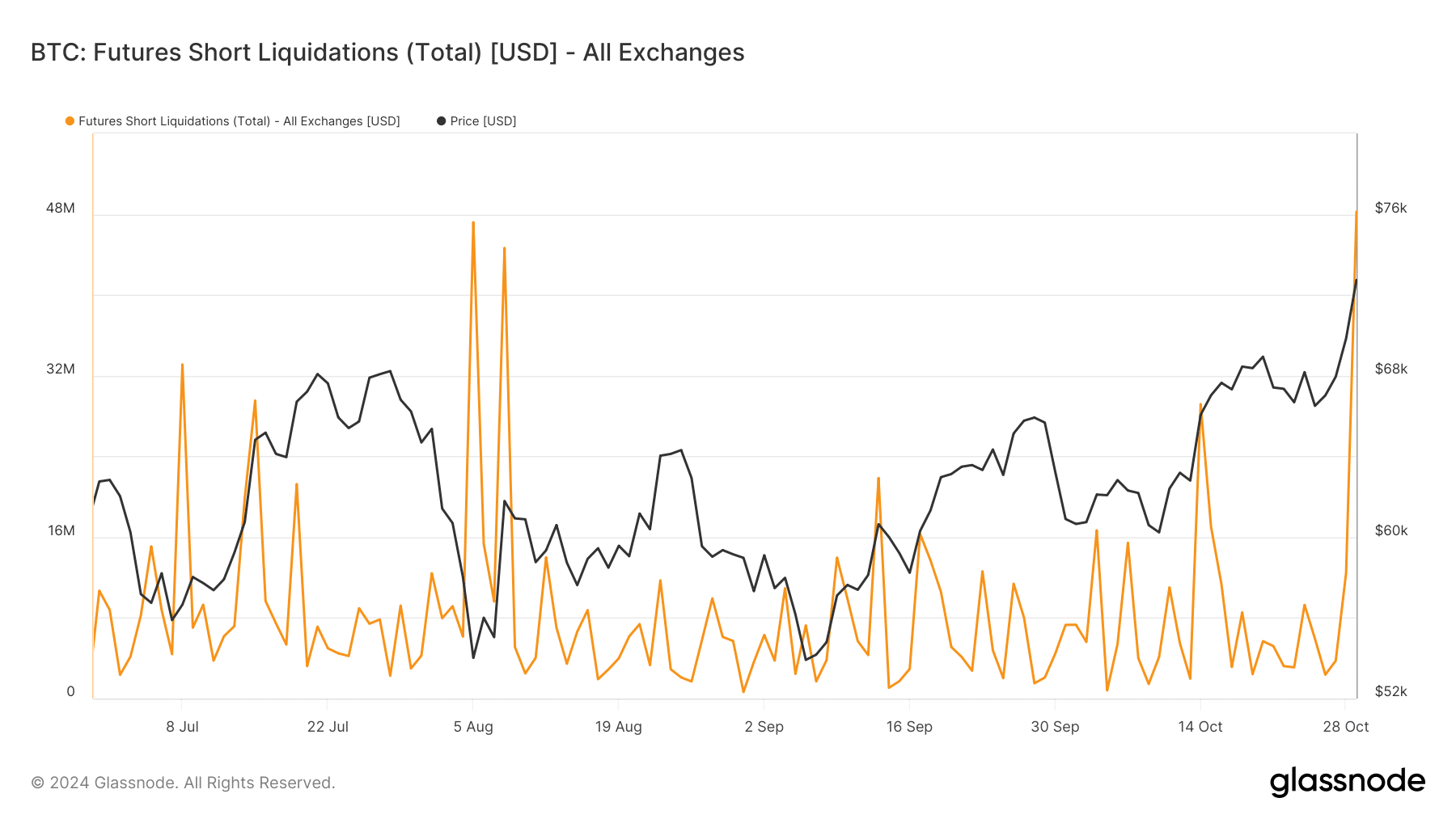

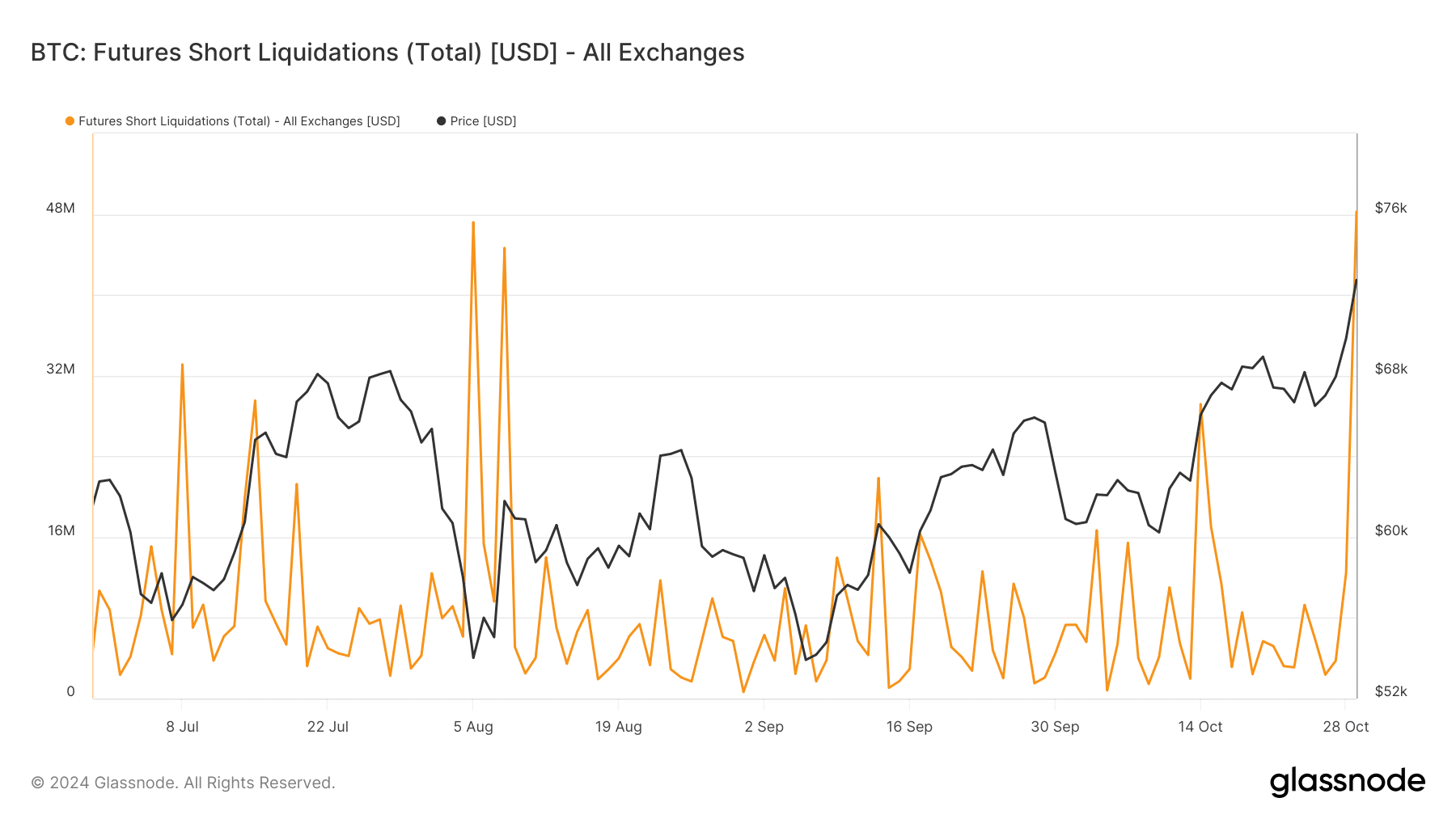

As the price of Bitcoin rose towards $72,000, a noticeable spike in short liquidations swept through the market. The increase in liquidations indicates the intense volatility in recent days, as many short positions were caught off guard by Bitcoin’s upward momentum.

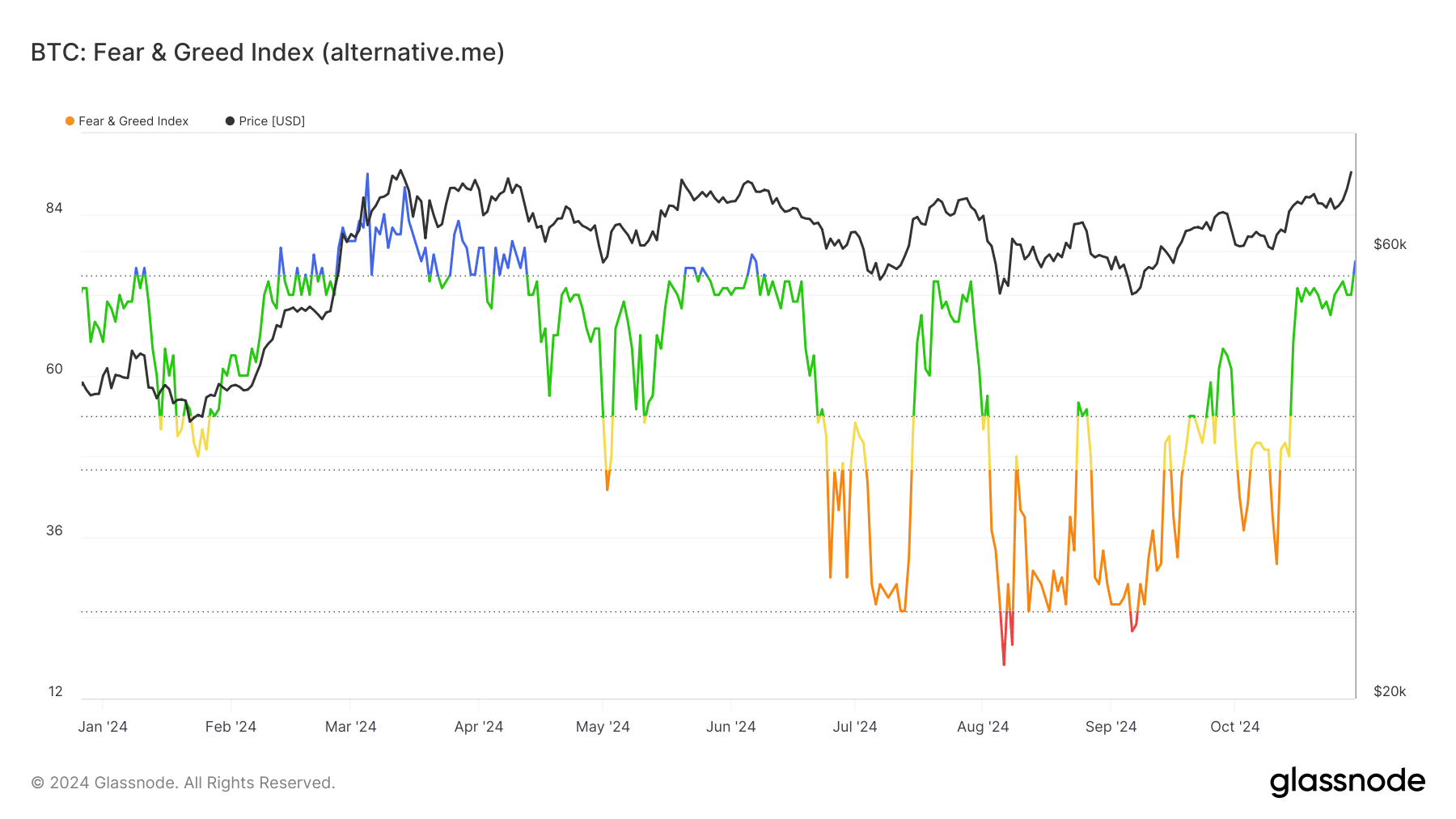

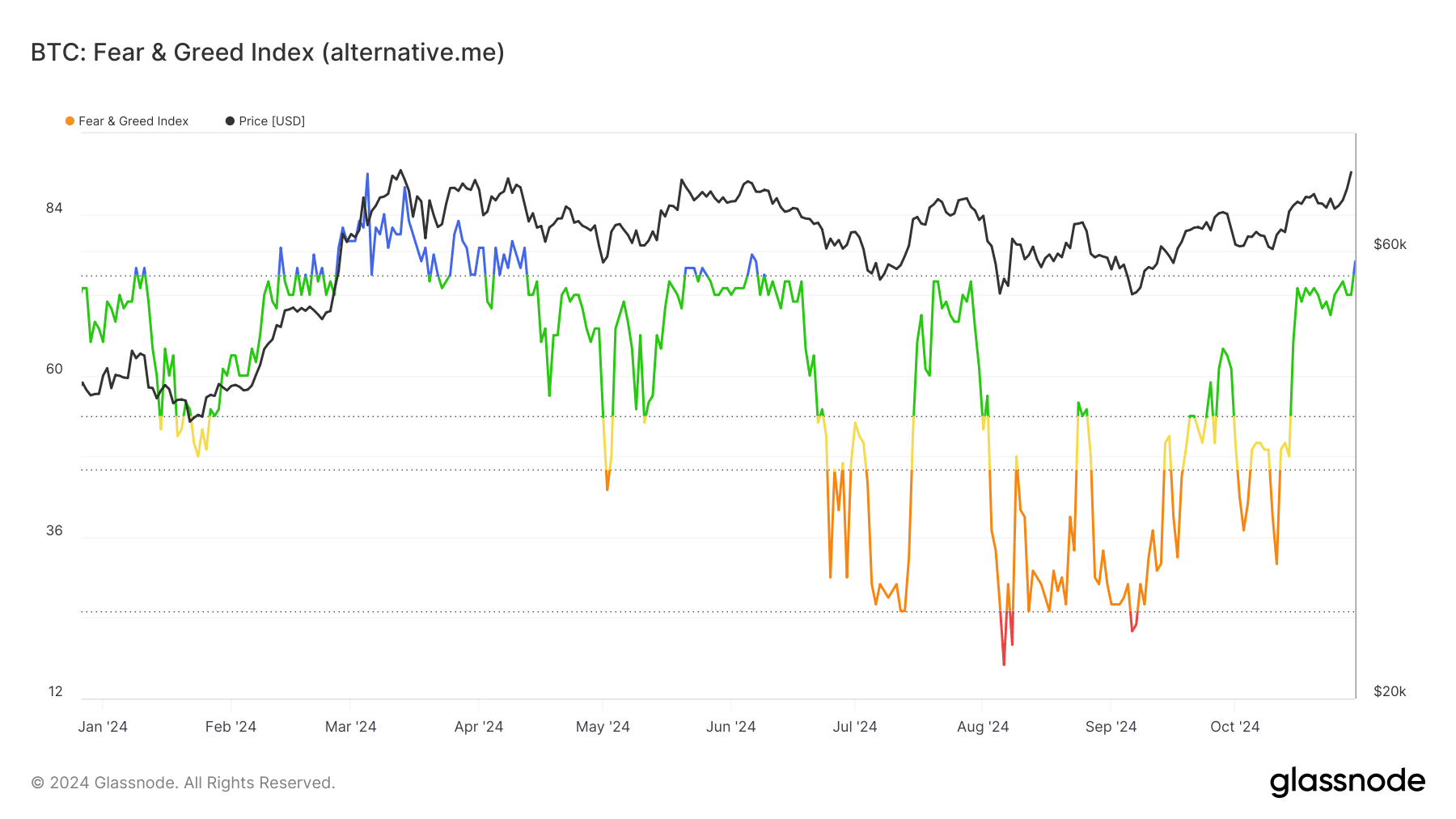

The convergence of Bitcoin’s price movements with the Fear and Greed Index reveals the underlying sentiment driving these fluctuations.

Short liquidations hit new highs during the Bitcoin rally

Bitcoin’s price rise over the past week has led to a significant increase in the number of short liquidations in futures on the major exchanges.

According to data from Glass junctionThe total number of short liquidations reached an unprecedented level, with more than $48 million wiped out in a single day as BTC breached critical resistance levels.

This spike in liquidations illustrates the market’s reaction to bullish momentum, as traders betting on a price drop were forced to exit their positions in quick succession.

Source: Glassnode

Liquidation volume highlights the sensitivity of leveraged short positions to Bitcoin’s price fluctuations. Now that the market has crossed the $72,000 threshold, short traders are retreating to avoid further liquidation losses.

The cascading effect of liquidations tends to further fuel price momentum as forced buybacks of short contracts drive Bitcoin’s price higher.

The Rising Fear and Greed Index reflects the changing sentiment

In addition to the spike in liquidations, the Fear and Greed Index has shown a steady increase, reflecting the shift from a cautious market stance to a more optimistic outlook.

In early October, the index was hovering in “fear territory,” indicating market hesitation.

However, as Bitcoin’s price continued to break through resistance levels, the index has turned to ‘greed’ and reached its highest value since the middle of the year.

Source: Glassnode

The Fear and Greed Index has traditionally been a barometer of potential market corrections, as extreme greed often precedes a short-term pullback.

However, current optimism driven by strong market fundamentals and institutional interest could support the rally. But increased greed could signal an overheating phase, where corrections become likely if sentiment becomes too exuberant.

What’s next for Bitcoin amid the high volatility?

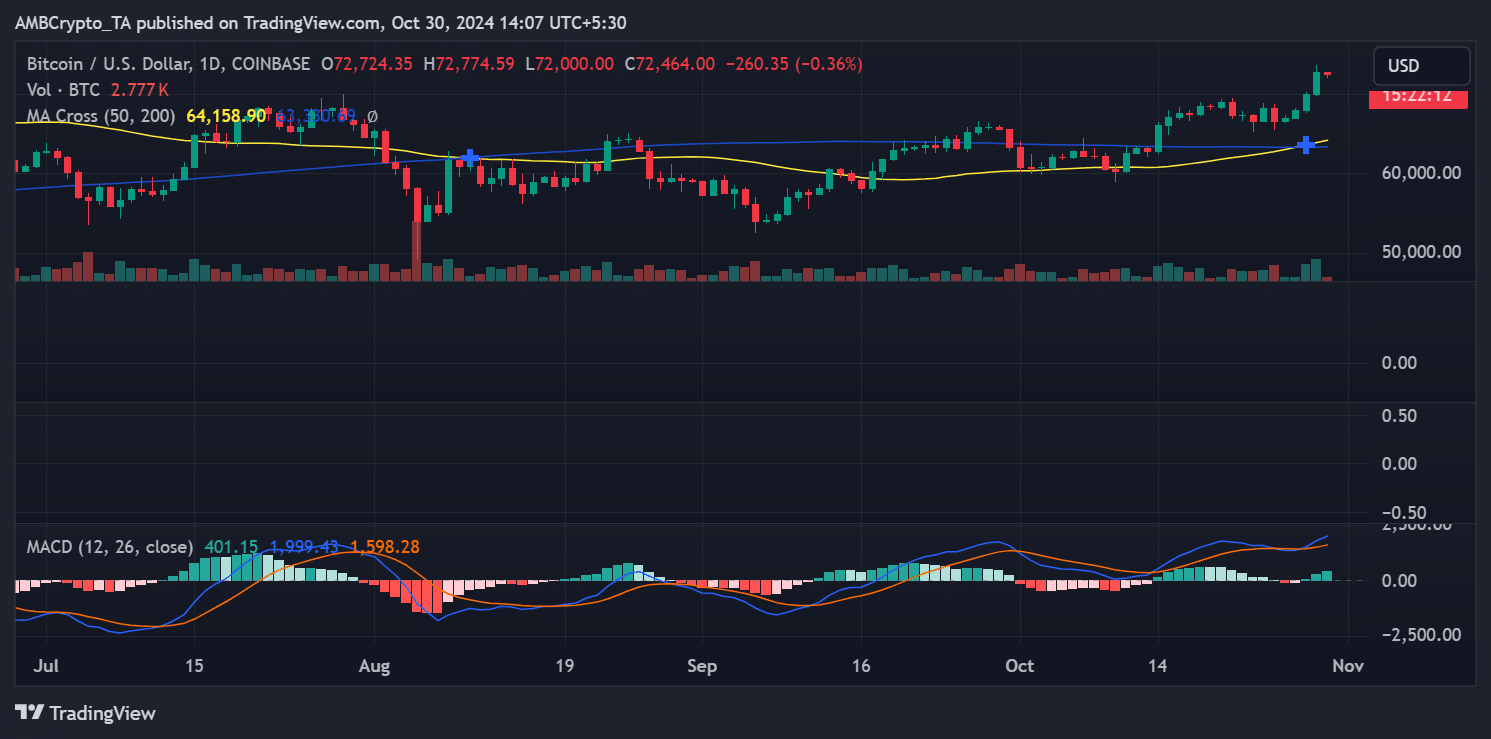

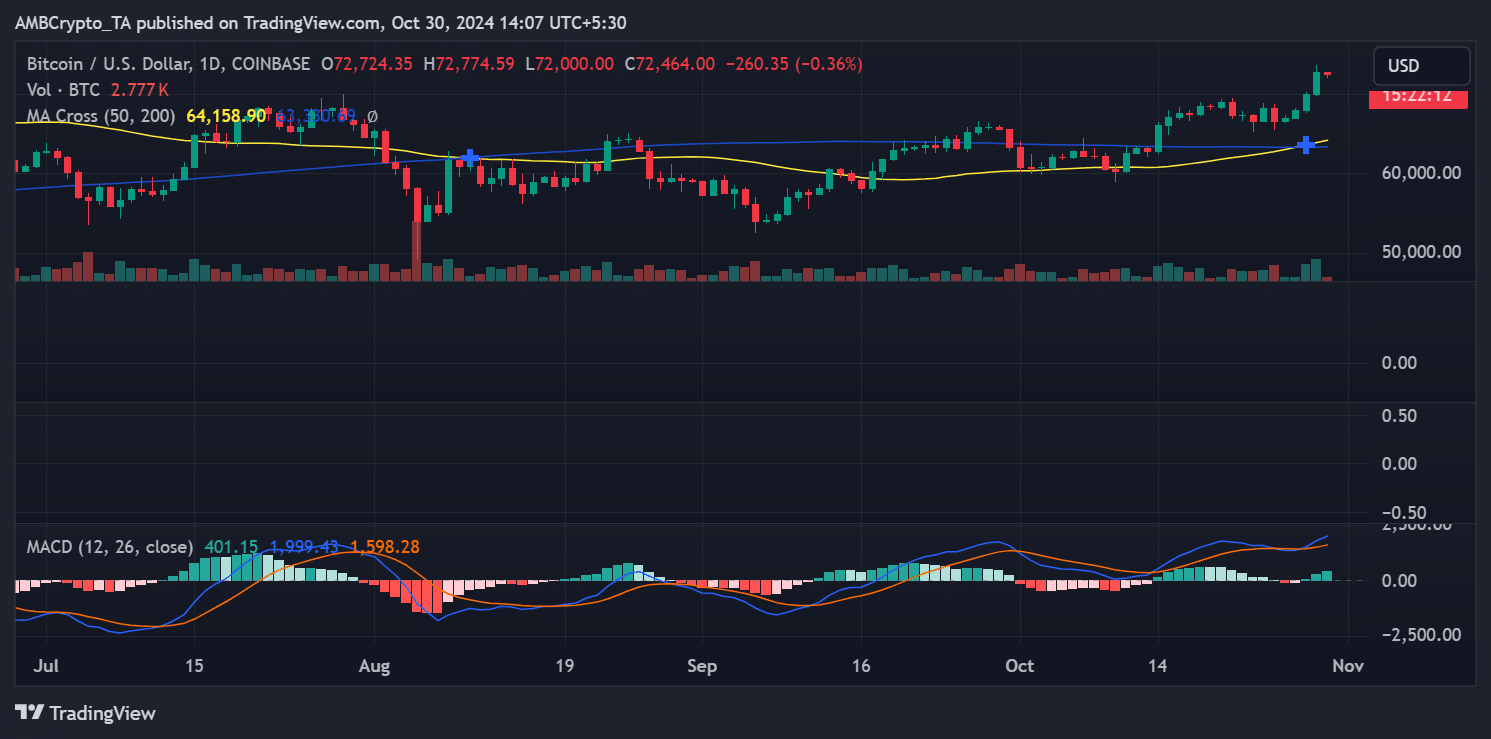

As Bitcoin moves closer to its all-time high, the market is primed for increased volatility. The MACD indicator on the daily chart shows bullish momentum.

At the same time, the Fear and Greed Index implies that sentiment is strongly in favor of further upside potential.

Source: TradingView

But as history shows, high levels of greed can result in sharp reversals, especially if the price fails to make a new high above resistance.

Read Bitcoin (BTC) price prediction 2024-25

Bitcoin’s trajectory will likely depend on continued buying interest and potential profit-taking pressure. Short traders may want to adopt more cautious strategies given the recent liquidations.

Overall, Bitcoin’s path appears bullish, but traders should still brace for possible corrections in this highly dynamic environment.