- The Solana ecosystem has experienced impressive growth in recent months.

- Despite this, the protocol faced problems in the NFT sector and in terms of price.

Solana [SOL] did not see any positive movement in terms of price in recent days. However, statistics suggest that SOL may have even more to offer.

Solana continues to grow

SOL emerged as a prominent leader in the fourth quarter market rally, closing the year with a remarkable market capitalization of $43.8 billion, reflecting a staggering 423% quarter-on-quarter (QoQ) increase and an impressive 1,106 % year-on-year (YoY). ) increase.

During the fourth quarter, SOL surpassed ADA, USDC and XRP in market capitalization.

the @MessariCrypto The fourth quarter status of smart contract platforms report looks at 10 top networks based on 13 metrics.@solana led QoQ growth in 6 of the metrics, including… pic.twitter.com/1TUZiT7W3v

— Peter Horton (@ph0rt0n) January 18, 2024

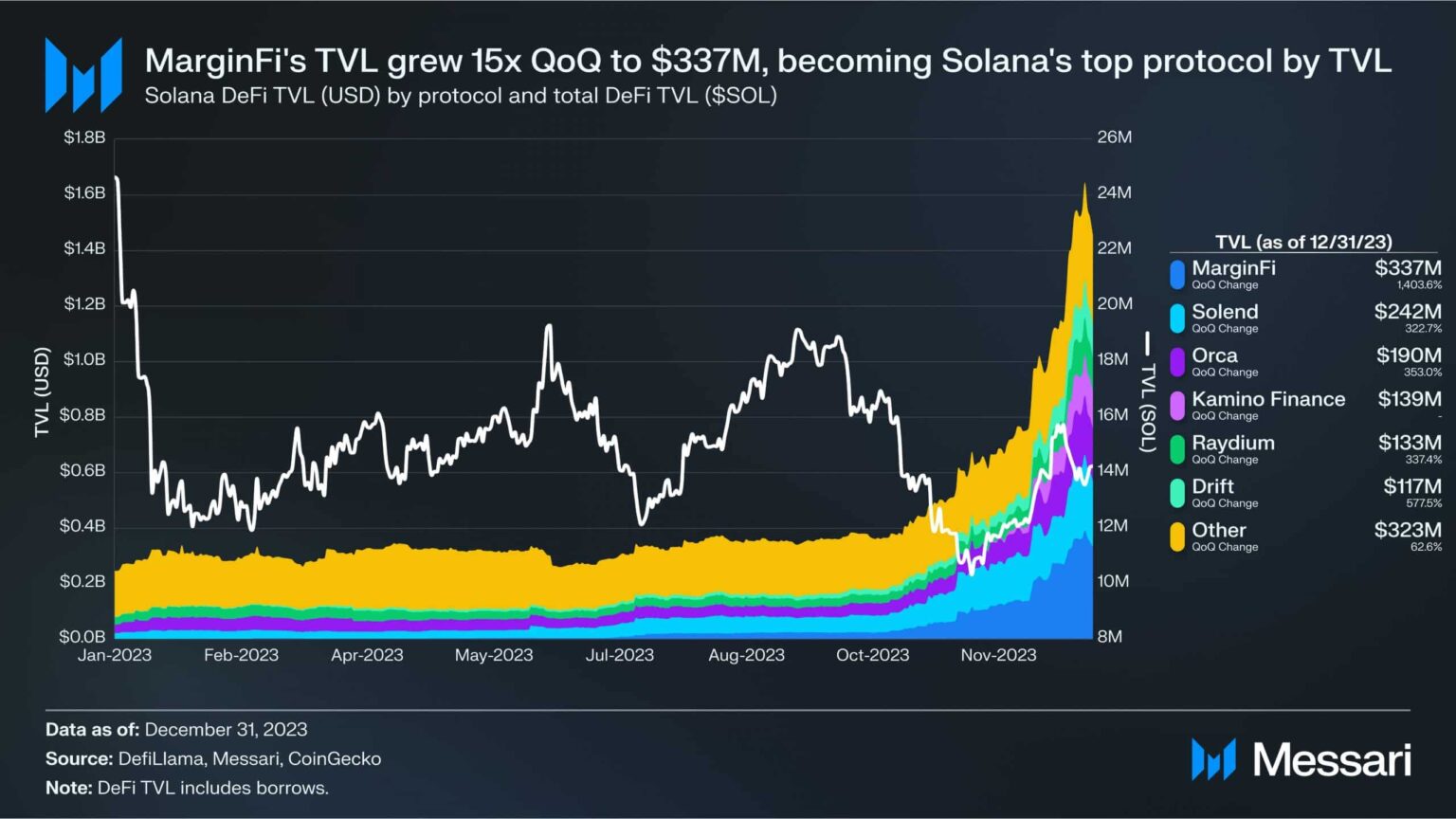

Solana’s DeFi Total Value Locked (TVL) showed growth, rising 303% to reach $1.5 billion. This wave was propelled by strategic points programs and air drops.

Protocols such as MarginFi and Jito have contributed immensely to this unprecedented increase in TVL.

MarginFi experienced extraordinary TVL growth of 1,404% quarter-over-quarter, moving from the sixth largest to the best Solana DeFi protocol.

Notably, TVL started at a modest $3.2 million when it introduced the points program on July 3.

Moreover, Jito’s airdrop also contributed to Solana’s growth. The protocol distributed 90 million JTO to fewer than 10,000 wallets, with the minimum airdrop amount set at approximately $10,000.

Source: Messari

Additionally, the network’s daily DeFi volume surpassed that of Ethereum for the first time, peaking at $2.6 billion on December 22.

Overall, Solana’s average daily DeFi volume saw an extraordinary 961% quarter-over-quarter increase to $416 million. The surge was fueled by memecoin trading and the wealth effect generated by the JTO airdrop.

NFT issues

However, things did not go well for Solana in all sectors. In the NFT space, a massive drop in interest in the Solana blue chip index was observed. This meant that the accumulation of popular Solana NFT collections began to decline.

Source: Solana Floor

This could be an indicator that all is not well in the Solana ecosystem and that other factors could negatively impact the popularity of the Solana ecosystem.

Realistic or not, here is SOL’s market cap in BTC terms

As for the SOL token, which it traded on $93.94 at the time of writing and the price had dropped 6.68% in the last 24 hours.

The volume on which SOL traded had also fallen during this period.

Source: Santiment