- Binance’s Bitcoin reserves have increased by 14% since the collapse of the FTX.

- Binance’s clean reserve ratio was over 94% at the time of publication.

The world’s largest crypto exchange Binance [BNB] has had to deal with unrelenting regulatory pressure in 2023. The latest revelation that the US Department of Justice (DoJ) was considering filing fraud charges against the crypto giant added further anxiety among market participants.

Read Binance Coin [BNB] Price Forecast 2023-24

The fear of an FTX-style bank run in November 2022 was the factor cited by law enforcement as a reason not to pursue the case. But is Binance’s balance sheet as shaky as the now-collapsed FTX?

Analysis of Binance’s currency reserves

Ki Young Ju, CEO of on-chain analytics firm CryptoQuant, seemed to disagree with concerns about Binance’s insolvency risks. He cited data on foreign exchange reserves to support his claim.

I’ve heard about the ‘bank run/insolvency risk on Binance’ a hundred times over the years, but their user balances always tell a different story.https://t.co/66yVQGjTBM https://t.co/YgxZcQPTUt pic.twitter.com/DgR4JqiKYP

— Ki Young Ju (@ki_young_ju) August 2, 2023

Apparently Binance’s Bitcoin [BTC] reserves, or in other words the exchange’s BTC liabilities, showed steady growth, with no inorganic peaks or troughs. In fact, reserves are up 14% since the collapse of the FTX. At the time of writing, deposits amounted to nearly 563,966.

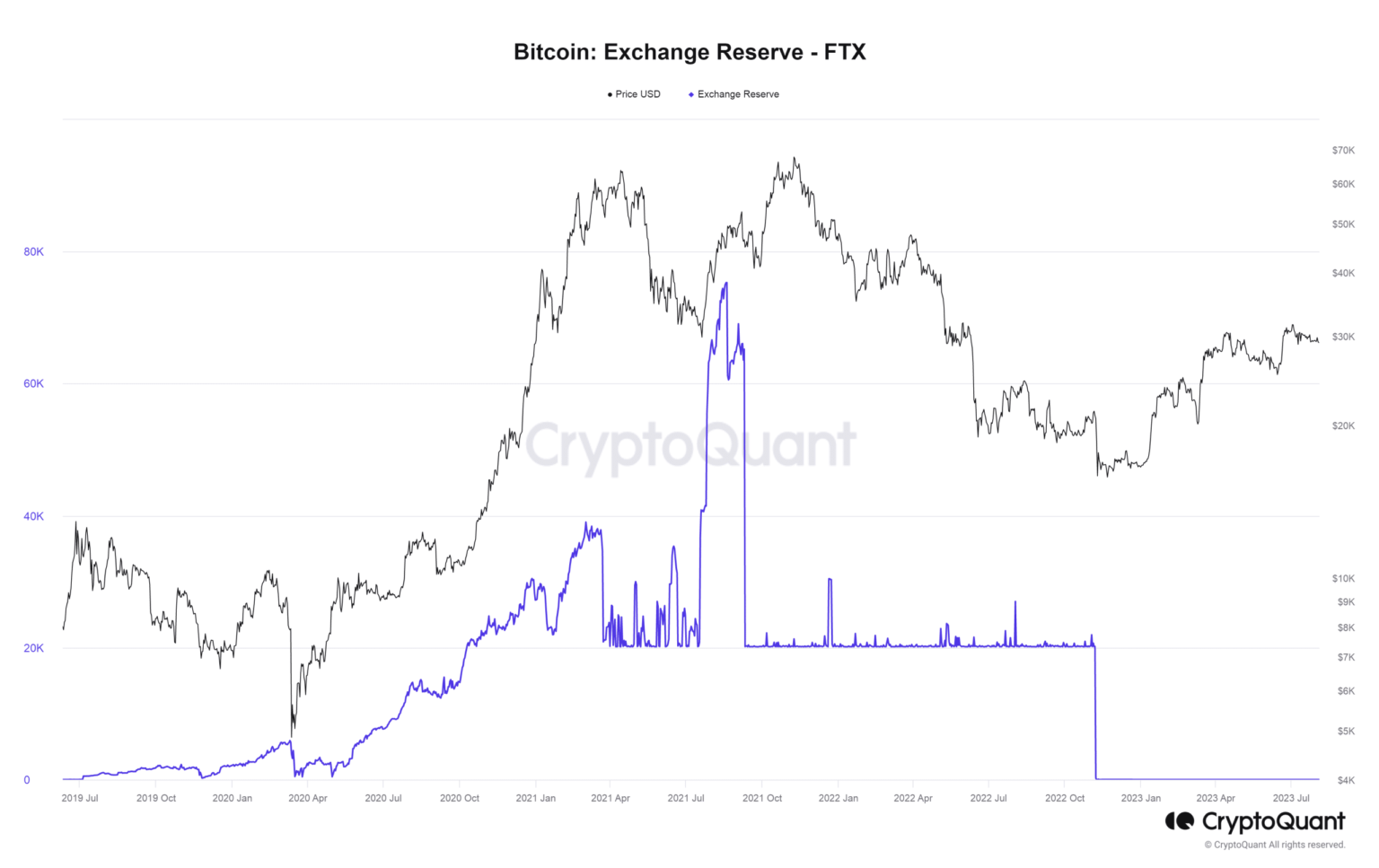

FTX, on the other hand, witnessed an inorganic movement of assets in and out of exchange portfolios leading to the collapse, an indication of serious liquidity problems.

Source: CryptoQuant

A similar contrasting picture came to light when the deposits of the second largest crypto asset, Ethereum [ETH], were analysed. At the time of writing, there was approximately 4.07 million ETH on Binance. While the decline was down 17% since the FTX collapse, the dip was due more to investor HODLing tendencies than evidence of misappropriation.

Compared to FTX’s trajectory, there have been dramatic ups and downs in ETH’s deposits on the exchange, with a massive 77% drop in the five days before bankruptcy.

Source: CryptoQuant

Binance appeared ‘clean’

Another important indicator often used to assess the financial health of crypto exchanges is the “Clean Reserve” metric. This metric represents the % of total reserves not represented by the exchange’s own token. The closer to 100%, the better.

Is your wallet green? Check out the Bitcoin Profit Calculator

Binance’s clean reserve ratio was over 94% at the time of publication, according to CryptoQuant, with BNB leading the way. This served as further evidence to prove that Binance’s current situation was no cause for panic.

Source: CryptoQuant