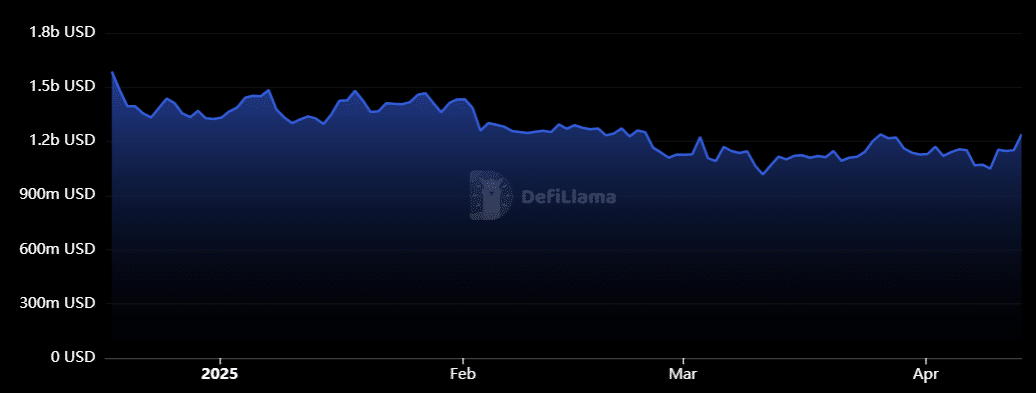

TVOUND after a three -month decrease

Avalanche’s TVL showed a remarkable rebound in April and climbing back above $ 1.2 billion after a persistent downward trend since the beginning of January.

The graph reflects a clear dip of more than $ 1.5 billion at the beginning of 2025 to sub-$ 1.1 billion at the end of March, with a broader risk-off sentiment reflected in crypto markets.

Source: Defillama

However, the recent increase suggests a shift in Momentum – probably powered by rising Avax prices, user stimuli and protocol reactivations.

While he is still under Q4 2024 levels, this bounce marks the first sign of sustainable recovery and can indicate a turning point.

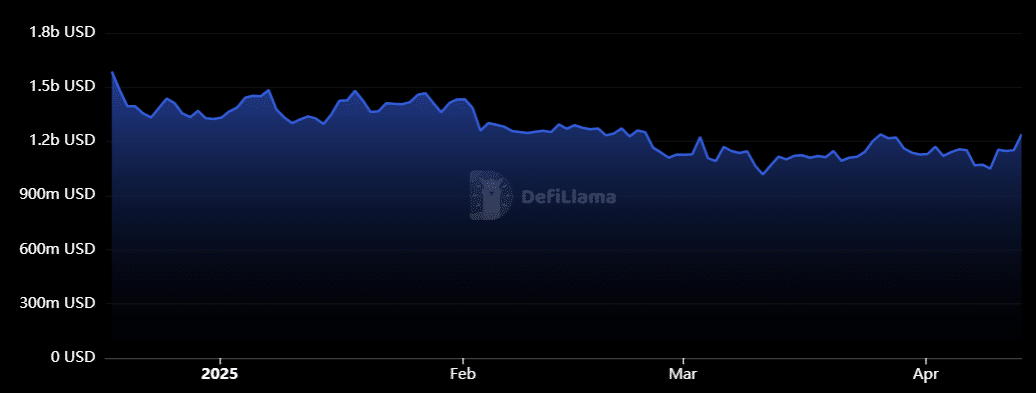

Avax -eyes $ 30, but resistance looms

At the time of the press, Avax acted around $ 20 and recovered in March low points near $ 16.

Technically, the level of $ 30 remains an important psychological and structural resistance-for the last tested at the beginning of February 2025 and again during several rejections in mid-2024.

Source: TradingView

The graph indicates that Avax breaks from its short-term downtrend. For a decisive step to the $ 30 marking, Bulls must, however, free up the resistance zone between $ 24 and $ 26.

If the momentum of and Avax applies the level of $ 26 firmly, a push to $ 30 will be feasible. That said, a period of short -term consolidation is probably before a possible outbreak occurs.