- Atom Crypto rose by 6% per day, with the price diagram that showed a break of the falling trendline.

- The response to the $ 5 zone could determine whether it is potential to continue trending higher.

Cosmos [ATOM] an increase of 6% achieved in a day because it successfully broken the falling trendline that appeared on his daily graph.

If the Bullish Momentum maintains its pace, Atom could stay higher, like the past two days.

Atom came dangerously close to the $ 5 resistance, which was essential to be broken for a bullish confirmation.

The price of Atom of more than $ 5 and determining long -term position above the current level can offer potential for a rally that could reach new resistance barriers.

Not breaking and retaining prices above $ 5 can make the Bullish Setup meaningless and result in price rejection that can cause market drop.

A price movement to $ 4.30 level can indicate the weakness of Atom, which could activate lower support areas near $ 4.

Source: Trade reproduction

The MACD indicator showed a weak bullish orientation from his histogram that was somewhat bearish from Bullish.

The proximity of MACD on its signal lines indicated a possibility of market stabilization before he came up with a clear trend pattern.

When Atom exceeded the falling trend line, this showed an evolving market momentum.

Price movement After the present moment, Cosmos could probably depend on the behavior of significant levels on $ 4.30 and $ 5.

Atom’s liquidation levels

More analysis showed that the Binance heat juice revealed a high concentration at the level of $ 4.87, accompanied by a liquidation lever of $ 233.23k.

These zones of high concentration of liquidation activities meant an important area of interest.

The daily profits created larger liquidations in the regions around $ 4.87 and $ 5, which indicates price resistance options.

Subsequently, long liquidation zones formed at $ 4.68 and $ 4.57 that have important support levels.

Long liquidations would probably occur if the atom did not maintain the positions above these resistance levels, which could lead to increased market fluctuations.

As an alternative, higher prices would flush more short positions.

Source: Coinglass

Atom has to settle on $ 4.87 and $ 5 to determine if it can have an upward trend.

A price rejection near $ 5 could result in a correction, but a successful break through this level can indicate further upward price movement.

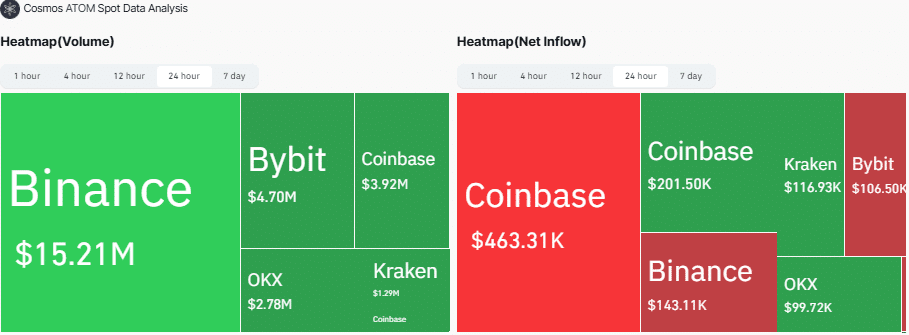

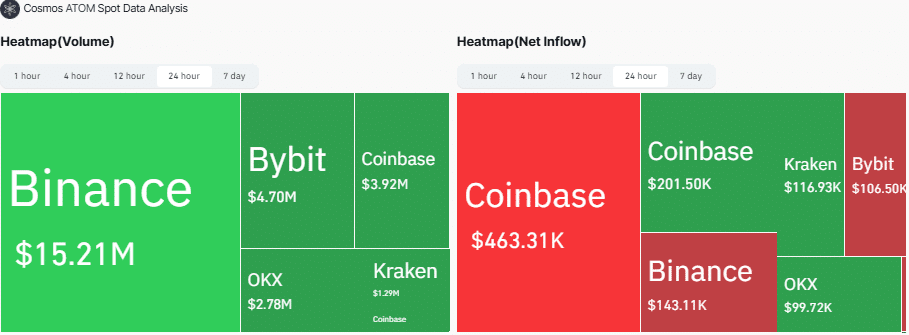

Volume and Netflow from Spot -Transactions

In the meantime, Binance maintained the highest atomic spot volume position at $ 15.21 million, Bybit at $ 4.70 million, while Coinbase received $ 3.92 million. The exchange of OKX and Kraken yielded $ 2.78 million and $ 1.29 million respectively.

The first Coinbase account saw an outflow of $ 463.31K, while Coinbase, Kraken and OKX Positive Insturrheafs maintained a total of $ 201.50k, $ 116.93k and $ 99.72K accordingly.

Binance and Bybit saw recordings worth $ 143.11k and $ 106.50k in their platforms respectively.

Source: Coinglass

The recordings can indicate investors who take a profit or redistribute funds, while the inflow suggested that the stock markets were still in a position to win extra money.

The increase in the intake of the assets intake of the exchange showed that the atom could continue to increase in value. If the platforms continued to drain, this can cause the temporary downward pressure on atom and other tokens.